For almost 10 years private equity and hedge fund houses and traditional asset managers have faced increasingly turbulent periods in the desperate search for significant excess returns to remunerate their demanding investors. The incapacity to find attractive investment opportunities has been justified in a variety of ways ranging from structural problems of the industry to excessively inflated asset prices. Most argue that stock picking practices of the most successful players have become well-known by the competition leading to an inevitable sharing of available opportunities. Others sustain that the sole HF source of competitive advantage lies in the weaker legal restrictions with respect to traditional mutual funds targeting retail investors.

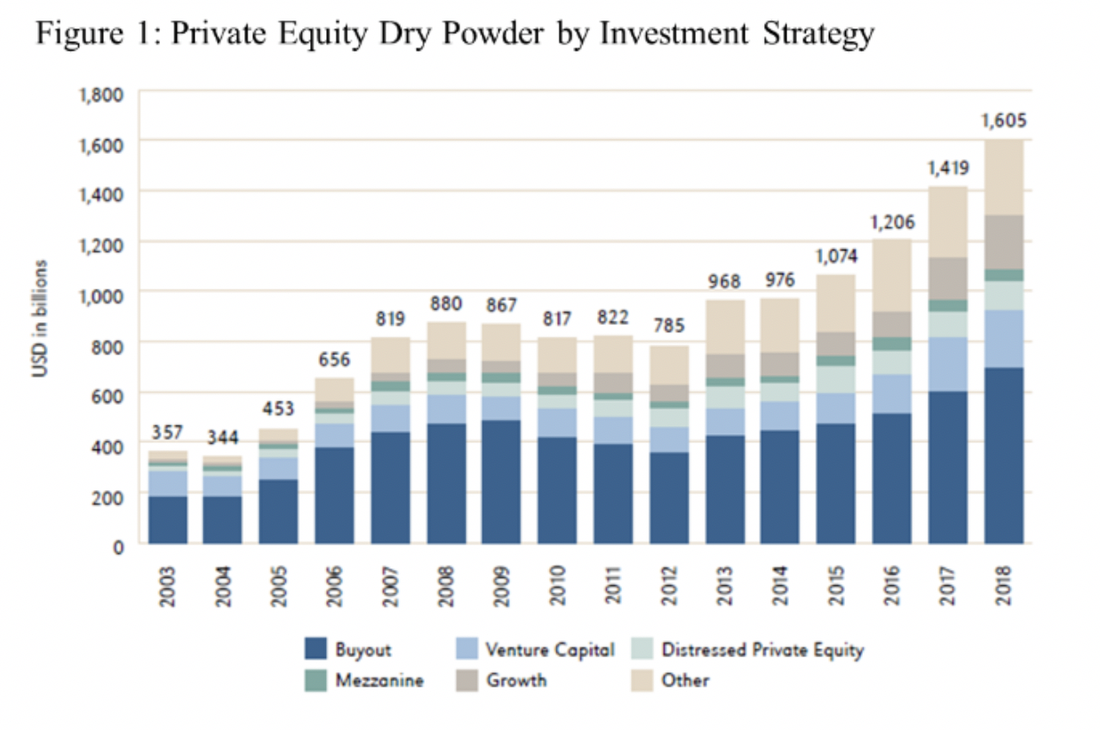

In any case, the liquidity accumulated by all categories of asset managers has reached a record high in 2019. And this must be summed with the combined dry powder at the disposal of PE investors which reached 1.6 trillion in 2018 as can be seen from the figure 1 below. This confirms the difficulties faced by investment managers in finding profitable investment opportunities in the past and allocates in their hand huge liquidity bullets to be targeted to attractive mispriced companies as soon as they emerge.

In any case, the liquidity accumulated by all categories of asset managers has reached a record high in 2019. And this must be summed with the combined dry powder at the disposal of PE investors which reached 1.6 trillion in 2018 as can be seen from the figure 1 below. This confirms the difficulties faced by investment managers in finding profitable investment opportunities in the past and allocates in their hand huge liquidity bullets to be targeted to attractive mispriced companies as soon as they emerge.

Source: PREQIN

Many among those who judged excessive prices as the reason for the accumulated liquidity believed that a crisis would have solved the problem. This is not confirmed by what we are observing in these days, as the biggest players of the industry seem reluctant in employing their capital, despite Covid-19 has pushed prices down as never seen in the past 10 years, as the S&P500 loosing 16% since the beginning of the crisis can confirm. Berkshire Hathaway is a good example of this.

