Introduction

On the 20th December 2021, Oracle Corporation completed its acquisition of Cerner Corporation for approximately $30bn. Cerner, a US-based international company that offers software, devices and other health-related services, has been attracting much investor attention in the last year, while its share price continues to reach record levels. Oracle, a tech-corporation headquartered in Austin, have approached Cerner as the firm looks to develop its expertise within the health sector. Currently positioned as the second largest software firm with respect to its revenue and market capitalization, Oracle is hoping to expand the global use of its software infrastructure through this deal. The acquisition of Cerner is now Oracle’s largest ever deal since the firm acquired cloud computing company NetSuite, in 2016 for $9.3 bn. Many believe that this will turn out to be one of 2021’s most significant acquisitions.

Oracle Corporation

Oracle corporation is an American multinational computer technology corporation, founded by Larry Ellison in 1977. The company provides products and services that address enterprise information technology environments worldwide. With a market cap of $244.72 billion, Oracle is now the world’s second-largest software company in the world by revenue and market capitalization, following Microsoft.

The company focuses on providing cloud software as a service. This includes cloud engineered systems and enterprise software products. The firm provides cloud software applications such as enterprise resource planning (ERP), enterprise performance management, cloud supply chain, manufacturing management, human capital management software (HCM) and customer relationship management software (CRM). In addition, Oracle provides cloud and license business infrastructure technologies, such as the Oracle Database (an enterprise database) as well as Java (a software development language).

Industries covered by Oracle today include among others Financial Services, Telecom, Utilities, Engineering, Hospitality, Manufacturing, Pharmaceuticals and Government.

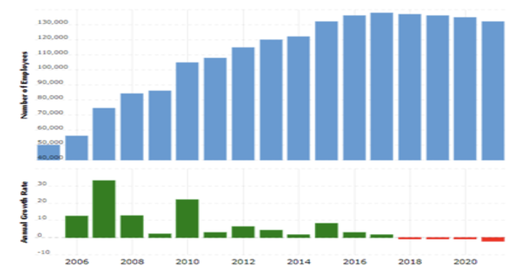

Oracle operates worldwide and counts more than 430,000 customers in 175 different countries and 20,000 partners across the globe. The number of active employees has grown at a steady pace from 2006 and 2016, stabilising at around 130,000 units, before experiencing a slight decrease in the most recent years.

Number of employees at Oracle worldwide between FY2007 and FY2021 (in 1,000s)

On the 20th December 2021, Oracle Corporation completed its acquisition of Cerner Corporation for approximately $30bn. Cerner, a US-based international company that offers software, devices and other health-related services, has been attracting much investor attention in the last year, while its share price continues to reach record levels. Oracle, a tech-corporation headquartered in Austin, have approached Cerner as the firm looks to develop its expertise within the health sector. Currently positioned as the second largest software firm with respect to its revenue and market capitalization, Oracle is hoping to expand the global use of its software infrastructure through this deal. The acquisition of Cerner is now Oracle’s largest ever deal since the firm acquired cloud computing company NetSuite, in 2016 for $9.3 bn. Many believe that this will turn out to be one of 2021’s most significant acquisitions.

Oracle Corporation

Oracle corporation is an American multinational computer technology corporation, founded by Larry Ellison in 1977. The company provides products and services that address enterprise information technology environments worldwide. With a market cap of $244.72 billion, Oracle is now the world’s second-largest software company in the world by revenue and market capitalization, following Microsoft.

The company focuses on providing cloud software as a service. This includes cloud engineered systems and enterprise software products. The firm provides cloud software applications such as enterprise resource planning (ERP), enterprise performance management, cloud supply chain, manufacturing management, human capital management software (HCM) and customer relationship management software (CRM). In addition, Oracle provides cloud and license business infrastructure technologies, such as the Oracle Database (an enterprise database) as well as Java (a software development language).

Industries covered by Oracle today include among others Financial Services, Telecom, Utilities, Engineering, Hospitality, Manufacturing, Pharmaceuticals and Government.

Oracle operates worldwide and counts more than 430,000 customers in 175 different countries and 20,000 partners across the globe. The number of active employees has grown at a steady pace from 2006 and 2016, stabilising at around 130,000 units, before experiencing a slight decrease in the most recent years.

Number of employees at Oracle worldwide between FY2007 and FY2021 (in 1,000s)

The software industry was not seriously affected by the COVID 19 outbreak in 2020. In reality, the industry quickly recovered from the pandemic, mainly due to the growing need for companies to implement systems to maximize the efficiency of work from home. Consequently, Oracle has been able to maintain high levels of competitiveness in the market, managing to quickly return to pre-pandemic revenue levels.

