INTRODUCTION

Destruction, weapons, death, and crime are the strongest and most heartbreaking images we have been witnessing lately since the war outbreak: not only were commercial activities affected, but also communication channels, as well as social networks, have been widely involved.

War broke out on the border of Europe on February 24th, when Russian troops invaded Ukraine, announcing it with a recorded video message from President Vladimir Putin.

It is not the first time that Moscow has involved Ukraine in a conflict. The invasion of the peninsula began eight years ago on 20 February 2014, when a group of Russian men broke into the Parliament of Simferopol, the capital of the Autonomous Republic of Crimea. Having established a pro-Russian government and organized a lightning referendum, Russia annexed the peninsula in violation of international law, Ukraine's sovereignty and territorial integrity.

Therefore, if it is true that in the last period there has been an escalation in the deterioration of relations between Moscow and Kiev, it must also be taken into consideration that the tensions between the two countries are not new.

Russia's offensive continues and the first war wounds are emerging both in terms of casualties and as an attack on the economy not only of the countries involved but also of a large part of the West.

HOW MUCH IS RUSSIA SPENDING ON THIS WAR?

The crippling blow struck from Russia appears to be hard not only for Ukraine but also for Russia.

Moscow is suffering big losses and the costs seem to be exorbitant: it is not known how long the conflict will continue, as the invasion of Ukraine has already placed Russia on the verge of bankruptcy.

With its 11 time zones, how can Russia be so small?

Although it has a large territorial extent, it is a small territory from an economic point of view and, according to the International Monetary Fund (IMF), Russia's gross domestic product (GDP) was $1.7tn in 2021 - rather low when compared to those of other European countries.

Therefore, contrary to what President Vladimir Putin probably thought before starting the war, Russia is not invincible and will certainly not have a dunk victory. Experts argue that with such a small economy, Russia is not enough to win a war against a country that is fighting its forces tooth and nail.

For instance, interest rates doubled, the stock market closed, and the ruble bottomed out. Similarly, Russia has also received strong international sanctions, designed to give the final blow to the Russian economy by the European Union, United States, United Kingdom and other Western nations.

INTERNATIONAL SANCTIONS

Destruction, weapons, death, and crime are the strongest and most heartbreaking images we have been witnessing lately since the war outbreak: not only were commercial activities affected, but also communication channels, as well as social networks, have been widely involved.

War broke out on the border of Europe on February 24th, when Russian troops invaded Ukraine, announcing it with a recorded video message from President Vladimir Putin.

It is not the first time that Moscow has involved Ukraine in a conflict. The invasion of the peninsula began eight years ago on 20 February 2014, when a group of Russian men broke into the Parliament of Simferopol, the capital of the Autonomous Republic of Crimea. Having established a pro-Russian government and organized a lightning referendum, Russia annexed the peninsula in violation of international law, Ukraine's sovereignty and territorial integrity.

Therefore, if it is true that in the last period there has been an escalation in the deterioration of relations between Moscow and Kiev, it must also be taken into consideration that the tensions between the two countries are not new.

Russia's offensive continues and the first war wounds are emerging both in terms of casualties and as an attack on the economy not only of the countries involved but also of a large part of the West.

HOW MUCH IS RUSSIA SPENDING ON THIS WAR?

The crippling blow struck from Russia appears to be hard not only for Ukraine but also for Russia.

Moscow is suffering big losses and the costs seem to be exorbitant: it is not known how long the conflict will continue, as the invasion of Ukraine has already placed Russia on the verge of bankruptcy.

With its 11 time zones, how can Russia be so small?

Although it has a large territorial extent, it is a small territory from an economic point of view and, according to the International Monetary Fund (IMF), Russia's gross domestic product (GDP) was $1.7tn in 2021 - rather low when compared to those of other European countries.

Therefore, contrary to what President Vladimir Putin probably thought before starting the war, Russia is not invincible and will certainly not have a dunk victory. Experts argue that with such a small economy, Russia is not enough to win a war against a country that is fighting its forces tooth and nail.

For instance, interest rates doubled, the stock market closed, and the ruble bottomed out. Similarly, Russia has also received strong international sanctions, designed to give the final blow to the Russian economy by the European Union, United States, United Kingdom and other Western nations.

INTERNATIONAL SANCTIONS

- Flights: Russian airlines have been banned from the airspace of the US, UK, EU and Canada, and the UK has also banned private jets chartered by Russians.

