Fintech Industry Overview

Since the 1980s, innovation in the financial services industry has skyrocketed, both in terms of products offered, with the development of derivatives and the acceleration of securitization, as well as in terms of supporting infrastructure and analytical methods. With the advancement of specialized applications of technology, it became clear that the future of finance is digital, and the degree of absorption of tech novelty in finance has been growing exponentially.

As a result, we may recognize the expansion of a distinct domain, called financial technology or, for short, fintech, consisting in the development and delivery of technological solutions to the financial industry. Fintech is widely considered to be a subsector of finance, or, rather, a new kind of financial industry, with key features such as automation, enhanced accessibility, and simplified systems.

Technologies used by fintech firms include Robotic Process Automation (RPA), artificial intelligence (AI), and blockchain. Some examples of areas enhanced by such innovations include payment infrastructure, credit scoring, fraud detection, alternative lending mechanisms and, perhaps most significantly, mobile banking.

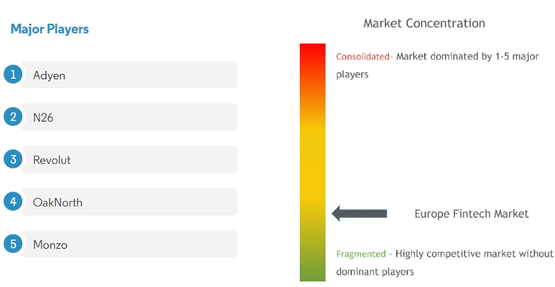

While the fintech industry is most developed in North America, it is in Europe where the openness to non-traditional financial services is greatest and where expansion opportunities are the most attractive to a number of firms. This could be partially attributable to the fact that the market is not particularly concentrated and mature, as illustrated below.

Since the 1980s, innovation in the financial services industry has skyrocketed, both in terms of products offered, with the development of derivatives and the acceleration of securitization, as well as in terms of supporting infrastructure and analytical methods. With the advancement of specialized applications of technology, it became clear that the future of finance is digital, and the degree of absorption of tech novelty in finance has been growing exponentially.

As a result, we may recognize the expansion of a distinct domain, called financial technology or, for short, fintech, consisting in the development and delivery of technological solutions to the financial industry. Fintech is widely considered to be a subsector of finance, or, rather, a new kind of financial industry, with key features such as automation, enhanced accessibility, and simplified systems.

Technologies used by fintech firms include Robotic Process Automation (RPA), artificial intelligence (AI), and blockchain. Some examples of areas enhanced by such innovations include payment infrastructure, credit scoring, fraud detection, alternative lending mechanisms and, perhaps most significantly, mobile banking.

While the fintech industry is most developed in North America, it is in Europe where the openness to non-traditional financial services is greatest and where expansion opportunities are the most attractive to a number of firms. This could be partially attributable to the fact that the market is not particularly concentrated and mature, as illustrated below.

Although the COVID pandemic has turned many investors away from risky start-ups and toward more mature firms, which put the industry under considerable stress in 2020, the situation appears to be improving in the context of the unusual success of first-generation companies. This attracts primarily American and Chinese investors. During the last quarter of 2019, total investments in the European fintech sector amounted to $5.1 billion, according to Statista research. Throughout 2020, total investments reached approximately $8.4 billion.

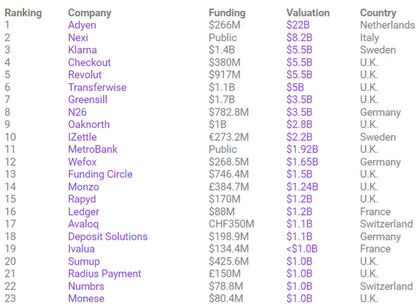

Europe accounts for approximately 17% of the total world valuation of the fintech industry, estimated to be over $2 trillion, and is a hotspot for its development, with some estimates of the world market size around $5.5 trillion in 2020.Below is a list of fintech VC-backed start-ups valued at over $1B as of 2019

