As the world shifts towards renewable energy sources, offshore wind power has emerged as a promising option to meet the rising demand for clean energy.

However, the success of offshore wind farms largely depends on one hidden key player: their maintenance and upkeep.

However, the success of offshore wind farms largely depends on one hidden key player: their maintenance and upkeep.

Introduction

The offshore wind maintenance industry plays a crucial role in maintaining and repairing offshore wind farms, which generate electricity from wind turbines located in large bodies of water such as oceans. Together with the offshore wind installation industry, it represents a significant bottleneck for the expansion of offshore wind farms in Europe. The complex maintenance tasks involved require highly skilled technicians and specialized vessels to carry out inspections, repairs, replacements, and upgrades of components such as blades, towers, foundations, and electrical systems. These tasks are often performed in challenging weather conditions, and workers require specialized equipment and techniques to access turbines located far from the shoreline. Regular maintenance is essential to ensure the safety and reliability of wind farms, maximize their energy output, and extend their lifespan. Through regular inspection and servicing of wind turbines, maintenance professionals can identify and address potential issues before they cause equipment failure or compromise safety.

According to a report by Wood Mackenzie, the global offshore wind operations and maintenance (O&M) market was valued at approximately USD 2.6 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 16% between 2021 and 2030 to a value of USD 12 billion. This growth prospect is attributed to several factors, including the increasing number of offshore wind farms, the need for regular maintenance and repair services, and the development of new technologies for more efficient maintenance. The offshore wind maintenance industry is also contributing to job creation and economic growth. According to a report by the International Renewable Energy Agency (IRENA), the offshore wind industry is expected to create over 24 million full-time equivalent jobs and up to $1 trillion in global GDP per year by 2050.

The offshore wind maintenance industry plays a crucial role in maintaining and repairing offshore wind farms, which generate electricity from wind turbines located in large bodies of water such as oceans. Together with the offshore wind installation industry, it represents a significant bottleneck for the expansion of offshore wind farms in Europe. The complex maintenance tasks involved require highly skilled technicians and specialized vessels to carry out inspections, repairs, replacements, and upgrades of components such as blades, towers, foundations, and electrical systems. These tasks are often performed in challenging weather conditions, and workers require specialized equipment and techniques to access turbines located far from the shoreline. Regular maintenance is essential to ensure the safety and reliability of wind farms, maximize their energy output, and extend their lifespan. Through regular inspection and servicing of wind turbines, maintenance professionals can identify and address potential issues before they cause equipment failure or compromise safety.

According to a report by Wood Mackenzie, the global offshore wind operations and maintenance (O&M) market was valued at approximately USD 2.6 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 16% between 2021 and 2030 to a value of USD 12 billion. This growth prospect is attributed to several factors, including the increasing number of offshore wind farms, the need for regular maintenance and repair services, and the development of new technologies for more efficient maintenance. The offshore wind maintenance industry is also contributing to job creation and economic growth. According to a report by the International Renewable Energy Agency (IRENA), the offshore wind industry is expected to create over 24 million full-time equivalent jobs and up to $1 trillion in global GDP per year by 2050.

Geographical Areas

The majority of offshore wind farms are concentrated in the northern regions of Europe, with the United Kingdom and Germany accounting for approximately 40% of the total offshore wind power capacity installed worldwide in 2022. Northern Europe is considered a promising area for the installation of offshore wind farms due to the high average wind speed present in the area, particularly around the United Kingdom and Scandinavian countries. This observation is supported by data from the wind atlas, which highlights the potential for harnessing wind energy in the region.

The majority of offshore wind farms are concentrated in the northern regions of Europe, with the United Kingdom and Germany accounting for approximately 40% of the total offshore wind power capacity installed worldwide in 2022. Northern Europe is considered a promising area for the installation of offshore wind farms due to the high average wind speed present in the area, particularly around the United Kingdom and Scandinavian countries. This observation is supported by data from the wind atlas, which highlights the potential for harnessing wind energy in the region.

Mean wind speed across EMEA.

Source: Global Wind Atlas

Source: Global Wind Atlas

Offshore wind farms generally benefit from a higher average wind speed compared to onshore areas. This is due in part to the absence of obstacles such as trees, buildings, and other constructions that can impair the quality of onshore wind. The physical argument for this phenomenon is based on the concepts of adhesion and fluid dynamic boundary layer. The condition of adhesion requires that, near fixed surfaces, the speed of a fluid is zero, leading to a zone of subsidence (velocity gradient) called the boundary layer that wind must traverse to reach the nominal speed in the vertical direction. Achieving the same efficiency per mill for onshore wind farms requires significant capital expenditures, as wind turbines need to be installed at greater heights to compensate for these obstacles. This trend is already observable in the onshore wind industry.

