BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

Intro

On 05 October, Nexi S.p.A. and SIA S.p.A. issued a joint press release to report the signing of a Memorandum of Understanding on the integration of the two groups. The merger will take place by incorporation of SIA into Nexi. This operation will mark the birth of a new Italian leader in digital payments, able to compete in the European PayTech industry. The companies are both electronic payments providers with a different focus: SIA focuses on services to financial intermediaries while Nexi deals directly with merchants. We will briefly assess the two businesses before diving into the deal rationale and valuation.

Nexi Overview

Nexi, founded in 2017 from the merger of ICBPI and CartaSì and headquartered in Milan, offers digital payment services and infrastructures for banks, companies, institutions, and public administration. Nexi manages over 41 million payment cards and 2.7 billion transactions each year. It has 890,000 POS points of sale, 1.4 million POS terminals, 446 billion euros in transactions, and 13.5 thousand ATMs throughout Italy. It has over 420 thousand customers using Interbank Corporate Banking services. The company is listed on the FTSE MIB since last year and it is controlled (52.4% of the capital) by Mercury UK HoldCo, a vehicle of Bain Capital, Advent and Hourglass funds. At the end of fiscal year 2019 it reported a financial and operating income of € 813.8 mm, with a net profit of € 135.2 mm and an EPS of 22 cents, up from 7 cents in 2018.

SIA Overview

Sia, founded in 1977 as the Italian Society for Automation and headquartered in Milan, has been a decisive driver of innovation for the development of electronic payments in Italy. After a strong M&A activity over the last decade, the company has strengthened its European and international dimension: it now plays a key role in the payment systems and cards sector and offers network and database services to support trading activities in the financial markets. SIA is substantially controlled by CDP (Cassa Depositi e Prestiti), which holds a 70% stake in FSIA Investimenti, the majority shareholder of the company (57.4% of the capital), as well as a direct stake of over 25% through the CDP Equity fund. In the 2019 fiscal year, SIA reported revenues of € 733 mm, more than two-thirds of which were linked to the Italian market, an operating income of € 138 mm, and a net profit of € 95 mm, with earning per share rising to 56 cents.