Europe accounts for approximately 17% of the total world valuation of the fintech industry, estimated to be over $2 trillion, and is a hotspot for its development, with some estimates of the world market size around $5.5 trillion in 2020.Below is a list of fintech VC-backed start-ups valued at over $1B as of 2019

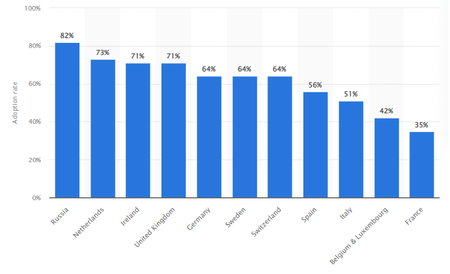

The unique advantages of the European market steam from several factors: various states such as the Netherlands, Switzerland and the Nordic countries top the world rankings of innovative and digital economies; there is superior infrastructure for internet connectivity, including support for 5G; customers are willing to wander outside traditional finance considerably more than the global average, especially in Russia, the United Kingdom, or Germany. The graph below illustrates adoption rates in various European countries, as of 2019.

As a result, the areas of fintech growing most rapidly in Europe are the ones geared toward retail customers, particularly mobile banking (conducting financial transactions through mobile devices, managing accounts, electronic bill payments and transaction monitoring).

We want to bring to your attention that evaluations of market size vary widely by methodology of compilation and by types of companies included. Some estimates include firms like Goldman Sachs and JPMorgan in fintech due to their efforts to become more digitalized and the enrichment of their product offerings in this area (most notably Marcus by GS). Others focus on pure fintech firms seen as challengers to established financial services companies.

Company Overview

N26 GmbH is a German neobank headquartered in Berlin, Germany. N26 was founded in Munich in 2013. The company's platform offers its products and services via online channels only: online banking websites and a mobile application. Its offer includes creating and handling current accounts, fixed accounts, and other banking-related services, enabling customers to manage and control their banking details via a smartphone application in a hassle freeway. Last January it reached 7 million customers across 25 markets, including Europe and the US (Berlin, Barcelona, Madrid, Milan, Paris, Vienna, Amsterdam, Belgrade, New York and São Paulo). Covid-19 restrictions have accelerated the growth of the company and, in general, the popularity of online banking. However, on the 18th of November the company decided to leave the US market (500.000 customers) a decision which will be further analyzed in the next section. Next objectives for the company are to continue deepening in existing core European markets, in central European countries, as well as expanding into Eastern Europe. In addition, They have established an autonomous business in Brazil that, powered by its own local license, is currently testing a local product. Major investors are Third Point Ventures, Coatue Management, Dragoneer Investment Group, Valar Ventures and Horizons Ventures.

N26’s Withdrawal from the US & Global Strategy

N26’s withdrawal from the US market raises multiple questions regarding its rationale and the future of its global strategy, given its ambitions to become a market leader worldwide and “do for finance what Spotify did for music and Uber did for mobility”, as declared by CEO Valentin Stalf in 2019. In a statement to Bloomberg, N26 expressed its intentions to sharpen its focus on Europe, where the company currently offers bank operations to about 7 million clients in a total of 24 countries, with an emphasis on expanding its product offerings beyond its current accounts to include additional financial products and services by investing significantly more funds and capital. This decision is not surprising, especially when considering its additional withdrawal from the UK market last year, citing Brexit uncertainty and the inability to operate in the region with an EU banking licence anymore as the primary reasons.

In the central European regions that N26 is already active and dominating in, there is still a lot of room for growth, even in its strongest markets, such as Paris and Berlin, where only about 5-7% of the population are users. Therefore, it makes a lot of sense to deepen its position in those markets and try to increase its market share, instead of trying to face the complex and environment of the US neobank industry. Another important event that has influenced N26’s strategy in Europe is the €4.25 million fine imposed by the German financial regulator BaFin in June because it submitted anti-money laundering-related suspicious activity reports late. Moreover, a month earlier, the authority ordered N26 to solve defects in its IT monitoring and customer due diligence and appointed a special commissioner to oversee its progress. As a result, the company has invested a lot in regulatory topics and its internal processes. BaFin also imposed a cap of no more than 50,000 new European customers per month, meaning that N26, for now, will only be able to accept less than a third of the customers each month that it has been. Fortunately, there is still the possibility that these restrictions are lifted in the next few months if the German regulator concludes that N26 has sufficiently improved its controls and policies by putting in place “a proper business organisation” and addressing any “risks to the institution’s operational resilience” place . However, it must be noted that according to the company’s statements these sanctions are unrelated to its decision to withdraw from the US.

