BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

On November 25th 2019, LVMH and Tiffany announced that they have entered into a definitive agreement for an all cash transaction, valuing Tiffany nearly $17.9 bn. After two rounds of negotiations, the companies settled on LVMH acquiring Tiffany for $135 per share (up from the initial offer of $120 of October 27th), for a total equity value of $16.2 bn making this operation the largest ever concluded in the whole luxury sector.

Market Overview

The acquisition stems from the continuous expansion of the market in which the two companies operate: the luxury market. When we refer to this industry, it is worth specifying which distinct sectors we are referring to. In fact, as LVMH embraces different branches of this broad market (Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics, Watches & Jewelry and Selective Retailing), Tiffany only covers one: personal luxury goods.

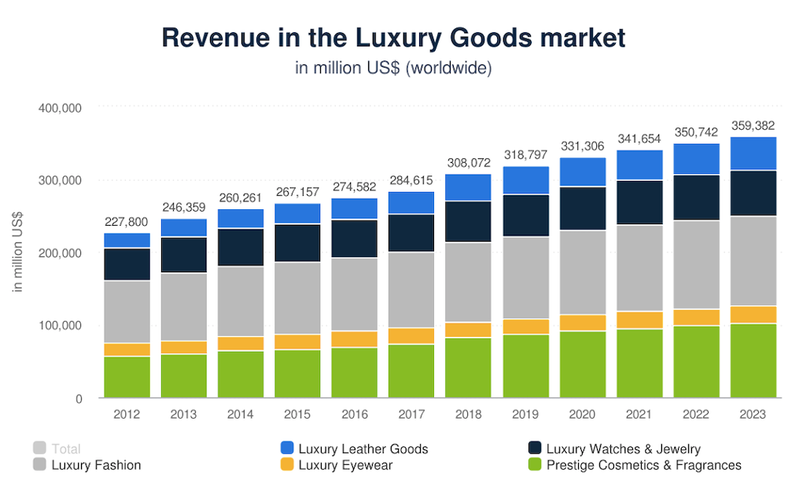

The next graph shows revenue by segment in the worldwide luxury goods market for the 2012-2023 period:

On November 25th 2019, LVMH and Tiffany announced that they have entered into a definitive agreement for an all cash transaction, valuing Tiffany nearly $17.9 bn. After two rounds of negotiations, the companies settled on LVMH acquiring Tiffany for $135 per share (up from the initial offer of $120 of October 27th), for a total equity value of $16.2 bn making this operation the largest ever concluded in the whole luxury sector.

Market Overview

The acquisition stems from the continuous expansion of the market in which the two companies operate: the luxury market. When we refer to this industry, it is worth specifying which distinct sectors we are referring to. In fact, as LVMH embraces different branches of this broad market (Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics, Watches & Jewelry and Selective Retailing), Tiffany only covers one: personal luxury goods.

The next graph shows revenue by segment in the worldwide luxury goods market for the 2012-2023 period:

Focusing on Tiffany’s niche of personal luxury goods, we can see how it is among the fastest-growing segments of the luxury market. Its outlook is highly positive, as reported in the following chart, and is mainly driven by Asian demand, principally made of high-income young customers.

Within this segment, jewelry occupies a significant position and shows the highest growth rate. The prospects are also promising, as it is estimated that the size of this sub-segment will be worth over $480 bn by 2025, expanding at a CAGR of 8.1%, according to a new report by Grand View Research, Inc. The sub-segment is expected to witness significant growth due to increase in income and shift in consumer preferences.

LVMH

The LVMH group is a French conglomerate headquartered in Paris. It currently is a world leader in luxury, being engaged in diversified businesses both in terms of business segments and geographies. It comprises 75 brands that create high quality products in all five major segments of the luxury market: Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics, Watches & Jewellery and Selective Retailing.