Offshore wind farms benefit from a more uniform airflow, resulting in higher load factors, an important key performance indicator (KPI) in the industry. Load factor is the ratio between the actual output of a wind turbine and the theoretical maximum output in a year, accounting for seasonality. Multiple sources indicate that onshore wind turbines have a load factor of approximately 23%, while offshore wind turbines have a load factor of 39%, representing a difference of approximately 15%.

The depth of the sea is another important factor for the installation of offshore wind farms, as offshore wind turbines can only be reasonably installed up to a depth of 60 meters. From the bathymetric profile, we can see that some promising wind locations, such as the Mediterranean Sea, are no longer suitable due to their depth. A potential solution to this problem is floating offshore wind turbines, which are currently being tested and represent 0.3% of the offshore wind market, with an expected compound annual growth rate (CAGR) of 42.4% until 2030. However, fixed offshore wind turbines remain the primary driver of offshore wind capacities due to the proven concept, lower costs, supply chain capacities, and availability of suitable locations around the United Kingdom and Scandinavian countries. Therefore, this article focuses on fixed offshore wind turbines.

Bathymetric profile: Europe mean underwater depth.

Source: Maritime Forum

Source: Maritime Forum

Value Chain Offshore

A stable and reliable offshore wind supply chain is crucial for Europe to become a world leader in renewable energy and achieve its target of CO2 neutrality by 2050. This article provides an overview of the current situation of the offshore wind value chain, its current flaws, and the role of governments in this process. Additionally, we will examine example companies that represent the individual steps in the value chain and elaborate on them.

There are several key characteristics in the value chain of the offshore wind industry that impose specific challenges on all market participants. Firstly, most of the steps in the supply chain are covered by companies that provide only one service. This leads to a highly fragmented supply chain with no fully integrated players in the market. As a result, almost all companies struggle to meet their delivery dates, as they are highly dependent on their suppliers. This leads to delays of multiple years at the end of the value chain for operators and owners of wind parks, such as Orsted, or maintenance companies, such as Edda Wind, which rely on timely delivery for their service vessels.

Secondly, the long-term planning of offshore wind parks and the uncertainty of realization make it a risky business, as large CAPEX expenditures need to be made in anticipation of future demand in the market. The new EU energy security strategy, REPowerEU, aims to more than double the 200 GW installed today by 2030. However, this has not yet translated into orders for the offshore wind industry. In recent years, many players have struggled as many offshore wind projects were delayed or put on hold due to supply chain issues arising from Covid-19. This development has led to overcapacity in wind turbines and significant bottlenecks in other parts of the value chain.

Thirdly, the industry is highly dependent on government decisions and financial support. It is noteworthy that this summer will see the first subsidy-free offshore wind farm in Europe. All other offshore wind farms depend on government funding to be attractive to private capital. The beginning of subsidy-free projects also leads to strong price pressures throughout the supply chain. Whether companies can remain profitable depends on their market power, negotiation skills, and ability to control costs. Accordingly, we are seeing the first signs of significant outsourcing of turbine blade production to China, which is a worrying development, as there are parallels to the downfall of the solar industry in Europe, as Chinese manufacturers are now starting to beat European companies on the cost and win orders in Europe.

On the process side, governments in Europe impose significant challenges on market participants through lengthy approval processes. According to data from the European power association Eurelectric, Europe has four times as much wind capacity awaiting approval as it does under construction. In addition, inadequately designed auctions aimed solely at price competition for the allocation of new offshore wind farm locations exacerbate a race to the bottom that leads to outsourcing and profitability focus rather than in-time delivery and stable supply chains. Interestingly, claim management for delays of deliverables is considered one of the most important factors for success in the European offshore wind market.

Fourthly, the trend towards larger wind turbines leads to constant adjustments in the capabilities of the supply chain. Turbines with more capacity require larger foundations and construction ships that can cope with the increased size. Often, these requirements are not met, which leads to significant delays for projects. A bright side of the development towards larger wind turbines is that this is one of the many factors that has led to lower offshore wind production costs. Currently, the largest installed wind turbine is the Vestas V236-15.0 MW with a rotor diameter of 236m.

