BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

On November 2, 2020, Nexi announced to have entered into exclusive negotiations to acquire Danish operator Nets, active in the markets of Northern Europe. Less than two weeks later – on November 15, 2020 – it signed the agreement to acquire Nets at an enterprise value of €7.8 billion with an equity value of €6 billion. The consideration will be paid in shares of 406.6 million new Nexi shares. Nets’ shareholders will hold 39% in the combined entity following completion. A potential earnout of up to €250 million, payable in share, could be paid out in 2022 based on results. The deal is subject to antitrust approvals and is expected to complete in Q2 2021. After last month’s wedding with Sia, the group led by Paolo Bertoluzzo is hence preparing to become the number one in Europe surpassing France-based group Worldline and keeping the pace of worldwide digital payments consolidation.

Nexi

Nexi SpA was born in 2017 from the merger of ICBPI and CartaSì, respectively founded in 1939 and 1986. Headquartered in Milan, the Italian group provides payment technology solutions that enable banks, merchants, and consumers to make and receive digital payments. It mainly operates through the following business units:

On November 2, 2020, Nexi announced to have entered into exclusive negotiations to acquire Danish operator Nets, active in the markets of Northern Europe. Less than two weeks later – on November 15, 2020 – it signed the agreement to acquire Nets at an enterprise value of €7.8 billion with an equity value of €6 billion. The consideration will be paid in shares of 406.6 million new Nexi shares. Nets’ shareholders will hold 39% in the combined entity following completion. A potential earnout of up to €250 million, payable in share, could be paid out in 2022 based on results. The deal is subject to antitrust approvals and is expected to complete in Q2 2021. After last month’s wedding with Sia, the group led by Paolo Bertoluzzo is hence preparing to become the number one in Europe surpassing France-based group Worldline and keeping the pace of worldwide digital payments consolidation.

Nexi

Nexi SpA was born in 2017 from the merger of ICBPI and CartaSì, respectively founded in 1939 and 1986. Headquartered in Milan, the Italian group provides payment technology solutions that enable banks, merchants, and consumers to make and receive digital payments. It mainly operates through the following business units:

- Merchant Services and Solutions, which supplies merchants with the necessary infrastructure to enable digital payment acceptance and execute card payments on behalf of the merchant;

- Digital Payments and Cards, which provides services in connection with the issuance of payment cards to cardholders;

- Digital Banking Services, which involves clearing and automated teller machine management services;

- Other Services, which include the remaining business activities which consist of business process outsourcing services and helpline.

Nets

Nets A/S is a private equity-backed company founded in 1968 and based in Ballerup, Denmark. It provides services and related technology solutions across the Nordic region. The company helps financial institutions, businesses, and merchants make tomorrow a little easier for the customers while providing unrivaled security and stability. The company turns a complex reality into easy, intuitive, and customer-oriented solutions and guarantees it remains a reliable hub of the payments industry building on unmatched connectivity. Nets has three main business segments:

