LVMH is a French multinational luxury goods holding headquartered in Paris and born in 1987 after the merger between the fashion companies Louis Vuitton and Moet Hennessy - derived in 1971 as a result of a merger between Moët & Chandon (champagne producer) and Hennessy (cognac manufacturer). Currently, it controls 60 subsidiaries which manage in turn different prestigious brands. Recent performances of the company show revenues for €46.862 billions in 2018 for a total income of nearly €6.5 billions and more than €125 billions of assets under management.

The soul of LVMH dates back to the 90s, when Bernard Arnault, CEO and major shareholder of the Group, had the idea to create a group of luxury brands. After four decades, he has turned it into the world’s largest luxury company in terms of revenue.

But what has been the key driver of the Group’s growth? This growth has been fostered by Arnault’s willingness to make new deals. The first, and historically most important, acquisition has been the one of Boussac, parent company of the luxury brand Christian Dior, which became the precursor of more than 40 future LVMH acquisitions. Reflecting on his idea to put so many luxury brands under one roof, Arnault told CNBC, “In the 90s, I had the idea of a luxury group and at the time I was very much criticized for it. I remember people telling me it doesn’t make sense to put together so many brands. And it was a success ... And for the last 10 years now, every competitor is trying to imitate, which is very rewarding for us. I think they are not successful but they try.”

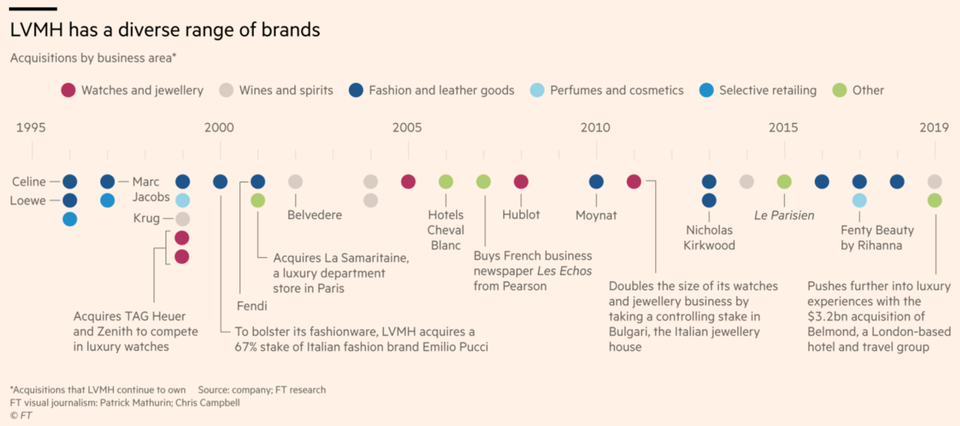

The key factor of LVMH’s appetite for dealmaking has been the advantage of diversification. Indeed, the variety of its brands allowed the company to increase its financial performance maintaining an incredibly high level of stability while beating all the potential competition. LVMH’s €46.8bn sales last year were more than three times the size of its nearest rival, Kering. Over the last decade, deals have become a way to expand beyond the company’s original root and enter new industries (see Exhibit 1). For example, since 2006 it has begun to expand in the hotel sector, with the acquisition of the hospitality groups Hotels Chevales and Belmond (2018), owner the Hotel Cipriani in Venice and the Venice Simplon-Orient-Express. Recently, LVMH decided to strengthen its position in the jewelry sector, by acquiring Tiffany&Co, the global luxury jeweler. The 14.5$ bn deal marked Arnault’s largest ever acquisition and pushed LVMH’s diversification business further.

Exhibit 1

The soul of LVMH dates back to the 90s, when Bernard Arnault, CEO and major shareholder of the Group, had the idea to create a group of luxury brands. After four decades, he has turned it into the world’s largest luxury company in terms of revenue.

But what has been the key driver of the Group’s growth? This growth has been fostered by Arnault’s willingness to make new deals. The first, and historically most important, acquisition has been the one of Boussac, parent company of the luxury brand Christian Dior, which became the precursor of more than 40 future LVMH acquisitions. Reflecting on his idea to put so many luxury brands under one roof, Arnault told CNBC, “In the 90s, I had the idea of a luxury group and at the time I was very much criticized for it. I remember people telling me it doesn’t make sense to put together so many brands. And it was a success ... And for the last 10 years now, every competitor is trying to imitate, which is very rewarding for us. I think they are not successful but they try.”

The key factor of LVMH’s appetite for dealmaking has been the advantage of diversification. Indeed, the variety of its brands allowed the company to increase its financial performance maintaining an incredibly high level of stability while beating all the potential competition. LVMH’s €46.8bn sales last year were more than three times the size of its nearest rival, Kering. Over the last decade, deals have become a way to expand beyond the company’s original root and enter new industries (see Exhibit 1). For example, since 2006 it has begun to expand in the hotel sector, with the acquisition of the hospitality groups Hotels Chevales and Belmond (2018), owner the Hotel Cipriani in Venice and the Venice Simplon-Orient-Express. Recently, LVMH decided to strengthen its position in the jewelry sector, by acquiring Tiffany&Co, the global luxury jeweler. The 14.5$ bn deal marked Arnault’s largest ever acquisition and pushed LVMH’s diversification business further.

Exhibit 1

The several acquisitions allowed LVMH to access to new experts, to encounter fresh ideas and new perspective and, first of all, to gain encouragement to keep building and growing. When a journalist of the Financial Times asked Mr’Arnaults if Tiffany&Co represented the last LVMH acquisition, he replied: “We are still small. We’re just getting started . . . We are number one, but we can go further.”

Riccardo Tirelli