A stable and reliable offshore wind supply chain is crucial for Europe to become a world leader in renewable energy and achieve its target of CO2 neutrality by 2050. This article provides an overview of the current situation of the offshore wind value chain, its current flaws, and the role of governments in this process. Additionally, we will examine example companies that represent the individual steps in the value chain and elaborate on them.

There are several key characteristics in the value chain of the offshore wind industry that impose specific challenges on all market participants. Firstly, most of the steps in the supply chain are covered by companies that provide only one service. This leads to a highly fragmented supply chain with no fully integrated players in the market. As a result, almost all companies struggle to meet their delivery dates, as they are highly dependent on their suppliers. This leads to delays of multiple years at the end of the value chain for operators and owners of wind parks, such as Orsted, or maintenance companies, such as Edda Wind, which rely on timely delivery for their service vessels.

Secondly, the long-term planning of offshore wind parks and the uncertainty of realization make it a risky business, as large CAPEX expenditures need to be made in anticipation of future demand in the market. The new EU energy security strategy, REPowerEU, aims to more than double the 200 GW installed today by 2030. However, this has not yet translated into orders for the offshore wind industry. In recent years, many players have struggled as many offshore wind projects were delayed or put on hold due to supply chain issues arising from Covid-19. This development has led to overcapacity in wind turbines and significant bottlenecks in other parts of the value chain.

Thirdly, the industry is highly dependent on government decisions and financial support. It is noteworthy that this summer will see the first subsidy-free offshore wind farm in Europe. All other offshore wind farms depend on government funding to be attractive to private capital. The beginning of subsidy-free projects also leads to strong price pressures throughout the supply chain. Whether companies can remain profitable depends on their market power, negotiation skills, and ability to control costs. Accordingly, we are seeing the first signs of significant outsourcing of turbine blade production to China, which is a worrying development, as there are parallels to the downfall of the solar industry in Europe, as Chinese manufacturers are now starting to beat European companies on the cost and win orders in Europe.

On the process side, governments in Europe impose significant challenges on market participants through lengthy approval processes. According to data from the European power association Eurelectric, Europe has four times as much wind capacity awaiting approval as it does under construction. In addition, inadequately designed auctions aimed solely at price competition for the allocation of new offshore wind farm locations exacerbate a race to the bottom that leads to outsourcing and profitability focus rather than in-time delivery and stable supply chains. Interestingly, claim management for delays of deliverables is considered one of the most important factors for success in the European offshore wind market.

Fourthly, the trend towards larger wind turbines leads to constant adjustments in the capabilities of the supply chain. Turbines with more capacity require larger foundations and construction ships that can cope with the increased size. Often, these requirements are not met, which leads to significant delays for projects. A bright side of the development towards larger wind turbines is that this is one of the many factors that has led to lower offshore wind production costs. Currently, the largest installed wind turbine is the Vestas V236-15.0 MW with a rotor diameter of 236m.

Foundation products - SIF

The foundations of offshore wind farms are critical components that provide essential support and stability for wind turbines situated in offshore locations. These foundations must be designed to withstand adverse environmental conditions, such as strong currents, waves, and storms, in addition to the weight and movement of the wind turbines themselves. Various materials, including steel, concrete, and composites, are employed in the construction of offshore wind farm foundations, with each material possessing distinct advantages and drawbacks depending on factors such as location, water depth, and turbine size.

SIF, a Dutch firm, is a leading manufacturer and installer of steel foundations for offshore wind farms. Established in 1942, the company has evolved to become a prominent player in the offshore wind industry. In recent years, SIF has experienced significant revenue growth, generating revenues of 235 million euros in 2018 and 422 million euros in 2021. However, the company experienced a decline in revenue to 374 million euros in 2022, attributable to supply chain bottlenecks that impacted the availability of raw materials required for production. Despite the decline in revenue, SIF was able to generate a commendable EBITDA of 36 million euros in 2022, representing a margin of 9.73%. This indicates that the company managed to maintain a certain level of profitability amid challenging market conditions.

The foundations of offshore wind farms are critical components that provide essential support and stability for wind turbines situated in offshore locations. These foundations must be designed to withstand adverse environmental conditions, such as strong currents, waves, and storms, in addition to the weight and movement of the wind turbines themselves. Various materials, including steel, concrete, and composites, are employed in the construction of offshore wind farm foundations, with each material possessing distinct advantages and drawbacks depending on factors such as location, water depth, and turbine size.