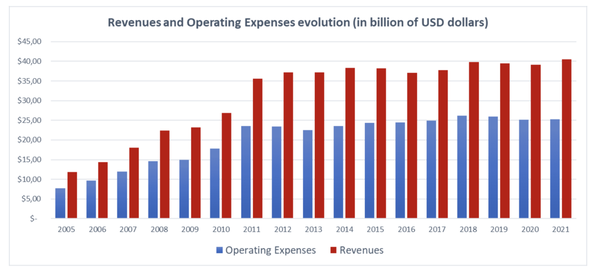

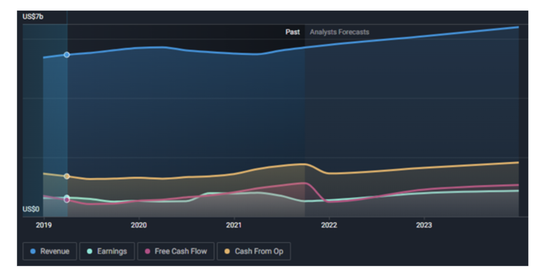

The graph below shows the evolution of the company revenue growth in the last 15 years together with the company's operating expenses.

The graph below shows the evolution of the company revenue growth in the last 15 years together with the company's operating expenses.

As shown in the graph, over the past decade, Oracle Corporation’s annual revenue has grown from around $22bn to over $40bn, with fiscal year 2021 marking one of the company’s highest revenue figures to date. The company’s Cloud services and license support segment is its biggest earner accounting for more than half of its overall revenues.

When analysing the data, one sees that owing to the fact that operating expenses have remained rather stable over the last decade (around $25bn annually), Oracle enjoys a high EBITDA. This has been seen more than ever this year, as the firm experienced an all-time high EBITDA value in 2021 of $18.129 bn, followed by the highest level of net income ever registered by the company: $13.746 bn (May 2021).

Oracle’s value of Total Assets in May 2021 was $131,107bn, of which $46,554bn was cash on hand. Thus, the company has found itself in a particularly strong position with regards to its solvency in the short term. Nevertheless, in the last 9 months, its liquidity levels have plummeted as current cash on hand level valued at $22.838 bn (a year-on-year decrease of 50%). Oracle’s Return on investment level is 10.5%, slightly below the industry average which is currently around 11%. On the other hand, Oracle’s return on investment is at around 19.94% which compares to the industry’s average of 19.4%. Oracle’s Total Liabilities in May 2021 were $125,155 million of which $75,995 million consisted of long term debt. Net financial position is $108,274bn, higher than that of 2020 ($59,664bn) and 2019 ($45,519 bn).

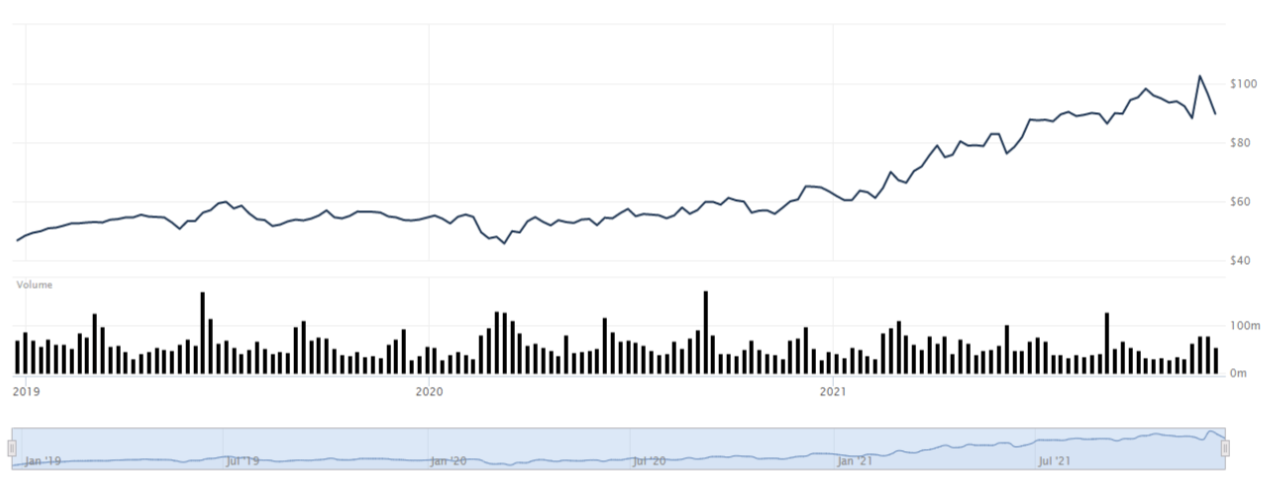

As said before, Oracle’s current market cap is $244.72bn. Its current price per share (22 December 2021) is $91.51. Notably, investors have bullish expectations on Oracle’s stocks as many indicators show large possibilities for a future price growth. With an increase in earnings-per-share of +21.1% if compared to 2020’s value, the PE ratio of the company stands at a value of 26.58. This is lower than the market average, which for North-American-based software companies is around 51.