The deal

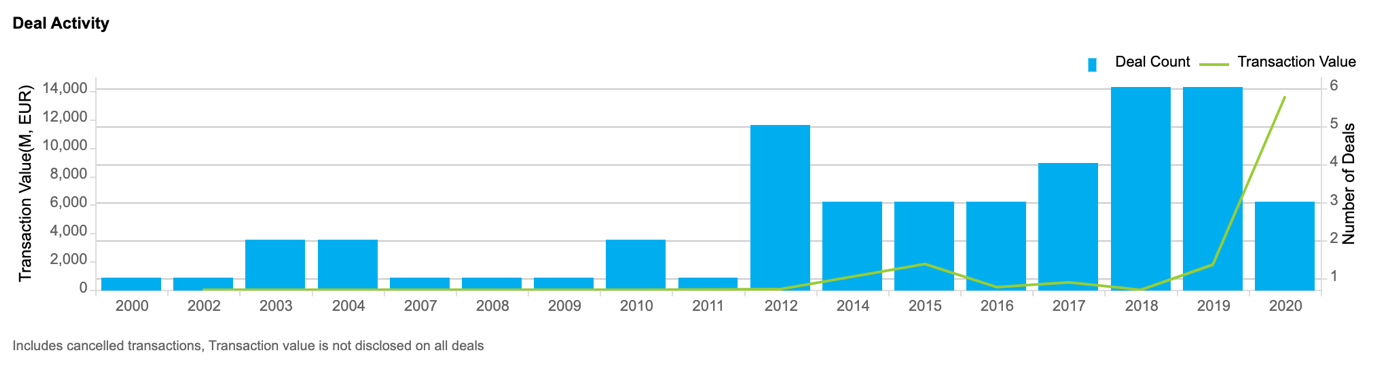

The consolidation wave that is affecting the industry began last year in the US. Fiserv took over First Data for $22 billion, Fidelity National Information Services bought Worldpay for about $43 billion (including debt) and Global Payments acquired Total System Services for $21.5 billion. In Europe, France-based Worldline agreed in February to buy Ingenico for nearly €8 billion. On October 4, 2020, Nexi announced the agreement with Sia, valued at €4.56 billion.

The rationale behind the Nets deal is then quite simple: Nexi wants to eliminate one of the last independent payment companies focused on Europe and become, together with Nets and Sia, the new leading group of the entire Union. The operation will be carried out as for the Sia deal. That is, Nexi will merge with Nets through a share exchange, with long-term "lock-up" commitments for the current shareholders of Nets (including Hellman & Friedman) and without the use of any debt. In doing so, Nexi expects shareholders to benefit from significant industrial synergies, estimated at around €170 million, in addition to the €150 million from the announced transaction with Sia (for a total estimated of €300-320 million). The giant payment group should be worth around €22 billion. Nexi, which capitalized €9.11 billion on November 6, together with Sia would reach almost €14 billion value plus about €8 billion for Nets. The group would have aggregate revenue of €2.9 billion (as of pro-forma 2020 data), EBITDA of €1.5 billion, and Operating Cash Flow of €1.2 billion denoting enormous potential profitability. At the closing of both mergers with Nets and Sia, the new group will be controlled by CDP with 17% share, Hellman & Friedman with 16%, Advent International & Bain Capital with 10%, Mercury UK with 10%, Intesa Sanpaolo with 5% , GIC with 3% and with a free float of approximately 38% which will remain listed on the Italian Stock Exchange. The “new” Nexi will still be led by Paolo Bertoluzzo while Michaela Castelli will remain president: the current Nets Group CEO, Bo Nilsson, will become a non-executive member of the board and will assume the position of president of Nets. Hellman & Friedman (which leads the consortium of funds that control Nets) will also appoint another board member upon completion of the transaction. Italy, where digital payments are growing fast (about 10% per year) and the use of cash is decreasing due to the current pandemic situation, is the country with the greatest margin for development. The Nexi-Sia integration will start in 2021 with a full focus on Italy, followed by the Nexi-Nets integration in 2022.

Advisors of the parties

Nexi is assisted by HSBC (which has already been an advisor to the company also in the integration with Sia), Centerview, BofA Securities, and Goldman Sachs as financial advisors; Legance and Linklaters as legal advisors; Bain&Co and Alix as industrial advisors; PWC as the advisor for the financial due diligence and KPMG as the advisor for the fiscal aspects. Nexi’s Committee for Transactions with Related Parties asked the opinion of Lazard and Prof. Gabriele Villa as financial advisors and is supported by Galbiati, Sacchi & Associati Law Firm as legal advisor. Nets is supported by Credit Suisse and JP Morgan as lead financial advisors with Deutsche Bank and Morgan Stanley as additional financial advisors; Freshfields Bruckhaus Deringer as legal advisor; Ernst Young as advisor for the financial and accounting due diligence and the fiscal aspects. Mercury UK is assisted by Mediobanca (with a team formed by Francesco Canzonieri, Francesco Rossitto and Serena Montalto), Citi and Barclays as financial advisors and Pirola Pennuto Zei & Associati as advisor for the fiscal aspects.