SIF, a Dutch firm, is a leading manufacturer and installer of steel foundations for offshore wind farms. Established in 1942, the company has evolved to become a prominent player in the offshore wind industry. In recent years, SIF has experienced significant revenue growth, generating revenues of 235 million euros in 2018 and 422 million euros in 2021. However, the company experienced a decline in revenue to 374 million euros in 2022, attributable to supply chain bottlenecks that impacted the availability of raw materials required for production. Despite the decline in revenue, SIF was able to generate a commendable EBITDA of 36 million euros in 2022, representing a margin of 9.73%. This indicates that the company managed to maintain a certain level of profitability amid challenging market conditions.

Wind turbine producer - Siemens Gamesa and Vestas

Offshore wind turbine production involves the manufacturing and assembly of large wind turbines that are designed to operate in offshore locations. This includes the production of various components such as the turbine itself, blades, towers and nacelles which are then assembled at wind turbine assembly facilities and transported to offshore wind farm sites for installation.

After the manufacturing of wind turbine components, they are assembled into a complete wind turbine at a wind turbine assembly facility. This involves the mounting of the blades onto the rotor hub, followed by attaching the rotor hub to the nacelle, which houses the generator and other components.

Vestas, a Danish wind energy company, specializes in designing, manufacturing, installing, and servicing wind turbines worldwide. The company has experienced significant revenue growth over the past few years, generating a revenue of 11.9 billion euros in 2018, which grew to 18.4 billion euros in 2021. However, in 2022, Vestas experienced a considerable drop in revenue, similar to its competitor Siemens Gamesa, reporting 15.2 billion euros. Additionally, the company became unprofitable during the same period, posting a –8% EBITDA margin. In response to these challenges, Vestas has recognized the need to enhance its discipline and optimize the value chain in collaboration with its partners. The company has prioritized the implementation of measures aimed at enhancing commercial efficiency, streamlining processes, and improving cost management. This strategy is intended to ensure that Vestas remains competitive, agile, and adaptable to the dynamic market conditions that characterize the wind energy industry.

Siemens Gamesa, a leading wind turbine manufacturer and competitor to Vestas, operates in the renewable energy sector. The company has a notable track record in the development, production, installation, and maintenance of wind turbines globally. In terms of its financial performance, Siemens Gamesa reported a revenue of 9.1 billion euros in FY 2018, which increased to 10.2 billion euros in FY 2019. However, the company experienced a slight decrease in revenue in FY 2020, reporting 9.4 billion euros. In FY 2021, Siemens Gamesa saw a revenue increase of 10.2 billion euros, but in FY 2022, the company experienced a decrease in revenue, reporting 9.8 billion euros. It is worth noting that the decrease in revenue reported by Siemens Gamesa in FY 2022 was attributed to raw materials bottlenecks. The company faced significant challenges related to the availability and pricing of raw materials, including steel and copper, which impacted its production and delivery schedules.

Offshore wind turbine production involves the manufacturing and assembly of large wind turbines that are designed to operate in offshore locations. This includes the production of various components such as the turbine itself, blades, towers and nacelles which are then assembled at wind turbine assembly facilities and transported to offshore wind farm sites for installation.

After the manufacturing of wind turbine components, they are assembled into a complete wind turbine at a wind turbine assembly facility. This involves the mounting of the blades onto the rotor hub, followed by attaching the rotor hub to the nacelle, which houses the generator and other components.

Vestas, a Danish wind energy company, specializes in designing, manufacturing, installing, and servicing wind turbines worldwide. The company has experienced significant revenue growth over the past few years, generating a revenue of 11.9 billion euros in 2018, which grew to 18.4 billion euros in 2021. However, in 2022, Vestas experienced a considerable drop in revenue, similar to its competitor Siemens Gamesa, reporting 15.2 billion euros. Additionally, the company became unprofitable during the same period, posting a –8% EBITDA margin. In response to these challenges, Vestas has recognized the need to enhance its discipline and optimize the value chain in collaboration with its partners. The company has prioritized the implementation of measures aimed at enhancing commercial efficiency, streamlining processes, and improving cost management. This strategy is intended to ensure that Vestas remains competitive, agile, and adaptable to the dynamic market conditions that characterize the wind energy industry.

