On February 11, Morgan Stanley announced that has reached a definitive agreement to acquire Solium Capital Inc. - the Canadian stock plan administrator - in a $900 million deal. It is the biggest corporate acquisition by a Wall Street investment bank since the financial crisis and it is aimed to create a leading provider of stock plan administration services and Workplace Wealth.

Solium Capital is a publicly traded company, based in Canada, that provides cloud services to manage stocks that corporate employees receive as part of their pay. The company has 3,000 corporate clients with one million participants, including famous startups such as Instacart, Shopify and Stripe, and a wide number of fast-growing companies – both private and public. On the other hand, Morgan Stanley is not new in this business: indeed, it already has 320 stock plans clients and 1.5 million participants.

However, the NY based investment bank has always been more geared toward Fortune 500 companies and their top executives. For this reason, the deal is not only about buying Solium’s technology and know-how, but also their young client base that tend to have fewer relationships with banks and great chances of being the next generation of millionaires. The acquisition provides Morgan Stanley with “a greater opportunity to establish and develop relationships with a younger demographic and service this population early in their wealth accumulation years,” said James Gorman, Chairman and CEO of the bank. He also added “most people’s money is coming through their workplace, so it’s an obvious place for us to be. We didn’t historically have a way to serve them, now we do”.

For Morgan Stanley, establishing and developing profitable relationships with this new type of clients is essential to sustain its long-term growth. The bank’s goal is to retain them and to exploit cross-selling opportunities, in order to introduce young workers in their wealth management business, a well-established arm of the bank that manages $2.3 trillion for 3.5 million American households. Moreover, they plan to advise this new client base using their new robo-advisory tool, launched at the end of 2017, until these accounts are wealthy enough to merit a human adviser.

“We view this acquisition as part of our broader, longer-term strategy, leveraging our digital capabilities in the workplace”, said Andy Saperstein, Co-Head of Wealth Management at Morgan Stanley. “By combining stock plan administration, 401(k), other forms of deferred compensation, employee Financial Wellness education and our core Goals-Based Planning technology, we plan to create an integrated ‘Morgan Stanley Wealth Portal,’ which will offer employers the opportunity to deliver tailored financial counselling and industry leading advice to their employees”.

On top of that, in the long run, Morgan Stanley will likely need to expand its banking products offerings, in order to retain millennials and contrast some possible wealth management competitors such as Fidelty.

At the same time, the plan to expand the wealth management division plays a big role in stabilizing and consolidating Morgan Stanley earnings. Indeed, wealth management is a subscription-based business that can do well in both hot and cold markets and that can tackle the risk took from the bank in other areas, such as trading.

Finally, the acquisition will offer Morgan Stanley the chance to enhance its corporate network, creating opportunity for new IPO mandates, given the strong pool of promising startups in Solium’s clients, or other services, as cash management.

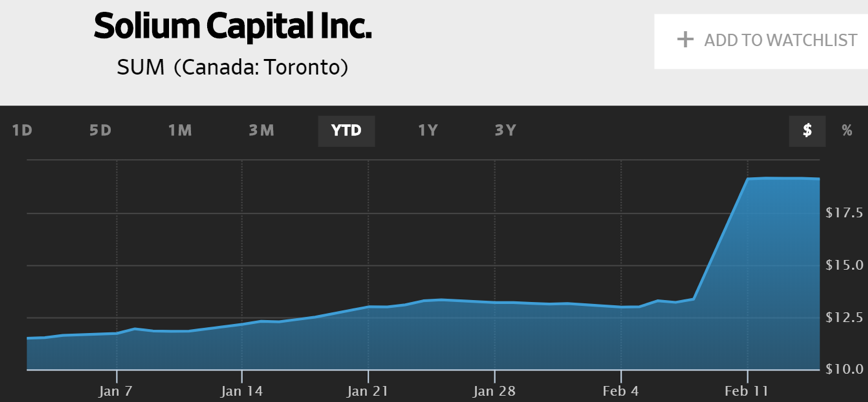

Under the terms of the agreement, Morgan Stanley will pay CAD 19.15 ($14.42) a share for Solium, a 43% premium over its Friday closing price of CAD 13.36 (about $10), valuing the company at about x60 the expected EBITDA, for a total value of CAD 1.1 billion ($0.9 billion) payed in cash.

Solium Capital is a publicly traded company, based in Canada, that provides cloud services to manage stocks that corporate employees receive as part of their pay. The company has 3,000 corporate clients with one million participants, including famous startups such as Instacart, Shopify and Stripe, and a wide number of fast-growing companies – both private and public. On the other hand, Morgan Stanley is not new in this business: indeed, it already has 320 stock plans clients and 1.5 million participants.

However, the NY based investment bank has always been more geared toward Fortune 500 companies and their top executives. For this reason, the deal is not only about buying Solium’s technology and know-how, but also their young client base that tend to have fewer relationships with banks and great chances of being the next generation of millionaires. The acquisition provides Morgan Stanley with “a greater opportunity to establish and develop relationships with a younger demographic and service this population early in their wealth accumulation years,” said James Gorman, Chairman and CEO of the bank. He also added “most people’s money is coming through their workplace, so it’s an obvious place for us to be. We didn’t historically have a way to serve them, now we do”.

For Morgan Stanley, establishing and developing profitable relationships with this new type of clients is essential to sustain its long-term growth. The bank’s goal is to retain them and to exploit cross-selling opportunities, in order to introduce young workers in their wealth management business, a well-established arm of the bank that manages $2.3 trillion for 3.5 million American households. Moreover, they plan to advise this new client base using their new robo-advisory tool, launched at the end of 2017, until these accounts are wealthy enough to merit a human adviser.

“We view this acquisition as part of our broader, longer-term strategy, leveraging our digital capabilities in the workplace”, said Andy Saperstein, Co-Head of Wealth Management at Morgan Stanley. “By combining stock plan administration, 401(k), other forms of deferred compensation, employee Financial Wellness education and our core Goals-Based Planning technology, we plan to create an integrated ‘Morgan Stanley Wealth Portal,’ which will offer employers the opportunity to deliver tailored financial counselling and industry leading advice to their employees”.

On top of that, in the long run, Morgan Stanley will likely need to expand its banking products offerings, in order to retain millennials and contrast some possible wealth management competitors such as Fidelty.

At the same time, the plan to expand the wealth management division plays a big role in stabilizing and consolidating Morgan Stanley earnings. Indeed, wealth management is a subscription-based business that can do well in both hot and cold markets and that can tackle the risk took from the bank in other areas, such as trading.

Finally, the acquisition will offer Morgan Stanley the chance to enhance its corporate network, creating opportunity for new IPO mandates, given the strong pool of promising startups in Solium’s clients, or other services, as cash management.

Under the terms of the agreement, Morgan Stanley will pay CAD 19.15 ($14.42) a share for Solium, a 43% premium over its Friday closing price of CAD 13.36 (about $10), valuing the company at about x60 the expected EBITDA, for a total value of CAD 1.1 billion ($0.9 billion) payed in cash.

The investment bank expects to close the deal by June 30, subject to court, Solium shareholders and regulatory approvals, and other customary closing conditions. The transaction for the company “is expected to have a minimal impact on the Firm’s earnings and capital ratios”, without any anticipate adjustments to its planned stock buybacks, while the CEO of Solium, Marcos Lopez, will remain with the company and be based in Calgary.

Lorenzo Gimigliano

Lorenzo Gimigliano