Riccardo Locatelli

Nets A/S is a private equity-backed company founded in 1968 and based in Ballerup, Denmark. It provides services and related technology solutions across the Nordic region. The company helps financial institutions, businesses, and merchants make tomorrow a little easier for the customers while providing unrivaled security and stability. The company turns a complex reality into easy, intuitive, and customer-oriented solutions and guarantees it remains a reliable hub of the payments industry building on unmatched connectivity. Nets has three main business segments:

- Merchant Services, which provides in-store, online, and mobile payment acceptance solutions;

- Financial and Network Services, which provides outsourced processing services to banks across the Nordic region;

- Corporate Services, which provides the payment platform for recurrent bill payments and credit transfer transactions primarily in Denmark and Norway.

The deal

The consolidation wave that is affecting the industry began last year in the US. Fiserv took over First Data for $22 billion, Fidelity National Information Services bought Worldpay for about $43 billion (including debt) and Global Payments acquired Total System Services for $21.5 billion. In Europe, France-based Worldline agreed in February to buy Ingenico for nearly €8 billion. On October 4, 2020, Nexi announced the agreement with Sia, valued at €4.56 billion.

The rationale behind the Nets deal is then quite simple: Nexi wants to eliminate one of the last independent payment companies focused on Europe and become, together with Nets and Sia, the new leading group of the entire Union. The operation will be carried out as for the Sia deal. That is, Nexi will merge with Nets through a share exchange, with long-term "lock-up" commitments for the current shareholders of Nets (including Hellman & Friedman) and without the use of any debt. In doing so, Nexi expects shareholders to benefit from significant industrial synergies, estimated at around €170 million, in addition to the €150 million from the announced transaction with Sia (for a total estimated of €300-320 million). The giant payment group should be worth around €22 billion. Nexi, which capitalized €9.11 billion on November 6, together with Sia would reach almost €14 billion value plus about €8 billion for Nets. The group would have aggregate revenue of €2.9 billion (as of pro-forma 2020 data), EBITDA of €1.5 billion, and Operating Cash Flow of €1.2 billion denoting enormous potential profitability. At the closing of both mergers with Nets and Sia, the new group will be controlled by CDP with 17% share, Hellman & Friedman with 16%, Advent International & Bain Capital with 10%, Mercury UK with 10%, Intesa Sanpaolo with 5% , GIC with 3% and with a free float of approximately 38% which will remain listed on the Italian Stock Exchange. The “new” Nexi will still be led by Paolo Bertoluzzo while Michaela Castelli will remain president: the current Nets Group CEO, Bo Nilsson, will become a non-executive member of the board and will assume the position of president of Nets. Hellman & Friedman (which leads the consortium of funds that control Nets) will also appoint another board member upon completion of the transaction. Italy, where digital payments are growing fast (about 10% per year) and the use of cash is decreasing due to the current pandemic situation, is the country with the greatest margin for development. The Nexi-Sia integration will start in 2021 with a full focus on Italy, followed by the Nexi-Nets integration in 2022.

Advisors of the parties

Nexi is assisted by HSBC (which has already been an advisor to the company also in the integration with Sia), Centerview, BofA Securities, and Goldman Sachs as financial advisors; Legance and Linklaters as legal advisors; Bain&Co and Alix as industrial advisors; PWC as the advisor for the financial due diligence and KPMG as the advisor for the fiscal aspects. Nexi’s Committee for Transactions with Related Parties asked the opinion of Lazard and Prof. Gabriele Villa as financial advisors and is supported by Galbiati, Sacchi & Associati Law Firm as legal advisor. Nets is supported by Credit Suisse and JP Morgan as lead financial advisors with Deutsche Bank and Morgan Stanley as additional financial advisors; Freshfields Bruckhaus Deringer as legal advisor; Ernst Young as advisor for the financial and accounting due diligence and the fiscal aspects. Mercury UK is assisted by Mediobanca (with a team formed by Francesco Canzonieri, Francesco Rossitto and Serena Montalto), Citi and Barclays as financial advisors and Pirola Pennuto Zei & Associati as advisor for the fiscal aspects.

Riccardo Locatelli