Oracle Corp. Stock Price (Jan 2019 - Dec 2021)

Cerner Corporation

Founded in 1979 by Neal Patterson, Paul Gorup, and Cliff Illig and headquartered in North Kansas City, Missouri, Cerner Corporation is a leading provider of digital information systems used within hospitals and health systems to enable medical professionals to deliver better healthcare to individual patients and communities. It does so by improving the caregiver experience and streamlining and automating clinical and administrative workflows. Cerner Corp. designs, develops, markets, installs, hosts and supports health care information technology, health care devices, hardware and content solutions for health care organizations and consumers. The company also provides a variety of value-added services including among others, implementation and training, operational management services, health care data analysis and clinical process optimization.

In 2020, its products were in use at more than 27,000 facilities around the world. The company had more than 28,000 employees globally, with over 13,000 in Kansas City.

Cerner operates through two main segments: domestic and international. The domestic segment includes revenue contributions and expenditures associated with business activity in the United States, while the international segment includes revenue contributions and expenditures linked to business activity in the rest of the world, including numerous regions such as Australia, Europe, South America, Africa and Asia.

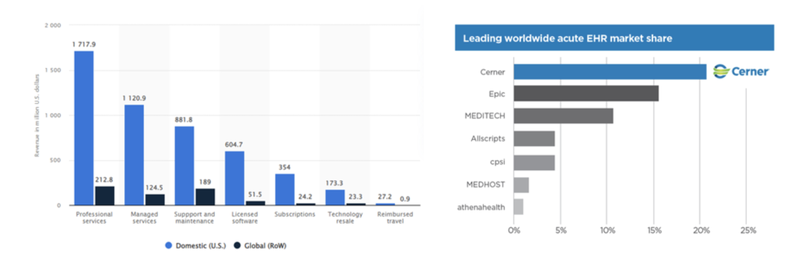

Despite the large and widespread international presence, most of Cerner’s revenues originate in the United States, as shown in detail in the chart below, which reports the breakdown of revenues by geographical area and area of operation. This also explains why most of Cerner’s employees are currently employed in the US.

Domestic vs. international revenues of Cerner Corporation in 2020, by segment (in million U.S. dollars)

Founded in 1979 by Neal Patterson, Paul Gorup, and Cliff Illig and headquartered in North Kansas City, Missouri, Cerner Corporation is a leading provider of digital information systems used within hospitals and health systems to enable medical professionals to deliver better healthcare to individual patients and communities. It does so by improving the caregiver experience and streamlining and automating clinical and administrative workflows. Cerner Corp. designs, develops, markets, installs, hosts and supports health care information technology, health care devices, hardware and content solutions for health care organizations and consumers. The company also provides a variety of value-added services including among others, implementation and training, operational management services, health care data analysis and clinical process optimization.

In 2020, its products were in use at more than 27,000 facilities around the world. The company had more than 28,000 employees globally, with over 13,000 in Kansas City.

Cerner operates through two main segments: domestic and international. The domestic segment includes revenue contributions and expenditures associated with business activity in the United States, while the international segment includes revenue contributions and expenditures linked to business activity in the rest of the world, including numerous regions such as Australia, Europe, South America, Africa and Asia.

Despite the large and widespread international presence, most of Cerner’s revenues originate in the United States, as shown in detail in the chart below, which reports the breakdown of revenues by geographical area and area of operation. This also explains why most of Cerner’s employees are currently employed in the US.

Domestic vs. international revenues of Cerner Corporation in 2020, by segment (in million U.S. dollars)

With a Market Cap of $26.92 Billion, Cerner Is the largest and most important company operating in the Electronic Health Records (EHR), followed by Epic and Meditech.

Revenues have steadily grown in the last decade, going from $1,850 bn in 2011 to $5,506 bn, registered at the end of 2020. When it comes to net earnings, the company has experienced a consistent +47,13% increase going from $529.454 mln in 2019 to $780.088 mln in 2021. Analysts forecast revenues to grow at a +17,7% annual rate average in the next 5 years.

- CERN's forecast earnings growth (17.7% per year) is above the savings rate (2%).

- CERN's earnings (17.7% per year) are forecast to grow faster than the US market (13.7% per year).

Cerner’s total asset value is $7.521 bn (2020), of which $615 mln is cash or equivalents and $442.47 mln is short- term investment.

Total value of liabilities has increased constantly in the last 3 years, going from $1.780 bn in 2018 to $2.577 in 2019 to a current level of $3.038 bn. Net financial position has then experienced a rapid decrease, caused by this constant growth of debt levels, going from $1.406 bn in 2018 to $2.423 bn at the end of 2020. Long-term debt has grown more than short-term did, going from $438 mln (2018) to 1.336 bn (2020).

Cerner's EBITDA interest coverage ratio for fiscal years ending December 2016 to 2020 averaged 149.6x while in the latest twelve months ebitda interest coverage ratio is 50.3x. At the end of December 2020 Cerner’s Return on Asset was 10.96% while its Return on Equity 18.63% (the industry one is at 7.2%) and its Return on Investment was 16.99%.