- Oil and Gas: even if the Russian economy is underdeveloped from the standpoint of manufacturing goods, which roughly make up two-thirds of Russian imports, it is important to point out that raw materials and energy (gas and oil) represent 80% of its exports, with most European countries dependent on Russia's gas deliveries. For example, in 2020 Russian gas accounted for around 65% of all German gas imports and 45% of Italian ones. Nevertheless, this does not seem to interest the other states, who instead think that in the longer run, however, Russia would suffer the most from such a move. Among the sanctions for Moscow, the US also aims to ban all Russian imports of oil and gas and the UK focuses on eliminating Russian oil by 2022. Similarly, the European Union aims to decrease imports of gas by two thirds within a year, seeking to make Europe independent of Russian energy "well before 2030".

- Financial Measures: major Russian banks have been banned from the international financial messaging system SWIFT, the most important payment transfer network. Moreover, Russia's central bank has had its assets frozen, and consequently can no longer use its $630bn of foreign currency reserves, held in various Western central banks, from the Fed to the Bank of Italy. Blocking access to these resources means that any request from the Russian monetary authorities to access the funds for withdrawals, exchanges, operations of any kind, will be refused. This does not allow to rebalance the forex market and it keeps Moscow's hands tied. Finally, also for this reason the ruble plunged to historic lows against the euro and dollar as markets reopened. The depreciation of the ruble leads to an increase in Russian inflation, which is already approaching the double digit (8.7% in January against a target of 4%).

HOW HAS RUSSIA REACTED TO THE WAR?

RUSSIAN CENTRAL BANK MEASURES

The Russian central bank has taken emergency measures to save its economy: first, it blocked exchanges on the stock exchange, delayed trading in the ruble (which in any case collapsed) and then it decided to raise the interest rate from 9.5 to 20% in one fell swoop, trying to limit bank runs. In addition, to bolster its reserves, the Central Bank required Russian companies to sell 80% of their foreign currency revenues to the state.

RUSSIAN CENTRAL BANK MEASURES

The Russian central bank has taken emergency measures to save its economy: first, it blocked exchanges on the stock exchange, delayed trading in the ruble (which in any case collapsed) and then it decided to raise the interest rate from 9.5 to 20% in one fell swoop, trying to limit bank runs. In addition, to bolster its reserves, the Central Bank required Russian companies to sell 80% of their foreign currency revenues to the state.

Since Russia cannot access its reserves, it is dependent on the payment flows it receives from gas deliveries, which offer some form of protection to Russia's financial situation. This is why Moscow thought it twice before turning off the taps: they need foreign currency to keep their economy running. Accordingly, Putin reacted by forcing hostile nations to pay rubles for their Russian gas imports, trying to save the value of the currency.

EUROBONDS

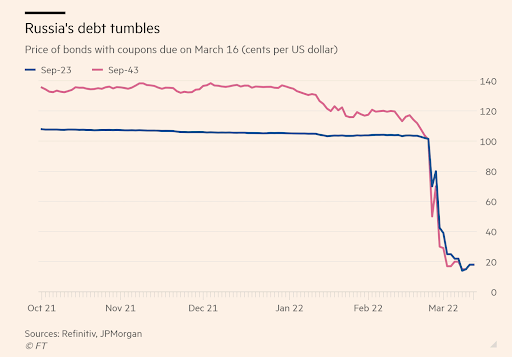

The freezing of foreign exchange reserves has caused a further problem that deals with the payment of Eurobonds, but the likelihood of default seems to have escaped. In fact, the Russian finance minister Anton Siluanov in an interview with the Rossiya-24 television channel stated that he had to pay two "Eurobonds" issued in 2013: the first is a 3 billion dollar bond maturing in 2023 with an interest rate of 4.875%, the second is a 1.5 billion bond with a rate of 5.875% maturing in 2043. The two coupons to be paid amount to $73m and $44m.

Previously, the holder of the Russian finances indicated the possibility that the payment of interest on the bonds would be made by Moscow in rubles with the consequence that Russia would be declared in default. But bondholders have begun to receive $117m coupon payments on Russian state-issued dollar bonds maturing on March 16th. The payments were received by the counterparty bank JPMorgan, which passed them on to the paying agent Citibank. This is the first payment due since February 24th, the day the invasion of Ukraine by Russian troops began.

Russia has not collapsed, but creditors holding Russian government bonds in dollars and euros would be the most likely to risk in the event of default. For all the major rating agencies (e.g., S&P, Fitch and Moody's), Russian bonds are on the step just above the default level. The next deadlines are approaching: on March 31st Moscow will have to pay another $359m on a bond maturing in 2030, on April 4th a $2bn bond matures.

