Introduction

On October 5th, 2021 OVHcloud announced the launch of its IPO, with the objective of raising around €350 million in its debut on the Euronext Paris market, happened on October 15th.

OVHCloud is a French-based cloud provider, leader in the European market and with high potential growth internationally. It serves around 1.6 million clients in over 140 countries, offering solutions suitable for digital companies, for corporates and public entities and also for private individuals, leveraging its completely vertically integrated model and its global network of more than 30 data centres in four continents. In addition to that, the company has a unique commitment to social and environmental issues, developing and using eco-friendly technologies and creating an inclusive, supporting and empowering environment.

The public offering had a price of €18.5 at its debut, valuing the firm at EUR 3.5 billion. In addition, it was based on a bipartite structure with an offer in France for retail investors and an international one for institutions. The IPO came together with a strong support from the French government and politicians who believe OVHcloud can compete with and become a valid alternative to other tech giants such as Amazon Web Services, Google Cloud and Microsoft’s Azure. The deal is mainly aimed at providing new resources to boost the company growth rate, consolidating its leadership position in the European market and, at the same time, supporting an international expansion, especially in the USA. The CFO declared that the proceeds will be sufficient or, even more than enough to meet the plan till 2025.

On October 5th, 2021 OVHcloud announced the launch of its IPO, with the objective of raising around €350 million in its debut on the Euronext Paris market, happened on October 15th.

OVHCloud is a French-based cloud provider, leader in the European market and with high potential growth internationally. It serves around 1.6 million clients in over 140 countries, offering solutions suitable for digital companies, for corporates and public entities and also for private individuals, leveraging its completely vertically integrated model and its global network of more than 30 data centres in four continents. In addition to that, the company has a unique commitment to social and environmental issues, developing and using eco-friendly technologies and creating an inclusive, supporting and empowering environment.

The public offering had a price of €18.5 at its debut, valuing the firm at EUR 3.5 billion. In addition, it was based on a bipartite structure with an offer in France for retail investors and an international one for institutions. The IPO came together with a strong support from the French government and politicians who believe OVHcloud can compete with and become a valid alternative to other tech giants such as Amazon Web Services, Google Cloud and Microsoft’s Azure. The deal is mainly aimed at providing new resources to boost the company growth rate, consolidating its leadership position in the European market and, at the same time, supporting an international expansion, especially in the USA. The CFO declared that the proceeds will be sufficient or, even more than enough to meet the plan till 2025.

Industry Overview

In the last years, a plethora of innovative technology solutions have been diversifying the industry to a never-seen-before extent, with products of each sub-sector finding disruptive applications across global markets for goods and services. One area expanding at breakneck speed and driving technological advancement for global users is cloud computing, which entails providing IT capabilities to firms through wide access networks and the internet.

Being a relatively new industry, cloud computing is becoming increasingly relevant as many government agencies, organisations and corporations operating in different industries invest considerably in information technology. While relatively stagnant until the 2000s, the cloud industry has been expanding rapidly during the last two decades, beginning with the foundation of Amazon Web Services in 2002, followed by other large technology companies such as Google (with its Google App engine in 2008) and Microsoft (with its Microsoft Azure in February 2010) offering on-demand computing services and infrastructure.

There are several benefits for corporations when switching from on-premises infrastructures to cloud services, which are driving growth in the cloud computing sector. However, the first and most important advantage, that is also the main growth driver of the cloud computing industry, is related to operational costs: firms must find ways to keep these costs as low as possible to remain competitive and cloud computing services eliminate the capital expenses related to hardware purchase and software maintenance. Other advantages include:

- speed: most cloud computing services are provided on-demand, which allows firms to get the required resources within few minutes

- productivity: removing the time required for hardware setup, software repair and other time- consuming tasks, the productivity of IT divisions in firms is significantly optimised

- reliability: thanks to centralisation in large, external data centres administered by the providers, data backup and disaster recovery become relatively easier

