The Lebanese financial situation has become more than critical in this period of high social tensions.

Lebanon has been troubled for more than a few weeks, since October 18th, with protests denouncing corruption, mismanagement of state finances by the political party which has driven the country into an economic crisis not seen since the 1990 civil war.

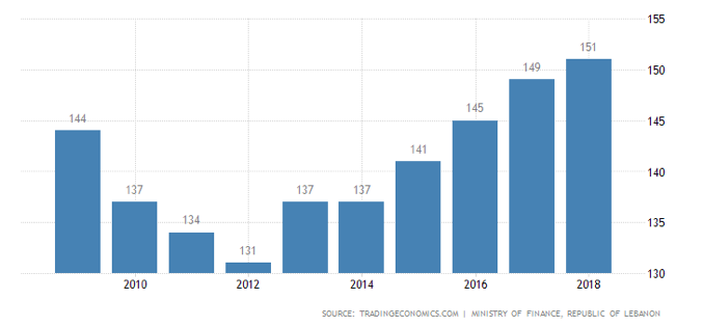

Indeed, in the last two decades, Lebanon has accumulated debt as to become the third most indebted country in the world - with a debt to GDP ratio which exceeds 150 per cent.

Lebanon has been troubled for more than a few weeks, since October 18th, with protests denouncing corruption, mismanagement of state finances by the political party which has driven the country into an economic crisis not seen since the 1990 civil war.

Indeed, in the last two decades, Lebanon has accumulated debt as to become the third most indebted country in the world - with a debt to GDP ratio which exceeds 150 per cent.

Despite this, the country has kept increasing its budget deficits and the government has continued to receive financings. These funds have mainly come from the Lebanese banking system, which is in turn funded by large deposits from the Lebanese diaspora and from rich citizens of the Gulf Cooperation Council countries. The increasingly critical economic situation of Lebanon led government lending to become an advantageous investment for Lebanese banks due to high interest rates, which thus favored to finance the government through US dollar-denominated Eurobonds and Lebanese pound-denominated T-bills and to hold “liquidity” in the form of excess reserves at the Lebanese central bank instead of lending to customers.

This large sovereign bond holdings created a large sovereign dependence of the Lebanese banking system. Clearly, any decrease in the amount of deposits would disastrously lead the entire financial edifice to crumble, since it would cause an incapacity of the banking system to keep financing the government. This would finally result in the simultaneous downfall of numerous banks. Lebanese banks trying to attract sufficient dollar-denominated deposits were forced to pay rates of exceeding 20 per cent.

In the meantime, in August, Lebanon's credit rating was downgraded to “CCC” by Fitch while Standard and Poor maintained their rating of B-, cautioning against a possible default on its debt if concrete reforms were not implemented.

This tense economic situation has grown worse since the recent announcement of economic reforms such as the establishment of new taxes. The main trigger which sparked wider anger and a will to protest against government’s austerity and corruption was a tax to be imposed on WhatsApp communication.

Even though new reforms such as a 50 per cent pay-cut in the salaries of current and former ministers, a $3.3 billion contribution from the central bank and private banks to reduce the deficit of the country, and plans to restructure the hamstring electricity industry were announced on Sunday 20th with the aim of appeasing demonstrators, the latter ask for the resignation of the whole government.

These recent mass protests have strengthened even more the existing strains that weight on the Lebanese financial system and led a State prosecutor to prohibit traders and money exchangers to move significant amounts of dollar currency out of the country at air and land borders. The aim is to avoid a panic-driven bank run to acquire dollars that would lead the Lebanese economy to collapse. Indeed, dollars have recently become harder to obtain at the official exchange rate of 1,511.70 pounds and cost on parallel markets 1,680 pounds. It is worth mentioning that the emergence of these parallel markets demonstrates the worsening economic situations of Lebanon which has been facing a wide slowdown of its economy and a huge decrease of capital inflows.

But what’s next?

With Lebanese banks being shuttered since de beginning of the protests in October, there is a growing fear that a sudden increase in withdrawals would occur when banks will reopen and that this would cut foreign currency deposits. On top of leading to the devaluation of the Lebanese currency or even to the collapse of the Lebanese economy by limiting the supply of deposits to finance the government debt, this would surely affect the ability of the country to import wheat, fuel and medicine.

Financial support from foreign countries is not on the agenda since Lebanon has already been offered $11 billion in soft loans and has been granted for an infrastructure spending program. However foreign institutions expect in exchange that the country undertakes large scale reforms to reduce its outstanding debt.

For many people, the main concern to be solved in this crisis is political corruption, which deeply constrains Lebanese economic wealth. It is argued that, as long as this issue will not be tackled, Lebanon will not reach a sustainable economic and social situation. This challenge could in particular unfold the potential of Lebanon to act as a major energy player, particularly in the oil sector.

The international community is for now uncertain about the possible outcome of this Lebanese economic emergency and of the political instability, supported by the resignation of the Lebanese Prime Minister Saad Hariri last Tuesday.

Clémence Louzier