Money Market Funds’ popularity grew, but what next?

Introduction

Money market funds (“MMFs”) invest in cash and low-risk / short-term debt securities, such as short-dated US government debt, and are generally considered an ultra-safe cash substitute. The instrument has been introduced in the 70s and has been gaining popularity ever since, but it is only in the recent period of economic uncertainty caused several factors (i.e. Covid-19 crisis, inflation and interest rate dynamics as well as the SVB crash) that it experienced a spike. Indeed, investors are looking for more stable, higher returns as well as for lower systemic risk in a period of high deposit retrievals from regional banks that is freeing a significant amount of liquidity that flew to MMFs.

Key definitions and history overview

MMFs are mostly of two types, government or prime funds. The former invests in short-term government debt securities while the latter in corporate commercial paper and bank debt securities (Financial Times, 2023).

Money market funds, also known as money market mutual funds, are considered one of the riskless investment vehicles available in the financing spectrum since they invest in short-term / high-quality instruments that include cash, cash equivalent and high-credit-rating debt-based securities (i.e. treasury bills, commercial paper, certificates of deposit (CDs), bankers' acceptances (BAs), and repurchase agreements (Repos)). The principal providers of this type of funds are mutual fund companies, banks, and brokerages. These funds aim to provide investors with liquidity, capital preservation, and modest income generation that can be either taxable or tax-exempt, depending on the types of securities invested. Owing to the short-maturity, c.13 months or less, and the minimal credit risk, money market funds are among the investments with the lowest volatility, which makes them very attractive for conservative investors and for those desiring to park money temporarily or might need to make anticipated cash outlays. Furthermore, they owe their popularity to the maintenance of a $1 net asset value (“NAV”) per share so any difference between the NAV share price and the earnings on the portfolio’s investments is distributed to fund investors. However, due to possible downsides that might be generated for instance by inflation and interest rate risk, these markets are insured by the Securities Investor Protection Corporation (“SIPC”), a nonprofit corporation that protects clients from bankruptcy, not by the Federal Deposit Insurance Corporation.

According to the class of invested assets, the maturity period, and other attributes, the U.S. Securities and Exchange Commission (“SEC”) mentiond three classes of money market funds: Government, Prime, and Municipal funds. Firstly, Government and Treasury money market funds invest at least 99.5% of their total assets in cash and instruments supported by the US government (i.e. treasury bills, repurchase agreements, treasury bonds, and government securities). Secondly, Prime money market funds, also known as general purpose funds, invest in floating-rate debt and commercial paper of non-treasury assets (issued by US government agencies and enterprises sponsored by the government (“GSEs”)). Finally, Municipal money market funds, often known as tax-exempt funds, invest in municipal securities whose interest is exempt from federal income tax (National Municipal funds) and from state personal income taxes (State Municipal funds).

The main advantages related to money market mutual funds are their stability and their liquidity. In addition, the funds are required by federal regulations to invest in short-maturity and low-risk investments, making them less vulnerable to market fluctuations. Moreover, they are sold on brokerage platforms and hence are more accessible to the public. Lastly, as mentioned before, Municipal MMFs offer a means of earning money exempt from federal and/or state income taxes. However, they are still exposed to the risk of price fluctuations, credit and inflation risk which might decrease the returns. Nonetheless, these funds, which are not designed to provide substantial returns, are currently yielding higher-than-average returns due to the Fed’s rate hikes, producing more than 4% a year. And, according to the inflation risk, they are not outpacing inflation, which now is still hovering at 6%.

Launched in the US in the 1970s, MMFs gained rapid popularity since they were a safe way to invest that often offered better returns than savings accounts. Originally, they held only government bonds and paid higher rates of return because of regulatory matters, that were however improved in 2008, 2010 and 2016 following the financial crisis. During the decade 2000-2010 both the tighter government control, the Fed monetary policies (that led to short-term interest rates hovering around 0%), and the unconventional policy of Quantitative Easing (“QE”) adversely impacted on money market funds. In fact, for the last 10 years, the S&P 500 averaged 9.82% per year compared to Vanguard’s VMFXX 0.78% return. But the situation changed dramatically in the recent period.

