Introduction

On March 21, 2021, Canadian Pacific Railway (CP), owner and operator of a transcontinental freight railway in North America, agreed to acquire the transportation holding company Kansas City Southern (KCS) in a stock and cash transaction. The deal values Kansas City Southern at around $29bn with the inclusion of $3.8bn of outstanding debt and represents the largest takeover of the year so far as well as the biggest transaction in CP history. Even though CP will overtake one of the least significant US railway operators, the transaction will combine the two best performing Class 1 railroads for the past three years on a revenue growth basis. The acquisition would represent the most significant change in the US railroad industry since 1999 when CSX and Norfolk Southern took over Conrail for splitting it between each other. Following the final approval from the Surface Transportation Board (STB) and closing of the transaction, Kansas City Southern shareholders are expected to own a 25% stake in Canadian Pacific Railways, therefore having exposure to synergies from the combination, which analysts expect to be accretive to Canadian Pacific’s EPS in the first year and generate double-digit accretion upon full realization.

Once completed in 2022, the company - eventually renamed Canadian Pacific Kansas City - will become the sixth-largest freight rail system in North America and the only Canada, United States and Mexico freight rail network on the continent.

Industry Overview

Transportation Industry

Throughout the twentieth century, many countries provided state-owned transportation services, while others, such as the United States, imposed economic regulation on private transportation operations. The rationale for limiting competition was that high fixed costs could have potentially made private companies unable to cover costs when facing competitive price pressures. While operations owned by the state could achieve the goal of providing universal and affordable service by using government revenue to subsidize transit operations.

In the 1970s though, the potential for improving efficiency by promoting competition led to the deregulation and privatization of transportation sectors. Deregulation gave companies greater freedom to set rates and to enter markets that were previously restricted to incumbent carriers, incentivising them to adopt cost-saving strategies across all transportation sectors. Evidence of public transit efficiency gains indicates cost savings in the range of 9 to 23 percent in the U.S., according to a 1988 report by Roger Teal.

The performance of companies in the transportation industry is very sensitive to fluctuations in company earnings and the price of transportation services. Main factors affecting company earnings include fuel costs, labour costs, demand for services, geopolitical events, and government regulation, many of which are very interconnected. Oil prices are a key factor for the industry, as the commodity’s price generally has an influence on transportation expenses. Raises in gas and fuel prices increase costs for a trucking companies, eating into their profits and potentially reducing their stock price. Energy costs and the value of transportation stocks are certainly interrelated.

In sum, according to the World Bank, the role of transportation services as an engine of economic growth will gain in importance during the “twenty-first-century trend” toward economic globalization. Those economies that can provide easy access to affordable services will enjoy a considerable competitive advantage over others. In the future, such success will rely heavily on the ability to make efficient use of non-renewable energy sources in addition to the ability to develop new energy alternatives: the transport industry accounts for about 64% of global oil consumption, 27% of all energy use, and 23% of energy-related CO2 emissions.

Railroad Industry: History and Overview

The railroads are part of a broader freight-hauling industry that includes truckers, barge operators, and air transporters; they enable the efficient flow of goods from producers to consumers and are, therefore, a vital part of the broad economy. In the 1860s railroad companies in the North and Midwest (U.S.), supported by a fast-developing financial system based on Wall Street, managed to construct a network that links nearly every major city. The effects of the American railways on rapid industrial growth were many, including the opening of hundreds of millions of acres of very good farmland ready for mechanization, lower costs for food and all goods, a huge national sales market, and the creation of the modern system of management.

During the post-World War II boom many railroads were driven out of business due to competition from alternative transportation methods (airlines and Interstate highways): two of the largest remaining railroads, the Pennsylvania Railroad and the New York Central, merged in 1968 to form the Penn Central, and others were forced to consolidate their lines in order to remain successful. These changes led to the current system of fewer, but profitable, Class 1 railroads covering larger regions of the United States.

(Class 1 railroads are companies that have exceeded $250m in gross revenues for each of the previous two years (including Canadian Pacific and Kansas City Southern)).

On this note, one of the most impactful deals was made in 1999, when CSX Corporation and Norfolk Southern Railway (two Class 1 railroads in the Eastern US area), after a 5-months takeover battle, agreed to split and buy Conrail (the only remaining Class 1 railroad in the US) for a combined price of $10.2bn. Most analysts consider this a perfect example of the fact that hostile takeovers often lead the buyer(s) to over-pay for the target company.