Cerner’s dividend yield is currently 1.19%, far lower than the market top 25% industries. On the other hand, the PE ratio is 51.1x, a far better indicator than most of the companies in EHR. This means the company, even at the current price of 92,11 USD (December 22, 2021) may still be undervalued.

Cerner Corp. Stock Price (Jan 2019 - Dec 2021)

The Software Industry: How do they handle it?

By providing multiple technological services to customers and commercial clients (enterprise software, business software, cloud computing, computer hardware and consulting), Oracle competes within various micro-industries which lay the foundations of the larger, more general software industry. The market leaders within this industry include Microsoft, IBM, Amazon Web Services as well many others. These firms are devoted to maintaining their industry presence. They therefore put strategic emphasis on differentiating their products, and protecting themselves against supplier and customer purchasing power.

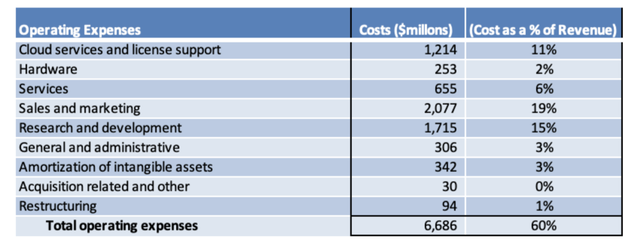

In order to ensure self-protection against potential entrants entering this increasingly profitable industry, incumbents regularly attempt to innovate, lower prices and lower costs. What must be noted is that many of these strategies (particularly cost-leadership strategies) are unpopular. This is owing to the very high production costs which are essential to maintaining innovation and product quality for existing firms. The table below reinforces this concept showing that costs accumulate to approximately 60% of revenues ($7bn in this case for Oracle). Notably, cloud services and license support (costs of managing and storing software licenses in the cloud, unique to cloud computing firms such as Oracle and Microsoft) as well as Sales and Marketing and Research and Development combine to represent 45% of revenue. These costs are essential to survival within the industry as they are the key drivers to innovation, product quality and consumer loyalty.

By providing multiple technological services to customers and commercial clients (enterprise software, business software, cloud computing, computer hardware and consulting), Oracle competes within various micro-industries which lay the foundations of the larger, more general software industry. The market leaders within this industry include Microsoft, IBM, Amazon Web Services as well many others. These firms are devoted to maintaining their industry presence. They therefore put strategic emphasis on differentiating their products, and protecting themselves against supplier and customer purchasing power.

In order to ensure self-protection against potential entrants entering this increasingly profitable industry, incumbents regularly attempt to innovate, lower prices and lower costs. What must be noted is that many of these strategies (particularly cost-leadership strategies) are unpopular. This is owing to the very high production costs which are essential to maintaining innovation and product quality for existing firms. The table below reinforces this concept showing that costs accumulate to approximately 60% of revenues ($7bn in this case for Oracle). Notably, cloud services and license support (costs of managing and storing software licenses in the cloud, unique to cloud computing firms such as Oracle and Microsoft) as well as Sales and Marketing and Research and Development combine to represent 45% of revenue. These costs are essential to survival within the industry as they are the key drivers to innovation, product quality and consumer loyalty.

Figure 1A: Data taken from Oracle’s Balance Sheet for Q4 2021. The values are in $millions and the percentages show the individual expenses as a percentage of total revenue.

Moreover, these extortionate costs strongly discourages entry to the industry. Only those large enough to reap the benefits of significant economies of scale will be able to survive. Nevertheless, it is important to mention that although these high costs raise entry barriers, the increasing availability of AI and IT, as well as other technological capabilities, means that incumbents must still continue to develop their methods of innovation in order to reduce the threat of new entrants into the market.

With regards to suppliers, in order to reduce supplier bargaining power, firms within the software industry try to purchase technological equipment from numerous suppliers. By building efficient supply chains with multiple suppliers, software firms are able to reduce the burden of supply shortages and supplier differentiation. Nevertheless, supplier bargaining power remains high for many as the ratio between industry concentration and supplier concentration is such that suppliers are not over reliant on single firms for revenues, and hence, the switching costs between who they supply to are very low.

Theoretically, consumers of services provided by software firms should possess some form of bargaining power due to the fragmentation of the industry. This is the case for standard products and services such as Java, which is offered by almost all software firms including Oracle, IBM, Talend and many others. For some particular products which are only provided by certain firms, this is not the case. For example, Oracle updated its Saas (software as a service) features in late 2020. As consumers could not find these services elsewhere, they were forced to pay higher prices. In fact, Oracle reported that Saas in 2021 contributed to 25% of total revenues as consumer demand for these products was high. Hence, in some cases, consumer groups are more fragmented than the ‘micro-industries’ providing these unique services. In these circumstances, consumers are unable to exploit bargaining power. All in all, in more cases than not, consumers benefit from the lack of price competition carried out within the industry and so enjoy consistent pricing. However, in the case that the service being provided is idiosyncratic, consumers are powerless.

