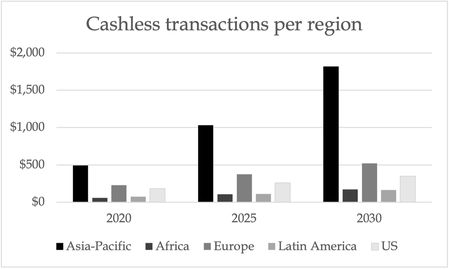

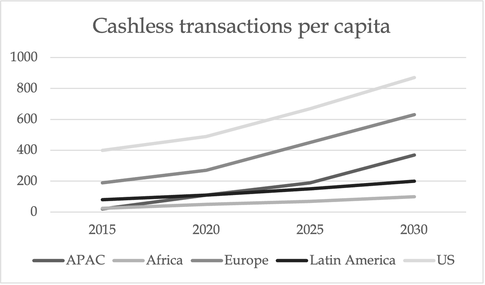

Over the past two decades, payment methods have undergone drastic changes. This transformative journey began in the early 2000s with the rise of online banking and digital wallets. Credit and debit cards, along with mobile wallets, have become the new norm in society. Cashless payments are expected to grow by just over 60% in the next six years, with the APAC region at the forefront. We look at the measures governments are implementing to enact this and the benefits and disadvantages of cashless payments.

Cashless transactions capitalise on the fact that there is no hard, physical exchange of cash. The rise of apps and services like Paypal, Google and Apple Pay, and Venmo have made it easier than ever to engage in cashless payments, as nearly everyone with a phone can use these services. While cash transactions can often take longer than expected due to breaking of notes and counting change, cashless transactions aim to simplify and streamline this process. With the APAC region accounting for 55% of cashless payments globally, we must look at how going cashless benefits consumers, businesses, and governments

Benefits of a Cashless Economy

One of the key advantages of a cashless society is the increased speed and efficiency of business. Paying by card or digitally significantly cuts down the processing time of the transaction as less work is required by both parties, allowing businesses to handle a higher volume of transactions with greater speed and precision. For consumers, there is also considerable time-saving. There is no longer a need to queue in banks to deposit and withdraw cash as funds are transferred straight to individuals' bank accounts, making it easier for consumers to purchase goods and services.

Another benefit of cashless transactions is the fact that all payments are traceable. Every transaction leaves a trail behind, and money can be easily tracked. This serves not only as a powerful tool for fraud detection but also provides valuable insights into the spending patterns of both consumers and businesses. Being able to monitor outgoings helps to encourage financial literacy and helps to avoid any accounting errors that could arise from cash payments.

Lastly, cashless transactions have allowed greater convenience in paying. It eliminates the need for consumers to carry around large amounts of cash and the feeling of danger that comes along with it. In addition, keeping large quantities of cash in stores can also invite danger and be inconvenient for business owners. Moreover, cashless transactions have also propelled the development of Buy Now Pay Later schemes provided by companies like Klarna and Afterpay. These schemes would be impossible with the use of cash as there is no accountability as opposed to a credit card. BNPL schemes have opened up the purchase of goods and services to a broader consumer base as sometimes people don't have the upfront funds to purchase something then and there.

Challenges of a Cashless Transition

While we've just explored the advantages of digital transactions, it's also vital to acknowledge the disadvantages that necessitate a balanced approach concerning their mass adoption.

A notable drawback of cashless payments revolves around the digital divide. Despite considerable technological advancements, a significant portion of the population still lacks access to smartphones and reliable internet (still, much progress has been made in the last 20 years in the APAC region, where individuals using the internet excluding high income jumped from 4% of the population in 2002 to 75% in 2022). This digital disparity negatively affects the universal acceptance of cashless transactions and worsens economic inequalities, particularly in less developed regions. Furthermore, the dependence on technology raises concerns about potential disruptions to the technological infrastructure, such as power outages or system failures, that would leave individuals and businesses temporarily without access to their funds or the ability to engage in transactions. Additionally, fragile parts of the population, such as older individuals and those with limited technological literacy, may encounter challenges adapting to the rapidly evolving digital landscape, excluding them from essential financial services. For example, an Indian study found that almost 86% of respondents were found to be digitally illiterate, the majority of whom were elderly people. While this remains a complex issue, the widespread diffusion of technology among the whole population over time is expected to render cashless payments universally accessible.

