On November 6th, the Danish pharmaceutical company Novo Nordisk A/S announced that they have reached a definitive agreement for buying all the outstanding shares of the US-based Emisphere Technologies Inc. for $1.35 bn. The two companies have been collaborating since 2007 and Novo Nordisk is currently using a drug delivery technology developed by Emisphere (Eligen SNAC). Due to the importance of such technology, the total acquisition cost will amount up to $1.8 bn since Novo Nordisk will also acquire Eligen SNAC royalty stream of obligations for $450 mn. As a consequence, this acquisition could represent a turning point for the Danish company, since it would become the owner of one of the most successful Emisphere’s licenses and eliminate its future obligations, thus generating cost synergies.

|

NOVO NORDISK

Novo Nordisk is a multinational pharmaceutical company based in Bagsværd (Denmark) whose production sites are based in 16 countries and whose products are marketed in 170 countries all over the world. The Company operates in two segments: Diabetes Care and Biopharmaceuticals. However, it is primarily known for the first of them, as it is the world leader in this field, offering the biggest portfolio of diabetes products and user-friendly devices for insulin injections. |

|

HEMISPHERE TECHNOLOGIES INC.

Emisphere Technologies Inc. is a US (New Jersey) based drug delivery company, the leader in converting injectable therapeutics into oral formulations, whose core business strategy is to partner its delivery technology and license Eligen B12. This technology allows pharmaceutical companies to improve both their new and existing products by widening their range and the circle of potential customers. |

COLLABORATION

As mentioned above, the long-time collaboration of the two companies resulted in various benefits, especially for Novo Nordisk. As a matter of fact, the entire deal revolves around the usage of Eligen SNAC: i.e. a technology which allows the oral absorption of small and large molecules without altering their properties. In fact, thanks to it Novo Nordisk developed an oral formulation of a GLP-1 receptor agonist semaglutide, marketed under the name of Rybelsus, which is the first oral drug of its kind. The development of this drug represented a turning point for many people who fight diabetes as it results in a much less invasive treatment when compared to traditional injections. Furthermore, Rybelsus contributed $173 mn to Novo Nordisk’s revenue during the first nine months of 2020, consistently with management’s estimates.

THE DEAL

The deal aims to consolidate the already well-established leadership position and to expand the offering of the Danish company in diabetes and other diseases. In fact, Mads Krogsgaard Thomsen, executive vice president and chief scientific officer of Novo Nordisk, stated “We intend to apply and further develop the technology and use it on current and future pipeline assets with the aim of making more biologic medicines orally available for patients”. Thomsen also stated that the platform will allow Novo Nordisk to reduce its costs, thus obtaining a greater market penetration.

Novo Nordisk is represented by Davis Polk & Wardwell LLP as legal advisor and Evercore as financial advisor.

On the other side, the deal has also been well received. As a matter of fact, Timothy G. Rothwell, Chairman of Emisphere, said “After a thorough analysis of strategic alternatives, the Emisphere Board and the Special Committee unanimously determined that a combination with Novo Nordisk is the best way to maximize value for our stockholders,”.

Emisphere is represented by Wachtell, Lipton, Rosen & Katz as legal advisor. Jefferies LLC is acting as the Emisphere Special Committee’s financial advisor and Wilmer Cutler Pickering Hale and Dorr LLP is acting as its legal advisor.

The acquisition will be an only cash deal in which Novo Nordisk will pay $1.35 bn to acquire the entirety of Emisphere’s shares. This amount reflects a price per share of approximately $7.82 and thus a 17% premium over Emisphere November 5, 2020 closing stock price. Simultaneously, the Danish company will pay $450 mn to MHR Fund Management LLC (Emisphere biggest shareholder) to acquire Eligen royalty stream obligations. The transaction will be financed through the emission of debt and, as stated by Novo Nordisk press release, it will not have any impact on 2020 profit projections and stock repurchase program. Moreover, according to management projections, the acquisition will have a -1% impact on 2021 operating profit and will have a positive influence in the following years.

