BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

Introduction

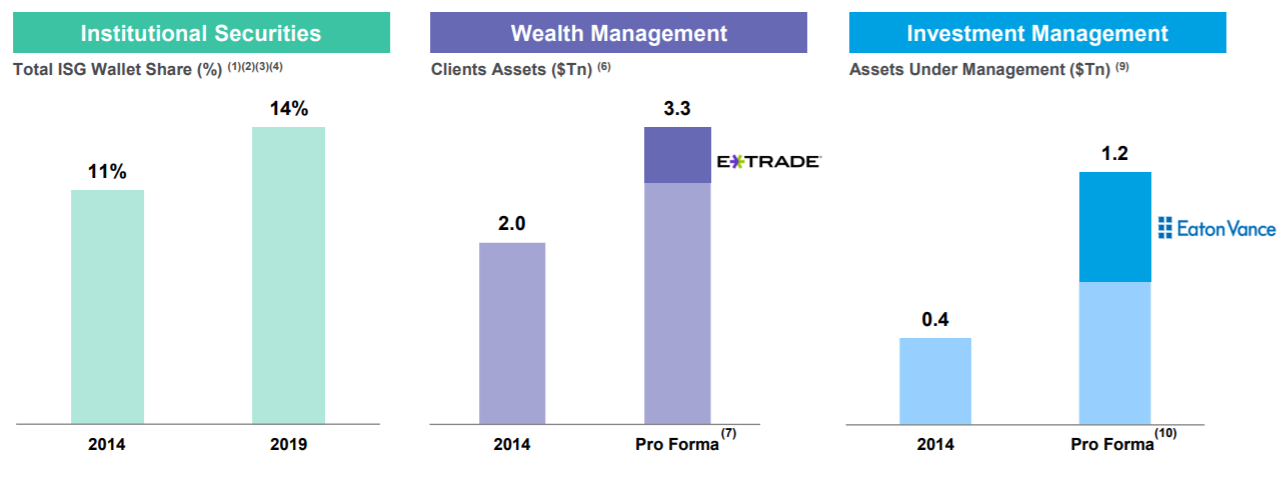

On the 8th of October, Morgan Stanley announced a definitive agreement to purchase Eaton Vance’s investment management business of over $500 billion AUM for an equity value of $7 billion by the end of 2021 on a 50% cash, 50% stock transaction. This announcement, following Morgan Stanley’s and E-Trade’s closing, will reshape the asset management industry and once again advance Morgan Stanley’ mission of becoming a top asset management firm.

Overview of Morgan Stanley

Founded in 1935 by two J.P. Morgan partners (Henry Morgan and Harold Stanley) after the separation of investment banks and consumer banks prompted by the Glass-Steagall Act, Morgan Stanley quickly rose to become a global investment bank with over 60,000 employees in 42 countries. Its business areas include institutional securities, wealth management, and investment management. Overall, the bank earned $41 billion in revenues and a net income of $9 billion in 2019, with the institutional securities department being responsible for over half of this value. Despite the institutional securities division being Morgan Stanley’s main revenue driver until recently, the wealth management division, which provides brokerage and investment advisory services to high net worth individuals, and the investment management division, which provides asset management services, are becoming increasingly important to the firm’s strategic development.

