On November 14th, Legal & General Investment (Holdings) Limited (LGIM) acquired Canvas, the European exchange-traded fund platform owned by ETF Securities. The UK’s biggest asset manager has now had a “Vanguard moment” and, after 24 years of sitting on the sidelines, it is finally “coming to the ETF party”.

Canvas is a platform that has built a diverse range of ETFs working with partners and directly in a UCITS compliant ETF format. It manages investments for a number of ETFs on the platform, while also allowing partners to launch and manage their own ETFs. Its product range is registered for distribution in 14 countries, all across Europe, and it holds $2.7bn AUM and 17 products across equity, fixed income and commodities. The platform will remain an open architecture for differentiated products and for the large majority of ETFs to be managed and distributed by LGIM.

Legal & General Investment Management (LGIM) is one of the UK’s largest asset managers and a major global investor, with total assets under management of £951.1 billion. They work with a wide range of global clients, including pension schemes, sovereign wealth funds, fund distributors and retail investors providing investment expertise across the full spectrum of asset classes.

The acquisition provides LGIM’s clients with access to one of the fastest growing segments in asset management, broadening LGIM’s geographical reach and product range. It will also bolster LGIM’s capabilities and expertise, enabling it to provide more solutions to help clients achieve their investment objectives.

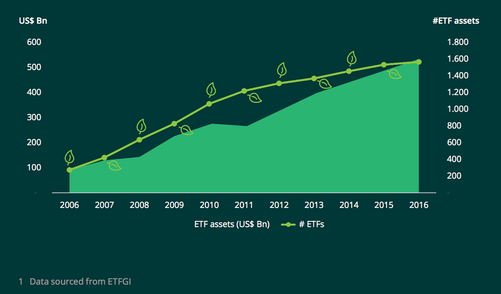

Explaining the acquisition, chief executive Mark Zinkula noted that the ETF market is one of the fastest growing segments in asset management. Globally, the ETF industry has $4.6tn under management and is set for a fourth consecutive year of record-breaking new business. Some $3.3tn is in the US but Europe is growing faster: assets held in ETFs and other exchange-traded products were up 34 per cent in the first 10 months of this year, to $800bn. Also, members of Deloitte stated that they “expect ETF assets to continue to grow, and predict that the industry AuM will reach US$ 3trillion by the end of 2020”.

Canvas is a platform that has built a diverse range of ETFs working with partners and directly in a UCITS compliant ETF format. It manages investments for a number of ETFs on the platform, while also allowing partners to launch and manage their own ETFs. Its product range is registered for distribution in 14 countries, all across Europe, and it holds $2.7bn AUM and 17 products across equity, fixed income and commodities. The platform will remain an open architecture for differentiated products and for the large majority of ETFs to be managed and distributed by LGIM.

Legal & General Investment Management (LGIM) is one of the UK’s largest asset managers and a major global investor, with total assets under management of £951.1 billion. They work with a wide range of global clients, including pension schemes, sovereign wealth funds, fund distributors and retail investors providing investment expertise across the full spectrum of asset classes.

The acquisition provides LGIM’s clients with access to one of the fastest growing segments in asset management, broadening LGIM’s geographical reach and product range. It will also bolster LGIM’s capabilities and expertise, enabling it to provide more solutions to help clients achieve their investment objectives.

Explaining the acquisition, chief executive Mark Zinkula noted that the ETF market is one of the fastest growing segments in asset management. Globally, the ETF industry has $4.6tn under management and is set for a fourth consecutive year of record-breaking new business. Some $3.3tn is in the US but Europe is growing faster: assets held in ETFs and other exchange-traded products were up 34 per cent in the first 10 months of this year, to $800bn. Also, members of Deloitte stated that they “expect ETF assets to continue to grow, and predict that the industry AuM will reach US$ 3trillion by the end of 2020”.

This deal follows the sale of ETF Securities’ European business to WisdomTree this week, representing $18bn AUM, as sign of the maturity and attractiveness of the industry. L&G commented that “a number of long-term macro trends, including the increasing use of passive vehicles and the drive to digitalization, will lead to a growing demand for ETF products” and called its move into the market a natural step in their strategy to develop products for a wider audience.

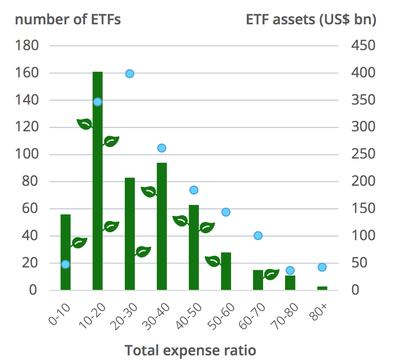

For L&G, the trouble is that others want to provide this service. JPMorgan, Franklin Templeton and BMO Global are also launching new ETF ranges in Europe. In addition, the last few years have seen a material re-pricing of ETFs, as new entrants have resulted in

aggressive market share plays based on low total expense ratios (TER).

For L&G, the trouble is that others want to provide this service. JPMorgan, Franklin Templeton and BMO Global are also launching new ETF ranges in Europe. In addition, the last few years have seen a material re-pricing of ETFs, as new entrants have resulted in

aggressive market share plays based on low total expense ratios (TER).

In addition to the competitiveness due to the growing interest in the industry, L&G’s challenge is that “it is arriving at the house party at the eleventh hour: it has a lot of catching up to do”.

Gianluca Giani

Sources: Financial Times, Reuters, Business Wire, Money Marketing, Performance Magazine

Gianluca Giani

Sources: Financial Times, Reuters, Business Wire, Money Marketing, Performance Magazine