EUROBONDS

The freezing of foreign exchange reserves has caused a further problem that deals with the payment of Eurobonds, but the likelihood of default seems to have escaped. In fact, the Russian finance minister Anton Siluanov in an interview with the Rossiya-24 television channel stated that he had to pay two "Eurobonds" issued in 2013: the first is a 3 billion dollar bond maturing in 2023 with an interest rate of 4.875%, the second is a 1.5 billion bond with a rate of 5.875% maturing in 2043. The two coupons to be paid amount to $73m and $44m.

Previously, the holder of the Russian finances indicated the possibility that the payment of interest on the bonds would be made by Moscow in rubles with the consequence that Russia would be declared in default. But bondholders have begun to receive $117m coupon payments on Russian state-issued dollar bonds maturing on March 16th. The payments were received by the counterparty bank JPMorgan, which passed them on to the paying agent Citibank. This is the first payment due since February 24th, the day the invasion of Ukraine by Russian troops began.

Russia has not collapsed, but creditors holding Russian government bonds in dollars and euros would be the most likely to risk in the event of default. For all the major rating agencies (e.g., S&P, Fitch and Moody's), Russian bonds are on the step just above the default level. The next deadlines are approaching: on March 31st Moscow will have to pay another $359m on a bond maturing in 2030, on April 4th a $2bn bond matures.

According to the Kremlin, Russia has all the means and resources necessary to avoid a default on public debt but it seems that Putin's certainties are not so well founded.

MILITARY SPENDING

A central point to consider is that Russia's military spending is currently insufficient to deal with a conflict that does not seem to see the light yet. Russia today spends around $62bn every year (about 4% of its GDP) on its military, which is just 8% of the United States military spending.

So, what is the solution the Kremlin is currently taking on?

Increasing spending on the ruble does not seem to be the right shot. At the same time, a greater investment in war armaments will necessarily lead to a reduction in production investments, which will weigh more and more on the Russian economy, which is evidently already close to a point of no return.

HOW WILL THE WAR END?

Despite everything, Putin does not give up: maybe he cannot win a war conventionally but it seems that he knows another unconventional way to wipe out a country in the blink of an eye. It’s terrifying, but do not forget that Russia's spearhead is its nuclear arsenal: nuclear bombs certainly cannot win a diplomatic war, but the Russian President seems far away from diplomacy.

That being said, we’ll now move on to understanding how the weapons industry acts behind closed doors. We’ll start off with a suitable introduction to the industry and then slowly dive into realizing how the industry incited the current Russia-Ukraine conflict. Such an understanding is fundamental in order to realize the meaning of the defense budget numbers presented earlier.

“HOW DO WE ARM THE OTHER ELEVEN?”

The weapon’s industry’s dynamics can be perfectly summed up by the following excerpt from the 2005 movie “Lord of War” which tells the story of the notorious arms dealer Viktor Bout:

“There are over 500 million firearms in the worldwide circulation

That is one firearm for every twelve people on the planet

The only question is

How do we arm the other eleven?”

According to the 2021 Stockholm International Peace Research Institute (SIPRI)’s annual report, 10 countries currently hold the industry monopoly as they control around 90% of the world’s arms trade. Germany, Russia, China, France, and the US accounted for well over 75% of it during the period going from 2016 to 2020. South Korea, Spain, Israel, Italy, and the UK offered an array of operationally tested equipment amounting to around 15 % of total global military revenue. The rest of the world, including giants like India (0.2% share), was responsible for providing the remaining 9-10% which was mostly made of secondary components to be supplied to large producers.

CHEERING FOR WAR

As human beings, we can all understand (unfortunately, some more than others) the sense of satisfaction that one may gain from seeing someone else in despair. Well, what if the other’s despair is equivalent to his death? While it may seem hard to believe that one would be excited as someone else’s death is imminent, it may be even more shocking to realize that the arms industry is even quite open about it.

Raytheon and Lockheed Martin (amongst the most advanced armament makers) have been publicly telling their investors how the Ukraine conflict (where millions of innocent lives are facing unimaginable atrocities given a few politicians’ greed) is extremely good for their profits.

Here is what Gregory J. Hayes, Raytheon's CEO, stated on a January 25th earnings call:

“We just have to look to last week where we saw the drone attack in the UAE […] And of course, the tensions in eastern Europe [...] all of those things are putting pressure on some of the defense spending over there [...] we’re going to see some benefit from it.”