LVMH was formed in 1987 when Louis Vuitton merged with Moet Hennessy in a $4 bn deal. Since then, other major acquisitions followed, including Givenchy (1988), Kenzo (1993), Marc Jacobs (1997), Gucci Group (1999), Bulgari (2011), Loro Piana (2013), and Stella McCartney (2019) among others.

Key to the long-hauled success of the group is its operational strategy. Although the Maisons are part of an ecosystem, they are autonomously run and have a business model that is unique to the brand. In fact, by decentralizing operations, the group stays agile and each brand is allowed to have their own entrepreneurial mindset, that enables them to keep their market position at the edge of the industry.

LVMH

The LVMH group is a French conglomerate headquartered in Paris. It currently is a world leader in luxury, being engaged in diversified businesses both in terms of business segments and geographies. It comprises 75 brands that create high quality products in all five major segments of the luxury market: Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics, Watches & Jewellery and Selective Retailing.

LVMH was formed in 1987 when Louis Vuitton merged with Moet Hennessy in a $4 bn deal. Since then, other major acquisitions followed, including Givenchy (1988), Kenzo (1993), Marc Jacobs (1997), Gucci Group (1999), Bulgari (2011), Loro Piana (2013), and Stella McCartney (2019) among others.

Key to the long-hauled success of the group is its operational strategy. Although the Maisons are part of an ecosystem, they are autonomously run and have a business model that is unique to the brand. In fact, by decentralizing operations, the group stays agile and each brand is allowed to have their own entrepreneurial mindset, that enables them to keep their market position at the edge of the industry.

In 2018, LVMH recorded revenues of €46.8 bn, an increase of 10% over the previous year. All business groups recorded an excellent performance, scoring a +21% growth in profits and reaching €10 bn, with Fashion and Leather Goods being the most profitable.

Given these results, the Annual General Meeting approved last April a dividend of €6 per share, that represents an increase of 20%.

The first half 2019 showed promising results as well, indicating a further growth, in fact revenues registered a +15% increase with respect to the previous year, signaling an encouraging perspective for the future.

When compared to its competitors, LVMH was one of the top performers in the stock in 2019. Its shares rose by more than 60% and outperformed all major competitors (Burberry, Richemont, Kering, Pernod Ricard, Prada, Ralph Lauren, Estee Lauder).

Tiffany

Tiffany & Co, is an American multinational jewellery company founded in 1837 and headquartered New York. The company is the designer, manufacturer and seller of its jewellery.

The company was first founded by a 25-year old Charles Lewis Tiffany who, together with the friend John B. Young, opened a stationary and fancy goods store in New York. The store adopted the British silver standard of using only material that was 92% pure, and quickly gained popularity.

The turning point came in 1887, when Tiffany bought the French Crown jewels. This solidified brand’s association with high-quality diamonds.

In 1978, the company sold to Avon Products Inc for $104 mln and, in 1984, the same Avon sold it again to an investor group for $135.5 mln. Tiffany went public in 1987 and raised about $103.5 mln from the sale of 4.5 mln shares of common stock.

At the beginning of its business, Tiffany would target extremely wealthy customer segments because of its expensive products. However, since the company introduced silver collections, its jewellery became more affordable and reached a larger pool of customers.

Given these results, the Annual General Meeting approved last April a dividend of €6 per share, that represents an increase of 20%.

The first half 2019 showed promising results as well, indicating a further growth, in fact revenues registered a +15% increase with respect to the previous year, signaling an encouraging perspective for the future.

When compared to its competitors, LVMH was one of the top performers in the stock in 2019. Its shares rose by more than 60% and outperformed all major competitors (Burberry, Richemont, Kering, Pernod Ricard, Prada, Ralph Lauren, Estee Lauder).

Tiffany

Tiffany & Co, is an American multinational jewellery company founded in 1837 and headquartered New York. The company is the designer, manufacturer and seller of its jewellery.

