A structural shift away from cash payments has led to rapid growth in the sector and encouraged a wave of big deals. In fact, activity in the sector of electronic payments has been high in the first months of 2019, the biggest on record for payments deals by value, according to the Financial Times. The most important deals were the following: in January, Fiserv acquired First Data in an all-stock deal valued $22 billion; in March, FIS acquired the processing giant Worldpay for $43 billion, heating up the consolidation trend in the industry; in April Network International raised $1.4billion in an initial public offering in London, after which its shares surged 19% valuing the company at £2.18 billion; also in April, Italian payments Nexi Group went public and agreed to sell €1.3bn of shares in Europe’s largest initial public offering of the year. Expectations for Nexi’s IPO were high but not everything went as expected. We will try to understand why in this article.

The company

Nexi is Italy’s biggest payment-service company, operating in merchant servicing, card payments and digital solutions. The firm has partnerships with about 150 Italian banks and has a 60% market share in card issuing. Nexi posted net income of €20 million last year with operating revenue of €931 million.

Nexi, was taken over by private equity funds Bain Capital, Advent International and Clessidra at the end of 2015, that now own approximately 60% of the company, after the IPO.

The offering

The Nexi IPO is the largest in Europe since German brake maker Knorr-Bremse AG’s €3.8 billion share listing in October. It is also the biggest in Milan since Pirelli & C. SpA returned to the market in 2017.

The initial public offering of Nexi SpA raised €2.01 billion, making it the biggest listing in Europe so far this year and the third major IPO of a payment-processing institution in the region in less than a year. The offer included:

Shares were offered through a private placement at €9 each, in the lower band of the initial price range of €8.5-10.35, giving the company a value of €7.3 billion including debt, with a capitalization of €5.7 billion, including the Capital Increase amounting to €700 million.

The company, whose investors include Advent International, Bain Capital and Clessidra SGR will have free float of 35.6%, which could be increased up to 40.9% following the possible exercise of Green-shoe Option.

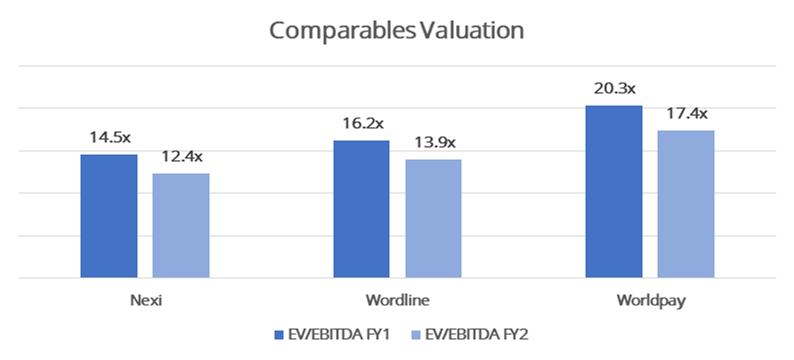

Looking at the EV/EBITDA multiples for 2019 and 2020, we see Nexi trading at a discount compared to multiples of comparable companies such as Worldline and Worldpay.

The company

Nexi is Italy’s biggest payment-service company, operating in merchant servicing, card payments and digital solutions. The firm has partnerships with about 150 Italian banks and has a 60% market share in card issuing. Nexi posted net income of €20 million last year with operating revenue of €931 million.

Nexi, was taken over by private equity funds Bain Capital, Advent International and Clessidra at the end of 2015, that now own approximately 60% of the company, after the IPO.

The offering

The Nexi IPO is the largest in Europe since German brake maker Knorr-Bremse AG’s €3.8 billion share listing in October. It is also the biggest in Milan since Pirelli & C. SpA returned to the market in 2017.

The initial public offering of Nexi SpA raised €2.01 billion, making it the biggest listing in Europe so far this year and the third major IPO of a payment-processing institution in the region in less than a year. The offer included:

- Newly issued Shares (amounting to a total of about €700 million) resulting from a capital increase

- Existing Shares, where Mercury UK Holdco Ltd (vehicle of private equity funds Bain Capital, Advent and Clessidra) will sell about 125 millions of shares while Banco BPM, Banca Popolare di Sondrio, Banca di Cividale, Credito Valtellinese and Iccrea Banca will sell about 21 millions shares

- Green-shoe option representing up to 15% of the shares sold in the offering

Shares were offered through a private placement at €9 each, in the lower band of the initial price range of €8.5-10.35, giving the company a value of €7.3 billion including debt, with a capitalization of €5.7 billion, including the Capital Increase amounting to €700 million.

The company, whose investors include Advent International, Bain Capital and Clessidra SGR will have free float of 35.6%, which could be increased up to 40.9% following the possible exercise of Green-shoe Option.

Looking at the EV/EBITDA multiples for 2019 and 2020, we see Nexi trading at a discount compared to multiples of comparable companies such as Worldline and Worldpay.

