On Monday 28th of January 2019, Entegris announced its plan to merge with Versum Materials through an all-stock deal for a total value of $4bn. This type of merge is defined as a merger of equals, which occurs when two firms of similar size come together to form a single company. The deal is structured as an exchange of old shares of the two pre-existing companies for shares of the new company (newco.). In this agreement, the parties have settled for an exchange ratio as to leave stockholders of Entegris with 52.5% of shares of the newco. and shareholders of Versum Materials with the remaining 47.5% of shares.

The newco. will have as chief executive officer and as chief financial officer the current CEO (Bertrand Loy) and CFO (Greg Graves) of Entegris, while the General Counsel (Michael Valente) and Chairman of the Board (Seifi Ghasemi) will come from Versum Materials. The newly formed company will also retain Entegris’ name and its headquarters.

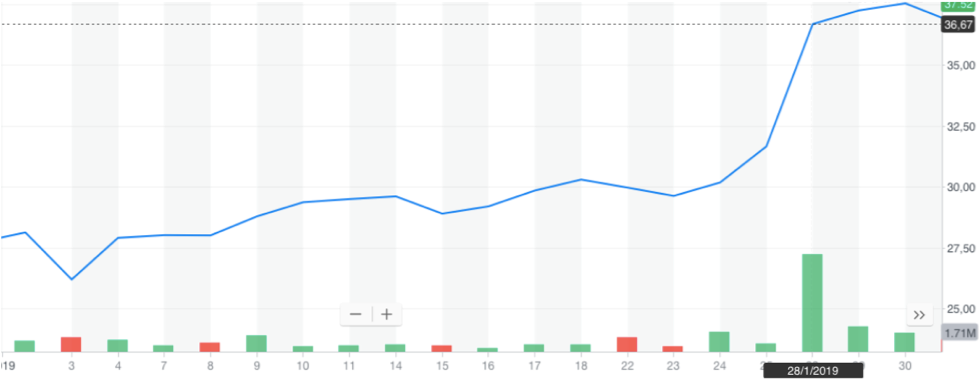

The deal announcement created an immediate effect in the stock price of both Versum (an increase of 15.8% in one day to 36,67$) and Entegris (an increase of 5.8% in one day to 33,16$): Graph 1 shows the time series for both stock prices in the month of January 2019, highlighting the effect of the announcement on January 28.

The newco. will have as chief executive officer and as chief financial officer the current CEO (Bertrand Loy) and CFO (Greg Graves) of Entegris, while the General Counsel (Michael Valente) and Chairman of the Board (Seifi Ghasemi) will come from Versum Materials. The newly formed company will also retain Entegris’ name and its headquarters.

The deal announcement created an immediate effect in the stock price of both Versum (an increase of 15.8% in one day to 36,67$) and Entegris (an increase of 5.8% in one day to 33,16$): Graph 1 shows the time series for both stock prices in the month of January 2019, highlighting the effect of the announcement on January 28.

The newly formed company would become a “premier specialty materials company”, supplying products for purifying, protecting and transporting materials used in the manufacturing process in the semiconductor and other high-tech industries. Furthermore, according to the investor presentation that was released by Entegris and Versum Materials on Monday 28, the newly created company would reach an enterprise value of approximately $9bn and revenues for approximately $3bn – estimated as the sum of the revenues of the two single companies in the preceding fiscal years (Versum Materials $1.4bn and Entegris $1.6bn). The expected synergies between the companies would allow more than $75m in cost savings within 12 months from the conclusion of the deal, arising also from the combination of the expertise of the companies, as well as a more global manufacturing footprint. The deal was unanimously approved by the Boards of Directors of both companies, which – by the beginning of February – expected the agreement to be smoothly concluded in the second half of 2019, following regulatory and shareholder approval.

However, their plans were abruptly disrupted as Merck KGaA, a German company operating both in the pharmaceutical and chemical industry, presented on February 27 an unsolicited offer to buy Versum Materials for $48 per share (in contrast to Entegris offer of $36 per share), valuing the company – including its debt – at $5.9bn. Graph 2 shows how this announcement brought an important increase in the price value of the shares of Versum Materials (an increase of 18,16% in one day for a value of 49,13$). At the same time Entegris’s share price dropped in two days from 37,73$ to 35,33$.

However, their plans were abruptly disrupted as Merck KGaA, a German company operating both in the pharmaceutical and chemical industry, presented on February 27 an unsolicited offer to buy Versum Materials for $48 per share (in contrast to Entegris offer of $36 per share), valuing the company – including its debt – at $5.9bn. Graph 2 shows how this announcement brought an important increase in the price value of the shares of Versum Materials (an increase of 18,16% in one day for a value of 49,13$). At the same time Entegris’s share price dropped in two days from 37,73$ to 35,33$.