Recent developments and drivers of the MMFs market

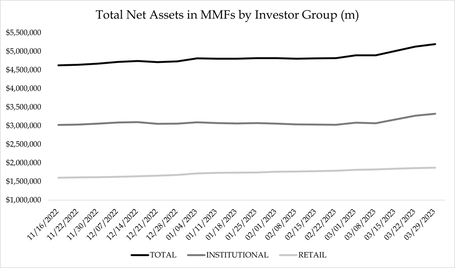

In recent weeks, due to significant turmoil and instability in the financial markets, many investors moved part of their assets to MMFs. In the first 26 days of March, $286bn was invested in MMFs, marking the largest inflow of capital since the start of the Covid-19 crisis (Masters et al., 2023). This was mostly due to an overall condition of economic instability exacerbated by the failure of the Silicon Valley Bank (“SVB”). In March, US MMFs encompassed $5tn for the first time in history. Data from Investment Company Institute tells a similar story as total net assets (“TNA”) increased by $101bn on average during the last three weeks of March. For comparison, in the 16 weeks prior the average amounted to almost $17bn. Graph 1 shows that institutional investors have consistently contributed two-thirds of the total net assets invested in MMFs in the US over the past 20 weeks up to March 29th. This pattern changed slightly, with institutional investments have increased more since the week of March 15th than retail investments (Investment Company Institute, 2023).

Investment Company Institute (2023

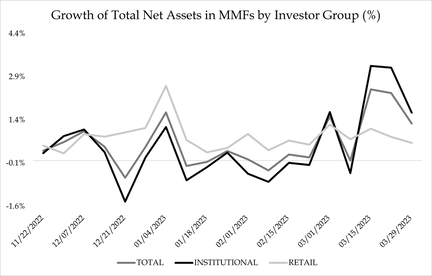

Graph 2 outlines the percentage growth for the past 19 weeks up to March 29th of both investor groups, which clearly shows the development of their invested assets in MMFs. Since the beginning of the banking turmoil around March 9th, when Silicon Valley Bank shares fell 60% after it had announced a $1.8 billion loss on the sale of securities a day earlier, both investor groups have increased their assets invested in MMFs (Zahn, 2023; Investment Company Institute, 2023). But institutional investors have shifted their money relatively more than retail investors. In the three weeks following the start of financial turmoil, the percentage growth of assets invested in MMFs by retail investors increased on average by 0.85% compared to a 16-week average of 0.82% prior to that. For institutional investors, the prior 16-week average is only 0.09% but increased rapidly to 2.73% during the last three weeks of March (Investment Company Institute, 2023). Meanwhile deposits at large banks decreased from $17.6tn to $17.5tn, and deposits at small banks decreased from $5.6tn to $5.4tn (Masters et al., 2023). This indicates that investors feel less comfortable with keeping their deposits with banks and prefer to shift them elsewhere – mainly into money market funds. But investors also move to MMFs because it currently offers relatively attractive returns (Masters et al., 2023) that move with interest rates, and are benefiting from the recent hikes imposed by Fed. While banks lag with raising their interest rates – they often offer rates at around 0.5% – MMFs already offer returns around 4.5% (Duguid et al., 2023), which lures investors into moving their assets.

Investment Company Institute (2023)

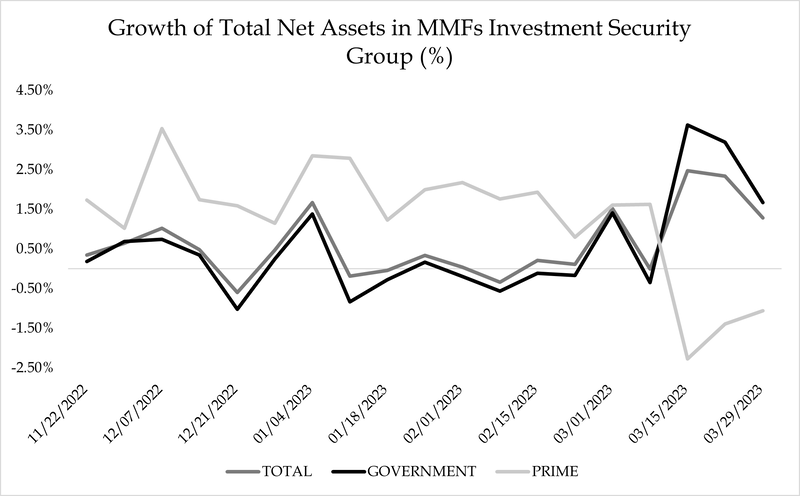

Data shows that investors have moved from prime funds to government ones, which are considered more stable and less risky. For government funds, the net change average of TNA during the last three weeks of March amounted to nearly $116bn, compared to merely $4bn in the 16-weeks prior – that is a 2768% increase. During the same period, the averages for prime funds amounted to positive $12bn and negative $12bn, respectively.