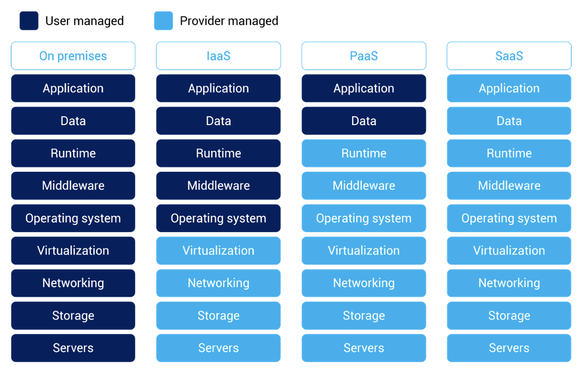

Source: Alibaba Cloud

The lowest level of externalization is a sub-category of IaaS known as Bare-metal cloud, where the providers only offer servers, storage, and networking without virtualization. IaaS implies the delivery of computing infrastructure to clients and is especially useful for young companies with highly volatile demand and, eventually, limited capital, for which maintaining own servers would be too costly. The customer therefore creates their own operating system and therefore builds both the platform and the final applications. By contrast, PaaS supports the creation of applications, being essentially an internet-based platform for the customer to create proprietary software on their own. It is useful when multiple developers are working on common projects and facilitates the creation of web. Lastly, SaaS essentially consists in the licensing of ready-to-use software, with everything from physical servers to the platform, application, maintenance, and security being managed by the provider. The acquisition and pricing plans are usually based on subscription models varying by length of use, number of users and number of devices. They are increasingly used in financial services, healthcare, education, customer relationship management.

Classified by exclusivity of use, cloud can be private (used by one firm only) and public (shared between several firms). There is also an increasing number of hybrid cloud offerings, with customers being responsible for data flow between private and public and the overall interaction between their services. Private cloud is considered more secure and can be hosted by the user or managed by a cloud provider.

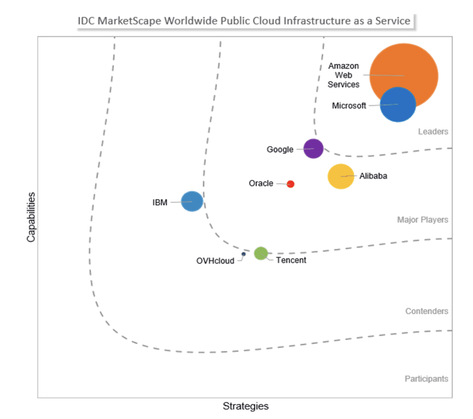

As of 2021, the global cloud computing industry has an estimated market size of approximately EUR 280-320 billion, but It is expected to grow to EUR 630-680 billion over the next five years. Of this industry, the most relevant sectors for the activity of OVH, IaaS and PaaS, are estimated to amount to EUR 130-135 billion for the current year. The most important players in the industry are currently based in the United States, with Microsoft Azure, Amazon Web Services, and Google Cloud Platform controlling a total of 70% of the market for public cloud. Other key companies, either specialised in cloud computing or offering these services among others, are IBM, Dell, HP, Salesforce, Adobe, Oracle, and VMware. On this market, OVH is a challenger with reduced power. The market for private cloud is more fragmented, which leaves OVH more room for manoeuvre. The firm controls between 10-15% in Europe, at par with main competitor IBM Cloud. Other competitors in this area are Hetzner (Germany), Rackspace (US) and Leaseweb (The Netherlands).

In Europe, the market for cloud services has some significant differences, primarily regulatory in nature, from the rest of the world. According to a survey and subsequent study by Bain & Company, European firms tend to resist the externalisation of critical workload to the cloud. Regulatory compliance, control and governance, and data security are of higher importance in Europe than anywhere else in the world, and strongly influence the decision by firms to keep computing capabilities on-premises. EU legislation on data security and the landmark court ruling invalidating the US-EU Privacy Shield Framework, is complicating the environment for both buyers and seller. From a global perspective, OVH has a very reduced market share, as illustrated below. In Europe, it is estimated by research firm Synergy that the firm controls approximately 2% of the market.