Railroad Industry: Challenges and Competitors

Competition varies widely, depending on the route and freight category in question. Fixed networks limit direct competition between railroads, while speed and flexibility often give trucker companies, like Swift Transportation, an advantage on short routes. Rails have the upper hand on long hauls and can carry bulk freight, such as coal. Indeed, an estimated 65% of U.S. coal shipments are delivered to final domestic destinations by rail.

On contested routes, railroads are well-positioned to take business from truckers. The rails consume less fuel than trucks (to move equivalent freight loads) while emitting fewer carbon emissions. Amid a growing push to adopt "green" practices, shippers may well elect to move more of their wares by rail over time. In a high-fuel-price environment, moving freight by rail also makes better sense cost-wise.

Another element that is worth mentioning is the fact that the structure of railroads in North America has been quite stagnant ever since the Conrail breakup in 1997. For this exact reason, the acquisition of Kansas City Southern by Canadian Pacific Railway has a huge potential to rock the boat and change the outlook of the transportation industry as a whole.

Railroad Industry: Outlook

In the North American region, the industry is nowadays dominated by a handful of large operators, while countless short-line railroads provide regional and local service. Very few of the publicly held railroads are involved in ferrying passengers. However, they do generate certain noncore revenue and income streams, be it from haulage agreements (track usage fees) or railcar switching for industrial customers.

Underpinned by the economic expansion that peaked in late 2007, the railroads produced enviable profit growth and above-average investment returns. Consistent gains led many to posit that the industry had entered a period of sustainable growth. With that in mind, patient investors, willing to maintain positions throughout the economic cycle, may continue to enjoy positive returns within the sector, especially as these companies focus on improving normalized earnings and the efficiency of operations. At the same time, novice and sophisticated investors alike are urged to survey the greater economic climate before committing funds.

In mid-2020 PE titans, Blackstone Group and Global Infrastructure Partners, were exploring a $21bn bid for Kansas City Southern (the freight rail operator that serves north-eastern Mexico and the U.S. borderland). As a matter of fact, despite a 20% drop in rail freight volumes caused by the pandemic, interest has been steady for freight rail targets; especially for private-to-private investments in short-line operators, mainly because of their traditionally attractive free cash flow yield-to-equity characteristics, and (possibly) their tendency to attract less regulatory scrutiny compared to larger acquisitions.

Buyer and Target

Canadian Pacific Railway

Canadian Pacific Railway Limited (formally known as Canadian Pacific) is the owner and operator of a transcontinental freight railway in Canada and the United States. Headquartered in Calgary, Canada, the company operates in the railroad industry and focuses on the transportation of bulk commodities and merchandise freight, along with intermodal traffic that comprises retail goods in overseas containers.

The company was spun-off from Canadian Pacific limited in 2001 and sought growth through external acquisitions. In October 2007, it merged with Dakota, Minnesota and Eastern Railroad paying $1.48bn plus an additional $1bn for the construction of strategic railway connections. The operation granted Canadian Pacific access to agricultural, ethanol and coal shippers from the U.S. coalfields in Wyoming and the Powder River Basin. To further pursue inorganic growth, Canadian Pacific acquired Iowa, Chicago and Eastern Railroad in October 2008 and attempted a merger with American Railway in October 2014. As of October 2011, Bill Ackman’s Pershing Square Capital Management revealed a 14.2% stake in the company making it the majority owner and launched a proxy to enter the company’s Board of Directors, which successfully led to the election of all his proposed nominees. In June 2012 Ackman appointed E. Hunter Harrison, the former president of CN Rail, as CEO with the stated objective of achieving an operating ratio of 65% by 2015 (down from 81.3 in 2011). During the 5 years of Ackman’s ownership, the company generated a compounded annualized total shareholder return of 45.39%, outperforming both the S&P and TSX 60 indexes. In August 2016 Pershing Square Capital Management announced the sale of its remaining stake, netting out an estimated $2.6bn profit from the investment and leaving a more competitive and efficient company.

Canadian Pacific has competitive access to key markets in Canada and the U.S. and to major ports on the West and East Coasts. Moreover, the connections with Class 1 railroads and short-line partnerships extend the reach of the rail service whereas the access to a network of over 100 transload facilities extends the service reach to markets that are not directly served by rail.