Overview of Eaton Vance

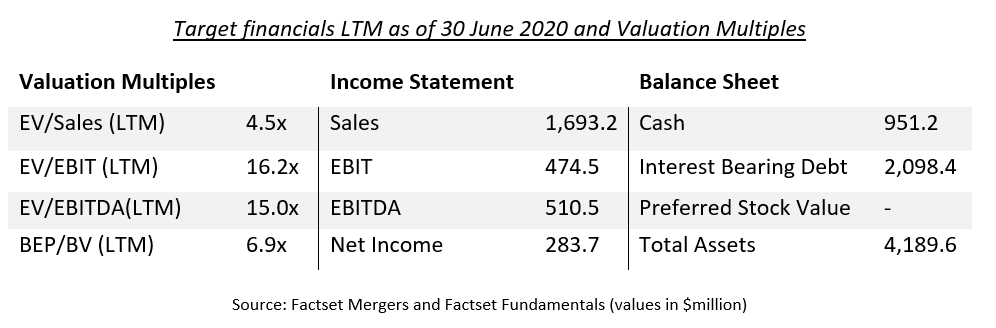

Founded in 1924 as a mutual fund in Boston by Charles Eaton and John Howard, Eaton & Howard became Eaton Vance following a merger in 1979 with Vance, Sanders & Company. The two mutual funds had a long history in the asset management industry, and, following their merger, Eaton Vance became a leader in customized retail investment solutions. Its main affiliates include Parametric, a leader in custom-managed accounts; Calvert, a top ESG investment manager; EVM, a fundamental active manager; Atlanta Capital, specialist in high-quality U.S. stock and bond; and Hexavest, a top-down global equity manager. In 2019, Eaton Vance reported $1.7 billion in total revenue, with Parametric being responsible for over half of this value. Additionally, Eaton Vance had $507 billion assets under management by July 2020, which, combined with Morgan Stanley Investment Management, will amount to $1.2 trillion.

Deal structure Morgan Stanley – Eaton Vance

The price of the transaction is US$6.5 billion. Morgan Stanley will acquire 114,622,322 shares of Eaton Vance, representing 100% stake in the company. As compensation, Eaton Vance shareholders will receive $28.25 per share in cash and 0.5833x of Morgan Stanley common stock.

On 7th October 2020, the day before the announcement of this acquisition, the closing share price of Morgan Stanley was $48.71 per share, thus if we add together what will be paid by cash and by stock, we obtain a value of $56.66 per share. Therefore, the payment will be approximately half by cash and half by stock. The portion which Morgan Stanley will finance by cash will be covered in part by the excess of capital at its disposal (approximately 100bps of the excess capital will be used, remaining the firm’s common equity tier 1 ratio approximately 300 bps above its stress capital buffer requirement of 13.2%).

Due to the fact that the closing share price of Eaton Vance on 7th October 2020 was $40.94 per share, we can state that the premium offered by the acquirer is 38.4%, while considering the closing price share on 8th September 2020 of $38.44 per share, the premium is 47.4%. Moreover, according to the merger agreement, an election procedure allows each Eaton Vance shareholder to choose all cash or all stock. In addition, Eaton Vance shareholders will receive before the closing a special cash dividend of $4.25 per share utilizing assets currently on the balance sheet.

The extent that Eaton Vance shareholders will obtain as consideration through Morgan Stanley common stock will not be taxable. The transaction has been accepted by the voting trust that holds all of the voting common stock of Eaton Vance.

The transaction is expected to be breakeven on an earnings per share basis immediately after the deal closes in the second quarter of 2021 and subsequently to be marginally accretive by realizing $150 million of annual cost savings through the deal (4% of the combined amount of Morgan Stanley investment management and Eaton Vance).

As Eaton Vance has over $500 billion in assets under management, the deal will give Morgan Stanley’s investment management branch approximately $1.2 trillion managed assets. Correspondingly, wealth management’s proforma revenues are expected to grow to $21 billion (they were $17.7 billion in 2019), with investment management proforma revenues of $5.0 billion (compared to $3.8 billion before the deal).

Financial Advisors to Target

Centerview Partners LLC (Advisor, Fairness Opinion),

Houlihan Lokey Capital, Inc (Advisor, Fairness Opinion)

Financial Advisors to Acquirer

Morgan Stanley (Advisor)

Strategic Rationale

The acquisition follows Morgan Stanley’s strategic transformation with three world-class businesses of scale: Institutional Securities, Wealth Management, and Investment Management. This scales Morgan Stanley’s asset management business and expose it to more positive trends in asset management.