The company was first founded by a 25-year old Charles Lewis Tiffany who, together with the friend John B. Young, opened a stationary and fancy goods store in New York. The store adopted the British silver standard of using only material that was 92% pure, and quickly gained popularity.

The turning point came in 1887, when Tiffany bought the French Crown jewels. This solidified brand’s association with high-quality diamonds.

In 1978, the company sold to Avon Products Inc for $104 mln and, in 1984, the same Avon sold it again to an investor group for $135.5 mln. Tiffany went public in 1987 and raised about $103.5 mln from the sale of 4.5 mln shares of common stock.

At the beginning of its business, Tiffany would target extremely wealthy customer segments because of its expensive products. However, since the company introduced silver collections, its jewellery became more affordable and reached a larger pool of customers.

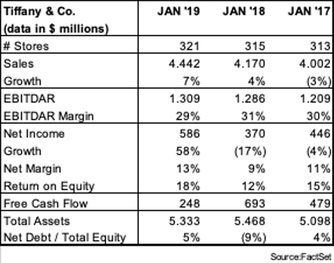

In 2018, Tiffany achieved $4.4 bn of net sales, with net earnings of $586 mln. The Board of Directors approved a 10% increase in dividend rate, signaling the company’s health.

The company furthermore flaunts a very strong brand recognition and reputation, which are arguably its strongest intangible assets.

Deal rationale

Through this acquisition, LVMH aims to further expand its presence in the “hard luxury” business. Indeed, the company’s “Watches & Jewellery” division has been growing in importance for the past two decades.

Acquiring Tiffany would more than double LVMH’s market share in jewellery to 18.4%, making it the number one player in the space. This would allow the conglomerate to better compete with Richemont, owner of brands such as Cartier and Van Cleef & Arpels, in the incredibly fast-growing category of the luxury goods sectors which is jewellery.

While the 37% premium LVMH agreed to pay over Tiffany’s undisturbed share price might be considered high, there are solid justifications for it – extending well beyond cost savings. With heavy investments in marketing and retail expansion, in fact, LVMH aims to leverage Tiffany’s heritage in order to further grow the brand’s appeal and dramatically increase the company’s financial performance. Analysts expect LVMH to be able to bring Tiffany’s operating margin from 17% to 23% within 5 years and create value for its shareholders through this acquisition by 2025.

LVMH has experience in creating value from its acquisitions. In 2011, it added Bulgari to its “Watches & Jewellery” division and since then, through a combination of strategic decisions and investments in marketing, it was able to double its sales and quintuple its profits.

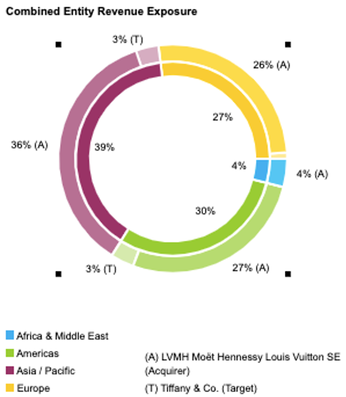

The acquisition of Tiffany will furthermore be beneficial for the geographical expansion of both companies. LVMH will grow its presence in the US, while Tiffany will benefit from expansion in Europe and China – where Bernard Arnault, chief executive of LVMH, says sees untapped opportunities for Tiffany.

The company furthermore flaunts a very strong brand recognition and reputation, which are arguably its strongest intangible assets.

Deal rationale

Through this acquisition, LVMH aims to further expand its presence in the “hard luxury” business. Indeed, the company’s “Watches & Jewellery” division has been growing in importance for the past two decades.

Acquiring Tiffany would more than double LVMH’s market share in jewellery to 18.4%, making it the number one player in the space. This would allow the conglomerate to better compete with Richemont, owner of brands such as Cartier and Van Cleef & Arpels, in the incredibly fast-growing category of the luxury goods sectors which is jewellery.