Moreover, the digital realm is susceptible to fraud and cybersecurity risks, as cashless transactions create new opportunities for malicious entities to exploit vulnerabilities. Phishing attacks, hacking incidents, and identity theft pose substantial threats to the financial well-being of users. In 2022, 1829 cyber incidents in the financial industry were reported worldwide (477 data breaches), down from 2527 in 2021 (690 data breaches), but still at a worryingly high number. Given the evolving tactics of cybercriminals, a crucial task will be to continuously improve security measures and instruct users to be constantly vigilant. This underscores the importance of robust technological systems and widespread education on cybersecurity to mitigate risks effectively.

Cashless payments may threaten personal data security in a world marked by eroding privacy from various sources. Each digital transaction leaves behind a discernible data trail, raising concerns regarding the extent to which financial institutions and payment processors collect and analyse personal information. While enhanced accountability and the potential to reduce illicit activities and money laundering are valuable outcomes, the general public's reservations about the erosion of financial privacy and freedom remain a significant concern. Reaching a balance between the convenience of cashless transactions and safeguarding individual privacy represents a substantial challenge in this interconnected age.

Furthermore, users often encounter transaction fees imposed by banks, payment processors, or third-party platforms. These fees can accumulate, particularly for businesses engaged in high transaction volumes, significantly impacting overall profitability and diminishing the perceived cost-effectiveness of cashless transactions.

The adoption of cashless payments presents various challenges. Addressing the digital divide, reinforcing privacy protections, improving technological infrastructure, and mitigating fraud risks are crucial steps to ensure that the advantages of cashless transactions do not come at the cost of societal inclusivity, individual privacy, and financial security. Navigating this evolving financial landscape requires a comprehensive understanding of the drawbacks associated with cashless payments, which can and must lead to informed decision-making, policy formulation, and strategies to mitigate potential pitfalls.

The Situation in APAC

In the APAC region, countries and market makers promote cashless payments via digital wallets and QR codes. Moreover, thanks to their easy sign-ups and interoperability, digital apps are to be considered among the main reasons for the increase in digital payments.

There are many advantages to these digital transactions. For instance, apps provide customers with instant onboarding and activations, facilitating transactions in fewer steps. Also, digital transactions are more transparent and help customers check their expenditures or always have a list of their receipts in case of fraud or money laundering.

APAC governments have started to play a more active role in this new economy. The governmental push by countries like China and South Korea on digital payments aims to consolidate cross-border payments and expand into global markets.

Moreover, this cashless trend paves the way for innovation, financial inclusion, and speedy transfers. For instance, the Indian Aadhaar system provides each citizen with a personal identity, allowing for cashless disbursements of government benefits faster and more efficiently.

This system of cashless transactions may also produce disadvantages, especially in the case of developing economies.

Furthermore, cash is still a critical budgeting tool for many, and a cashless economy could create imbalances in such cases.

One could also raise concerns regarding people without a personal bank account. However, in many parts of Asia, even citizens with no bank accounts engage in cashless transactions thanks to digital wallets and topping them up at retail stores.

Thanks to using payment super apps, entire economies have detached from regular credit cards. For example, in China WeChat Pay and Alipay are very popular, as well as Paytm in India, KakaoPay and Samsung Pay in South Korea, and GCash in the Philippines.

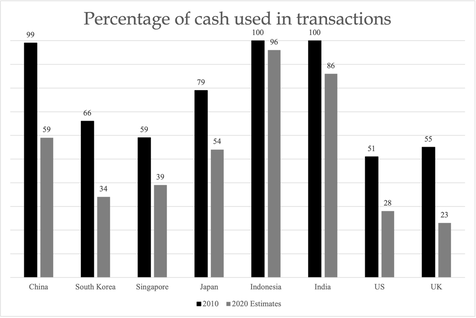

If we consider how cashless innovation is shaping the consumer experience by looking at the graph below, South Korea is the most cashless economy in Asia. Customers are used to paying with e-money via e-wallets. The most famous digital wallet in South Korea is Danal Fintech's Paycoin Wallet. Paycoin even allows you to buy cryptocurrencies. The Paycoin wallet is widely accepted, as more than 60,000 merchants in the country accept payments through it.

In Singapore, cash transactions are also lower than e-payments, with the latter being part of the Singapore Monetary Authority's (SMA's) plan to transform the country into a "smart financial centre." As a matter of fact, during COVID, market makers incentivised citizens to go cashless and adopt QR codes to make payments by offering cash bonuses.

Nevertheless, if we look at Indonesia, one of the world's most populous countries, cash use is still high. However, the country has a promising and fast-growing e-commerce market, valued at $40 billion, with the digitalisation of traditional commerce and business helping small merchants during COVID. Moreover, PT Bukalapak, an Indonesian e-commerce platform, raised $1.5 billion in Indonesia's biggest initial public offering ever. Central banks and authorities have a major role in enabling the shift to cashless in countries like Indonesia.