An issue that makes the expansion of a neobank in a new geographical area significantly difficult is the vast amount of resources needed to apply and receive a local banking licence, as well as to set up the required agreements and payment trails, which essentially means starting from scratch each time. This is also a factor that contributed to N26’s decision to withdraw from the US, since it was not able to successfully acquire its own banking license and had to operate through a local lender, Axos, for the period it was active in the region. Despite the complexity of geographical expansion, however, N26 is still assessing the possibility of expanding in additional markets in Eastern Europe throughout 2022, since there has been a constantly growing customer demand and there is still room for some competition, despite Revolut’s dominance in the area. Moreover, it has recently also secured a Brazilian banking license, hinting at plans to expand in South America, even though no official launch date has been set yet. This could be a bold and rather risky strategic decision, however, since Nubank already has tens of millions of clients in Latin America.

Similarly to other startups in the technology industry, N26 adjusted its product offerings to optimize for profitability and long-term financial sustainability because of the COVID-19 pandemic. In detail, core products offered by N26 include premium subscriptions, as well as first- and third-party banking products, such as credit products, overdraft capabilities, and phone and electronics insurance. Given the projections of a total of $90 billion in transaction volume being processed by N26 in 2021, the capital available to the company, and the loyalty of its user base, the company can now also start working on long-term projects to expand its product offerings and greatly increase this metric. More specifically, it is planning to invest in developing new products in the fields of investment and trading, which would give N26 a lot of opportunities for recurring interactions and an increased revenue per customer index. For instance, the neobank is planning to offer crypto trading services for Irish customers shortly. By expanding its product offerings, N26 is hoping to further empower its customers to manage their financial lives efficiently and seamlessly, as well as to encourage them to invest more in the public market, as an alternative to keeping their money in a savings account with negative interest rates and a way to increase their wealth over the years.

N26’s Recent Fundraising Round and Plans for future IPO

In March 2021, N26 applied for a Financial Holding license as the next step towards public listing within the next few years and becoming the first financial technology company in Germany to commit to being regulated as a group. In October 2021, N26 concluded a new funding round (Series E), raising a total of $900 million and showing that its operational issues haven’t negatively influenced the investors’ support. The capital was raised at a total valuation of $9 billion, which is on par with the market capitalization of Commerzbank AG, Germany’s second-largest listed lender and marks a big jump from the company’s Series D valuation of $3.5 billion. According to the company’s founders, this is expected to be the last funding round before an IPO, which would be the next step in realizing the company’s vision of building a global financial institution in the long run. Moreover, they stated that there is no exact timeframe for a public listing, but in the next 12 months the company will be structurally ready and it will therefore be available as a strategic move.

Regarding N26’s valuation in case of an IPO, the instability and unpredictability stemming from both the recent withdrawals from the US and UK markets, as well as the restrictions imposed by the German regulator hinting at certain operational issues, could put downward pressure on the company’s valuation. The situation is also worsened by the fact that about 500,000 accounts of US customers will be closed by January 2022, which is rather significant since the total customer base is about 7 million globally. Despite this reality, it must also be noted that N26’s strategy to strengthen and deepen its position in the European market, while broadening its product offerings to its clients, if successful, could lead to a stable growth rate in the next few years and an increase in its valuation. Moreover, the knowledge resulting from the short-lived expansion to the US could help N26 succeed in future endeavours to penetrate new markets, such as South America and Eastern Europe and therefore increase its revenues and valuation. However, the valuation will also depend considerably on the company’s ability to successfully navigate competition with other neobanks active in the areas it is active in and planning to expand to, such as Revolut and Nubank.

