The Covid-19 pandemic has had a devastating impact on economies all over the world and forced more-at-risk businesses to close and reinvent their business model to survive the crisis: among those who mainly suffered from the lockdowns imposed in most countries, there are restaurants and food industries. Nevertheless, due to Covid-19, new innovative trends have been set: supported by efficient home delivery services, home consumerism is at an all-time high, with people utilizing online shopping and home dining like never before. Another significant change in the mindset of consumers is the one regarding increasing demand for food options that are good for health, producers, and the planet. Healthy nutrition has proved to be a core aspect of a healthy lifestyle and after the pandemic has shown our weaknesses as human beings, now more than ever people are getting selective and keen about such aspects of their daily routines.

Having said that, it seems that such companies as Freshly look like to be the perfect fit for these new trends: founded in 2015, Freshly delivers a menu of fresh, chef-cooked meals to customers across the US, breaking down the barriers to healthy eating by delivering nutrition and convenience at scale. Thought as a time-saving solution for those looking for a fast but tasty and healthy meal, the concept of Freshly is one that has suited the work-from-home lifestyle that took over during the pandemic. With a corporate mission to break down the barriers to healthy eating, Freshly believes that taste and health don't need to be compromised for convenience. Freshly's food philosophy is centered on less sugar, less processed, and more nutrients. All meals are gluten-free and single-serve for effortless portion control. Developed by chefs and nutritionists, the menu features better-for-you versions of classic comfort foods with smart ingredient swaps, making eating better easier than ever.

The company had been successful even before the pandemic but it gained much success with Government imposing lockdowns and social distancing restrictions that constrained dining in restaurants and numbers in supermarkets across the US. After acquiring a 16% stake in the company’s in 2017 as a strategic move to evaluate and test the burgeoning meal kit delivery market, Nestlé finally decided to acquire Freshly, Inc. this year, strengthening its external growth strategy, especially after the $2.6 billion purchase in August of Aimmune Therapeutics. Freshly pioneered the direct-to-consumer prepared meal delivery channel and is known for its use of standard-setting technology and analytics, which will build upon Nestlé's strong base of innovation.

"We are excited to welcome Freshly to the Nestlé family," said Nestlé USA Chairman and CEO, Steve Presley. "Consumers are embracing e-commerce and eating at home like never before. It's an evolution brought on by the pandemic but taking hold for the long term. Freshly is an innovative, fast-growing, food-tech startup, and adding them to the portfolio accelerates our ability to capitalize on the new realities in the U.S. food market and further positions Nestlé to win in the future."

The deal values Freshly at USD 950 million, with potential earnouts up to USD 550 million contingent on the successful growth of the business, witnessing Nestlé’s high expectations over the coming months. Despite being an already well-established company in the US with a presence in 48 states, one million prepared meals per week, and projected sales of $430m for 2020, the acquisition gives the New York-based company the possibility to strengthen its position through Nestlé's financial resources and experience. This is significant considering the highly competitive market Freshly has to face with such competitors as HelloFresh and Blue Apron. The acquisition of Freshly is also the first step for Nestlé in the meal kit delivery market, representing the opportunity to enter a market whose size is expected to reach $19.92 billion by 2027, as well as benefit from an economic windfall given the current global pandemic. Indeed, the move brings together Nestlé's deep understanding of what and how people eat at home, and world-class research and development capabilities with Freshly's highly specialized consumer analytics platform and distribution network to fuel growth opportunities within the Freshly business and across Nestlé's portfolio.

As witnessed by the mediocre performance of “Covid friendly” companies’ stocks since the news of the Pfizer and Moderna vaccine, the question for Nestlé and Freshly is now how to implement sustainable growth in a company that has thrived under corona-virus restrictions, but may find it difficult to establish in a world where those very restrictions may soon be a thing of the past.

Moreover, the industry in which Freshly operates is characterized by high competition and low barriers-to-entry. Freshly’s current unique competitive advantage is its offering of high-quality, precooked meals that need only be heated (“Heat and Eat”), while its main competitors, such as Blue Apron and Dinnerly, offer not-already-cooked artisan ingredients, requiring more work for customers and addressing a similar but not equal target. However, as Freshly’s business model continues to prove successful, competitors might find it easy to emulate the idea and forward integrate. Under this scenario, Freshly’s profits would drop and competition would create a price war between brands. Therefore for Nestle, the most efficient solution to preserve the competitive advantage will be to enhance the Freshly brand’s added value, quality, and efficiency, so that rivals appear as inferior goods, rather than competitive substitutes.