Market Overview

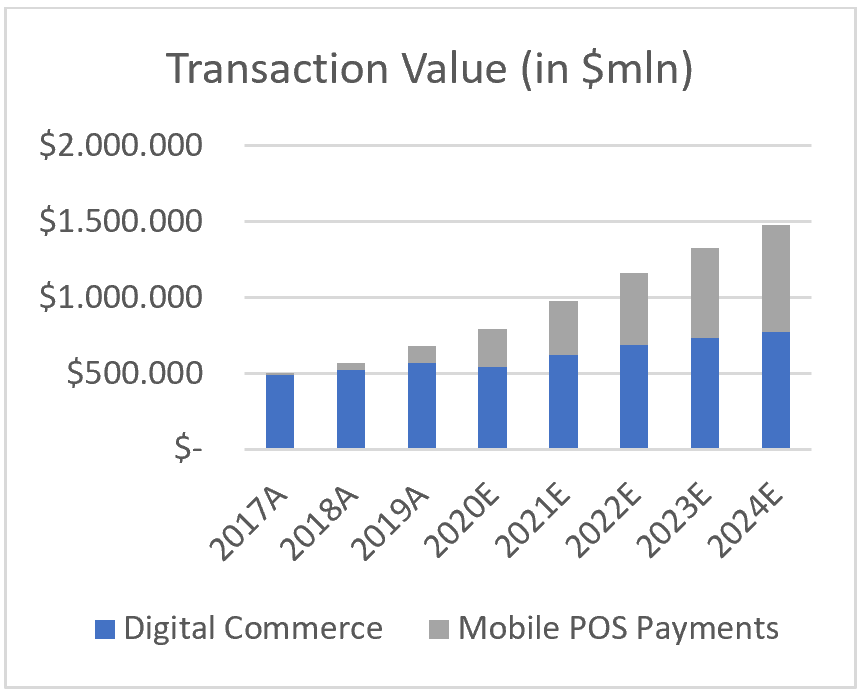

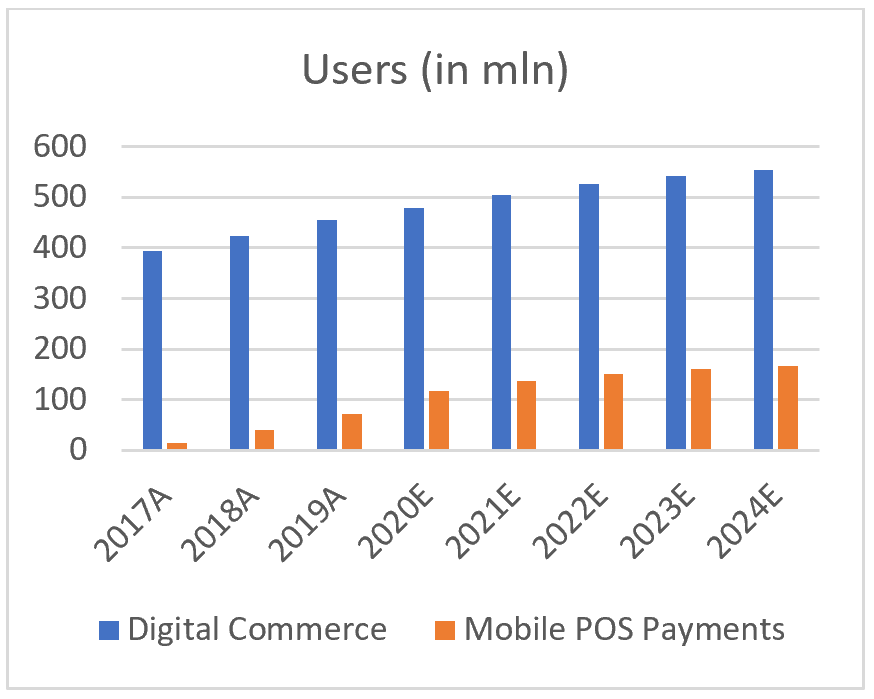

The PayTech market enjoys excellent growth prospects both in Europe and globally. Total transaction value is expected to show an annual growth rate (CAGR 2020-2024) of 13.4% resulting in a projected total amount of US$8,170,406m by 2024. In particular, as the new player will have to compete in the European market, we show two key indicators to highlight the expected growth in this geographic area.

Intro

On 05 October, Nexi S.p.A. and SIA S.p.A. issued a joint press release to report the signing of a Memorandum of Understanding on the integration of the two groups. The merger will take place by incorporation of SIA into Nexi. This operation will mark the birth of a new Italian leader in digital payments, able to compete in the European PayTech industry. The companies are both electronic payments providers with a different focus: SIA focuses on services to financial intermediaries while Nexi deals directly with merchants. We will briefly assess the two businesses before diving into the deal rationale and valuation.

Nexi Overview

Nexi, founded in 2017 from the merger of ICBPI and CartaSì and headquartered in Milan, offers digital payment services and infrastructures for banks, companies, institutions, and public administration. Nexi manages over 41 million payment cards and 2.7 billion transactions each year. It has 890,000 POS points of sale, 1.4 million POS terminals, 446 billion euros in transactions, and 13.5 thousand ATMs throughout Italy. It has over 420 thousand customers using Interbank Corporate Banking services. The company is listed on the FTSE MIB since last year and it is controlled (52.4% of the capital) by Mercury UK HoldCo, a vehicle of Bain Capital, Advent and Hourglass funds. At the end of fiscal year 2019 it reported a financial and operating income of € 813.8 mm, with a net profit of € 135.2 mm and an EPS of 22 cents, up from 7 cents in 2018.

SIA Overview

Sia, founded in 1977 as the Italian Society for Automation and headquartered in Milan, has been a decisive driver of innovation for the development of electronic payments in Italy. After a strong M&A activity over the last decade, the company has strengthened its European and international dimension: it now plays a key role in the payment systems and cards sector and offers network and database services to support trading activities in the financial markets. SIA is substantially controlled by CDP (Cassa Depositi e Prestiti), which holds a 70% stake in FSIA Investimenti, the majority shareholder of the company (57.4% of the capital), as well as a direct stake of over 25% through the CDP Equity fund. In the 2019 fiscal year, SIA reported revenues of € 733 mm, more than two-thirds of which were linked to the Italian market, an operating income of € 138 mm, and a net profit of € 95 mm, with earning per share rising to 56 cents.

Market Overview

The PayTech market enjoys excellent growth prospects both in Europe and globally. Total transaction value is expected to show an annual growth rate (CAGR 2020-2024) of 13.4% resulting in a projected total amount of US$8,170,406m by 2024. In particular, as the new player will have to compete in the European market, we show two key indicators to highlight the expected growth in this geographic area.

As we can see from the charts, the segment that will drive the industry will be that of mobile POS, a very attractive segment in which several European fintech companies are bringing major innovations, just think about Revolut (English), N26, and Wirecard (both German), or Adyen (Dutch). Nexi-SIA should be ready to face tough competition in a fast-growing market, that opens the door to new opportunities if the merger will be successful and the two players will be able to effectively integrate their businesses. Otherwise, they will both lose the objective of the integration due to the cutthroat competition.