Due to the large variety of products provided within the software industry, the threat of substitute services is rather inconsistent. On the one hand, some products, such as cloud computing, have to compete with many substitute products such as Dropbox and Google Drive. Nevertheless, other products such as specific computer hardware are unsubstitutable due to their complex nature. Therefore, the threat of substitutes to the industry depends on the given product or service produced by the incumbent firm.

Competition within the software industry is intense. Firms, more often than not, produce very similar services as their neighbours and this creates significant product homogeneity within the industry. Nevertheless, firms do whatever it takes to maximise customer value in order to sustain a healthy presence within the industry and maintain profitability. This can be shown by the industry's R & D average of 13.6 % (as a percentage of total sales) as firms are committed to incrementing consumer value. Furthermore, services provided seem rather bleak and technical. As a result, firms try to generate brand loyalty through extensive marketing campaigns. For example, Oracle spent $7.7 bn on marketing and sales related activities in 2021. Firms behave in such a way in order to maintain long lasting consumer demand for their goods.

As an incumbent within the software industry, Oracle faces multiple challenges when making key strategic decisions as it attempts to maintain its position as a world-leading software company. The firm is committed to protecting its competitive advantage in order to nurture future growth, maintain profit margins and support its dynamic efficiency (the firm spent $6.53bn on research and development investment in 2021). It does so by reducing costs through exploiting economies of scale and innovating, thus providing customers with unique services which competitors struggle to replicate. By expanding large levels of output over increasing unit costs and by creating groundbreaking technology, Oracle is able to protect itself from competition against potential entrants, existing incumbents as well as substitute products and services. Oracle fends off supplier bargaining power by expanding its product ranges (such as the recent expansion of its SaaS services as mentioned above) and hence, not relying on specific resources for production. This process helps the firm to provide industry-unique services at prices which consumers are unable to bargain with.

The health information technology industry, in which Cerner is currently operating, is now one of the fastest growing due to recent technological advancements which have been enhanced by the medical demands of the coronavirus pandemic. In fact, recent projections have predicted that the industry’s market size will grow from $29.16 bn to $47.25 bn from 2021-2027. The acquisition of Cerner is therefore likely to provide Oracle with key technical insight from the health sector. One hopes that consequently, Oracle can expand its product range and more effectively implement its differentiation strategy through this groundbreaking deal.

Deal analysis: One of 2021’s largest takeovers

On December 20th,, the acquisition agreement between Oracle and Cerner was finalized. Thebid for Cerner will far surpass Oracle’s next-largests transactions. These include the firm’s quasi-$10 billion acquisition of enterprise-software firm PeopleSoft in 2005, followed by the $9 billion acquisition of cloud-software provider NetSuite in 2016, both aimed to consolidate the company’s position in the software industry.

In fact, an Oracle-Cerner deal will be worth around $28.3 billion in equity value, through an all-cash tender offer for $95.00 per share. This would therefore include a typical takeover premium, given that the amount represents a 20% premium to Cerner’s closing share price on December 16th (ed. Cerner has a market value of around $23 billion).

Already a year ago, Oracle showed appetite for bigger deals, as it reached a preliminary agreement to acquire TikTok’s U.S operations, the Chinese-owned social media company. However, due to both Trump and Biden’s administration concerns, the deal was put indefinitely on hold. This left the company, managed by Safra Catz, to focus more on purchasing firms that are better aligned with its strategic business units.

As a matter of fact, Oracle already has a large presence in healthcare, providing technology to assist health insurers, clinicians, and public health systems in parsing data in order to optimize efficiency and improve patient outcomes. The move to acquire Cerner, well known for creating electronic medical records, follows Microsoft’s agreement in April to buy speech artificial intelligence company Nuance Communications for $16 billion. The deal appears to be an attempt by Oracle to capitalize on the growing demand for digital healthcare tools and to forge deeper connections within the healthcare industry.

Cerner's business is highly focused on conventional software sales and support as well as services. However, it has been trying to go further into newer cloud services - a market worth $214 billion, in which Oracle is also seeking to expand.

Therefore, through this deal, Oracle is attempting to make up ground after slipping behind firms like Amazon, Microsoft and Google. The firm, through this transaction, hopes to respond to investors and partners who have warmed to the Austin-based company, as the firm cranks up its focus on gaining cloud-computing business after its initial reluctance to embrace the expanding market for storing and analyzing data on remote softwares. For instance, Ron Zapar, CEO of Oracle’s partner Re-Quest, which offers managed services in health care, affirmed that the Cerner’s acquisition could give a major boost in cloud, data analytics and AI-related offerings: “IBM has it, Microsoft has it. So it’s really an arms race in this health care space in the cloud at the end of the day. It’s a way for Oracle to jump No.1 in that space because of who Cerner is and what their history is and how much market share those guys have”.