Investment Company Institute (2023)

MMFs regulation in the US

In early 2022, the SEC proposed amendments to the Investment Company Act of 1940, specifically rule 2a-7, aiming to improve the resilience and transparency of money market funds. Heavy redemptions and lack of liquidity during difficult times, such as the 2008 financial crisis and the Covid-19 economic crisis, rose concerns for the SEC. This amendment aims to increase the minimum liquidity requirements, remove the ability of money market funds to impose liquidity fees and redemption gates when dropping below liquidity thresholds and enhance the reporting requirements (SEC, 2022b).

With these changes the SEC hopes to enhance buffers during periods of rapid redemptions, eliminate the incentives for preemptive redemptions, improve the ability of the SEC to monitor and analyze money market fund data and to make investors bear part of the liquidity costs of their redemptions (SEC, 2022b).

Even though this might reduce the liquidity risk, returns are still not guaranteed. Moreover, the benefit of enhanced transparency should be weighed against the greater costs and times associated to data gathering. Overall, the SEC reforms aim to strengthen the market and to equip it for times of uncertainty, but this could also reduce the returns on investment over time (FSinvestments, 2023).

When comparing the US MFFs market with the European one, it is to be noted that the US market has often greatly outperformed the European one. In 2021, European MMFs reached €1.44tr (Oladipupo, 2023), whereas those in the US reached USD5.21tr (SEC, 2022a), evidencing the overall greater prominence of the US market. This can be attributed to the US being a reliable economy and the European MMF market being relatively more fragmented, discouraging investors.

Overall, US regulators are more restrictive and have greater requirements to reduce risk, including diversification guidance and lower interest rate risk taking. Moreover, it is mandatory to invest in assets maturing daily and weekly, to diversification properly, and to respect high disclosure standards (Baklanova, 2012).

MMFs regulation in the US

In early 2022, the SEC proposed amendments to the Investment Company Act of 1940, specifically rule 2a-7, aiming to improve the resilience and transparency of money market funds. Heavy redemptions and lack of liquidity during difficult times, such as the 2008 financial crisis and the Covid-19 economic crisis, rose concerns for the SEC. This amendment aims to increase the minimum liquidity requirements, remove the ability of money market funds to impose liquidity fees and redemption gates when dropping below liquidity thresholds and enhance the reporting requirements (SEC, 2022b).

With these changes the SEC hopes to enhance buffers during periods of rapid redemptions, eliminate the incentives for preemptive redemptions, improve the ability of the SEC to monitor and analyze money market fund data and to make investors bear part of the liquidity costs of their redemptions (SEC, 2022b).

Even though this might reduce the liquidity risk, returns are still not guaranteed. Moreover, the benefit of enhanced transparency should be weighed against the greater costs and times associated to data gathering. Overall, the SEC reforms aim to strengthen the market and to equip it for times of uncertainty, but this could also reduce the returns on investment over time (FSinvestments, 2023).

When comparing the US MFFs market with the European one, it is to be noted that the US market has often greatly outperformed the European one. In 2021, European MMFs reached €1.44tr (Oladipupo, 2023), whereas those in the US reached USD5.21tr (SEC, 2022a), evidencing the overall greater prominence of the US market. This can be attributed to the US being a reliable economy and the European MMF market being relatively more fragmented, discouraging investors.

Overall, US regulators are more restrictive and have greater requirements to reduce risk, including diversification guidance and lower interest rate risk taking. Moreover, it is mandatory to invest in assets maturing daily and weekly, to diversification properly, and to respect high disclosure standards (Baklanova, 2012).

Outlook for the future

The question is, how will the cash inflow trend into money market funds develop in the future. These types of funds are not considered long term investments, they are constructed for investors to park their cash temporarily and therefore there are always inflows and outflows of large amounts of money.

Even though predictions are difficult to make, forecasts about the underlying macro-economic factors impacting the MMF landscape as well as expectations on general industry trends are helpful to analyse predictions on the upcoming months.