Siemens Gamesa, a leading wind turbine manufacturer and competitor to Vestas, operates in the renewable energy sector. The company has a notable track record in the development, production, installation, and maintenance of wind turbines globally. In terms of its financial performance, Siemens Gamesa reported a revenue of 9.1 billion euros in FY 2018, which increased to 10.2 billion euros in FY 2019. However, the company experienced a slight decrease in revenue in FY 2020, reporting 9.4 billion euros. In FY 2021, Siemens Gamesa saw a revenue increase of 10.2 billion euros, but in FY 2022, the company experienced a decrease in revenue, reporting 9.8 billion euros. It is worth noting that the decrease in revenue reported by Siemens Gamesa in FY 2022 was attributed to raw materials bottlenecks. The company faced significant challenges related to the availability and pricing of raw materials, including steel and copper, which impacted its production and delivery schedules.

Planning & Installation of offshore – DNV and Cadeler

The planning and installation of offshore wind farms involve careful consideration of various factors, such as location, weather, and seabed conditions. The process includes design verification, certification, and independent engineering to ensure the successful installation and operation of the wind turbines. Heavy lift vessels are used to transport and install large wind turbine components in challenging offshore environments. Project management, engineering, and logistical support are also critical to the successful delivery of offshore wind projects from start to finish.

DNV and Cadeler are prominent players in this field. DNV offers top-notch technical assurance, advisory, and risk management services, with a notable presence in the offshore wind energy sector. The company provides diverse services, such as design verification, certification, and independent engineering, to facilitate offshore wind farm planning and installation. On the other hand, Cadeler is a pure play in the offshore wind industry, specializing in the installation and maintenance of offshore wind turbines. The company operates a fleet of advanced heavy lift vessels suitable for transporting and installing large wind turbine components in challenging offshore environments. Cadeler's revenue grew from around 160 million USD in 2018 to 290 million USD in 2021, while DNV's maritime business was estimated at USD 930.02 million in 2018 and declined to USD 906.58 million in 2020. The reduction in revenue was attributed to reduced activity levels in the newbuilding market, lower volumes in classification services, and fewer surveys and inspections.

The planning and installation of offshore wind farms involve careful consideration of various factors, such as location, weather, and seabed conditions. The process includes design verification, certification, and independent engineering to ensure the successful installation and operation of the wind turbines. Heavy lift vessels are used to transport and install large wind turbine components in challenging offshore environments. Project management, engineering, and logistical support are also critical to the successful delivery of offshore wind projects from start to finish.

DNV and Cadeler are prominent players in this field. DNV offers top-notch technical assurance, advisory, and risk management services, with a notable presence in the offshore wind energy sector. The company provides diverse services, such as design verification, certification, and independent engineering, to facilitate offshore wind farm planning and installation. On the other hand, Cadeler is a pure play in the offshore wind industry, specializing in the installation and maintenance of offshore wind turbines. The company operates a fleet of advanced heavy lift vessels suitable for transporting and installing large wind turbine components in challenging offshore environments. Cadeler's revenue grew from around 160 million USD in 2018 to 290 million USD in 2021, while DNV's maritime business was estimated at USD 930.02 million in 2018 and declined to USD 906.58 million in 2020. The reduction in revenue was attributed to reduced activity levels in the newbuilding market, lower volumes in classification services, and fewer surveys and inspections.

The operator/owners of wind farms – Orsted

Wind farm operators are companies that own and manage wind farms, generating electricity from wind turbines. They are responsible for the planning, development, construction, and operation of these wind power plants. This includes tasks such as site selection, securing permits, arranging financing, and managing power production. The operators also maintain and service the wind turbines to ensure their reliability and optimal performance, while monitoring the electricity output to provide a stable supply to the grid.

Orsted is a prominent participant in the offshore wind market and has built more offshore wind farms than any other company globally. In 2022, Orsted's business generated a revenue of approximately 20 billion USD. Orsted's EBITDA margin was 16% in 2022, indicating its sturdy position in the market. Presently, offshore wind farms contribute to 61% of the absolute EBITDA of 2022. The company has established a formidable objective of achieving 30 GW of offshore wind capacity by 2030, and it is positioned optimally to take advantage of the surging demand for renewable energy and the global shift from fossil fuels.

Wind farm operators are companies that own and manage wind farms, generating electricity from wind turbines. They are responsible for the planning, development, construction, and operation of these wind power plants. This includes tasks such as site selection, securing permits, arranging financing, and managing power production. The operators also maintain and service the wind turbines to ensure their reliability and optimal performance, while monitoring the electricity output to provide a stable supply to the grid.