Customers’ Trust in Digital Banking Trends

N26’s vision is to build the bank that everyone in the world loves to use; however, the digital banking pioneer might find it hard to achieve this, at least for the near future, given the results of recent studies regarding the customers’ trust in digital banking and neobanks.

Even though there has been a significant increase in neobank adoption according to the 2020 Accenture Global Banking Consumer Survey (23% of survey respondents in 2020 maintaining a neobank account, compared to only 17% back in 2019), only about 12% of them use their neobanking account as their main one. The overall interest is now fairly moderate, thanks to the convenient, seamless, and personalized experiences provided by these platforms, as well as to potential cost savings. However, a surprising result was that only about 45% of UK-based customers expect neobanks to survive the next year and about 20% of them saying they don’t trust these modern financial institutions “at all.”

These results can be understood by considering the factors important to consumers when choosing financial institutions today, based on PYMNTS’ new study “Digital Banking: The Brewing Battle for Where We Will Bank” in collaboration with Optherium. In detail, trust, name recognition, and a proven record of providing excellent digital experiences and services securely are the most important element in the decision-making process. Additionally, fraud risk and data security concerns were cited as the main reasons for reluctance to switch their primary service provider by 41% and 47% of “uninterested consumers”, respectively. Finally, the majority of customers who maintain a neobank account but don’t use it for most of their transactions stated the fact that they were quite satisfied with their existing banking service provider as the main reason.

Market impact

In the context of increased turmoil in markets, fueled by the pandemic, inflationary pressure and the increased resulting possibility of monetary policy normalization, investors have expressed a preference for safer companies through their capital allocations. Since mid-November, a wealth of fintech stocks have performed rather poorly, from large cap firms like Square and PayPal to mid-caps such as Affirm, SoFi and Upstart and small companies such as Fiserv and Paysafe.

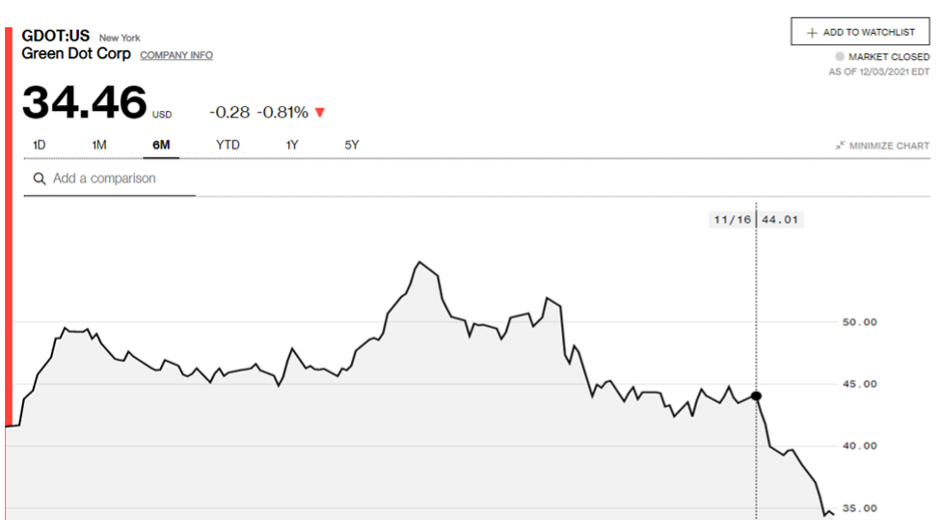

Analyzing stock price data, a sharp drop in price beginning November 16th is noticeable for Square and Green Dot, whereas an overall decline in the stock price is more accentuated in the case of PayPal.

We want to bring to your attention that evaluations of market size vary widely by methodology of compilation and by types of companies included. Some estimates include firms like Goldman Sachs and JPMorgan in fintech due to their efforts to become more digitalized and the enrichment of their product offerings in this area (most notably Marcus by GS). Others focus on pure fintech firms seen as challengers to established financial services companies.

