In January 2019, the South Africa’s Competition Tribunal reported that it has prohibited a proposed merger between private hospital groups Mediclinic Southern Africa and Matlosana Medical Health Services (MMHS), scuppering the former’s plans to expand in the country’s North West province.

South Africa is mainly dominated by the presence of government run hospitals and clinics in fact the government holds the majority stake in lots of hospital and clinics while the rest remains private. In 2004, a ruling by the South Africa’s Competition Tribunal in the country has changed the entire structure of the healthcare market preventing collective pricing done by various organizations. Consequently, a number of mergers and acquisitions within the market has been made which has lead the private hospital market to concentrate.

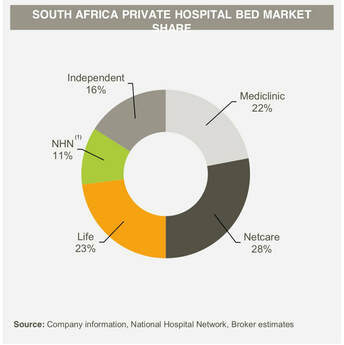

The chart below gives an overview of the Mediclinic’s market positioning and the entire private hospital market, showing that the country is dominated by three major players, which are Netcare Limited, The life Healthcare Group Limited and Mediclinic Southern Africa.

South Africa is mainly dominated by the presence of government run hospitals and clinics in fact the government holds the majority stake in lots of hospital and clinics while the rest remains private. In 2004, a ruling by the South Africa’s Competition Tribunal in the country has changed the entire structure of the healthcare market preventing collective pricing done by various organizations. Consequently, a number of mergers and acquisitions within the market has been made which has lead the private hospital market to concentrate.

The chart below gives an overview of the Mediclinic’s market positioning and the entire private hospital market, showing that the country is dominated by three major players, which are Netcare Limited, The life Healthcare Group Limited and Mediclinic Southern Africa.

Mediclinic Southern Africa is a private hospital group operating in South Africa and Namibia focused on providing acute care, specialist-orientated, multi-disciplinary hospital services and related service offerings operating with 51 private hospitals and four-day clinics throughout South Africa and Namibia. Mediclinic Southern Africa is a wholly owned subsidiary of the international private healthcare group Mediclinic International PLC, listed on the LSE (London Stock Exchange) with a secondary listing on the JSE (Johannesburg Stock Exchange) and the NSX (Namibian Stock Exchange). It owns private hospitals in Southern Africa, Switzerland and the Middle East, and has a minority stake in British private hospital group Spire Healthcare.

Matlosana Medical Health Services (MMHS) is the holding company of Wilmed Park Private Hospital, Sunningdale Private Hospital, Parkmed Neuro Clinic and MMS Ambulance Service. MMHS is situated in Klerksdorp, providing services to the greater community of the Matlosana District also the surrounding communities such as Wolmaranstad, Ventersdorp, Lichtenburg, Coligny and the other surrounding towns.

The Tribunal claims in a statement: "Mediclinic, one of the largest hospital groups in South Africa, owns and operates, inter alia, Mediclinic Potchefstroom which is located about 50km from the target hospitals and Mediclinic Potchefstroom, Wilmed Park and Sunningdale all provide inpatient private hospital services in the Klerksdorp and Potchefstroom area."

In June 2017, the Competition Commission, after investigating on the situation about medical services in South Africa, recommended to the Tribunal that the proposed merger should be prohibited on grounds that it could lead into a kind of monopoly in the sense that the joining together of Mediclinic Potchefstroom, Wilmed Park and Sunningdale hospitals would likely result in a significant increase in healthcare prices in the region, less choice due to reduced competitiveness in the sector, conferring to Mediclinic relatively greater bargaining power in terms of medical schemes and infrastructures.

Lastly, the Commission stated that, after the merger, other structural factors would have been changed such as non-price factors, as patient experience and quality healthcare, which would likely diminish, depending on the main player in the market.

The two companies, Mediclinic and MMHS denied that the proposed merger would have transformed the market in a kind of monopoly, producing negative effects on competition and they argued the opposite, sustaining that it would lead to a number of positive efficiencies in terms of competition. These efficiencies could include improved costs of procurement, increased clinical quality and patient experience at the target hospitals.

Finally, the South Africa’s Competition Tribunal declared, in favor of the prohibition of the potential merger, that, after careful consideration also with a number of medical aids, no appropriate remedy was tendered that would cure the substantial lessening of competition that would arise as a result of the proposed transaction.

Roberto Senatore

Matlosana Medical Health Services (MMHS) is the holding company of Wilmed Park Private Hospital, Sunningdale Private Hospital, Parkmed Neuro Clinic and MMS Ambulance Service. MMHS is situated in Klerksdorp, providing services to the greater community of the Matlosana District also the surrounding communities such as Wolmaranstad, Ventersdorp, Lichtenburg, Coligny and the other surrounding towns.

The Tribunal claims in a statement: "Mediclinic, one of the largest hospital groups in South Africa, owns and operates, inter alia, Mediclinic Potchefstroom which is located about 50km from the target hospitals and Mediclinic Potchefstroom, Wilmed Park and Sunningdale all provide inpatient private hospital services in the Klerksdorp and Potchefstroom area."

In June 2017, the Competition Commission, after investigating on the situation about medical services in South Africa, recommended to the Tribunal that the proposed merger should be prohibited on grounds that it could lead into a kind of monopoly in the sense that the joining together of Mediclinic Potchefstroom, Wilmed Park and Sunningdale hospitals would likely result in a significant increase in healthcare prices in the region, less choice due to reduced competitiveness in the sector, conferring to Mediclinic relatively greater bargaining power in terms of medical schemes and infrastructures.

Lastly, the Commission stated that, after the merger, other structural factors would have been changed such as non-price factors, as patient experience and quality healthcare, which would likely diminish, depending on the main player in the market.

The two companies, Mediclinic and MMHS denied that the proposed merger would have transformed the market in a kind of monopoly, producing negative effects on competition and they argued the opposite, sustaining that it would lead to a number of positive efficiencies in terms of competition. These efficiencies could include improved costs of procurement, increased clinical quality and patient experience at the target hospitals.

Finally, the South Africa’s Competition Tribunal declared, in favor of the prohibition of the potential merger, that, after careful consideration also with a number of medical aids, no appropriate remedy was tendered that would cure the substantial lessening of competition that would arise as a result of the proposed transaction.

Roberto Senatore