Recently, Bank of England required UK financial institutions to disclose in more details their exposure to European banks, with a particular focus on the open positions with Deutsche Bank and Monte dei Paschi di Siena. Although it cannot be denied that the above-mentioned institutions may be source of concerns, it is becoming straightforward that too much emphasis is being addressed on the European financial stability while disregarding or underestimating the Chinese one.

It should be widely accepted that the biggest credit risk is not so much among western bank, which are steadily scrutinized by strict regulators and subject to the whole public audience which has unlimited access to the information disclosed. On the other hand, what we know about China’s banks is what the government discloses, whose reliability and completeness may be subject to further investigation.

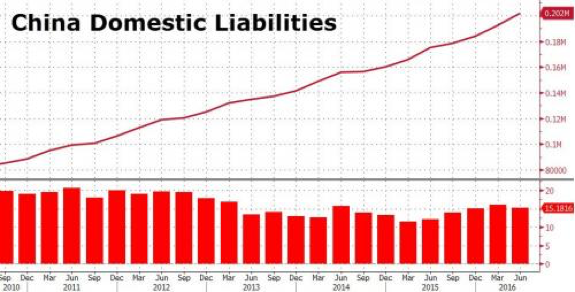

Sticking to data allegedly reported by China’s Banking Regulatory Commission, the Chinese banks’ assets have reached a peak of over $32 trillion, implying a growth in September of 14.7%. This data may sound positive news if actually signaled increased lending to real economy. However, we have to take into account that it represents more than double the rate of growth of China’s overall economy. The right hand side of the balance sheet has kept up the pace as well, exhibiting an even faster growth of 15.5% surpassing the $30 trillion. By contrast, US bank liabilities are half this amount and this really allows to fully grasp the actual size of the issue.

It should be widely accepted that the biggest credit risk is not so much among western bank, which are steadily scrutinized by strict regulators and subject to the whole public audience which has unlimited access to the information disclosed. On the other hand, what we know about China’s banks is what the government discloses, whose reliability and completeness may be subject to further investigation.

Sticking to data allegedly reported by China’s Banking Regulatory Commission, the Chinese banks’ assets have reached a peak of over $32 trillion, implying a growth in September of 14.7%. This data may sound positive news if actually signaled increased lending to real economy. However, we have to take into account that it represents more than double the rate of growth of China’s overall economy. The right hand side of the balance sheet has kept up the pace as well, exhibiting an even faster growth of 15.5% surpassing the $30 trillion. By contrast, US bank liabilities are half this amount and this really allows to fully grasp the actual size of the issue.

Lesson from the European bank crisis teaches us how the probability of loan defaults increases more than proportionally especially when the asset side expands so rapidly. Analysts’ estimates indicate the presence of roughly 15% to 20% in the form of bad loans. By comparison, in order to give a benchmark, Italian NPLs (Non-performing Loans) are stable at €360 billion, corresponding to 18% of outstanding loans and half of this number consists of bad loans.

Another issue that deserves mentioning is the $1.9 trillion locked up with the off-balance-sheet, non-principal guaranteed Wealth Management products, up to now exempt from regulatory supervision. Although it is not clear when or if the People’s Bank of China will introduce them to scrutiny, the implications can be significant. First of all, capital adequacy requirements for banks would become stricter in line with Basel III and as it always happens, more regulation entails higher costs transferred to investors. Therefore, these products would not be as attractive as before and funds, many of which are of highly suspect origins, may be channeled elsewhere for instance in the digital currency Bitcoin. Some analysts agree this could be the catalyst to push bitcoin higher in the future.

To conclude, the topic of Chinese “shadow banking” should be further discussed, as the implications may be severe in an environment based on customer confidence and highly subject to systemic risk.

Laporta Davide