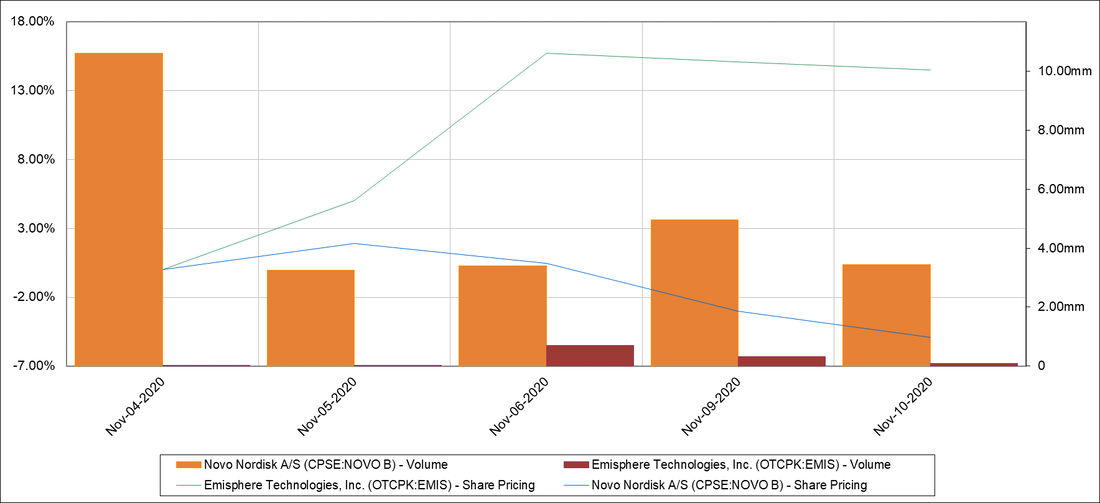

On the day of the announcement, Novo Nordisk shares went down by 1.4%. On the other hand, on the same day, Emisphere stock price saw a 10.2% jump. The transaction is now under typical closing conditions, which include a formal Emisphere shareholders approval and the expiration of the waiting period provided for in the Hart-Scott-Rodino Antitrust Improvements Act of 1976. However, as of November 9, 2020, different legal investigations started in order to verify whether the board of directors of Emisphere Technologies breached its fiduciary duties or violated any laws in connection with the company’s proposed acquisition by Novo Nordisk.

Dario Spinelli

As mentioned above, the long-time collaboration of the two companies resulted in various benefits, especially for Novo Nordisk. As a matter of fact, the entire deal revolves around the usage of Eligen SNAC: i.e. a technology which allows the oral absorption of small and large molecules without altering their properties. In fact, thanks to it Novo Nordisk developed an oral formulation of a GLP-1 receptor agonist semaglutide, marketed under the name of Rybelsus, which is the first oral drug of its kind. The development of this drug represented a turning point for many people who fight diabetes as it results in a much less invasive treatment when compared to traditional injections. Furthermore, Rybelsus contributed $173 mn to Novo Nordisk’s revenue during the first nine months of 2020, consistently with management’s estimates.

THE DEAL

The deal aims to consolidate the already well-established leadership position and to expand the offering of the Danish company in diabetes and other diseases. In fact, Mads Krogsgaard Thomsen, executive vice president and chief scientific officer of Novo Nordisk, stated “We intend to apply and further develop the technology and use it on current and future pipeline assets with the aim of making more biologic medicines orally available for patients”. Thomsen also stated that the platform will allow Novo Nordisk to reduce its costs, thus obtaining a greater market penetration.

Novo Nordisk is represented by Davis Polk & Wardwell LLP as legal advisor and Evercore as financial advisor.

On the other side, the deal has also been well received. As a matter of fact, Timothy G. Rothwell, Chairman of Emisphere, said “After a thorough analysis of strategic alternatives, the Emisphere Board and the Special Committee unanimously determined that a combination with Novo Nordisk is the best way to maximize value for our stockholders,”.

Emisphere is represented by Wachtell, Lipton, Rosen & Katz as legal advisor. Jefferies LLC is acting as the Emisphere Special Committee’s financial advisor and Wilmer Cutler Pickering Hale and Dorr LLP is acting as its legal advisor.

The acquisition will be an only cash deal in which Novo Nordisk will pay $1.35 bn to acquire the entirety of Emisphere’s shares. This amount reflects a price per share of approximately $7.82 and thus a 17% premium over Emisphere November 5, 2020 closing stock price. Simultaneously, the Danish company will pay $450 mn to MHR Fund Management LLC (Emisphere biggest shareholder) to acquire Eligen royalty stream obligations. The transaction will be financed through the emission of debt and, as stated by Novo Nordisk press release, it will not have any impact on 2020 profit projections and stock repurchase program. Moreover, according to management projections, the acquisition will have a -1% impact on 2021 operating profit and will have a positive influence in the following years.

On the day of the announcement, Novo Nordisk shares went down by 1.4%. On the other hand, on the same day, Emisphere stock price saw a 10.2% jump. The transaction is now under typical closing conditions, which include a formal Emisphere shareholders approval and the expiration of the waiting period provided for in the Hart-Scott-Rodino Antitrust Improvements Act of 1976. However, as of November 9, 2020, different legal investigations started in order to verify whether the board of directors of Emisphere Technologies breached its fiduciary duties or violated any laws in connection with the company’s proposed acquisition by Novo Nordisk.

Dario Spinelli