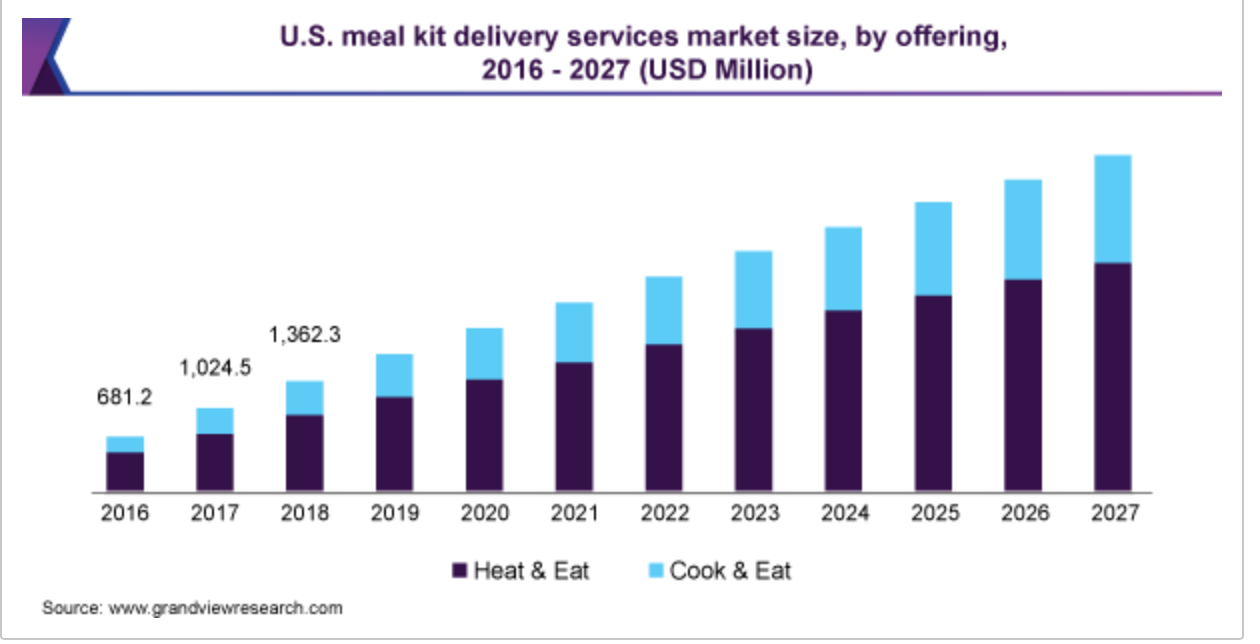

As aforesaid, the global meal kit delivery services market size was valued at USD 7.60 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2020 to 2027. Increasing preference for homemade meals among millennials is expected to be a major factor contributing to the growth of the market. Indeed, Millennials and Generation Z account for the largest consumer group of these meal kit delivery services. In particular, rather than “Cook and Eat”, it is the “Heat and Eat” segment to lead the market, accounting for more than 65% share of the global revenue in 2019. Growing busy and hectic lifestyles among younger generations at the global level is expected to expand the scope of meal “Heat and Eat” delivery service over the next few years. This segment is expected to register the fastest CAGR of 13.2% from 2020 to 2027. What’s more, although offline platforms accounted for 65% of the global meal kit delivery services market in 2019, the online platform is expected to register the fastest CAGR of 13.4% from 2020 to 2027 thanks to wider distribution networks and improved efficiency. Also, the opportunity of ordering multiple kit delivery services seems appealing, and more and more customers are opting for it. Finally, while North America dominated the market and accounted for over 30% of the overall revenue in 2019, due to increasing employment and hence a busier lifestyle, Asia Pacific bears expectations to expand at the fastest CAGR of 14.0% from 2020 to 2027.

To sum up, the decision from Nestle’s management to invest in the meal kit delivery market through the acquisition of Freshly can be regarded as a promising bet in one of the Covid-pushed new trends. Thanks to the impulse give from the pandemic to the industry, the meal kit delivery service market seems to be on the verge of astonishing growth: new generations’ busy lives and concerns require innovative solutions and this could represent one of them.

Alessandro Maraldi

Having said that, it seems that such companies as Freshly look like to be the perfect fit for these new trends: founded in 2015, Freshly delivers a menu of fresh, chef-cooked meals to customers across the US, breaking down the barriers to healthy eating by delivering nutrition and convenience at scale. Thought as a time-saving solution for those looking for a fast but tasty and healthy meal, the concept of Freshly is one that has suited the work-from-home lifestyle that took over during the pandemic. With a corporate mission to break down the barriers to healthy eating, Freshly believes that taste and health don't need to be compromised for convenience. Freshly's food philosophy is centered on less sugar, less processed, and more nutrients. All meals are gluten-free and single-serve for effortless portion control. Developed by chefs and nutritionists, the menu features better-for-you versions of classic comfort foods with smart ingredient swaps, making eating better easier than ever.