To gain a deeper understanding on the benefits and risks coming from the deal to both companies, it is important to report different opinions on the matter coming from several financial institutions. A report from KeyBank, an Ohio based investment firm, affirms that the deal provides “potential for standalone Cerner cost improvements and acquisition cost synergies including potential movement of Cerner software and managed service onto the Oracle OCI (ed. Oracle Cloud Infrastructure) cloud that could improve deal accretion”, and the deal would be positive for Oracle since “Cerner would expand Oracle’s current range of healthcare software offerings by adding its core Electronic Health Records (EHR)”.

Furthermore, according to a report from Barclays, one expects the deal to be rather positive for Cerner, as the company’s “organic growth has slowed over the past several years as the EHR adoption has reached full penetration in the US market, and the company has remained challenged to post meaningful growth from additional products and services from the large EHR related revenue base.” The British bank also believes that in the hands of another larger tech company such as Oracle, Cerner may be better able to move into data analytics and other growth opportunities. The only surprising aspect of the deal regarding Cerner’s side is timing, since a new CEO has been appointed recently, with David Feinberg starting the role in October after joining from Google. Nevertheless, it is possible that because Oracle has a relatively limited footprint in healthcare today (assets are primarily related to clinical trial data storage), CERN executives could remain in place and lead CERN operations moving forward under the overall Oracle corporate umbrella.

From Oracle’s point of view, in contradiction to what was affirmed by KeyBank, Barclays is not fully convinced about the merits of the deal. Of course the acquisition would enhance another vertical maneuver for the company, and hence increase the scale of the cloud footprint. However, given the fact that Oracle was only just restarting its comeback as a public cloud vendor, spending the rumored $30 billion on a secondary asset, when money is needed for increasing cloud CAPEX, seems suboptimal to analysts at Barclays. Finally, the investment banking report notes that the merger could damage Oracle in other aspects including the firm’s management credibility. In fact, as affirmed in the report: “ After all, the message to investors was that the cloud journey is now finally taking off, despite last quarter’s beat only coming from non-cloud related license sales, so a Cerner deal could be seen as an admission that management’s cloud expansion might not be quite as high as portrayed.

In the joint official announcement, both companies are looking to the deal optimistically. In fact, Cerner believes that through Oracle’s resources, infrastructure and capabilities and experience will be able to accelerate the pace of product and technology development and therefore expand exponentially its business into many more countries throughout the world, while Oracle will implement thanks to the acquisition a huge additional revenue growth engine for years to come. We can surely, according to Cerner’s CEO David Feinberg, affirm that the two companies together will radically transform healthcare:

“Joining Oracle as a dedicated Industry Business Unit provides an unprecedented opportunity to accelerate our work modernizing electronic health records (EHR), improving the caregiver experience, and enabling more connected, high-quality and efficient patient care.”

The transaction is scheduled to finalize in calendar year 2022. The closing is subject to receiving approvals and other satisfying conditions including Cerner stockholder tendering a majority of Cerner’s outstanding shares in the tender offer. When it will be concluded, Cerner will finally join Oracle as a strategic business unit and will be Oracle's cornerstone asset as it expands into healthcare and we will work together to enhance medical care for individuals and communities across the world.

Conclusion

To say the least, Oracle’s imminent acquisition of Cerner is a very sensible move for both firms. Oracle, competing within an innovation-intense industry, finds itself obliged to expand its product range through ingenious strategic decisions which can help maintain its firm’s competitive advantage. Cerner, on the other hand, is a corporation hoping to exploit its position in one of the world’s fastest growing industries. Due to the pandemic, this industry is expected to boom as healthcare returns as one of society’s top priorities since the Second World War. Financially, one concludes that the two organisations are in healthy (no pun intended) states despite the global economic difficulties of the pandemic. Hence, with some degree of certainty, one would hope that following this deal, the two firms can become ever more stable and profitable by providing each other with both professional and technical expertise. If successful, this deal could turn out to be one of the best deals of the decade - not just one of 2021’s most significant acquisitions.

Moreover, these extortionate costs strongly discourages entry to the industry. Only those large enough to reap the benefits of significant economies of scale will be able to survive. Nevertheless, it is important to mention that although these high costs raise entry barriers, the increasing availability of AI and IT, as well as other technological capabilities, means that incumbents must still continue to develop their methods of innovation in order to reduce the threat of new entrants into the market.

With regards to suppliers, in order to reduce supplier bargaining power, firms within the software industry try to purchase technological equipment from numerous suppliers. By building efficient supply chains with multiple suppliers, software firms are able to reduce the burden of supply shortages and supplier differentiation. Nevertheless, supplier bargaining power remains high for many as the ratio between industry concentration and supplier concentration is such that suppliers are not over reliant on single firms for revenues, and hence, the switching costs between who they supply to are very low.