On March 21, 2021, Canadian Pacific Railway (CP), owner and operator of a transcontinental freight railway in North America, agreed to acquire the transportation holding company Kansas City Southern (KCS) in a stock and cash transaction. The deal values Kansas City Southern at around $29bn with the inclusion of $3.8bn of outstanding debt and represents the largest takeover of the year so far as well as the biggest transaction in CP history. Even though CP will overtake one of the least significant US railway operators, the transaction will combine the two best performing Class 1 railroads for the past three years on a revenue growth basis. The acquisition would represent the most significant change in the US railroad industry since 1999 when CSX and Norfolk Southern took over Conrail for splitting it between each other. Following the final approval from the Surface Transportation Board (STB) and closing of the transaction, Kansas City Southern shareholders are expected to own a 25% stake in Canadian Pacific Railways, therefore having exposure to synergies from the combination, which analysts expect to be accretive to Canadian Pacific’s EPS in the first year and generate double-digit accretion upon full realization.

Once completed in 2022, the company - eventually renamed Canadian Pacific Kansas City - will become the sixth-largest freight rail system in North America and the only Canada, United States and Mexico freight rail network on the continent.

Industry Overview

Transportation Industry

Throughout the twentieth century, many countries provided state-owned transportation services, while others, such as the United States, imposed economic regulation on private transportation operations. The rationale for limiting competition was that high fixed costs could have potentially made private companies unable to cover costs when facing competitive price pressures. While operations owned by the state could achieve the goal of providing universal and affordable service by using government revenue to subsidize transit operations.

In the 1970s though, the potential for improving efficiency by promoting competition led to the deregulation and privatization of transportation sectors. Deregulation gave companies greater freedom to set rates and to enter markets that were previously restricted to incumbent carriers, incentivising them to adopt cost-saving strategies across all transportation sectors. Evidence of public transit efficiency gains indicates cost savings in the range of 9 to 23 percent in the U.S., according to a 1988 report by Roger Teal.

The performance of companies in the transportation industry is very sensitive to fluctuations in company earnings and the price of transportation services. Main factors affecting company earnings include fuel costs, labour costs, demand for services, geopolitical events, and government regulation, many of which are very interconnected. Oil prices are a key factor for the industry, as the commodity’s price generally has an influence on transportation expenses. Raises in gas and fuel prices increase costs for a trucking companies, eating into their profits and potentially reducing their stock price. Energy costs and the value of transportation stocks are certainly interrelated.

In sum, according to the World Bank, the role of transportation services as an engine of economic growth will gain in importance during the “twenty-first-century trend” toward economic globalization. Those economies that can provide easy access to affordable services will enjoy a considerable competitive advantage over others. In the future, such success will rely heavily on the ability to make efficient use of non-renewable energy sources in addition to the ability to develop new energy alternatives: the transport industry accounts for about 64% of global oil consumption, 27% of all energy use, and 23% of energy-related CO2 emissions.

Railroad Industry: History and Overview

The railroads are part of a broader freight-hauling industry that includes truckers, barge operators, and air transporters; they enable the efficient flow of goods from producers to consumers and are, therefore, a vital part of the broad economy. In the 1860s railroad companies in the North and Midwest (U.S.), supported by a fast-developing financial system based on Wall Street, managed to construct a network that links nearly every major city. The effects of the American railways on rapid industrial growth were many, including the opening of hundreds of millions of acres of very good farmland ready for mechanization, lower costs for food and all goods, a huge national sales market, and the creation of the modern system of management.

During the post-World War II boom many railroads were driven out of business due to competition from alternative transportation methods (airlines and Interstate highways): two of the largest remaining railroads, the Pennsylvania Railroad and the New York Central, merged in 1968 to form the Penn Central, and others were forced to consolidate their lines in order to remain successful. These changes led to the current system of fewer, but profitable, Class 1 railroads covering larger regions of the United States.

(Class 1 railroads are companies that have exceeded $250m in gross revenues for each of the previous two years (including Canadian Pacific and Kansas City Southern)).

On this note, one of the most impactful deals was made in 1999, when CSX Corporation and Norfolk Southern Railway (two Class 1 railroads in the Eastern US area), after a 5-months takeover battle, agreed to split and buy Conrail (the only remaining Class 1 railroad in the US) for a combined price of $10.2bn. Most analysts consider this a perfect example of the fact that hostile takeovers often lead the buyer(s) to over-pay for the target company.

Railroad Industry: Challenges and Competitors

Competition varies widely, depending on the route and freight category in question. Fixed networks limit direct competition between railroads, while speed and flexibility often give trucker companies, like Swift Transportation, an advantage on short routes. Rails have the upper hand on long hauls and can carry bulk freight, such as coal. Indeed, an estimated 65% of U.S. coal shipments are delivered to final domestic destinations by rail.