Classified by exclusivity of use, cloud can be private (used by one firm only) and public (shared between several firms). There is also an increasing number of hybrid cloud offerings, with customers being responsible for data flow between private and public and the overall interaction between their services. Private cloud is considered more secure and can be hosted by the user or managed by a cloud provider.

As of 2021, the global cloud computing industry has an estimated market size of approximately EUR 280-320 billion, but It is expected to grow to EUR 630-680 billion over the next five years. Of this industry, the most relevant sectors for the activity of OVH, IaaS and PaaS, are estimated to amount to EUR 130-135 billion for the current year. The most important players in the industry are currently based in the United States, with Microsoft Azure, Amazon Web Services, and Google Cloud Platform controlling a total of 70% of the market for public cloud. Other key companies, either specialised in cloud computing or offering these services among others, are IBM, Dell, HP, Salesforce, Adobe, Oracle, and VMware. On this market, OVH is a challenger with reduced power. The market for private cloud is more fragmented, which leaves OVH more room for manoeuvre. The firm controls between 10-15% in Europe, at par with main competitor IBM Cloud. Other competitors in this area are Hetzner (Germany), Rackspace (US) and Leaseweb (The Netherlands).

In Europe, the market for cloud services has some significant differences, primarily regulatory in nature, from the rest of the world. According to a survey and subsequent study by Bain & Company, European firms tend to resist the externalisation of critical workload to the cloud. Regulatory compliance, control and governance, and data security are of higher importance in Europe than anywhere else in the world, and strongly influence the decision by firms to keep computing capabilities on-premises. EU legislation on data security and the landmark court ruling invalidating the US-EU Privacy Shield Framework, is complicating the environment for both buyers and seller. From a global perspective, OVH has a very reduced market share, as illustrated below. In Europe, it is estimated by research firm Synergy that the firm controls approximately 2% of the market.

Source: IDC, 2020

In Europe, the American companies continue controlling the market, with local providers struggling to keep up.

In the context of the COVID-19 pandemic, there is increased demand for shifting to the cloud. Remote working is requiring firms to shift to cloud in order to provide common working platforms for employees. It is highly probable that the most significant increases are in the SaaS sector, since not all companies develop their own platforms or software based on external infrastructure, but most companies need ready-to-use software for general work assignments, online meetings, and other communication and data sharing. As the pandemic essentially generated a sudden pressure for firms to move online with no prior planning, most customers turned to hyper-scalers with very high capacity to ensure data flow and storage, contributing to the increase in the market share of top performers. Tracking and monitoring the pandemic has also increased the overall volume of data.

In the context of the COVID-19 pandemic, there is increased demand for shifting to the cloud. Remote working is requiring firms to shift to cloud in order to provide common working platforms for employees. It is highly probable that the most significant increases are in the SaaS sector, since not all companies develop their own platforms or software based on external infrastructure, but most companies need ready-to-use software for general work assignments, online meetings, and other communication and data sharing. As the pandemic essentially generated a sudden pressure for firms to move online with no prior planning, most customers turned to hyper-scalers with very high capacity to ensure data flow and storage, contributing to the increase in the market share of top performers. Tracking and monitoring the pandemic has also increased the overall volume of data.

Company overview

OVHcloud is a cloud computing company based in Paris, France. Originally created as OVH in 1999 by Octave Klaba, the company was designed to meet the public need for Internet hosting. After that, the business started to grow exponentially year-after-year and to meet the needs of an increasingly international customer base new offices were opened in Germany, United Kingdom, Italy, Portugal, Netherlands and Ireland. The turning point was reached in 2010, when OVH entered the world of cloud with two key offers: the Hosted Private Cloud and the Public Cloud. To meet the growing global demand for cloud computing services, in 2016 OVH also decided to finalize a partnership with two leading investment firms, namely KKR and TowerBrook Capital Partners. They acquired a 20% minority stake of €250 million in OVH, with the Klaba family retaining the majority stake in the company and thus continuing with the management team to lead the company’s strategy and operations. New data centers were opened across the world, such as in the US, Singapore, Australia and India. Since 2018, the name has changed to OVHcloud to emphasize its position as pure player in the cloud computing industry.