Company Overview

N26 GmbH is a German neobank headquartered in Berlin, Germany. N26 was founded in Munich in 2013. The company's platform offers its products and services via online channels only: online banking websites and a mobile application. Its offer includes creating and handling current accounts, fixed accounts, and other banking-related services, enabling customers to manage and control their banking details via a smartphone application in a hassle freeway. Last January it reached 7 million customers across 25 markets, including Europe and the US (Berlin, Barcelona, Madrid, Milan, Paris, Vienna, Amsterdam, Belgrade, New York and São Paulo). Covid-19 restrictions have accelerated the growth of the company and, in general, the popularity of online banking. However, on the 18th of November the company decided to leave the US market (500.000 customers) a decision which will be further analyzed in the next section. Next objectives for the company are to continue deepening in existing core European markets, in central European countries, as well as expanding into Eastern Europe. In addition, They have established an autonomous business in Brazil that, powered by its own local license, is currently testing a local product. Major investors are Third Point Ventures, Coatue Management, Dragoneer Investment Group, Valar Ventures and Horizons Ventures.

N26’s Withdrawal from the US & Global Strategy

N26’s withdrawal from the US market raises multiple questions regarding its rationale and the future of its global strategy, given its ambitions to become a market leader worldwide and “do for finance what Spotify did for music and Uber did for mobility”, as declared by CEO Valentin Stalf in 2019. In a statement to Bloomberg, N26 expressed its intentions to sharpen its focus on Europe, where the company currently offers bank operations to about 7 million clients in a total of 24 countries, with an emphasis on expanding its product offerings beyond its current accounts to include additional financial products and services by investing significantly more funds and capital. This decision is not surprising, especially when considering its additional withdrawal from the UK market last year, citing Brexit uncertainty and the inability to operate in the region with an EU banking licence anymore as the primary reasons.

In the central European regions that N26 is already active and dominating in, there is still a lot of room for growth, even in its strongest markets, such as Paris and Berlin, where only about 5-7% of the population are users. Therefore, it makes a lot of sense to deepen its position in those markets and try to increase its market share, instead of trying to face the complex and environment of the US neobank industry. Another important event that has influenced N26’s strategy in Europe is the €4.25 million fine imposed by the German financial regulator BaFin in June because it submitted anti-money laundering-related suspicious activity reports late. Moreover, a month earlier, the authority ordered N26 to solve defects in its IT monitoring and customer due diligence and appointed a special commissioner to oversee its progress. As a result, the company has invested a lot in regulatory topics and its internal processes. BaFin also imposed a cap of no more than 50,000 new European customers per month, meaning that N26, for now, will only be able to accept less than a third of the customers each month that it has been. Fortunately, there is still the possibility that these restrictions are lifted in the next few months if the German regulator concludes that N26 has sufficiently improved its controls and policies by putting in place “a proper business organisation” and addressing any “risks to the institution’s operational resilience” place . However, it must be noted that according to the company’s statements these sanctions are unrelated to its decision to withdraw from the US.

An issue that makes the expansion of a neobank in a new geographical area significantly difficult is the vast amount of resources needed to apply and receive a local banking licence, as well as to set up the required agreements and payment trails, which essentially means starting from scratch each time. This is also a factor that contributed to N26’s decision to withdraw from the US, since it was not able to successfully acquire its own banking license and had to operate through a local lender, Axos, for the period it was active in the region. Despite the complexity of geographical expansion, however, N26 is still assessing the possibility of expanding in additional markets in Eastern Europe throughout 2022, since there has been a constantly growing customer demand and there is still room for some competition, despite Revolut’s dominance in the area. Moreover, it has recently also secured a Brazilian banking license, hinting at plans to expand in South America, even though no official launch date has been set yet. This could be a bold and rather risky strategic decision, however, since Nubank already has tens of millions of clients in Latin America.