Theoretically, consumers of services provided by software firms should possess some form of bargaining power due to the fragmentation of the industry. This is the case for standard products and services such as Java, which is offered by almost all software firms including Oracle, IBM, Talend and many others. For some particular products which are only provided by certain firms, this is not the case. For example, Oracle updated its Saas (software as a service) features in late 2020. As consumers could not find these services elsewhere, they were forced to pay higher prices. In fact, Oracle reported that Saas in 2021 contributed to 25% of total revenues as consumer demand for these products was high. Hence, in some cases, consumer groups are more fragmented than the ‘micro-industries’ providing these unique services. In these circumstances, consumers are unable to exploit bargaining power. All in all, in more cases than not, consumers benefit from the lack of price competition carried out within the industry and so enjoy consistent pricing. However, in the case that the service being provided is idiosyncratic, consumers are powerless.

Due to the large variety of products provided within the software industry, the threat of substitute services is rather inconsistent. On the one hand, some products, such as cloud computing, have to compete with many substitute products such as Dropbox and Google Drive. Nevertheless, other products such as specific computer hardware are unsubstitutable due to their complex nature. Therefore, the threat of substitutes to the industry depends on the given product or service produced by the incumbent firm.

Competition within the software industry is intense. Firms, more often than not, produce very similar services as their neighbours and this creates significant product homogeneity within the industry. Nevertheless, firms do whatever it takes to maximise customer value in order to sustain a healthy presence within the industry and maintain profitability. This can be shown by the industry's R & D average of 13.6 % (as a percentage of total sales) as firms are committed to incrementing consumer value. Furthermore, services provided seem rather bleak and technical. As a result, firms try to generate brand loyalty through extensive marketing campaigns. For example, Oracle spent $7.7 bn on marketing and sales related activities in 2021. Firms behave in such a way in order to maintain long lasting consumer demand for their goods.

As an incumbent within the software industry, Oracle faces multiple challenges when making key strategic decisions as it attempts to maintain its position as a world-leading software company. The firm is committed to protecting its competitive advantage in order to nurture future growth, maintain profit margins and support its dynamic efficiency (the firm spent $6.53bn on research and development investment in 2021). It does so by reducing costs through exploiting economies of scale and innovating, thus providing customers with unique services which competitors struggle to replicate. By expanding large levels of output over increasing unit costs and by creating groundbreaking technology, Oracle is able to protect itself from competition against potential entrants, existing incumbents as well as substitute products and services. Oracle fends off supplier bargaining power by expanding its product ranges (such as the recent expansion of its SaaS services as mentioned above) and hence, not relying on specific resources for production. This process helps the firm to provide industry-unique services at prices which consumers are unable to bargain with.

The health information technology industry, in which Cerner is currently operating, is now one of the fastest growing due to recent technological advancements which have been enhanced by the medical demands of the coronavirus pandemic. In fact, recent projections have predicted that the industry’s market size will grow from $29.16 bn to $47.25 bn from 2021-2027. The acquisition of Cerner is therefore likely to provide Oracle with key technical insight from the health sector. One hopes that consequently, Oracle can expand its product range and more effectively implement its differentiation strategy through this groundbreaking deal.

Deal analysis: One of 2021’s largest takeovers

On December 20th,, the acquisition agreement between Oracle and Cerner was finalized. Thebid for Cerner will far surpass Oracle’s next-largests transactions. These include the firm’s quasi-$10 billion acquisition of enterprise-software firm PeopleSoft in 2005, followed by the $9 billion acquisition of cloud-software provider NetSuite in 2016, both aimed to consolidate the company’s position in the software industry.

In fact, an Oracle-Cerner deal will be worth around $28.3 billion in equity value, through an all-cash tender offer for $95.00 per share. This would therefore include a typical takeover premium, given that the amount represents a 20% premium to Cerner’s closing share price on December 16th (ed. Cerner has a market value of around $23 billion).

Already a year ago, Oracle showed appetite for bigger deals, as it reached a preliminary agreement to acquire TikTok’s U.S operations, the Chinese-owned social media company. However, due to both Trump and Biden’s administration concerns, the deal was put indefinitely on hold. This left the company, managed by Safra Catz, to focus more on purchasing firms that are better aligned with its strategic business units.

As a matter of fact, Oracle already has a large presence in healthcare, providing technology to assist health insurers, clinicians, and public health systems in parsing data in order to optimize efficiency and improve patient outcomes. The move to acquire Cerner, well known for creating electronic medical records, follows Microsoft’s agreement in April to buy speech artificial intelligence company Nuance Communications for $16 billion. The deal appears to be an attempt by Oracle to capitalize on the growing demand for digital healthcare tools and to forge deeper connections within the healthcare industry.

Cerner's business is highly focused on conventional software sales and support as well as services. However, it has been trying to go further into newer cloud services - a market worth $214 billion, in which Oracle is also seeking to expand.