Orsted is a prominent participant in the offshore wind market and has built more offshore wind farms than any other company globally. In 2022, Orsted's business generated a revenue of approximately 20 billion USD. Orsted's EBITDA margin was 16% in 2022, indicating its sturdy position in the market. Presently, offshore wind farms contribute to 61% of the absolute EBITDA of 2022. The company has established a formidable objective of achieving 30 GW of offshore wind capacity by 2030, and it is positioned optimally to take advantage of the surging demand for renewable energy and the global shift from fossil fuels.

Maintenance of wind farms– Edda Wind

Information regarding Edda Wind and the industry can be found in the following two sections.

Information regarding Edda Wind and the industry can be found in the following two sections.

Industry Analysis Offshore Wind Maintenance

The offshore wind maintenance industry encompasses a wide range of services, including preventative maintenance, corrective maintenance, and monitoring and inspection. The cost of labour, materials, and equipment all play a significant role in O&M costs for offshore wind farms. In addition, the harsh offshore environment presents unique maintenance challenges, such as accessibility and weather conditions.

Effective offshore wind maintenance services can help optimize O&M costs and improve project performance, leading to greater long-term sustainability and competitiveness. For example, implementing proactive maintenance strategies can reduce downtime and extend the life of wind turbines, while utilizing advanced monitoring technologies can help identify potential issues before they result in costly repairs. As the demand for renewable energy continues to grow, the importance of effective offshore wind maintenance services will only continue to increase.

Offshore wind maintenance services are crucial for the long-term success of offshore wind projects, as they directly impact the levelized cost of energy (LCOE) and overall project performance. The LCOE for offshore wind projects is heavily influenced by the operating and maintenance (O&M) costs, which account for up to 23% of the total investment cost. In contrast, onshore wind turbines typically have lower O&M costs, comprising only about 5% of their total investment cost.

According to a report by Wood Mackenzie, the global offshore wind O&M market is expected to grow from $2.6 billion in 2020 to $12 billion by 2030, representing a compound annual growth rate (CAGR) of 16%. The report notes that this growth is being driven by increasing installed capacity, maturing projects, and the need for ongoing maintenance and repairs.

The offshore wind maintenance industry encompasses a wide range of services, including preventative maintenance, corrective maintenance, and monitoring and inspection. The cost of labour, materials, and equipment all play a significant role in O&M costs for offshore wind farms. In addition, the harsh offshore environment presents unique maintenance challenges, such as accessibility and weather conditions.

Effective offshore wind maintenance services can help optimize O&M costs and improve project performance, leading to greater long-term sustainability and competitiveness. For example, implementing proactive maintenance strategies can reduce downtime and extend the life of wind turbines, while utilizing advanced monitoring technologies can help identify potential issues before they result in costly repairs. As the demand for renewable energy continues to grow, the importance of effective offshore wind maintenance services will only continue to increase.

Offshore wind maintenance services are crucial for the long-term success of offshore wind projects, as they directly impact the levelized cost of energy (LCOE) and overall project performance. The LCOE for offshore wind projects is heavily influenced by the operating and maintenance (O&M) costs, which account for up to 23% of the total investment cost. In contrast, onshore wind turbines typically have lower O&M costs, comprising only about 5% of their total investment cost.

According to a report by Wood Mackenzie, the global offshore wind O&M market is expected to grow from $2.6 billion in 2020 to $12 billion by 2030, representing a compound annual growth rate (CAGR) of 16%. The report notes that this growth is being driven by increasing installed capacity, maturing projects, and the need for ongoing maintenance and repairs.

Edda Wind IPO

A significant development in the emerging offshore maintenance industry is the initial public offering (IPO) of Edda Wind on November 26, 2021, with a pre-money valuation of €103m. Edda Wind was established in 2015 as a spin-off by Østensjø Group, a well-respected maritime services company with a strong offshore presence. In 2020, Wilhelmsen Group acquired 50% of Edda Wind, resulting in a 50/50 pre-IPO ownership split between the two groups.

To support its expansion plans, Edda Wind required substantial capital due to the Capex-intensive nature of the business, which necessitates pre-financing of future vessels. Following the vessel order, Edda Wind can then seek out potential customers and establish contracts. The company's IPO was an attractive option for equity investors due to several reasons, including the fact that Edda Wind is the only true pure play on the offshore maintenance business, which provided investors with specific exposure to the offshore maintenance industry theme. Additionally, Edda Wind's ESG exposure was particularly attractive to sustainability-driven investors.