On contested routes, railroads are well-positioned to take business from truckers. The rails consume less fuel than trucks (to move equivalent freight loads) while emitting fewer carbon emissions. Amid a growing push to adopt "green" practices, shippers may well elect to move more of their wares by rail over time. In a high-fuel-price environment, moving freight by rail also makes better sense cost-wise.

Another element that is worth mentioning is the fact that the structure of railroads in North America has been quite stagnant ever since the Conrail breakup in 1997. For this exact reason, the acquisition of Kansas City Southern by Canadian Pacific Railway has a huge potential to rock the boat and change the outlook of the transportation industry as a whole.

Railroad Industry: Outlook

In the North American region, the industry is nowadays dominated by a handful of large operators, while countless short-line railroads provide regional and local service. Very few of the publicly held railroads are involved in ferrying passengers. However, they do generate certain noncore revenue and income streams, be it from haulage agreements (track usage fees) or railcar switching for industrial customers.

Underpinned by the economic expansion that peaked in late 2007, the railroads produced enviable profit growth and above-average investment returns. Consistent gains led many to posit that the industry had entered a period of sustainable growth. With that in mind, patient investors, willing to maintain positions throughout the economic cycle, may continue to enjoy positive returns within the sector, especially as these companies focus on improving normalized earnings and the efficiency of operations. At the same time, novice and sophisticated investors alike are urged to survey the greater economic climate before committing funds.

In mid-2020 PE titans, Blackstone Group and Global Infrastructure Partners, were exploring a $21bn bid for Kansas City Southern (the freight rail operator that serves north-eastern Mexico and the U.S. borderland). As a matter of fact, despite a 20% drop in rail freight volumes caused by the pandemic, interest has been steady for freight rail targets; especially for private-to-private investments in short-line operators, mainly because of their traditionally attractive free cash flow yield-to-equity characteristics, and (possibly) their tendency to attract less regulatory scrutiny compared to larger acquisitions.

Buyer and Target

Canadian Pacific Railway

Canadian Pacific Railway Limited (formally known as Canadian Pacific) is the owner and operator of a transcontinental freight railway in Canada and the United States. Headquartered in Calgary, Canada, the company operates in the railroad industry and focuses on the transportation of bulk commodities and merchandise freight, along with intermodal traffic that comprises retail goods in overseas containers.

The company was spun-off from Canadian Pacific limited in 2001 and sought growth through external acquisitions. In October 2007, it merged with Dakota, Minnesota and Eastern Railroad paying $1.48bn plus an additional $1bn for the construction of strategic railway connections. The operation granted Canadian Pacific access to agricultural, ethanol and coal shippers from the U.S. coalfields in Wyoming and the Powder River Basin. To further pursue inorganic growth, Canadian Pacific acquired Iowa, Chicago and Eastern Railroad in October 2008 and attempted a merger with American Railway in October 2014. As of October 2011, Bill Ackman’s Pershing Square Capital Management revealed a 14.2% stake in the company making it the majority owner and launched a proxy to enter the company’s Board of Directors, which successfully led to the election of all his proposed nominees. In June 2012 Ackman appointed E. Hunter Harrison, the former president of CN Rail, as CEO with the stated objective of achieving an operating ratio of 65% by 2015 (down from 81.3 in 2011). During the 5 years of Ackman’s ownership, the company generated a compounded annualized total shareholder return of 45.39%, outperforming both the S&P and TSX 60 indexes. In August 2016 Pershing Square Capital Management announced the sale of its remaining stake, netting out an estimated $2.6bn profit from the investment and leaving a more competitive and efficient company.

Canadian Pacific has competitive access to key markets in Canada and the U.S. and to major ports on the West and East Coasts. Moreover, the connections with Class 1 railroads and short-line partnerships extend the reach of the rail service whereas the access to a network of over 100 transload facilities extends the service reach to markets that are not directly served by rail.