One of the most crucial elements is the interest rate set by the FED as part of its monetary policy. As interest rates are set to battle inflation, it is important to delve a bit deeper in the current trends surrounding this topic. Although decreasing, inflation in the US is still high (around the 6% level) and hasn’t been slowing as quickly as some FED officials had expected (Foster, 2023). Declining energy prices and earlier-than-expected reopening of China at the beginning of 2023 improved the outlook, but there are still no signs of inflation nearing the 2% target level set by the FED and other major central banks.

This means interest rates are not expected to decrease in the short term, as confirmed by the Fed Chair Jerome Powell, and with interest rates now set at 5%, market participants are anticipating a 75 basis point cut only in early 2024. The OECD also forecasts a tight monetary policy rate across all major economies going into 2023 because of the inflationary pressure (OECD, 2023). Money market funds, which invest (amongst others) in short-term government debt can thus keep providing their attractive yields to investors. In a period of uncertainty and volatility, these funds provide excellent opportunities for investors to place their money as the world is still struck by recessionary fears and a war going on between Russia and Ukraine. It is however to be noted that over the long-term money market funds are not considered as the best investment available, as inflation is still higher than their yields, thus representing a loss in purchasing power.

As explained earlier, one of the drivers for the recent surge of money inflows into MMFs was the turmoil in the banking sector across the globe that pushed depositors to look for short-term safer options for their money. Going forward into 2023, it is expected that this disruption will largely cool off, as investors and depositors will realise that banks are generally well capitalised and funded, while the recent situation was mainly the result of fear, that is already disappearing (Hooker, 2023). Although the banking sector is extremely complex, deposits are generally protected, and the trend of capital invested in MMFs as a panic reaction to banks failing might reverse again. As a result, we might say goodbye to the all-time highs of money invested in these funds.

Outlook for the future

The question is, how will the cash inflow trend into money market funds develop in the future. These types of funds are not considered long term investments, they are constructed for investors to park their cash temporarily and therefore there are always inflows and outflows of large amounts of money.

Even though predictions are difficult to make, forecasts about the underlying macro-economic factors impacting the MMF landscape as well as expectations on general industry trends are helpful to analyse predictions on the upcoming months.

One of the most crucial elements is the interest rate set by the FED as part of its monetary policy. As interest rates are set to battle inflation, it is important to delve a bit deeper in the current trends surrounding this topic. Although decreasing, inflation in the US is still high (around the 6% level) and hasn’t been slowing as quickly as some FED officials had expected (Foster, 2023). Declining energy prices and earlier-than-expected reopening of China at the beginning of 2023 improved the outlook, but there are still no signs of inflation nearing the 2% target level set by the FED and other major central banks.

This means interest rates are not expected to decrease in the short term, as confirmed by the Fed Chair Jerome Powell, and with interest rates now set at 5%, market participants are anticipating a 75 basis point cut only in early 2024. The OECD also forecasts a tight monetary policy rate across all major economies going into 2023 because of the inflationary pressure (OECD, 2023). Money market funds, which invest (amongst others) in short-term government debt can thus keep providing their attractive yields to investors. In a period of uncertainty and volatility, these funds provide excellent opportunities for investors to place their money as the world is still struck by recessionary fears and a war going on between Russia and Ukraine. It is however to be noted that over the long-term money market funds are not considered as the best investment available, as inflation is still higher than their yields, thus representing a loss in purchasing power.

As explained earlier, one of the drivers for the recent surge of money inflows into MMFs was the turmoil in the banking sector across the globe that pushed depositors to look for short-term safer options for their money. Going forward into 2023, it is expected that this disruption will largely cool off, as investors and depositors will realise that banks are generally well capitalised and funded, while the recent situation was mainly the result of fear, that is already disappearing (Hooker, 2023). Although the banking sector is extremely complex, deposits are generally protected, and the trend of capital invested in MMFs as a panic reaction to banks failing might reverse again. As a result, we might say goodbye to the all-time highs of money invested in these funds.

Conclusion

The outlook for the future of MMFs depends on how its underlying drivers will develop in the next few months, including in particular interest rates set by the Fed, that will impact the amount of funds flowing to the market. Moreover, the potential regulatory changes might affect MMFs in the future, with the SEC trying to make the US MMF market safer. Overall, for the moment forecasts are consistent with the current situation, but a quick normalisation of markect conditions could led to a reversal of the recent trend.