Merck KGaA has already started its procedure to strengthen its position in the materials business through the acquisition of AZ electronics for £1.6bn in 2013 and the acquisition of Versum Materials would be the next step in this process to become a leading player in the electronic materials market.

Versum’s Board of Directors reviewed the offer from Merck but, subsequently, on March 1 decided to reject the offer as it has identified greater synergies in its deal with Entegris (even though the valuation of the shares of Versum made by Entegris is lower than the one done by Merck), declaring its intention to be committed to the already existing deal. The two companies have increased the estimate of cost savings in the first 12 months from $75m to $125m, in order to further convince Versum shareholders of the goodness of the agreement. The refusal of the offer caused Merck to go hostile against Versum Materials management as the German company decided, upon advice of Goldman Sachs, to bring the offer directly to the shareholders of Versum, in order to influence their vote on the deal with Entegris - which is scheduled for late April.

However, shareholders never had the possibility to vote on the ratification of this deal between Versum Materials and Entegris, as on the 8th of April the board of directors of Versum Materials decided to accept the revised offer of Merck KGaA of $53 (higher than the initial offer of Merck that was at $48 per share) valuing the U.S. semiconductor supplier at $6.5bn. This agreement also requires the German chemical company to take on approximately $570m of the net debt of Versum Materials. Following the decision of the board of Versum, Entegris decided not to propose a counter bid (which it had the right to do within the 11th of April, according to the terms of its deal with Versum) and walked away from the talks with a termination fee from Versum of $140m.

The fight between Entegris and Merck for Versum Materials has led to a notable appreciation in the stock price of the latter. The price of Versum Materials was at the start of 2019 around $28 per share and is now at the end of April at around $52 (as can be seen in the graph below).

Versum’s Board of Directors reviewed the offer from Merck but, subsequently, on March 1 decided to reject the offer as it has identified greater synergies in its deal with Entegris (even though the valuation of the shares of Versum made by Entegris is lower than the one done by Merck), declaring its intention to be committed to the already existing deal. The two companies have increased the estimate of cost savings in the first 12 months from $75m to $125m, in order to further convince Versum shareholders of the goodness of the agreement. The refusal of the offer caused Merck to go hostile against Versum Materials management as the German company decided, upon advice of Goldman Sachs, to bring the offer directly to the shareholders of Versum, in order to influence their vote on the deal with Entegris - which is scheduled for late April.

However, shareholders never had the possibility to vote on the ratification of this deal between Versum Materials and Entegris, as on the 8th of April the board of directors of Versum Materials decided to accept the revised offer of Merck KGaA of $53 (higher than the initial offer of Merck that was at $48 per share) valuing the U.S. semiconductor supplier at $6.5bn. This agreement also requires the German chemical company to take on approximately $570m of the net debt of Versum Materials. Following the decision of the board of Versum, Entegris decided not to propose a counter bid (which it had the right to do within the 11th of April, according to the terms of its deal with Versum) and walked away from the talks with a termination fee from Versum of $140m.

The fight between Entegris and Merck for Versum Materials has led to a notable appreciation in the stock price of the latter. The price of Versum Materials was at the start of 2019 around $28 per share and is now at the end of April at around $52 (as can be seen in the graph below).

This surge in the stock price of Versum Materials is even more impressive if we consider that the growth in the semiconductor industry (of which Versum is a supplier and so whose prospects and future profits are inevitably connected to those of the semiconductor industry) has been sluggish in these months following a slowdown in the demand for mobile devices and a strong decline in the prices for memory chips. However, this has not had a major impact on the semiconductor industry as the ETF which tracks the semiconductor industry, the VanEck Vectors Semiconductor ETF (a value weighted ETF that tracks the biggest semiconductor producers such as Intel, NVIDIA and Qualcomm), shows since there has been an impressive surge in value as the ETF has reached on the 18/04/2019 a value of $117.73.

Graph 4: VanEck Vectors Semiconductor ETF development in these 5 years

Graph 4: VanEck Vectors Semiconductor ETF development in these 5 years

Click here to edit.

The ETF has reached such a high value because of many factors, some of which are firm specific (Apple and Qualcomm in mid-April have reached an agreement which has led to a notable boost in the Qualcomm share price) while others concern the industry as the prospects for the switch to the 5G wireless technology and for opportunities that AI development might bring to the semiconductor industry envisage a bright future for the semiconductor manufacturers as a whole. It was probably these future prospects that convinced Merck KGaA to step up its offer and bet on the U.S. semiconductor supplier.

Federico Adorini

Federico Adorini