BLOOD AND GOLD

As previously discussed, the conflict has already seen an outstanding increase in defense spending. Europe has already announced how it would buy and deliver around $450m of weapons to Russia’s rival, while the US has pledged $350m in military aid other than over 90 tons of military supplies. For example, the conflict has seen NATO and the US sending over 15,000 anti-tank weapons and around 2,000 Stinger anti-aircraft missiles in recent weeks. An international coalition of nations (including UK, Australia, Turkey and Canada) is also arming the Ukrainian military.

Focusing exclusively on Europe, the European Commission President Ursula von der Leyen has recently announced that the EU would finance a systematic military aid to Ukraine. Germany has broken with its policy of banning all exports of lethal weapons to conflict zones and will deliver weapons and fuel to Ukraine. Besides that, Germany has also announced that it would increase its defense budget by a whopping €100bn and raise it well above the 2% of GDP required by NATO - as the German Chancellor Olaf Scholz said: "We will have to invest more in the security of our country to protect our freedom and democracy".

In break with its neutral stance, Sweden announced it would deliver anti-tank weapons to Kyiv. France has committed defense equipment and fuel support. Belgium and the Netherlands will also provide an array of weapons and protective equipment. Portugal, the Czech Republic and Romania are also supporting the Ukrainian borders by providing military equipment.

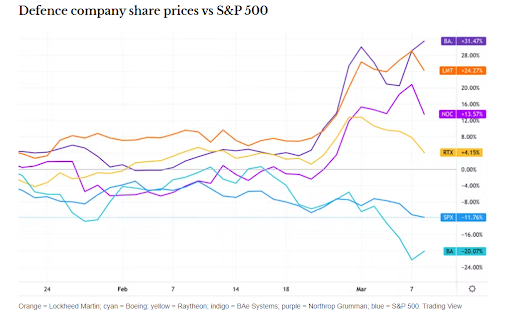

This is a gold mine for the arms industry. For instance, Raytheon makes the Stinger missiles, and jointly with Lockheed Martin makes the Javelin anti-tank missiles being supplied by countries like the US and Estonia. Both US companies, Lockheed and Raytheon shares are up by more than 15% and 4% respectively since the conflict started, compared to the 1% drop in the S&P 500.

MILITARY SPENDING

A central point to consider is that Russia's military spending is currently insufficient to deal with a conflict that does not seem to see the light yet. Russia today spends around $62bn every year (about 4% of its GDP) on its military, which is just 8% of the United States military spending.

So, what is the solution the Kremlin is currently taking on?

Increasing spending on the ruble does not seem to be the right shot. At the same time, a greater investment in war armaments will necessarily lead to a reduction in production investments, which will weigh more and more on the Russian economy, which is evidently already close to a point of no return.

HOW WILL THE WAR END?

Despite everything, Putin does not give up: maybe he cannot win a war conventionally but it seems that he knows another unconventional way to wipe out a country in the blink of an eye. It’s terrifying, but do not forget that Russia's spearhead is its nuclear arsenal: nuclear bombs certainly cannot win a diplomatic war, but the Russian President seems far away from diplomacy.

That being said, we’ll now move on to understanding how the weapons industry acts behind closed doors. We’ll start off with a suitable introduction to the industry and then slowly dive into realizing how the industry incited the current Russia-Ukraine conflict. Such an understanding is fundamental in order to realize the meaning of the defense budget numbers presented earlier.

“HOW DO WE ARM THE OTHER ELEVEN?”

The weapon’s industry’s dynamics can be perfectly summed up by the following excerpt from the 2005 movie “Lord of War” which tells the story of the notorious arms dealer Viktor Bout:

“There are over 500 million firearms in the worldwide circulation

That is one firearm for every twelve people on the planet

The only question is

How do we arm the other eleven?”

According to the 2021 Stockholm International Peace Research Institute (SIPRI)’s annual report, 10 countries currently hold the industry monopoly as they control around 90% of the world’s arms trade. Germany, Russia, China, France, and the US accounted for well over 75% of it during the period going from 2016 to 2020. South Korea, Spain, Israel, Italy, and the UK offered an array of operationally tested equipment amounting to around 15 % of total global military revenue. The rest of the world, including giants like India (0.2% share), was responsible for providing the remaining 9-10% which was mostly made of secondary components to be supplied to large producers.