Similarly to other startups in the technology industry, N26 adjusted its product offerings to optimize for profitability and long-term financial sustainability because of the COVID-19 pandemic. In detail, core products offered by N26 include premium subscriptions, as well as first- and third-party banking products, such as credit products, overdraft capabilities, and phone and electronics insurance. Given the projections of a total of $90 billion in transaction volume being processed by N26 in 2021, the capital available to the company, and the loyalty of its user base, the company can now also start working on long-term projects to expand its product offerings and greatly increase this metric. More specifically, it is planning to invest in developing new products in the fields of investment and trading, which would give N26 a lot of opportunities for recurring interactions and an increased revenue per customer index. For instance, the neobank is planning to offer crypto trading services for Irish customers shortly. By expanding its product offerings, N26 is hoping to further empower its customers to manage their financial lives efficiently and seamlessly, as well as to encourage them to invest more in the public market, as an alternative to keeping their money in a savings account with negative interest rates and a way to increase their wealth over the years.

N26’s Recent Fundraising Round and Plans for future IPO

In March 2021, N26 applied for a Financial Holding license as the next step towards public listing within the next few years and becoming the first financial technology company in Germany to commit to being regulated as a group. In October 2021, N26 concluded a new funding round (Series E), raising a total of $900 million and showing that its operational issues haven’t negatively influenced the investors’ support. The capital was raised at a total valuation of $9 billion, which is on par with the market capitalization of Commerzbank AG, Germany’s second-largest listed lender and marks a big jump from the company’s Series D valuation of $3.5 billion. According to the company’s founders, this is expected to be the last funding round before an IPO, which would be the next step in realizing the company’s vision of building a global financial institution in the long run. Moreover, they stated that there is no exact timeframe for a public listing, but in the next 12 months the company will be structurally ready and it will therefore be available as a strategic move.

Regarding N26’s valuation in case of an IPO, the instability and unpredictability stemming from both the recent withdrawals from the US and UK markets, as well as the restrictions imposed by the German regulator hinting at certain operational issues, could put downward pressure on the company’s valuation. The situation is also worsened by the fact that about 500,000 accounts of US customers will be closed by January 2022, which is rather significant since the total customer base is about 7 million globally. Despite this reality, it must also be noted that N26’s strategy to strengthen and deepen its position in the European market, while broadening its product offerings to its clients, if successful, could lead to a stable growth rate in the next few years and an increase in its valuation. Moreover, the knowledge resulting from the short-lived expansion to the US could help N26 succeed in future endeavours to penetrate new markets, such as South America and Eastern Europe and therefore increase its revenues and valuation. However, the valuation will also depend considerably on the company’s ability to successfully navigate competition with other neobanks active in the areas it is active in and planning to expand to, such as Revolut and Nubank.

Customers’ Trust in Digital Banking Trends

N26’s vision is to build the bank that everyone in the world loves to use; however, the digital banking pioneer might find it hard to achieve this, at least for the near future, given the results of recent studies regarding the customers’ trust in digital banking and neobanks.

Even though there has been a significant increase in neobank adoption according to the 2020 Accenture Global Banking Consumer Survey (23% of survey respondents in 2020 maintaining a neobank account, compared to only 17% back in 2019), only about 12% of them use their neobanking account as their main one. The overall interest is now fairly moderate, thanks to the convenient, seamless, and personalized experiences provided by these platforms, as well as to potential cost savings. However, a surprising result was that only about 45% of UK-based customers expect neobanks to survive the next year and about 20% of them saying they don’t trust these modern financial institutions “at all.”

These results can be understood by considering the factors important to consumers when choosing financial institutions today, based on PYMNTS’ new study “Digital Banking: The Brewing Battle for Where We Will Bank” in collaboration with Optherium. In detail, trust, name recognition, and a proven record of providing excellent digital experiences and services securely are the most important element in the decision-making process. Additionally, fraud risk and data security concerns were cited as the main reasons for reluctance to switch their primary service provider by 41% and 47% of “uninterested consumers”, respectively. Finally, the majority of customers who maintain a neobank account but don’t use it for most of their transactions stated the fact that they were quite satisfied with their existing banking service provider as the main reason.

Market impact

In the context of increased turmoil in markets, fueled by the pandemic, inflationary pressure and the increased resulting possibility of monetary policy normalization, investors have expressed a preference for safer companies through their capital allocations. Since mid-November, a wealth of fintech stocks have performed rather poorly, from large cap firms like Square and PayPal to mid-caps such as Affirm, SoFi and Upstart and small companies such as Fiserv and Paysafe.