Deal Rationale & Synergies

The principal reason behind the deal is growth in terms of scale and international dimension. This merger will provide consolidation in the Italian panorama, making Italy less attractive to other payments groups which are also racing to consolidate. It will push up bigger barriers to entry in the Italian payments market while giving Nexi’s shareholders greater foreign exposure. The new group will be the largest group in Europe for number of merchants served (2 million), number of cards (120 million), and number of transactions executed each year (21 billion). The merger is creating substantial synergies amounting to around €150 million a year. €100 million will derive from reduced operating costs, €35 million from an increased operating margin due to higher revenues, €15 million because of more efficient CapEx. Additionally, this will make this new group one of the 10 largest companies in Italy for market capitalization.

This deal marks a step towards digitalizing payments as Italy is more reliant on cash than any other European country, with a penetration of digital payments of 24%. Additionally, Italy presents some of the highest levels of tax evasion in Europe and digital payments could be a way to reduce it. This merger will allow Nexi to increase its size as online purchases intensify during the pandemic and as consumers move away from using physical cash. Furthermore, the Italian government is now developing the “cashless plan” aimed at supporting payments with cards and reduce more and more the use of cash. Cashback is one of the ideas promoted by this new plan that allows the reimbursement of 10% on a maximum yearly small spending of €3,000 paid for with electronic transactions.

Deal Rationale & Synergies

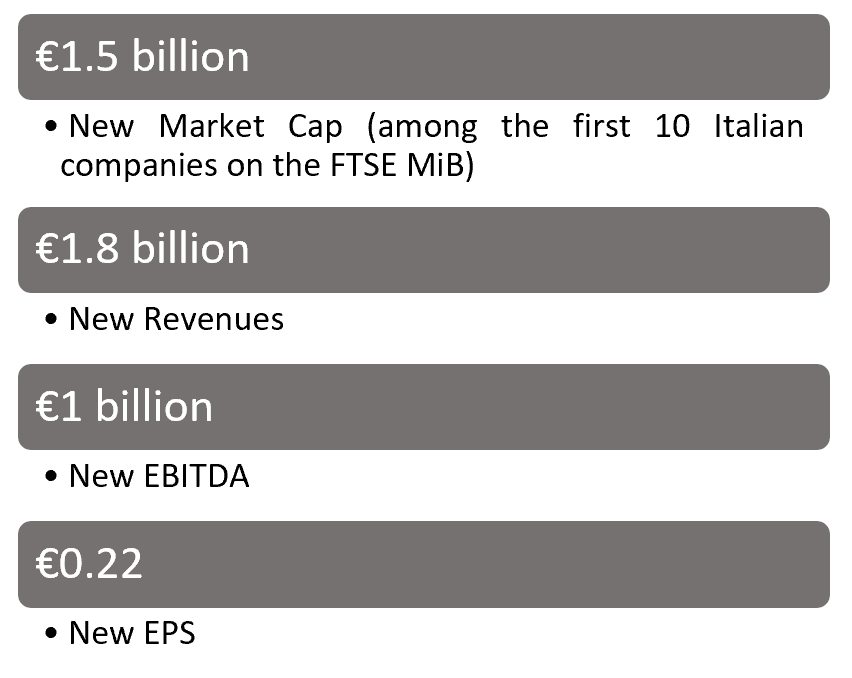

The principal reason behind the deal is growth in terms of scale and international dimension. This merger will provide consolidation in the Italian panorama, making Italy less attractive to other payments groups which are also racing to consolidate. It will push up bigger barriers to entry in the Italian payments market while giving Nexi’s shareholders greater foreign exposure. The new group will be the largest group in Europe for number of merchants served (2 million), number of cards (120 million), and number of transactions executed each year (21 billion). The merger is creating substantial synergies amounting to around €150 million a year. €100 million will derive from reduced operating costs, €35 million from an increased operating margin due to higher revenues, €15 million because of more efficient CapEx. Additionally, this will make this new group one of the 10 largest companies in Italy for market capitalization.

This deal marks a step towards digitalizing payments as Italy is more reliant on cash than any other European country, with a penetration of digital payments of 24%. Additionally, Italy presents some of the highest levels of tax evasion in Europe and digital payments could be a way to reduce it. This merger will allow Nexi to increase its size as online purchases intensify during the pandemic and as consumers move away from using physical cash. Furthermore, the Italian government is now developing the “cashless plan” aimed at supporting payments with cards and reduce more and more the use of cash. Cashback is one of the ideas promoted by this new plan that allows the reimbursement of 10% on a maximum yearly small spending of €3,000 paid for with electronic transactions.