Buffet’s strategy, as it can be retrieved by Berkshire Hathaway annual reports has always appeared tremendously simple, and the most effective of all time as proven by the record high excess returns it has achieved: buy high quality at cheap price, or what is more formally known as value investing. However, Buffet doesn’t seem to be willing to exploit the recent drop in prices as we would expect: he increased his liquidity pile to 137 billion USD by selling 6 billion worth of stake in the 4 major airline companies in the US, which traded at about 10 billion USD at the end of 2019.

The proceeds of the divestiture and the other cumulated liquidity have not been employed yet and will not be according to what analysts interpreted from the 2020 annual shareholders meeting of Saturday May the 2nd, held online due to coronavirus. This decision came as a big surprise for most shareholders as they expected Buffet to take advantage from fall in prices due to Covid-19 to increase his stock portfolio, in line with what happened in 2008-2009 when Berkshire Hathaway became the big player in most distressed firms of the financial sector. The tremendously profitable deal Buffet took home by subscribing a 5 billion private placement in Goldman Sachs is a good example of this.

To those wondering about the excess amount of cumulated cash Buffets replied that it should not be seen as excessive if we think about the worst possible scenarios that we may have ahead of us. This further confirms that Buffet sees this crisis differently from that of 2008 and that he does not see opportunities to buy even after the biggest drop of prices in the last decade.

What makes this crisis different from those of the past and should make us reluctant in exploiting cheap prices is an unprecedented degree of uncertainty. While very few anticipated the 2008 mortgage bubble, it was not impossible to predict how companies in the financial sectors would have reacted once the crisis manifested. A good dose of accounting knowledge and investment expertise allowed Buffet to recognise the banks in best shapes that would have recovered soon. The situation now is different. Understanding how fast it will take to develop a vaccine, whether the virus can mutate with time, predicting for how long the behaviours of consumers will be affected are tasks that go well beyond basic financial knowledge and that can be difficult for even the world’s most famous investor. To put it in simple terms, Buffets states that as he did not foresee the impossibility of getting a haircut for 7 weeks, he can’t predict how this crisis is evolving.

Nicola Bulgarelli

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Buffet’s strategy, as it can be retrieved by Berkshire Hathaway annual reports has always appeared tremendously simple, and the most effective of all time as proven by the record high excess returns it has achieved: buy high quality at cheap price, or what is more formally known as value investing. However, Buffet doesn’t seem to be willing to exploit the recent drop in prices as we would expect: he increased his liquidity pile to 137 billion USD by selling 6 billion worth of stake in the 4 major airline companies in the US, which traded at about 10 billion USD at the end of 2019.

The proceeds of the divestiture and the other cumulated liquidity have not been employed yet and will not be according to what analysts interpreted from the 2020 annual shareholders meeting of Saturday May the 2nd, held online due to coronavirus. This decision came as a big surprise for most shareholders as they expected Buffet to take advantage from fall in prices due to Covid-19 to increase his stock portfolio, in line with what happened in 2008-2009 when Berkshire Hathaway became the big player in most distressed firms of the financial sector. The tremendously profitable deal Buffet took home by subscribing a 5 billion private placement in Goldman Sachs is a good example of this.

To those wondering about the excess amount of cumulated cash Buffets replied that it should not be seen as excessive if we think about the worst possible scenarios that we may have ahead of us. This further confirms that Buffet sees this crisis differently from that of 2008 and that he does not see opportunities to buy even after the biggest drop of prices in the last decade.

What makes this crisis different from those of the past and should make us reluctant in exploiting cheap prices is an unprecedented degree of uncertainty. While very few anticipated the 2008 mortgage bubble, it was not impossible to predict how companies in the financial sectors would have reacted once the crisis manifested. A good dose of accounting knowledge and investment expertise allowed Buffet to recognise the banks in best shapes that would have recovered soon. The situation now is different. Understanding how fast it will take to develop a vaccine, whether the virus can mutate with time, predicting for how long the behaviours of consumers will be affected are tasks that go well beyond basic financial knowledge and that can be difficult for even the world’s most famous investor. To put it in simple terms, Buffets states that as he did not foresee the impossibility of getting a haircut for 7 weeks, he can’t predict how this crisis is evolving.

Nicola Bulgarelli

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.