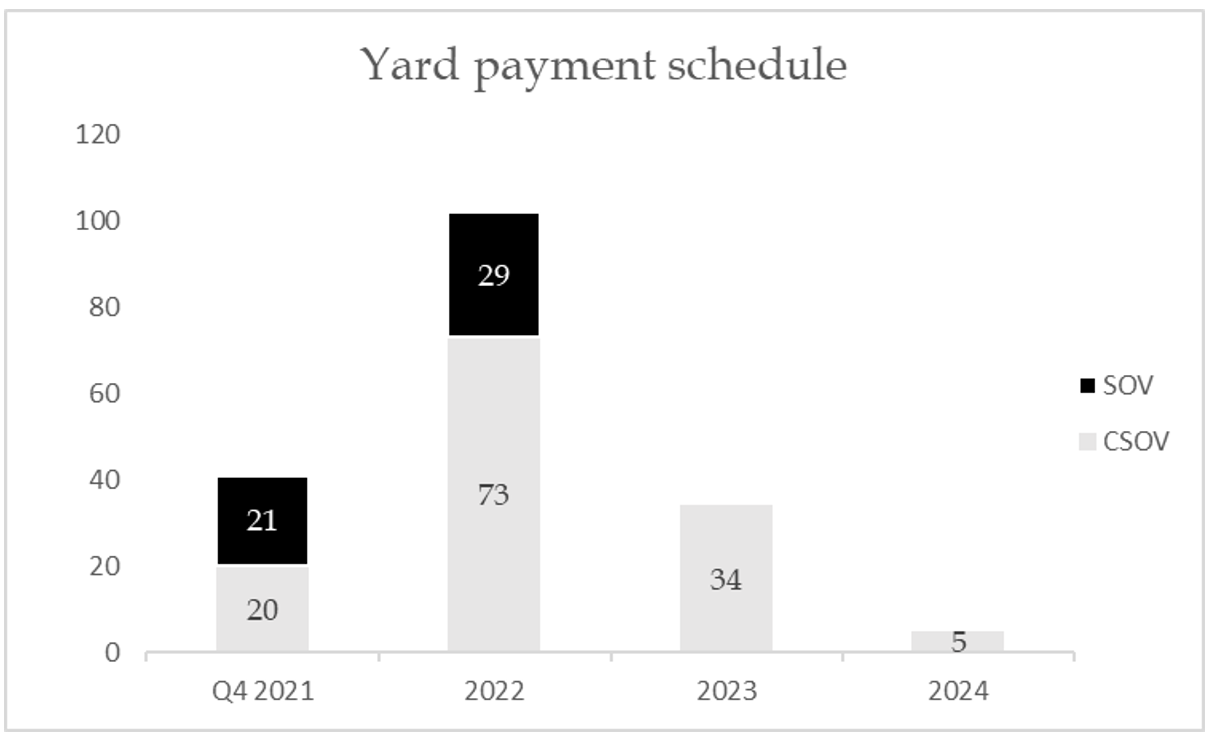

As per the IPO prospectus, Edda Wind planned to increase its number of SOVs and CSOVs from 2 to 8 by Q2 2024. The equity story presented was that the IPO proceeds would finance the new vessels, three of which already had long-term service contracts with major players such as Vestas, Ocean Breeze, and Doggerbank, resulting in long-term growth and profitability for investors. Maintenance vessels are one of the major bottlenecks for the offshore wind industry, representing a significant value-creation opportunity as 23% of offshore wind costs are attributed to O&M, whereas for onshore wind, it accounts for only 5%.

However, since the IPO, Edda Wind has faced challenges due to global supply chain problems, leading to delays in vessel deliveries as essential parts were unavailable. In July, Edda Wind had to cancel two shipbuilding contracts at Colombo Dockyards PLC due to adverse developments in Sri Lanka. As a result of these adverse developments, the share price has declined by approximately 30% since the IPO. This shows the significant risks associated with this business model, as timely delivery of service vessels and low construction costs are essential to achieve the promised margins in the IPO prospectus.

Despite the operational challenges faced by Edda Wind, the company has secured a vessel construction backlog of six additional vessels until Q1 2026, leading to a total backlog of eight vessels. In March 2023, a private placement of 1.2 billion NOK was completed to finance these orders, and in February 2023, a green loan facility of EUR 120 million was secured. The stock market has certainly priced Edda Wind's future growth prospects through its vessel backlog and the positive market outlook while also considering the operational problems and significant delays in vessel delivery.