Analyzing stock price data, a sharp drop in price beginning November 16th is noticeable for Square and Green Dot, whereas an overall decline in the stock price is more accentuated in the case of PayPal.

Upon examination of major thematic indexes such as Global X Fintech Thematic ETF (FINX), the Ark Fintech Innovation (ARKF), the ETFMG Prime Mobile Payments (IPAY) and Ecofin Digital Payments Infrastructure (TPAY), similar negative patterns are recognizable.

It is therefore almost impossible to quantitatively assess to what extent N26’s plans to withdraw from the United States, announced November 18th, affected public markets and sector indices, as this would imply the isolation of a multitude of variables.

Across the four ETFs mentioned above (FINX, ARKF, IPAY, TPAY), there is indeed a sharper decline in the week after the announcement than in the week previous to the announcement. Most notably, ARKF fell 1.89% between the 11th and the 18th of November, and 6.27% in the week after N26’s press release. However, finding a statistical correlation is unlikely, as the decline had already begun before the press release by N26.

In comparison with major tech indexes, fintech ones experience a more severe overall decline (especially since the 16th of November). Vanguard Information Technology ETF (VGT) rose by 2.41% between the 11th and 18th of November, and then fell 2.79% in the following week. ARK Innovation ETF (ARKK) exhibited a general decline.

It is, however, worth noting that N26’s customers will likely move to competitors, which will imply a positive impact on their revenues. An estimated 6% of Americans use mobile banking for their wealth management and the positive trend is likely to continue, especially as new coronavirus variants spread and physical access into financial institutions may be limited. The following year is expected to bring further volatility on financial markets, especially in the technology sector. In this environment, the anticipation of increased sales for fintech firms may not weigh as much in the stock prices as the relatively weaker fundamentals of young firms and the conditions of macroeconomic stress. Investors are very likely to exhibit a strong preference for larger firms, better equipped to withstand potential interest rate hikes or even tax increases as they navigate the complex pandemic economy.

Note: Stock price variations computed to account for the Thanksgiving break on Nov. 25.

Sources

Article written by Chiara Cerrato, Stergios Mastoris, Teodor Ioan Matei

Across the four ETFs mentioned above (FINX, ARKF, IPAY, TPAY), there is indeed a sharper decline in the week after the announcement than in the week previous to the announcement. Most notably, ARKF fell 1.89% between the 11th and the 18th of November, and 6.27% in the week after N26’s press release. However, finding a statistical correlation is unlikely, as the decline had already begun before the press release by N26.

In comparison with major tech indexes, fintech ones experience a more severe overall decline (especially since the 16th of November). Vanguard Information Technology ETF (VGT) rose by 2.41% between the 11th and 18th of November, and then fell 2.79% in the following week. ARK Innovation ETF (ARKK) exhibited a general decline.

It is, however, worth noting that N26’s customers will likely move to competitors, which will imply a positive impact on their revenues. An estimated 6% of Americans use mobile banking for their wealth management and the positive trend is likely to continue, especially as new coronavirus variants spread and physical access into financial institutions may be limited. The following year is expected to bring further volatility on financial markets, especially in the technology sector. In this environment, the anticipation of increased sales for fintech firms may not weigh as much in the stock prices as the relatively weaker fundamentals of young firms and the conditions of macroeconomic stress. Investors are very likely to exhibit a strong preference for larger firms, better equipped to withstand potential interest rate hikes or even tax increases as they navigate the complex pandemic economy.

Note: Stock price variations computed to account for the Thanksgiving break on Nov. 25.

Sources

- Accenture

- Allied Market Research

- altfi

- Bloomberg

- Crowdfund Insider

- CNBC

- ETF Database (ETFDB)

- EY

- Financial Times

- Finextra

- Finovate

- FinTech Magazine

- Irish Times

- Mordor Intelligence

- N26

- PYMNTS

- ScienceDirect

- Sifted

- Statista

- Techcrunch

- The Motley Fool

- The Wall Street Journal

- Yahoo Finance

Article written by Chiara Cerrato, Stergios Mastoris, Teodor Ioan Matei