We have seen several falling knives in the technology sector this week. Whether this was due to the 23% plunge of the Lenovo Group or the 5% fall of Facebook, the Nasdaq lost approximately more than 8%.

From a research note by Bank of America Merrill Lynch & Goldman Sachs it is clear that the S&P 500 has significantly relied upon the incredible growth of the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google). Since they have such large market capitalizations, they have a significant weight in the index. For the past year or so the FAANG stocks have been responsible for 98% of the gains of the S&P 500. Yes, that’s right: 98%. In fact, the reliance on them is so high, the index would be in the red if it weren’t for their stupendous outperformance year by year (Exhibit 3).

From a research note by Bank of America Merrill Lynch & Goldman Sachs it is clear that the S&P 500 has significantly relied upon the incredible growth of the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google). Since they have such large market capitalizations, they have a significant weight in the index. For the past year or so the FAANG stocks have been responsible for 98% of the gains of the S&P 500. Yes, that’s right: 98%. In fact, the reliance on them is so high, the index would be in the red if it weren’t for their stupendous outperformance year by year (Exhibit 3).

Thus, we could interpret this as an excellent trigger for a flash crash or even a crisis. Or at least it could be the first flake to the snowball effect. Most asset managers are heavily allocated into tech, and especially the FAANG stocks, inclunding pension funds and sovereign wealth funds. So exposure is everywhere!

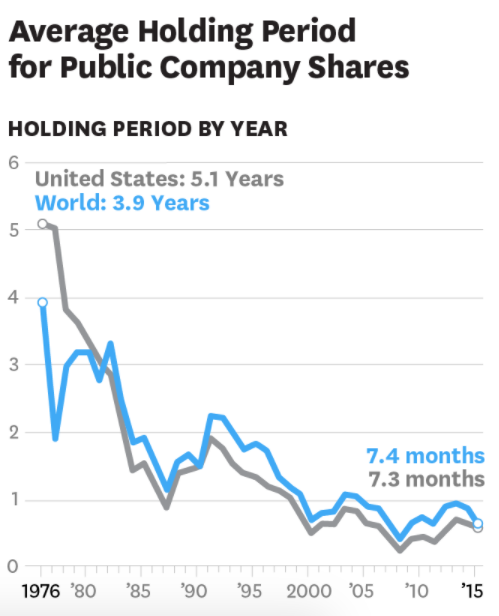

But, you may wonder: why would the FAANG stocks fall? After all, they are safe bets, are they not? Well, the issue here is we are nearing the end of the era of “easy money.” Rates are rising in the U.S; the FED is deleveraging their balance sheet, the ECB is slowly cutting back on QE... Overall, credit is getting more expensive. But does this have anything to do with the performance of the FAANG stocks? Yes, it does. As asset managers often utilize leverage to amplify returns, although leverage comes with costs, as interest has to be paid upon borrowed capital. This means that both the institutional and retail side will not be able to 2x base capital as quickly as before - as the debt servicing costs are too high. In fact, investment accounts globally have never been so highly leveraged - even more so than in 2008.

But, you may wonder: why would the FAANG stocks fall? After all, they are safe bets, are they not? Well, the issue here is we are nearing the end of the era of “easy money.” Rates are rising in the U.S; the FED is deleveraging their balance sheet, the ECB is slowly cutting back on QE... Overall, credit is getting more expensive. But does this have anything to do with the performance of the FAANG stocks? Yes, it does. As asset managers often utilize leverage to amplify returns, although leverage comes with costs, as interest has to be paid upon borrowed capital. This means that both the institutional and retail side will not be able to 2x base capital as quickly as before - as the debt servicing costs are too high. In fact, investment accounts globally have never been so highly leveraged - even more so than in 2008.

The risk this causes to FAANG stocks is tightened liquidity. And liquidity is the name of the game! Fewer inflows mean less volume, which means less potential to upkeep the crazy momentum of these tech giants. The broader issue here is the fact that many asset managers have depended on momentum strategies in the past few years. Otherwise, this would be less of an issue. An even bigger problem is the number of quant funds utilizing algorithms that make decisions on whether to retain stocks on their books, liquidate them, reduce them, or increase them. So since they are dependent on statistical analysis, a natural drop out of a long-term upward channel can kick off a sell order.

The proposed strategy

An approach to this could be to track all the tech sector, namely the FAANGs and other tech large caps. As soon as we see large block trades coming from institutions to cut their positions in FAANGs or in general tech large caps, we will start looking more into the situation. If we see the slightest breakdown from momentum channels across the FAANGs (which has already started to happen), we will purchase DOTM Put options (buy to open) on the SPDR ETF and on the Nasdaq ETF ONEQ. A strategy like this, even with mediocre execution, can generate significant alpha, as most of the market is not even looking at betting against tech.

Gregory Laurent Josi

The proposed strategy

An approach to this could be to track all the tech sector, namely the FAANGs and other tech large caps. As soon as we see large block trades coming from institutions to cut their positions in FAANGs or in general tech large caps, we will start looking more into the situation. If we see the slightest breakdown from momentum channels across the FAANGs (which has already started to happen), we will purchase DOTM Put options (buy to open) on the SPDR ETF and on the Nasdaq ETF ONEQ. A strategy like this, even with mediocre execution, can generate significant alpha, as most of the market is not even looking at betting against tech.

Gregory Laurent Josi