Today, OVHcloud is the first European cloud provider offering an extensive range of services from internet hosting to private, public and hybrid cloud infrastructures for developers and businesses. To be more specific, it operates in what could be defined as four “cloud universes”: Baremetal Cloud, Hosted Private Cloud, Public Cloud and Web Cloud. Moreover, Baremetal Cloud, Hosted Private Cloud and Public Cloud use a shared private network which is also used to connect customer premises for hybrid services (OVHcloud Connect), delivered from 30 datacenters with 380,000 physical servers in 12 different locations. Yet, while the Public Cloud segment is currently heavily dominated by few key US players, such as Google, Amazon and Microsoft, OVH position is stronger in the private cloud segment within three main categories of customers: large corporations and public institutions, which account for 35% of the client base; technology companies, which account for 40% and white-label partners (i.e., companies that buy the products from OVH and resell them to third parties as their own products) which account for 25%.

The business model relies heavily on vertical integration and the firm is involved in every step of the lifecycles of its servers and data centers. The company manufactures its own serves at their plants in France and Canada, internalising all maintenance and administering all networks on its own. This greatly reduces the risk of supply chain stress, a key concern in the current environment of bottlenecks, delays, or lack of productive capacity. However, OVHcloud isn’t big enough to do everything and uses strategic partners where it makes sense. For instance, in November 2020 it announced a partnership with Google, based on which it will manage, host and sell Google's Anthos platform entirely within its data centres in order to ensure data security and remain a trusted platform.

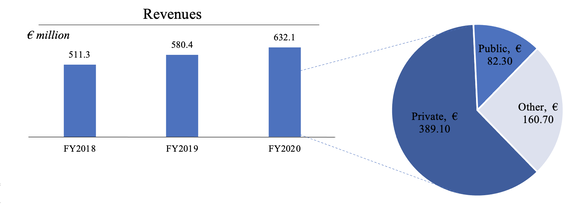

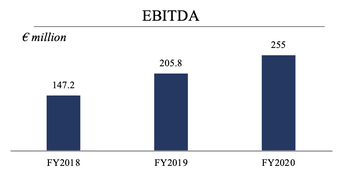

Source: OVHCloud's Public Disclosure

Despite different trends in the different business segments could be observed, the spread of COVID-19 has not slowed the business in a significant way overall. In 2020, the firm reported revenues of EUR 632 million and EBITDA of EUR 255 million. For the first 9 months of the year 2021, revenues of EUR 495.1 million were reported, showing an increase of 4.9% over the same period of 2020. A fire in March 2021, which affected some of its servers in France, negatively impacted the financial situation for the rest of the year. Revenues attributable to hosted private cloud services dropped 14.7% compared to 2020, with all other categories reporting gains between 1.7% and 14.8%. The total negative impact on the firm’s operational results is estimated to be around EUR 55.1 million. Net income reported by OVH in its regulatory filings is negative. Net losses are estimated at EUR 44.9 million for the first nine months of 2021, largely due to the fire. In the same period of 2020, the firm reported net losses of EUR 4.7 million.

Despite the unforeseeable fire event, the firm is recovering rapidly, notably due to their independence from external technical support or maintenance and expects contract flow to recover. The exceptional industry growth coupled with management confidence about the future financial performance of the company and room for expansion serve as one of the main arguments for the IPO decision.

Despite the unforeseeable fire event, the firm is recovering rapidly, notably due to their independence from external technical support or maintenance and expects contract flow to recover. The exceptional industry growth coupled with management confidence about the future financial performance of the company and room for expansion serve as one of the main arguments for the IPO decision.