By Willem van der Mee, Vasara Silininkaite, Francesca Dini, Tobias van Winkel

References

Ashford, K. (2020, August 25). What Is A Money Market Fund? Forbes Advisor. https://www.forbes.com/advisor/investing/what-is-money-market-fund/

Baklanova, V. (2012). Money market funds in the US and the EU: a legal and comparative analysis. University of Westminster. https://westminsterresearch.westminster.ac.uk/download/3f430d6dcd6e0ff74c03a2b07961d12c038b03ed4e6259b61a1d2c583851b557/2343964/Viktoria_BAKLANOVA.pdf

Barros, D. (n.d.). Savers And Investors Are Flocking To Money Market Funds. Here Are The Pros And Cons. Forbes. Retrieved April 7, 2023, from https://www.forbes.com/sites/delyannebarros/2023/03/27/savers-and-investors-are-flocking-to-money-market-funds/?sh=1a3e11b07f78

Domm, P. (2023, January 19). Investors are holding near-record levels of cash and may be poised to snap up stocks. CNBC. https://www.cnbc.com/amp/2023/01/18/investors-are-holding-near-record-levels-of-cash-and-may-be-poised-to-snap-up-stocks.html

Duguid, K., Clarfelt, H., & Smith, C. (2023, March 31). Flood of cash into US money market funds could add to banking strains. Financial Times. https://www.ft.com/content/c16a62e3-5a6e-4b09-9bd1-72a7e4c787cb

Economic outlook: slightly more optimistic but fragile, says OECD. (n.d.). Www.oecd.org. https://www.oecd.org/newsroom/economic-outlook-slightly-more-optimistic-but-fragile.htm

Federal Reserve presses ahead with quarter-point rate rise despite banking turmoil. (2023, March 22). Financial Times. https://www.ft.com/content/8fefddc0-c611-4400-b112-51e8d0a763da

Financial Times. (2023, March 24). News updates from March 24: Scholz dismisses fears over Deutsche Bank, UK drops key concern on Microsoft’s Activision deal. Financial Times. https://www.ft.com/content/299b95e2-eb19-4580-a18f-c4a700aaf774#post-4fd5c394-a01a-43d4-bd6b-72aefb047739

Foster, S. (2022, December 21). How Much Will The Fed Raise Rates In 2023? Bankrate. https://www.bankrate.com/banking/federal-reserve/how-much-will-fed-raise-rates-in-2023/

Hooker, L. (2023, March 14). What do we know about the Silicon Valley and Signature Bank collapse? BBC News. https://www.bbc.com/news/business-64951630

Investment Company Institute. (2023, March 30). Release: Money Market Fund Assets. Investment Company Institute. https://www.ici.org/research/stats/mmf

Lex. (2023, March 19). US money market funds: cash is king amid banking turmoil. Financial Times. https://www.ft.com/content/fb689136-1f95-4936-9b9a-8dfc96bd9274

Masters, B., Clarfelt, H., & Duguid, K. (2023, March 26). Money market funds swell by more than $286bn amid deposit flight. Financial Times. https://www.ft.com/content/032523bc-3b92-4b94-b6b8-ebbe1d606b2c

Oladipupo, S. (2023, February 8). Europe’s Money Market Fund Assets See €1.44T in 2021. Financial and Business News | Finance Magnates. https://www.financemagnates.com/institutional-forex/europes-money-market-fund-assets-stood-at-144tn-in-2021-says-esma/

SEC. (2022a). Division of Investment Management Analytics Office Money Market Fund Statistics. https://www.sec.gov/files/mmf-statistics-2021-12.pdf

SEC. (2022b). Money Market Fund Reforms. In SEC. https://www.sec.gov/rules/proposed/2021/ic-34441-fact-sheet.pdf

Segal, T. (2021, March 21). Why to Park Your Cash in a Money Market Fund. Investopedia. https://www.investopedia.com/terms/m/money-marketfund.asp

What are money market funds? - Fidelity. (n.d.). Www.fidelity.com. https://www.fidelity.com/learning-center/investment-products/mutual-funds/what-are-money-market-funds

Why liquidity matters. (2023). FS Investments. https://fsinvestments.com/education/why-liquidity-matters/

Zahn, M. (2023, March 14). A timeline of the Silicon Valley Bank collapse. ABC News. https://abcnews.go.com/Business/timeline-silicon-valley-bank-collapse/story?id=97846565