CHEERING FOR WAR

As human beings, we can all understand (unfortunately, some more than others) the sense of satisfaction that one may gain from seeing someone else in despair. Well, what if the other’s despair is equivalent to his death? While it may seem hard to believe that one would be excited as someone else’s death is imminent, it may be even more shocking to realize that the arms industry is even quite open about it.

Raytheon and Lockheed Martin (amongst the most advanced armament makers) have been publicly telling their investors how the Ukraine conflict (where millions of innocent lives are facing unimaginable atrocities given a few politicians’ greed) is extremely good for their profits.

Here is what Gregory J. Hayes, Raytheon's CEO, stated on a January 25th earnings call:

“We just have to look to last week where we saw the drone attack in the UAE […] And of course, the tensions in eastern Europe [...] all of those things are putting pressure on some of the defense spending over there [...] we’re going to see some benefit from it.”

BLOOD AND GOLD

As previously discussed, the conflict has already seen an outstanding increase in defense spending. Europe has already announced how it would buy and deliver around $450m of weapons to Russia’s rival, while the US has pledged $350m in military aid other than over 90 tons of military supplies. For example, the conflict has seen NATO and the US sending over 15,000 anti-tank weapons and around 2,000 Stinger anti-aircraft missiles in recent weeks. An international coalition of nations (including UK, Australia, Turkey and Canada) is also arming the Ukrainian military.

Focusing exclusively on Europe, the European Commission President Ursula von der Leyen has recently announced that the EU would finance a systematic military aid to Ukraine. Germany has broken with its policy of banning all exports of lethal weapons to conflict zones and will deliver weapons and fuel to Ukraine. Besides that, Germany has also announced that it would increase its defense budget by a whopping €100bn and raise it well above the 2% of GDP required by NATO - as the German Chancellor Olaf Scholz said: "We will have to invest more in the security of our country to protect our freedom and democracy".

In break with its neutral stance, Sweden announced it would deliver anti-tank weapons to Kyiv. France has committed defense equipment and fuel support. Belgium and the Netherlands will also provide an array of weapons and protective equipment. Portugal, the Czech Republic and Romania are also supporting the Ukrainian borders by providing military equipment.

This is a gold mine for the arms industry. For instance, Raytheon makes the Stinger missiles, and jointly with Lockheed Martin makes the Javelin anti-tank missiles being supplied by countries like the US and Estonia. Both US companies, Lockheed and Raytheon shares are up by more than 15% and 4% respectively since the conflict started, compared to the 1% drop in the S&P 500.

BAE Systems, the weapons industry’s protagonist in the UK and Europe, is up by more than 20%. Of the world’s top 5 defense contractors by sales, only Boeing has dropped, simply because of its exposure to airlines.

The biggest risk to this industry, as mentioned by Richard Aboulafia, managing director of US defense consultancy AeroDynamic Advisory, is that “the whole thing is revealed to be a Russian house of cards and the threat dissipates”. Put simply, everyone involved in the weapons sector is cheering for the war to continue and hence, for more deaths, atrocities and bombings.

“Politics is not a game, it’s a serious business” (W. Churchill)

As mentioned by the the magazine “In These Times”, the US military-industrial complex has been employing around 700 lobbyists per year since 2017, equivalent to more than one lobbyist per member of Congress, to push their military agendas. Raytheon, Lockheed Martin and General Dynamics (another leading US military behemoth which is part of the Lockheed Martin group) are all co-founders of the US’s Center for Strategic and International Studies which have been doggedly pushing the Biden administration to take immediate action in the Russia-Ukraine conflict.

As Erik Sperling, head of Just Policy, said: “Everyone in (Washington) DC knows that weapon manufacturers are helping skew US policy towards militarism, but they usually try to be less obvious”.

The set of dynamics is quite nostalgic of the movie “Charlie Wilson’s War”. The latter is based on the efforts of both the Congressman Wilson and a Central Intelligence Agency operative to arm the Afghan Mujahideen in Pakistan for the apparent purpose of securing Soviet Army’s eviction from Afghanistan, much to the profitable delight of America’s weapons industrialists.

To conclude, let's remind ourselves of the wise words of Smedley Butler, the most decorated marine in U.S. history at time of death in 1940:

“War is a racket. It always has been.

It is possibly the oldest, easily the most profitable, surely the most vicious.

It is the only one international in scope.

It is the only one in which the profits are reckoned in dollars and the losses in lives.“

Written by Anna Rosaria Manni and Arshdeep Singh