Risks associated with investing in OVH

The company argues that one of its main strengths is the confidentiality and security of data, which makes it a viable choice for large corporations. The European legislative context is also favourable when it comes to the investment choice in OVHcloud. Many political circles based in Paris and Brussels are pointing at OVHcloud success due to concerns that the European sovereignty and economic competitiveness could be threatened if companies and governmental authorities are forced to exclusively rely on US based providers. As a matter of fact, following the US Congress’ Cloud Act of 2018 authorising courts to issue warrants requesting data handovers from certain foreign cloud providers, an increasing number of European companies are turning to companies which are not subject to this law, and primarily to OVH.

The primary risk associated with investing in OVH is cybersecurity risk. The firm licenses data protection software and does not control (and, therefore, cannot guarantee) the efficiency of the protection mechanisms against future, previously unseen types of attacks. The developments in the legal framework of domestic and international data handling such as the Schrems II Ruling may also impact the firm. Other risks pertain to the market and competitive environment in which the firm operates. The company’s rapid expansion, especially since 2017, depends entirely on the customers’ willingness to externalize their information technology needs. Aggressive migration to cloud was also induced by the COVID-19 pandemic, which may be interpreted as a forced increase in demand and a lower correlation between managerial efficiency and financial performance.

The markets on which the firm operates are very dynamic and its competitors have size advantages. They are also relatively newly developed, which causes a precise definition (and, hence, precise forecasting of market share) to be very difficult. There are some risks associated with operations, most notably the availability of its platforms. In its contracts with clients, the company guarantees a maximum of 44 minutes of interruption monthly. Such interruptions may have causes outside the reach and responsibility of the firm, but still constitute reasons for clients to abandon this provider due to inadequate level of service, as well as reasons to request the termination of the contract and the payment of financial damages pursuant to the agreement. This may negatively impact both current revenues and projections for future sales.

OVH engages in strategic acquisitions, which generally pose great financial risk. If expected benefits are not met or synergies are not effectively realized, this can negatively impact the financial situation of the buyer.

Eventually

Structure of the deal

OVHcloud’s IPO is carried out as part of a global offer and it is based on a bipartite structure addressing both retail and institutional investors. The first part is a French Public Offering to retail investors, in the form of an open price offer. Specifically, this offer turned out to be very successful, with the highest participation rate in France in the last 10 years and with also employees who bought shares, pointing to a great loyalty and commitment. The second one is an International Private Placement to institutional investors inside and outside of France. In particular, in the USA the qualified institutional investors are defined by Rule 144A under the U.S. Securities Act of 1933, while outside of the USA by the Regulations S. If there will be sufficient demand in the French Offering, the number of shares allocated to subscriptions to this offer will be equal to at least 10% of the total and the final allocation will also depend on the results of the French Offering itself.

Price range

The Offering price was initially expected to be between 18.50 EUR and 20.00 EUR per share, which was the range approved by the Company’s Board of Directors on October 3rd , 2021. Importantly, the price of the shares in the French Public Offering and the International Offering was supposed to be the same and the indicative offering price range could be modified at any time up to and including the date of the determination of the offering price. Eventually, the deal was set to move ahead at a price of 18.5 EUR per share, the lower end of the range, valuing the firm at €3.5 billion.

Overallotment option

KKR and Tower Brook Capital Partners sold additional existing shares worth up to 15% of the total number of New Shares and Sale Shares (the "Option Shares"), equating to up to 3,243,244 extra existing shares at the low end of the indicative price range. This Over-Allotment Option was supposed to cover any future prospective over-allotments as well as any stabilisation activities aimed at supporting the stock's market price. It may be exercised only once and at any time, in whole or in part, within the 30 calendar days after the determination of the Offering Price, from October 14th, 2021, to November 13th, 2021, according to the suggested timeline.

Underwriters

BNP Paribas, Citigroup, JP Morgan, and KKR Capital Markets are acting as Joint Global Coordinators and Joint Bookrunners, respectively; Credit Suisse, Goldman Sachs, Morgan Stanley, and Société Générale are acting as Joint Bookrunners, and CIC is acting as Co-Lead Manager (collectively, the "Banks"). OVHcloud has hired independent financial advisers Rothschild & Co and Eight Advisory, as well as legal advisors Cleary Gottlieb Steen & Hamilton LLP, financial communications advisor Brunswick, and investor relations advisor Accellency. The Banks have hired White & Case LLP as their legal counsel.