Ashford, K. (2020, August 25). What Is A Money Market Fund? Forbes Advisor. https://www.forbes.com/advisor/investing/what-is-money-market-fund/

Baklanova, V. (2012). Money market funds in the US and the EU: a legal and comparative analysis. University of Westminster. https://westminsterresearch.westminster.ac.uk/download/3f430d6dcd6e0ff74c03a2b07961d12c038b03ed4e6259b61a1d2c583851b557/2343964/Viktoria_BAKLANOVA.pdf

Barros, D. (n.d.). Savers And Investors Are Flocking To Money Market Funds. Here Are The Pros And Cons. Forbes. Retrieved April 7, 2023, from https://www.forbes.com/sites/delyannebarros/2023/03/27/savers-and-investors-are-flocking-to-money-market-funds/?sh=1a3e11b07f78

Domm, P. (2023, January 19). Investors are holding near-record levels of cash and may be poised to snap up stocks. CNBC. https://www.cnbc.com/amp/2023/01/18/investors-are-holding-near-record-levels-of-cash-and-may-be-poised-to-snap-up-stocks.html

Duguid, K., Clarfelt, H., & Smith, C. (2023, March 31). Flood of cash into US money market funds could add to banking strains. Financial Times. https://www.ft.com/content/c16a62e3-5a6e-4b09-9bd1-72a7e4c787cb

Economic outlook: slightly more optimistic but fragile, says OECD. (n.d.). Www.oecd.org. https://www.oecd.org/newsroom/economic-outlook-slightly-more-optimistic-but-fragile.htm

Federal Reserve presses ahead with quarter-point rate rise despite banking turmoil. (2023, March 22). Financial Times. https://www.ft.com/content/8fefddc0-c611-4400-b112-51e8d0a763da

Financial Times. (2023, March 24). News updates from March 24: Scholz dismisses fears over Deutsche Bank, UK drops key concern on Microsoft’s Activision deal. Financial Times. https://www.ft.com/content/299b95e2-eb19-4580-a18f-c4a700aaf774#post-4fd5c394-a01a-43d4-bd6b-72aefb047739

Foster, S. (2022, December 21). How Much Will The Fed Raise Rates In 2023? Bankrate. https://www.bankrate.com/banking/federal-reserve/how-much-will-fed-raise-rates-in-2023/

Hooker, L. (2023, March 14). What do we know about the Silicon Valley and Signature Bank collapse? BBC News. https://www.bbc.com/news/business-64951630

Investment Company Institute. (2023, March 30). Release: Money Market Fund Assets. Investment Company Institute. https://www.ici.org/research/stats/mmf

Lex. (2023, March 19). US money market funds: cash is king amid banking turmoil. Financial Times. https://www.ft.com/content/fb689136-1f95-4936-9b9a-8dfc96bd9274

Masters, B., Clarfelt, H., & Duguid, K. (2023, March 26). Money market funds swell by more than $286bn amid deposit flight. Financial Times. https://www.ft.com/content/032523bc-3b92-4b94-b6b8-ebbe1d606b2c

Oladipupo, S. (2023, February 8). Europe’s Money Market Fund Assets See €1.44T in 2021. Financial and Business News | Finance Magnates. https://www.financemagnates.com/institutional-forex/europes-money-market-fund-assets-stood-at-144tn-in-2021-says-esma/

SEC. (2022a). Division of Investment Management Analytics Office Money Market Fund Statistics. https://www.sec.gov/files/mmf-statistics-2021-12.pdf

SEC. (2022b). Money Market Fund Reforms. In SEC. https://www.sec.gov/rules/proposed/2021/ic-34441-fact-sheet.pdf

Segal, T. (2021, March 21). Why to Park Your Cash in a Money Market Fund. Investopedia. https://www.investopedia.com/terms/m/money-marketfund.asp

What are money market funds? - Fidelity. (n.d.). Www.fidelity.com. https://www.fidelity.com/learning-center/investment-products/mutual-funds/what-are-money-market-funds

Why liquidity matters. (2023). FS Investments. https://fsinvestments.com/education/why-liquidity-matters/

Zahn, M. (2023, March 14). A timeline of the Silicon Valley Bank collapse. ABC News. https://abcnews.go.com/Business/timeline-silicon-valley-bank-collapse/story?id=97846565