Bank of America Corp., Credit Suisse Group AG, Banca IMI SpA, Goldman Sachs Group Inc. and Mediobanca SpA are the joint global coordinator of the initial public offering.

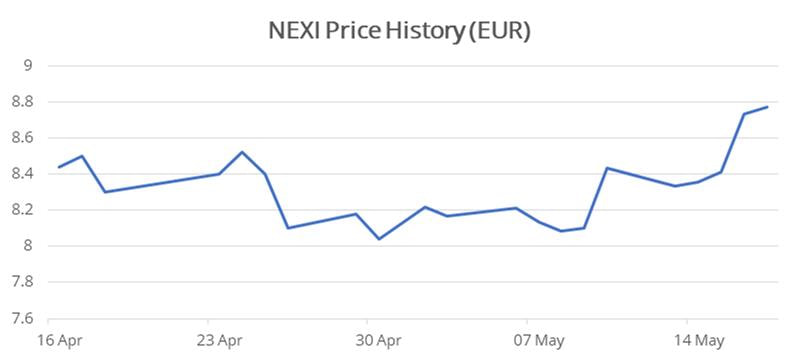

The debut at Piazza Affari

Notwithstanding the promising background of this IPO things did not go as expected. Shares in Nexi dropped by as much as 8% on their first day of trading. The company traded as low as €8.29 on the Borsa Italiana on Tuesday and it recovered slightly by early afternoon to trade at €8.49, down 6%, for a capitalization of €5.35 billion (down €300 million). Currently the share price seems to be on its way back up, but it is still trading below the listing price of €9. What went wrong?

The debut at Piazza Affari

Notwithstanding the promising background of this IPO things did not go as expected. Shares in Nexi dropped by as much as 8% on their first day of trading. The company traded as low as €8.29 on the Borsa Italiana on Tuesday and it recovered slightly by early afternoon to trade at €8.49, down 6%, for a capitalization of €5.35 billion (down €300 million). Currently the share price seems to be on its way back up, but it is still trading below the listing price of €9. What went wrong?

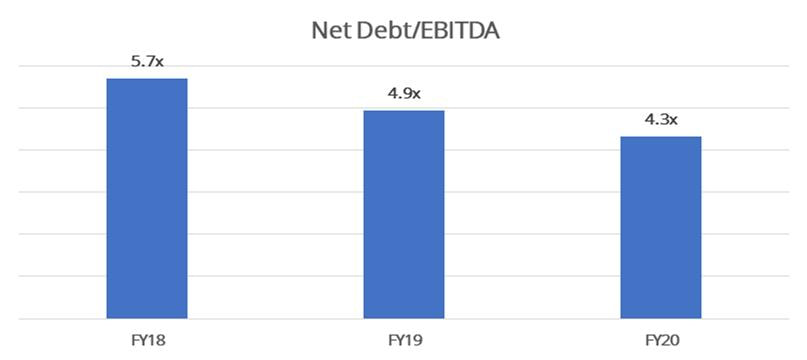

One issue that could have influenced the IPO could be linked to the high amount of debt Nexi has. Before the IPO, the company publicly confirmed it will use the proceeds from the fresh capital and from a new term loan to buy back a portion of its existing debt, eventually reducing its gross debt to about €2 billion from €2.6 billion. However, investors did not seem to be convinced. The company's debt/EBITDA ratio is expected to remain at 4x-5x in 2019 and 2020. Therefore, the high interest from debt paid by Nexi could in the future jeopardize its ability to make investments in key areas, such as technological infrastructures, with the possibility, therefore, that the Group cannot keep up with the innovation that characterizes the markets in which it operates.

Moreover, It is important to underline that private equity owners still own approximately 57.3% of Nexi, even after the IPO. Therefore, they retain control of the company and entirely define its capital strategy, including its appetite for leverage. This fact might have worried investors since the industry as a whole is consolidating throughout Europe, and investors cannot be sure that Nexi's management won't decide to pursue debt-financed opportunities to build scale and grow externally, thus further increasing its debt.

Another issue could be linked to the fast-growing competition from newcomers tapping technologies for alternative payment methods in the payments business, that worries investors. Moreover, in Italy only 14% of purchases are cashless compared with more than half in the Netherlands, fact that can be seen both as an opportunity and as a possible challenge for Nexi.

The CEO Paolo Bertoluzzo commented on the IPO :“The listing is a starting- and not an end-point”. Therefore, it may be too early to judge whether the operation is a flop or not.

Massimiliano Radogna

19 May, 2019

Article made possible by FactSet

Another issue could be linked to the fast-growing competition from newcomers tapping technologies for alternative payment methods in the payments business, that worries investors. Moreover, in Italy only 14% of purchases are cashless compared with more than half in the Netherlands, fact that can be seen both as an opportunity and as a possible challenge for Nexi.

The CEO Paolo Bertoluzzo commented on the IPO :“The listing is a starting- and not an end-point”. Therefore, it may be too early to judge whether the operation is a flop or not.

Massimiliano Radogna

19 May, 2019

Article made possible by FactSet