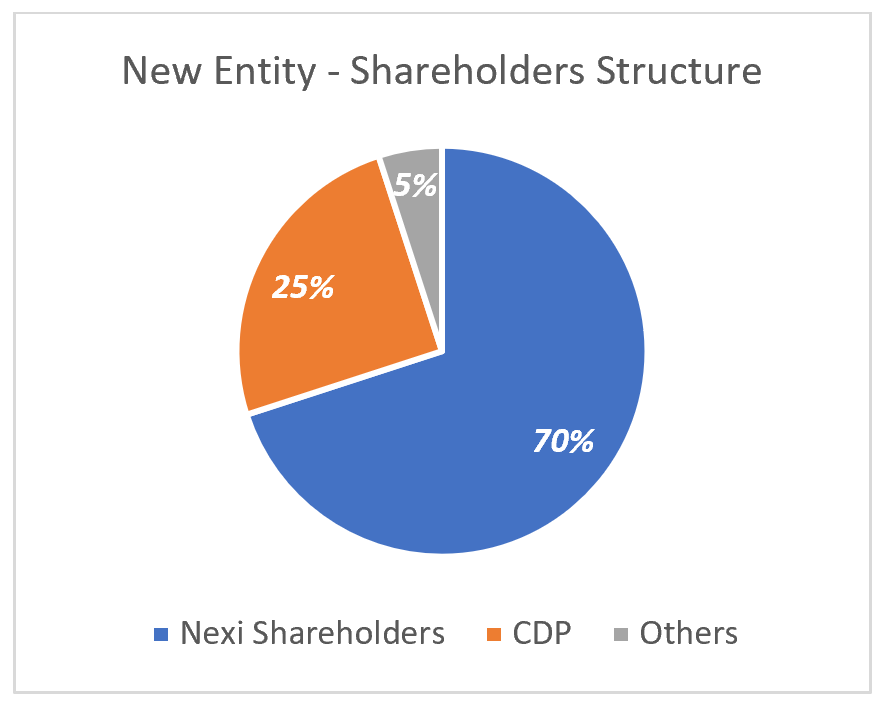

Terms and Valuation

The merger, valued at €15bn, is an all-share deal. Nexi will retain 70% of the ownership while SIA’s main investor, Cassa Depositi e Prestiti (CDP), will own 25% of the merged entity. As an all-share deal, it brings the advantages of this kind of operation: it is faster to raise than debt, the seller can participate in the potential upside of buyer’s stock price and it is not taxed until the stock is sold. On the other hand, it is riskier, as the share price could change. The operation has an accretive effect and EPS is expected to double in 2022 (now 0.22 for Nexi).

The EV/EBITDA multiple of the operation is around 19x and it is in line with that of its main competitor, Worldline, which recently agreed to acquire Ingenico for €9bn (EV/EBITDA of 16x) to become the largest payment provider in Europe.

Advisors, Timetable, and Conclusion

Nexi is assisted by BofA Securities, HSBC Bank, and Mediobanca as financial advisors, by Legance - Avvocati Associati for legal aspects as well as by PWC for financial and accounting due diligence and by KPMG for tax aspects. Sia is assisted by J.P. Morgan as Sole Financial Advisor and supported by Rothschild for specific activities in the context of the transaction, by Gianni, Origoni, Grippo, Cappelli & Partners for legal aspects as well as by KPMG for financial and accounting due diligence and by Tremonti, Romagnoli, Piccardi e Associati for tax aspects. Mercury UK is assisted by IMI-Intesa Sanpaolo and Nomura as financial advisors.

The merger should be finalized by the summer of 2021 and by then we will assist to the birth of a new European key player of the next decade for the payment industry.

Davide Cibaldi

The merger, valued at €15bn, is an all-share deal. Nexi will retain 70% of the ownership while SIA’s main investor, Cassa Depositi e Prestiti (CDP), will own 25% of the merged entity. As an all-share deal, it brings the advantages of this kind of operation: it is faster to raise than debt, the seller can participate in the potential upside of buyer’s stock price and it is not taxed until the stock is sold. On the other hand, it is riskier, as the share price could change. The operation has an accretive effect and EPS is expected to double in 2022 (now 0.22 for Nexi).

The EV/EBITDA multiple of the operation is around 19x and it is in line with that of its main competitor, Worldline, which recently agreed to acquire Ingenico for €9bn (EV/EBITDA of 16x) to become the largest payment provider in Europe.

Advisors, Timetable, and Conclusion

Nexi is assisted by BofA Securities, HSBC Bank, and Mediobanca as financial advisors, by Legance - Avvocati Associati for legal aspects as well as by PWC for financial and accounting due diligence and by KPMG for tax aspects. Sia is assisted by J.P. Morgan as Sole Financial Advisor and supported by Rothschild for specific activities in the context of the transaction, by Gianni, Origoni, Grippo, Cappelli & Partners for legal aspects as well as by KPMG for financial and accounting due diligence and by Tremonti, Romagnoli, Piccardi e Associati for tax aspects. Mercury UK is assisted by IMI-Intesa Sanpaolo and Nomura as financial advisors.

The merger should be finalized by the summer of 2021 and by then we will assist to the birth of a new European key player of the next decade for the payment industry.

Davide Cibaldi