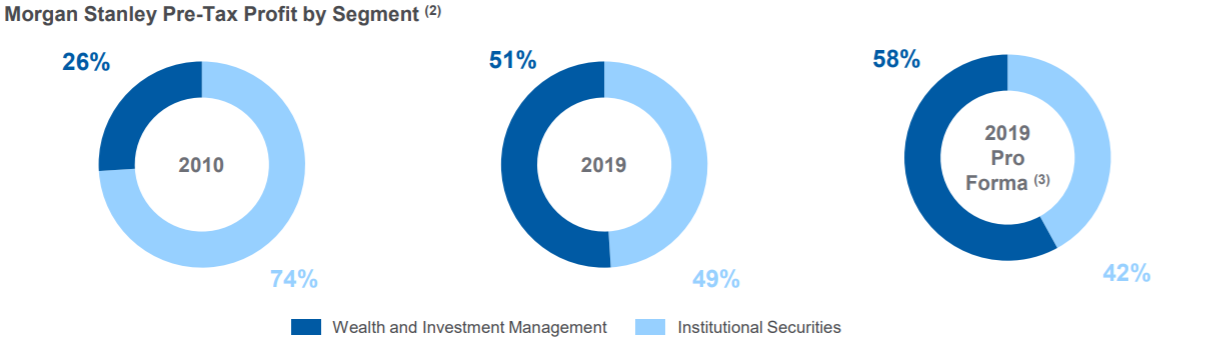

Morgan Stanley CEO has long been working to transform the company so it can perform competitively without having to rely too much on its institutional securities division. This resulted in multiple acquisitions aimed at increasing the wealth and investment management divisions’ pre-tax profit in relation to profits generated by the institutional securities division.

Beginning in 2012 with the acquisition of Smith Barney in the largest integration in the history of wealth management, Morgan Stanley continued to acquire a series of investment management and financial software firms to expand its wealth management division including Mesa West, a commercial real estate credit platform, Solium Capital, an employee stock-options SaaS company and the recent acquisition of E*TRADE, an electronic trading platform.

The purchase of the Boston-headquartered investment management marks a further attempt by Morgan Stanley to establish a relevant presence in the Asset Management industry, bringing the Investment Bank to a better position against the passive fund houses BlackRock and Vanguard, as well as against the asset management arms of rival banks JPMorgan and Goldman Sachs.

Three world-scale class of business

Sources: https://www.morganstanley.com/about-us-ir/pdf/morgan-stanley-to-acquire-eaton-vance.pdf

Transition to more durable lower-risk sources of revenue

Sources: https://www.morganstanley.com/about-us-ir/pdf/morgan-stanley-to-acquire-eaton-vance.pdf

Market risks and uncertainties

The short-term uncertainties are linked to the Asset Management industry facing constantly increasing costs and lower revenue growth. Passive funds, including robo-advisors and index funds, are causing a growing pressure on active managed funds. That makes scale important for profits and analysts expect the existing trend will accelerate because of the current market crisis, motivating some asset managers to make M&A decisions more quickly.

While the asset management industry is going to face a decline in operating margins, a scale-driven deal could help to cut costs and improve these margins. The complementarity in investment and distribution capabilities of Morgan Stanley Investment Management - MSIM - and Eaton Vance will enable not only to fill product gaps and deliver quality scale to the MSIM franchise, but also to improve economies of scale and scope. The bank expects to cut approximately 4% from the combined expense base of Eaton Vance and MSIM, with annual savings of $150m.

The short-term uncertainties are linked to the Asset Management industry facing constantly increasing costs and lower revenue growth. Passive funds, including robo-advisors and index funds, are causing a growing pressure on active managed funds. That makes scale important for profits and analysts expect the existing trend will accelerate because of the current market crisis, motivating some asset managers to make M&A decisions more quickly.

While the asset management industry is going to face a decline in operating margins, a scale-driven deal could help to cut costs and improve these margins. The complementarity in investment and distribution capabilities of Morgan Stanley Investment Management - MSIM - and Eaton Vance will enable not only to fill product gaps and deliver quality scale to the MSIM franchise, but also to improve economies of scale and scope. The bank expects to cut approximately 4% from the combined expense base of Eaton Vance and MSIM, with annual savings of $150m.

“Eaton Vance is a perfect fit for Morgan Stanley. This transaction further advances our strategic transformation by continuing to add more fee-based revenues to complement our world-class investment banking and institutional securities franchise. With the addition of Eaton Vance, Morgan Stanley will oversee $4.4 trillion of client assets and AUM across its Wealth Management and Investment Management segments.”

-James P. Gorman, Chairman and Chief Executive Officer of Morgan Stanley

ANALYSTS:

Ana Leticia Raposo

Gloria Urbini Capanni

Edoardo D'Aprile