The Future of Asian Countries

Beginning in the 90s, most economies adopted real-time gross settlement (RTGS). RTGS allows for settlement of payments continuously in real-time, reducing credit exposures between banks and enhancing oversight. While RTGS facilitates wholesale settlements, fast payment systems (FPS) allow instant retail payments by individuals and businesses, enabling cashless transactions.

Speaking to the most advanced countries in cashless transactions within Asia, Singapore, and Thailand have spearheaded the evolution of the region’s cross-border payment infrastructure by linking their local FPS (Singapore’s PayNow and Thailand’s PromptPay) in April of 2021, transactions are free-of-charge for Singaporean’s and around $4 for Thais with an average $150-200 transfer (previously 10% of transaction amount for any party). Singapore and Thailand had previously established their FPSs in 2017 and 2016, respectively. In connecting these systems, the central banks aimed to extend domestic convenience to cross-border payments within South-East Asia. As cross-border transactions in Asia grow, and other countries in the region become more developed in cashless transactions, we can expect more of these developments between countries.

In the legal and regulatory space surrounding cashless transactions, compliance requirements concerning areas such as AML/CFT screening and the sharing of customer data differ across Asia, which may slow the growth of the cashless transactions sector in some parts relative to others, alongside the drag that is legacy technical architecture of institutions which differ across countries.

In Vietnam, the government set a target in 2017 to reduce the ratio of cash payments to less than 10% by 2020 to reduce the costs that come with cash, such as infrastructure like ATMs and other issues. With the onset of health restrictions during the pandemic (which permanently changed how young people, in particular within ASEAN countries, transacted) and government initiatives to promote digital payments, such as the annual “Cashless Day,” which started in 2019, the proportion of Vietnamese citizens with bank accounts spiked to 60% in H1 2022 from 30.8% in 2019. The Vietnamese government now targets 50% of cashless transactions in e-commerce (traditionally paid in cash on doorsteps) and 80% of people older than 15 with bank accounts before 2025.

Similarly, In Myanmar, the central bank formed the National Payment System Supervision Committee to achieve the goals of the National Payment Strategy (2020-2025). In 2022, the country achieved a 47% YoY increase in mobile payments.

In 2016, India’s central bank’s decision to pull 500 and 1000-rupee notes from circulation resulted in a cash shortage and played a role in the increased adoption of cashless payments. The National Payments Corporation of India, a non-profit under the management of India’s central bank, launched the United Payments Interface (UPI) in the same year. UPI is an interoperable direct bank transfer platform that supports multiple bank accounts in a single mobile application. Again, the transition to cashless in India was further supported by pandemic restrictions; according to the World Bank, more than 80 million adults in India made their first digital merchant payment after the start of the pandemic.

In Indonesia, paper money exchanges still represent 85% of transactions by volume. So far, the government has established the Indonesia Payment System Blueprint 2025. In 2021, the central bank rolled out a real-time retail payment system infrastructure (BIFAST), which is available 24/7.

To an extent, cash in Japan also holds some prominence, though not as much as in Indonesia. In 2018, Japan’s Ministry of Economy, Trade and Industry proposed the “Cashless Vision,” which aims to make 40% of all transactions cashless by 2025 and ultimately 80%. In 2022, the government announced a system for paying salaries digitally, and in 2023, companies have been able to make payments directly to payment provider accounts via smartphone payment apps instead of traditional bank accounts.

Conclusion

Despite the heavier cultural engrainment of cash relative to other regions of the world, the benefits of cashless transactions will help the new form of payment in trumping traditional payment methods. In less developed countries, cashless transactions will help societies skip the costly implementation of cash infrastructure such as ATMs, instead leaping straight to mobile platforms in countries where mobile usage exceeds that of desktops. However, mobile and internet penetration is not the only driver of cashless transactions. As demonstrated by the gap between Latin America (the highest growth mobile and internet usage region) and Asia-Pacific, central banks and authorities have a significant role in guiding the transition through their policy. Cashless transactions are set to reach $3tn by 2030, and the APAC region may take the lead in this transition.

By: Pietro Vascotto Vidal, Matilde Chiavenato, Vittorio Granuzzo, Kabir Wal

Sources

- Asia Banking and Finance

- Channel News Asia

- Deutsche Bank

- Forbes

- McKinesey

- PwC

- South China Morning Post

- Telecom Review

- World Economic Forum

- Yahoo Finance