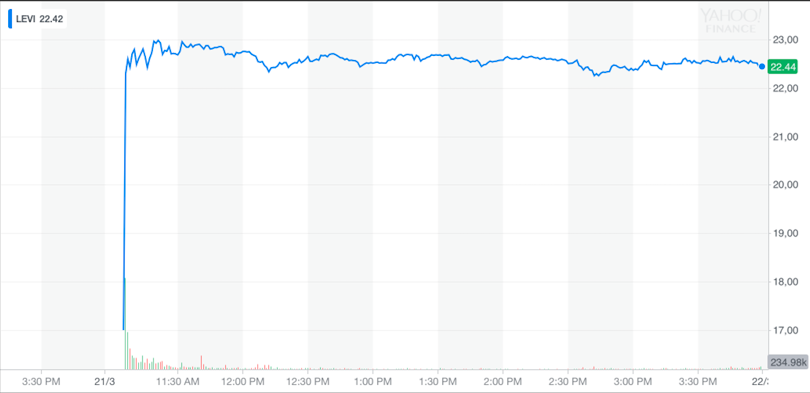

Levi Strauss made an initial public offering Thursday morning, marking the second Wall Street debut for the iconic jeans maker in its 166-year history. Traders at the New York Stock Exchange got in the spirit today by wearing Levi's denim from head-to-toe, breaking with a longstanding "no jeans allowed" policy. The stock - traded under the ticker LEVI - has enjoyed a great deal of enthusiasm by investors, with a 32% over-performance with respect to expectations two hours after market opening, trading at $22.50. Levi's was first taken public in 1971, before being privatized in 1985. The money being raised in its return to the public markets is part of the San Francisco-based company's plans to expand.

Levi Strauss announced Wednesday afternoon that at least 36.7 million shares were sold at $17 apiece, raising about $623.3 million at a valuation topping $6.5 billion. The price was even higher than Levi’s expected leading up to the IPO, as it had stated a range of $14 to $16. Moreover, there were 12 underwriters on the deal led by Goldman Sachs & Co., and they have access to another 5.5 million shares that would be sold by the company. Though it may be best known for jeans, the company also sells dress pants, shoes, and accessories. It also owns the Dockers brand, which the company says helped to drive the 1990s trend toward “Casual Fridays”, and the Signature by Levi Strauss & Co. and Denizen brands, which are priced affordably.

Unlike the vast majority of recent IPO’s, LEVI is highly profitable and relatively cheap. However, the high number of insiders selling shares in the IPO should give investors pause. The company indeed is only selling 9 million out of the 36.7 placed on the markets, with the rest of proceeds going in the pockets of existing shareholders. In addition, the company’s dual-class share structure gives the Haas family – descendants of founder Levi Strauss – total control while preventing public shareholders from having a say on corporate governance. Each Class A share is entitled to one vote, while each Class B share has 10 votes, with the latter primarily held by the Haas family. The company was indeed publicly traded from 1971 to 1985, until it was bought in a leveraged buyout by the descendants of the company’s founder, for whom - analysts say - the public offering has been a financial boon. Nonetheless, even after the IPO, the company will maintain roughly 80% of the voting shares.

Levi Strauss announced Wednesday afternoon that at least 36.7 million shares were sold at $17 apiece, raising about $623.3 million at a valuation topping $6.5 billion. The price was even higher than Levi’s expected leading up to the IPO, as it had stated a range of $14 to $16. Moreover, there were 12 underwriters on the deal led by Goldman Sachs & Co., and they have access to another 5.5 million shares that would be sold by the company. Though it may be best known for jeans, the company also sells dress pants, shoes, and accessories. It also owns the Dockers brand, which the company says helped to drive the 1990s trend toward “Casual Fridays”, and the Signature by Levi Strauss & Co. and Denizen brands, which are priced affordably.

Unlike the vast majority of recent IPO’s, LEVI is highly profitable and relatively cheap. However, the high number of insiders selling shares in the IPO should give investors pause. The company indeed is only selling 9 million out of the 36.7 placed on the markets, with the rest of proceeds going in the pockets of existing shareholders. In addition, the company’s dual-class share structure gives the Haas family – descendants of founder Levi Strauss – total control while preventing public shareholders from having a say on corporate governance. Each Class A share is entitled to one vote, while each Class B share has 10 votes, with the latter primarily held by the Haas family. The company was indeed publicly traded from 1971 to 1985, until it was bought in a leveraged buyout by the descendants of the company’s founder, for whom - analysts say - the public offering has been a financial boon. Nonetheless, even after the IPO, the company will maintain roughly 80% of the voting shares.

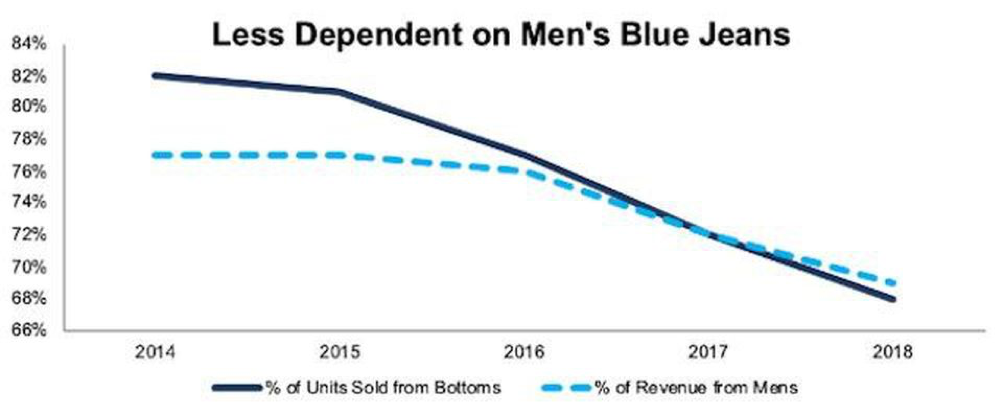

The company had $5.6 billion in revenue in fiscal 2018 across three reporting geographies: the Americas accounted for 55% of its sales, Europe for 29% and Asia, which includes the Mideast and Africa, contributed to 16%. Net revenue has grown from $4.8 billion in fiscal 2011, representing a compound annual growth of 2.3%. However, net income has grown from $135 million in fiscal 2011 to $285 million in fiscal 2018, for a CAGR of 11.3%. Wholesale channels accounted for 65% of net revenues in fiscal 2018, but no single customer represented 10% or more of the total. It is the top jeans brand in the world by total retail sales, according to its prospectus.

"We are focusing on our product design and marketing efforts to reshape our global consumer perceptions from a US men's bottoms-oriented company to a global lifestyle leader for both men and women," it said in a February regulatory filing. To do that, the apparel brand wants to push deeper into different categories, such as tops and women's wear. The company is also looking to expand in key markets such as China, India and Brazil. China, for instance, makes up about 20% of the global apparel market but only represented 3% of Levi's revenue in the last fiscal year. The money raised through today’s IPO could then be the mean by which such an expansion strategy is implemented.

Daniel Sacco

Daniel Sacco