A significant development in the emerging offshore maintenance industry is the initial public offering (IPO) of Edda Wind on November 26, 2021, with a pre-money valuation of €103m. Edda Wind was established in 2015 as a spin-off by Østensjø Group, a well-respected maritime services company with a strong offshore presence. In 2020, Wilhelmsen Group acquired 50% of Edda Wind, resulting in a 50/50 pre-IPO ownership split between the two groups.

To support its expansion plans, Edda Wind required substantial capital due to the Capex-intensive nature of the business, which necessitates pre-financing of future vessels. Following the vessel order, Edda Wind can then seek out potential customers and establish contracts. The company's IPO was an attractive option for equity investors due to several reasons, including the fact that Edda Wind is the only true pure play on the offshore maintenance business, which provided investors with specific exposure to the offshore maintenance industry theme. Additionally, Edda Wind's ESG exposure was particularly attractive to sustainability-driven investors.

As per the IPO prospectus, Edda Wind planned to increase its number of SOVs and CSOVs from 2 to 8 by Q2 2024. The equity story presented was that the IPO proceeds would finance the new vessels, three of which already had long-term service contracts with major players such as Vestas, Ocean Breeze, and Doggerbank, resulting in long-term growth and profitability for investors. Maintenance vessels are one of the major bottlenecks for the offshore wind industry, representing a significant value-creation opportunity as 23% of offshore wind costs are attributed to O&M, whereas for onshore wind, it accounts for only 5%.

However, since the IPO, Edda Wind has faced challenges due to global supply chain problems, leading to delays in vessel deliveries as essential parts were unavailable. In July, Edda Wind had to cancel two shipbuilding contracts at Colombo Dockyards PLC due to adverse developments in Sri Lanka. As a result of these adverse developments, the share price has declined by approximately 30% since the IPO. This shows the significant risks associated with this business model, as timely delivery of service vessels and low construction costs are essential to achieve the promised margins in the IPO prospectus.

Despite the operational challenges faced by Edda Wind, the company has secured a vessel construction backlog of six additional vessels until Q1 2026, leading to a total backlog of eight vessels. In March 2023, a private placement of 1.2 billion NOK was completed to finance these orders, and in February 2023, a green loan facility of EUR 120 million was secured. The stock market has certainly priced Edda Wind's future growth prospects through its vessel backlog and the positive market outlook while also considering the operational problems and significant delays in vessel delivery.

Anticipated payments by Edda Wind for ordered vessels at the time of the IPO.

Source: Edda Wind IPO

Source: Edda Wind IPO

CONCLUSION

The offshore wind maintenance industry is set to expand significantly in northern Europe, driven by increasing investments in renewable energy and government initiatives. The complex value chain of the industry includes specialized service providers such as vessel operators, maintenance contractors, and original equipment manufacturers. Despite challenges like technical complexity and harsh operating conditions, the Edda Wind IPO highlights the industry's potential for continued growth. Overall, the offshore wind maintenance industry offers exciting opportunities for investors, service providers, and stakeholders to contribute to a more sustainable future.

The offshore wind maintenance industry is set to expand significantly in northern Europe, driven by increasing investments in renewable energy and government initiatives. The complex value chain of the industry includes specialized service providers such as vessel operators, maintenance contractors, and original equipment manufacturers. Despite challenges like technical complexity and harsh operating conditions, the Edda Wind IPO highlights the industry's potential for continued growth. Overall, the offshore wind maintenance industry offers exciting opportunities for investors, service providers, and stakeholders to contribute to a more sustainable future.

By David Overbeck, Scarlett Cheng, and Federica Guirguis

Sources:

- The Bottlenecks Challenging Growth in the EU Offshore Wind Supply Chain by Rabo Bank (2023)

- Supply chain of renewable energy technologies in Europe a JRC Science Report (2017)

- Unlocking Europe’s offshore wind potential Moving towards a subsidy-free industry by PWC (2018)

- Global Wind Power Market Outlook Update: Q4 2021 Wood Mackenzie

- Accenture

- Offshore-windindustry.com

- Mckinsey

- Ocean Energy Europe

- Fortune Business Insights

- Edda Wind IPO prospectus

- Science Direct

- Catapult

- FactSet