The company had been successful even before the pandemic but it gained much success with Government imposing lockdowns and social distancing restrictions that constrained dining in restaurants and numbers in supermarkets across the US. After acquiring a 16% stake in the company’s in 2017 as a strategic move to evaluate and test the burgeoning meal kit delivery market, Nestlé finally decided to acquire Freshly, Inc. this year, strengthening its external growth strategy, especially after the $2.6 billion purchase in August of Aimmune Therapeutics. Freshly pioneered the direct-to-consumer prepared meal delivery channel and is known for its use of standard-setting technology and analytics, which will build upon Nestlé's strong base of innovation.

"We are excited to welcome Freshly to the Nestlé family," said Nestlé USA Chairman and CEO, Steve Presley. "Consumers are embracing e-commerce and eating at home like never before. It's an evolution brought on by the pandemic but taking hold for the long term. Freshly is an innovative, fast-growing, food-tech startup, and adding them to the portfolio accelerates our ability to capitalize on the new realities in the U.S. food market and further positions Nestlé to win in the future."

The deal values Freshly at USD 950 million, with potential earnouts up to USD 550 million contingent on the successful growth of the business, witnessing Nestlé’s high expectations over the coming months. Despite being an already well-established company in the US with a presence in 48 states, one million prepared meals per week, and projected sales of $430m for 2020, the acquisition gives the New York-based company the possibility to strengthen its position through Nestlé's financial resources and experience. This is significant considering the highly competitive market Freshly has to face with such competitors as HelloFresh and Blue Apron. The acquisition of Freshly is also the first step for Nestlé in the meal kit delivery market, representing the opportunity to enter a market whose size is expected to reach $19.92 billion by 2027, as well as benefit from an economic windfall given the current global pandemic. Indeed, the move brings together Nestlé's deep understanding of what and how people eat at home, and world-class research and development capabilities with Freshly's highly specialized consumer analytics platform and distribution network to fuel growth opportunities within the Freshly business and across Nestlé's portfolio.

As witnessed by the mediocre performance of “Covid friendly” companies’ stocks since the news of the Pfizer and Moderna vaccine, the question for Nestlé and Freshly is now how to implement sustainable growth in a company that has thrived under corona-virus restrictions, but may find it difficult to establish in a world where those very restrictions may soon be a thing of the past.

Moreover, the industry in which Freshly operates is characterized by high competition and low barriers-to-entry. Freshly’s current unique competitive advantage is its offering of high-quality, precooked meals that need only be heated (“Heat and Eat”), while its main competitors, such as Blue Apron and Dinnerly, offer not-already-cooked artisan ingredients, requiring more work for customers and addressing a similar but not equal target. However, as Freshly’s business model continues to prove successful, competitors might find it easy to emulate the idea and forward integrate. Under this scenario, Freshly’s profits would drop and competition would create a price war between brands. Therefore for Nestle, the most efficient solution to preserve the competitive advantage will be to enhance the Freshly brand’s added value, quality, and efficiency, so that rivals appear as inferior goods, rather than competitive substitutes.

As aforesaid, the global meal kit delivery services market size was valued at USD 7.60 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 12.8% from 2020 to 2027. Increasing preference for homemade meals among millennials is expected to be a major factor contributing to the growth of the market. Indeed, Millennials and Generation Z account for the largest consumer group of these meal kit delivery services. In particular, rather than “Cook and Eat”, it is the “Heat and Eat” segment to lead the market, accounting for more than 65% share of the global revenue in 2019. Growing busy and hectic lifestyles among younger generations at the global level is expected to expand the scope of meal “Heat and Eat” delivery service over the next few years. This segment is expected to register the fastest CAGR of 13.2% from 2020 to 2027. What’s more, although offline platforms accounted for 65% of the global meal kit delivery services market in 2019, the online platform is expected to register the fastest CAGR of 13.4% from 2020 to 2027 thanks to wider distribution networks and improved efficiency. Also, the opportunity of ordering multiple kit delivery services seems appealing, and more and more customers are opting for it. Finally, while North America dominated the market and accounted for over 30% of the overall revenue in 2019, due to increasing employment and hence a busier lifestyle, Asia Pacific bears expectations to expand at the fastest CAGR of 14.0% from 2020 to 2027.

To sum up, the decision from Nestle’s management to invest in the meal kit delivery market through the acquisition of Freshly can be regarded as a promising bet in one of the Covid-pushed new trends. Thanks to the impulse give from the pandemic to the industry, the meal kit delivery service market seems to be on the verge of astonishing growth: new generations’ busy lives and concerns require innovative solutions and this could represent one of them.

Alessandro Maraldi