Change in the shareholding structure

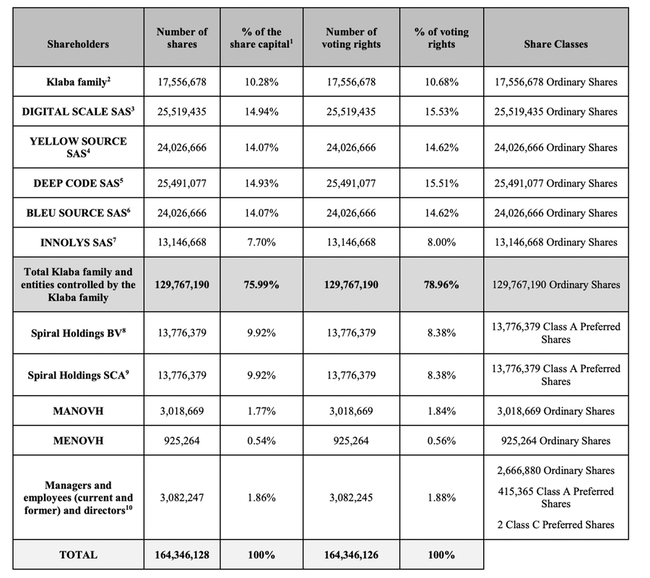

The Company is a simplified stock company owned by the Klaba family as of the date of this Registration Document, and it is envisaged that they will continue to control the Company once the Company's shares are admitted to trade on Euronext Paris. As of the date of this Registration Document, the following table shows the shareholdings in the Company's share capital:

Structure of the deal

OVHcloud’s IPO is carried out as part of a global offer and it is based on a bipartite structure addressing both retail and institutional investors. The first part is a French Public Offering to retail investors, in the form of an open price offer. Specifically, this offer turned out to be very successful, with the highest participation rate in France in the last 10 years and with also employees who bought shares, pointing to a great loyalty and commitment. The second one is an International Private Placement to institutional investors inside and outside of France. In particular, in the USA the qualified institutional investors are defined by Rule 144A under the U.S. Securities Act of 1933, while outside of the USA by the Regulations S. If there will be sufficient demand in the French Offering, the number of shares allocated to subscriptions to this offer will be equal to at least 10% of the total and the final allocation will also depend on the results of the French Offering itself.

Price range

The Offering price was initially expected to be between 18.50 EUR and 20.00 EUR per share, which was the range approved by the Company’s Board of Directors on October 3rd , 2021. Importantly, the price of the shares in the French Public Offering and the International Offering was supposed to be the same and the indicative offering price range could be modified at any time up to and including the date of the determination of the offering price. Eventually, the deal was set to move ahead at a price of 18.5 EUR per share, the lower end of the range, valuing the firm at €3.5 billion.

Overallotment option

KKR and Tower Brook Capital Partners sold additional existing shares worth up to 15% of the total number of New Shares and Sale Shares (the "Option Shares"), equating to up to 3,243,244 extra existing shares at the low end of the indicative price range. This Over-Allotment Option was supposed to cover any future prospective over-allotments as well as any stabilisation activities aimed at supporting the stock's market price. It may be exercised only once and at any time, in whole or in part, within the 30 calendar days after the determination of the Offering Price, from October 14th, 2021, to November 13th, 2021, according to the suggested timeline.

Underwriters

BNP Paribas, Citigroup, JP Morgan, and KKR Capital Markets are acting as Joint Global Coordinators and Joint Bookrunners, respectively; Credit Suisse, Goldman Sachs, Morgan Stanley, and Société Générale are acting as Joint Bookrunners, and CIC is acting as Co-Lead Manager (collectively, the "Banks"). OVHcloud has hired independent financial advisers Rothschild & Co and Eight Advisory, as well as legal advisors Cleary Gottlieb Steen & Hamilton LLP, financial communications advisor Brunswick, and investor relations advisor Accellency. The Banks have hired White & Case LLP as their legal counsel.