While the 37% premium LVMH agreed to pay over Tiffany’s undisturbed share price might be considered high, there are solid justifications for it – extending well beyond cost savings. With heavy investments in marketing and retail expansion, in fact, LVMH aims to leverage Tiffany’s heritage in order to further grow the brand’s appeal and dramatically increase the company’s financial performance. Analysts expect LVMH to be able to bring Tiffany’s operating margin from 17% to 23% within 5 years and create value for its shareholders through this acquisition by 2025.

LVMH has experience in creating value from its acquisitions. In 2011, it added Bulgari to its “Watches & Jewellery” division and since then, through a combination of strategic decisions and investments in marketing, it was able to double its sales and quintuple its profits.

The acquisition of Tiffany will furthermore be beneficial for the geographical expansion of both companies. LVMH will grow its presence in the US, while Tiffany will benefit from expansion in Europe and China – where Bernard Arnault, chief executive of LVMH, says sees untapped opportunities for Tiffany.

Deal valuation and Price history

Tiffany was advised by Goldman Sachs & Co. and Centerview Partners, while Citigroup and JPMorgan Chase & Co. advised LVMH

The following table reports the main items included in the final valuation of the all cash deal:

Enterprise Value 17,878.07

- Interest Bearing Debt 2,205.90

+ Cash 680.60

= Equity Value 16,352.77

Offer Price per Share 135

Premium 37%

The charts below shows both acquirer and target’s share prices evolution in 2019 and market reactions to the deal:

It is easy to see market’s reaction on October 28, following the news that Tiffany & Co received an unsolicited, non-binding proposal from LVMH, as well as the stronger one after the revised offer was submitted on November 24.

Given the rational previously outlined the deal was welcomed by the market: LVMH’s share price, in fact, rose 6.31% on the day of announcement.

The US$135 per share in cash agreement was reached on November 25, 2019 and on February 4, 2020, it was announced that, Tiffany & Co's 71.9% of the shareholders approved the transaction which is expected to be completed in the second quarter of 2020.

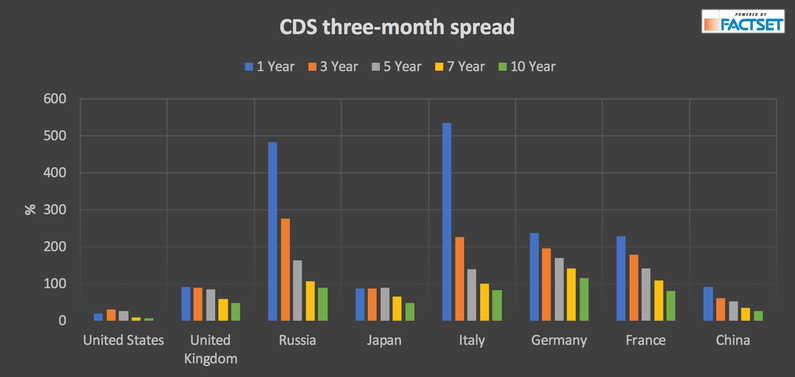

Finally, on February 5, it was reported that LVMH had planned a bond issuance to raise EUR9.3 billion (US$10.3 billion) to help fund the transaction.

EMEA TEAM (Alessandro Marengo, Lorenzo Monticone, Sofiya Sergeeva, Valentina Pascoletti, Davide Cibaldi)

Given the rational previously outlined the deal was welcomed by the market: LVMH’s share price, in fact, rose 6.31% on the day of announcement.

The US$135 per share in cash agreement was reached on November 25, 2019 and on February 4, 2020, it was announced that, Tiffany & Co's 71.9% of the shareholders approved the transaction which is expected to be completed in the second quarter of 2020.

Finally, on February 5, it was reported that LVMH had planned a bond issuance to raise EUR9.3 billion (US$10.3 billion) to help fund the transaction.

EMEA TEAM (Alessandro Marengo, Lorenzo Monticone, Sofiya Sergeeva, Valentina Pascoletti, Davide Cibaldi)