Leveraged loans have been a highly discussed topic in recent months. Several voices have risen among American institutions and market participants to express several concerns about the risks of this market, which is now worth more than $1.3 trillion only in the US. Among them, Janet Yellen, former FED Chair, clearly expressed her concerns about the growth of this market in an interview with The Financial Times at the end of October of last year. “I am worried about the systemic risks associated with these loans”, she said, “There has been a huge deterioration in standards; covenants have been loosened in leveraged lending”.

Now, the virus seems to be gradually spreading also to Europe, and the conditions in this market seem to be even worse.

Concerns about leveraged loans – defined as senior secured loans extended by a group of lenders to a borrower that has below-investment grade rating – has to do with the size reached by this market of credits which are, by definition, risky and potentially characterized by the deterioration of covenant terms.

Focusing on the European case, the size of the market is still quite limited when compared to the US: according to S&P Global Market Intelligence, European Leveraged Loans outstanding were around €180 billion at the end of 2018, therefore representing less than 1/5 of the US ones.

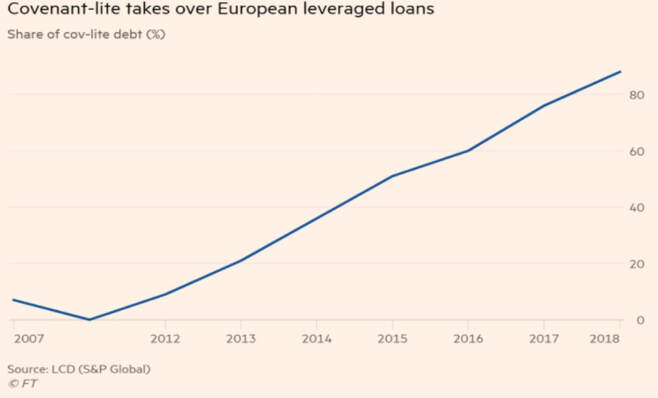

Meanwhile, as for the deterioration of covenant terms, European Loans keep the pace with the US ones. The concerns, in particular, focus on the increasing share of covenant-lite leverage loans due to demand in this market constantly outstripping supply. Traditionally, loans were characterized by so-called “maintenance” covenants, i.e. conditions on the issuers that are tested periodically and irrespective of any corporate action. On the contrary, loans with “incurrence” covenants or “cov-lite loans” are characterized by covenants that are tested only if relevant corporate actions are taken (like an increase in debt, M&A activity, etc.).

Alarms are justified by the fact that maintenance covenants are normally considered as a better protection for lenders, who can take actions earlier if a borrower is in a situation of distress and, potentially, reduce losses in case of default.

The share of EU cov-lite loans has grown to 88 percent of the total – while the US ones are at around 85 percent of the total. This is something completely unprecedented in Europe: while the share of cov-lite loans in the US reached a similar level before the 2008 crisis, in 2007 only 7% of European Leveraged Loans lacked these protections.

Now, the virus seems to be gradually spreading also to Europe, and the conditions in this market seem to be even worse.

Concerns about leveraged loans – defined as senior secured loans extended by a group of lenders to a borrower that has below-investment grade rating – has to do with the size reached by this market of credits which are, by definition, risky and potentially characterized by the deterioration of covenant terms.

Focusing on the European case, the size of the market is still quite limited when compared to the US: according to S&P Global Market Intelligence, European Leveraged Loans outstanding were around €180 billion at the end of 2018, therefore representing less than 1/5 of the US ones.

Meanwhile, as for the deterioration of covenant terms, European Loans keep the pace with the US ones. The concerns, in particular, focus on the increasing share of covenant-lite leverage loans due to demand in this market constantly outstripping supply. Traditionally, loans were characterized by so-called “maintenance” covenants, i.e. conditions on the issuers that are tested periodically and irrespective of any corporate action. On the contrary, loans with “incurrence” covenants or “cov-lite loans” are characterized by covenants that are tested only if relevant corporate actions are taken (like an increase in debt, M&A activity, etc.).

Alarms are justified by the fact that maintenance covenants are normally considered as a better protection for lenders, who can take actions earlier if a borrower is in a situation of distress and, potentially, reduce losses in case of default.

The share of EU cov-lite loans has grown to 88 percent of the total – while the US ones are at around 85 percent of the total. This is something completely unprecedented in Europe: while the share of cov-lite loans in the US reached a similar level before the 2008 crisis, in 2007 only 7% of European Leveraged Loans lacked these protections.

Not everybody, however, demonizes this change in the market: Dwight Scott, CEO of GSO, the credit arm of Blackstone, says in an interview with the Financial Times that “The increase in “covenant lite” loans is not necessarily a sign of imprudent lending. Rather, it reflects the evolution of this market. Unlike banks, which often hold loans until repaid, today’s more diverse investor base actively buys and sells loans, making certain types of covenants less useful. If a loan’s risk profile changes, investors can sell”.

This opinion lies on the grounded consideration that the investor base for Leveraged Loans has dramatically changed with time. While the term loans seems to indicate credit instruments that are held on the balance sheets of the lenders (the banks), these loans are nowadays almost fully syndicated to Institutional Investors that, especially in this phase of the market, engage in constant trade with each other.

This implies, at least in the US, a level of liquidity in the Leveraged Loans Market which is comparable to the one of full-fledged capital markets products, like Bonds. The problem, once again, is that the European Loan market does not showcase the same levels of trading and liquidity. Jonathan Butler, head of European leveraged finance at PGIM Fixed Income, a fund with assets worth $730 billion, says that it commonly takes 20 days for loan trades to settle in Europe – compared with 3-5 days in the US. This could lead, if a downturn in the European Loans market occurs, to a fall in prices of loans much deeper than the one that could be expected in the US market.

US institutional voices are facing the risks posed by the Leveraged Loans Market. European counterparties should realize that the situation in our continent is no less concerning, and actually it is even more so: neglecting this would be myopic.

Giacomo Longoni

This opinion lies on the grounded consideration that the investor base for Leveraged Loans has dramatically changed with time. While the term loans seems to indicate credit instruments that are held on the balance sheets of the lenders (the banks), these loans are nowadays almost fully syndicated to Institutional Investors that, especially in this phase of the market, engage in constant trade with each other.

This implies, at least in the US, a level of liquidity in the Leveraged Loans Market which is comparable to the one of full-fledged capital markets products, like Bonds. The problem, once again, is that the European Loan market does not showcase the same levels of trading and liquidity. Jonathan Butler, head of European leveraged finance at PGIM Fixed Income, a fund with assets worth $730 billion, says that it commonly takes 20 days for loan trades to settle in Europe – compared with 3-5 days in the US. This could lead, if a downturn in the European Loans market occurs, to a fall in prices of loans much deeper than the one that could be expected in the US market.

US institutional voices are facing the risks posed by the Leveraged Loans Market. European counterparties should realize that the situation in our continent is no less concerning, and actually it is even more so: neglecting this would be myopic.

Giacomo Longoni