Change in the shareholding structure

The Company is a simplified stock company owned by the Klaba family as of the date of this Registration Document, and it is envisaged that they will continue to control the Company once the Company's shares are admitted to trade on Euronext Paris. As of the date of this Registration Document, the following table shows the shareholdings in the Company's share capital:

Source: OVHCloud's Public Disclosure

The Klaba family controls the Company as of the date of this Registration Document, holding approximately 76 percent of the share capital and roughly 79 percent of the voting rights of the Company as of the date of this Registration Document.

Following the listing of the Company's shares on Euronext Paris' regulated market, the Klaba family is likely to retain control of the company.

The Company thinks there is no risk of such control being used in an inappropriate manner. In this regard, it should be noted that, as of the Company's listing on the regulated market of Euronext Paris, at least five independent directors, representing more than a third of the directors, will be appointed in accordance with the AFEP-MEDEF Code's recommendations, as of the Company's listing on the regulated market of Euronext Paris. It should also be mentioned that, as of the date of the Company's conversion to a société anonyme, the Chairman of the Board of Directors and Chief Executive Officer positions will be held by two different people.

As of the date of this Registration Document, there was no agreement to the Company's knowledge; whose execution may result in a shift in control at a later date.

Following the listing of the Company's shares on Euronext Paris' regulated market, the Klaba family is likely to retain control of the company.

The Company thinks there is no risk of such control being used in an inappropriate manner. In this regard, it should be noted that, as of the Company's listing on the regulated market of Euronext Paris, at least five independent directors, representing more than a third of the directors, will be appointed in accordance with the AFEP-MEDEF Code's recommendations, as of the Company's listing on the regulated market of Euronext Paris. It should also be mentioned that, as of the date of the Company's conversion to a société anonyme, the Chairman of the Board of Directors and Chief Executive Officer positions will be held by two different people.

As of the date of this Registration Document, there was no agreement to the Company's knowledge; whose execution may result in a shift in control at a later date.

Market reaction

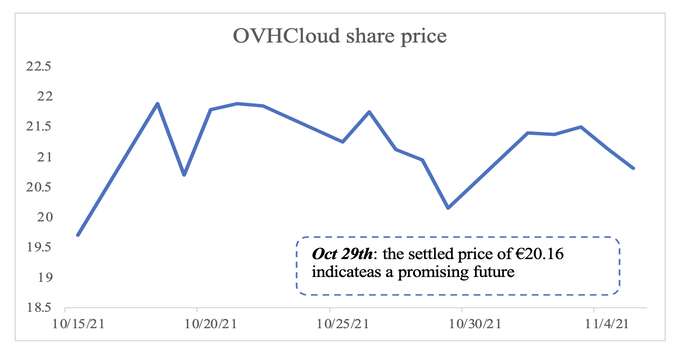

After dropping slightly below the offer price in early trade, the shares were up around €19.70 near end of day. Currently having reached two weeks so far, the share price has varied in the 17.80-22.50 euros range, to have finally settled on the price of 20.16 euros as of October 29th, indicating a promising future for the company.

After dropping slightly below the offer price in early trade, the shares were up around €19.70 near end of day. Currently having reached two weeks so far, the share price has varied in the 17.80-22.50 euros range, to have finally settled on the price of 20.16 euros as of October 29th, indicating a promising future for the company.

Source: Yahoo Finance

Sources

George Aris Lavas, Teodor Matei, Giacomo Maria Villa

- OVHCloud - Investor Relations

- Alibaba Cloud

- Bain & Company - Technology Report 2021

- Yahoo Finance

- Financial Times

- IDC.com

- Reuters

- Bloomberg

George Aris Lavas, Teodor Matei, Giacomo Maria Villa