Therefore, through this deal, Oracle is attempting to make up ground after slipping behind firms like Amazon, Microsoft and Google. The firm, through this transaction, hopes to respond to investors and partners who have warmed to the Austin-based company, as the firm cranks up its focus on gaining cloud-computing business after its initial reluctance to embrace the expanding market for storing and analyzing data on remote softwares. For instance, Ron Zapar, CEO of Oracle’s partner Re-Quest, which offers managed services in health care, affirmed that the Cerner’s acquisition could give a major boost in cloud, data analytics and AI-related offerings: “IBM has it, Microsoft has it. So it’s really an arms race in this health care space in the cloud at the end of the day. It’s a way for Oracle to jump No.1 in that space because of who Cerner is and what their history is and how much market share those guys have”.

To gain a deeper understanding on the benefits and risks coming from the deal to both companies, it is important to report different opinions on the matter coming from several financial institutions. A report from KeyBank, an Ohio based investment firm, affirms that the deal provides “potential for standalone Cerner cost improvements and acquisition cost synergies including potential movement of Cerner software and managed service onto the Oracle OCI (ed. Oracle Cloud Infrastructure) cloud that could improve deal accretion”, and the deal would be positive for Oracle since “Cerner would expand Oracle’s current range of healthcare software offerings by adding its core Electronic Health Records (EHR)”.

Furthermore, according to a report from Barclays, one expects the deal to be rather positive for Cerner, as the company’s “organic growth has slowed over the past several years as the EHR adoption has reached full penetration in the US market, and the company has remained challenged to post meaningful growth from additional products and services from the large EHR related revenue base.” The British bank also believes that in the hands of another larger tech company such as Oracle, Cerner may be better able to move into data analytics and other growth opportunities. The only surprising aspect of the deal regarding Cerner’s side is timing, since a new CEO has been appointed recently, with David Feinberg starting the role in October after joining from Google. Nevertheless, it is possible that because Oracle has a relatively limited footprint in healthcare today (assets are primarily related to clinical trial data storage), CERN executives could remain in place and lead CERN operations moving forward under the overall Oracle corporate umbrella.

From Oracle’s point of view, in contradiction to what was affirmed by KeyBank, Barclays is not fully convinced about the merits of the deal. Of course the acquisition would enhance another vertical maneuver for the company, and hence increase the scale of the cloud footprint. However, given the fact that Oracle was only just restarting its comeback as a public cloud vendor, spending the rumored $30 billion on a secondary asset, when money is needed for increasing cloud CAPEX, seems suboptimal to analysts at Barclays. Finally, the investment banking report notes that the merger could damage Oracle in other aspects including the firm’s management credibility. In fact, as affirmed in the report: “ After all, the message to investors was that the cloud journey is now finally taking off, despite last quarter’s beat only coming from non-cloud related license sales, so a Cerner deal could be seen as an admission that management’s cloud expansion might not be quite as high as portrayed.

In the joint official announcement, both companies are looking to the deal optimistically. In fact, Cerner believes that through Oracle’s resources, infrastructure and capabilities and experience will be able to accelerate the pace of product and technology development and therefore expand exponentially its business into many more countries throughout the world, while Oracle will implement thanks to the acquisition a huge additional revenue growth engine for years to come. We can surely, according to Cerner’s CEO David Feinberg, affirm that the two companies together will radically transform healthcare:

“Joining Oracle as a dedicated Industry Business Unit provides an unprecedented opportunity to accelerate our work modernizing electronic health records (EHR), improving the caregiver experience, and enabling more connected, high-quality and efficient patient care.”

The transaction is scheduled to finalize in calendar year 2022. The closing is subject to receiving approvals and other satisfying conditions including Cerner stockholder tendering a majority of Cerner’s outstanding shares in the tender offer. When it will be concluded, Cerner will finally join Oracle as a strategic business unit and will be Oracle's cornerstone asset as it expands into healthcare and we will work together to enhance medical care for individuals and communities across the world.

Conclusion

To say the least, Oracle’s imminent acquisition of Cerner is a very sensible move for both firms. Oracle, competing within an innovation-intense industry, finds itself obliged to expand its product range through ingenious strategic decisions which can help maintain its firm’s competitive advantage. Cerner, on the other hand, is a corporation hoping to exploit its position in one of the world’s fastest growing industries. Due to the pandemic, this industry is expected to boom as healthcare returns as one of society’s top priorities since the Second World War. Financially, one concludes that the two organisations are in healthy (no pun intended) states despite the global economic difficulties of the pandemic. Hence, with some degree of certainty, one would hope that following this deal, the two firms can become ever more stable and profitable by providing each other with both professional and technical expertise. If successful, this deal could turn out to be one of the best deals of the decade - not just one of 2021’s most significant acquisitions.

Sources

- Financial Times

- Statista

- Wall Street Journal

- Yahoo Finance

- Simply Wall Street

Boaz Lister, Matteo Panizza, Lorenzo Bernareggi