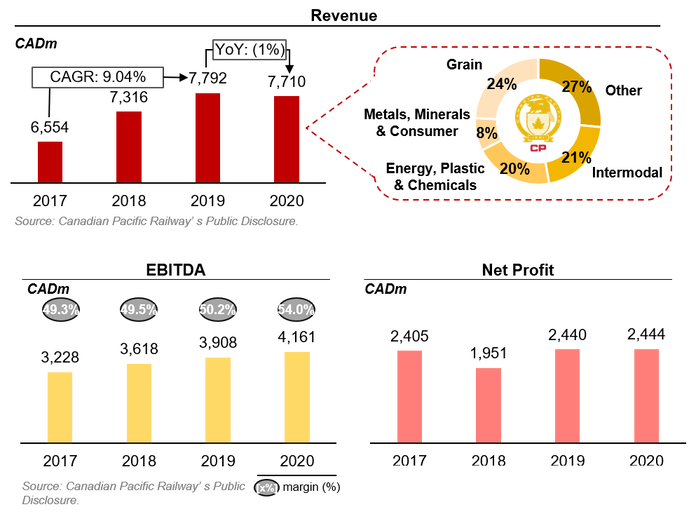

By focusing on providing best-in-class services at the lowest cost, the company showed its resilience in generating earnings growth through various economic environments, with adjusted diluted EPS growing 7% YoY in 2020, albeit revenues dropped 1% YoY as a result of the COVID-19 Pandemic. The precision performance strategy put in place by the company is driving stronger margins and top-line revenue growth with room for margin improvements targeting approximately 100 bps per year. The company improved its adjusted operating ratio by 420 bps in the last 4 years and is consistently investing $800mn per year in maintenance capital, with the rest of CAPEX plowed into rolling stock and network enhancement.

The main shareholder of Canadian Pacific is TCI Fund Management Ltd. (8.38%) - which manages the investment with a very high degree of activism - followed by Fidelity (6.54%), WCM Investment Management LLC (4.64%) and RBC Global Asset Management, Inc (3.63%) - that adopt instead a more passive investment strategy.

Kansas City Southern

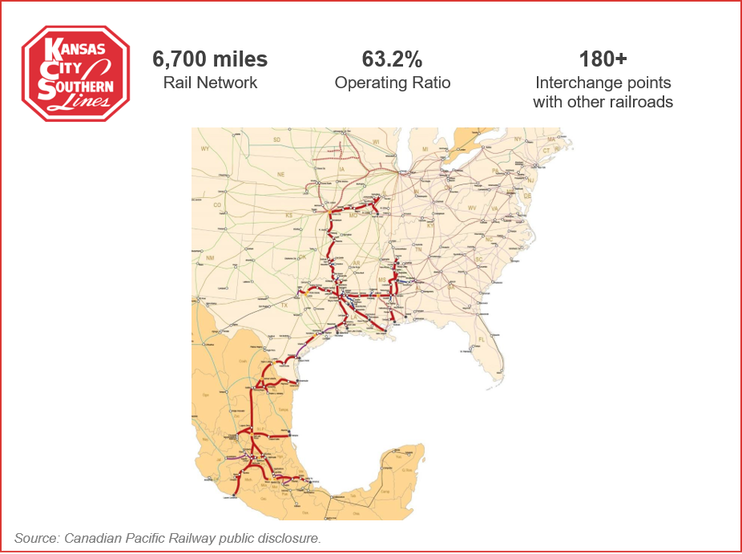

Kansas City Southern (also known as KCS) is a transportation holding company headquartered in Kansas City, Missouri that operates in the railroads industry. The company is the seventh Class I railroad in the US and provides domestic and international transportation services in North America, serving a wide array of markets, among which chemical and petroleum, industrial and consumer products, agriculture, minerals, energy and automotive.

In 2002, the Kansas City Southern Industries spun-off several subsidiaries whose business was not directly related to the railroads industry and changed its formal name to Kansas City Southern. In 2005, the company purchased Transportacion Maritima Mexicana’s (TMM) shares in Grupo Transportación Ferroviaria Mexicana (TFM) and Texas Mexican Railway (TM), giving them full ownership of the companies. With this move, the company secured full control of the Mexican government concession to operate a rail system in the country previously won in a KCS-TMM joint bid during the ‘90s. In September 2020, the company rejected a $23bn takeover offer from Global Infrastructure Partners, a Blackstone-led consortium that valued it at a 17% premium compared to its share high of February 2020.

Kansas City Southern’s rail network extends for approximately 7,100 route miles from the Midwest and Southeast portions of the United States south into Mexico. With 181 interchange points with other railroads (including all U.S. and Mexico Class I railroads), it services 12 Gulf ports and 1 Pacific Ocean port. Among Class I railroads, KCS competitive advantage derives from having the shortest route between Kansas City, which is the second-largest rail hub in the US, and the Gulf of Mexico.

Kansas City Southern

Kansas City Southern (also known as KCS) is a transportation holding company headquartered in Kansas City, Missouri that operates in the railroads industry. The company is the seventh Class I railroad in the US and provides domestic and international transportation services in North America, serving a wide array of markets, among which chemical and petroleum, industrial and consumer products, agriculture, minerals, energy and automotive.

In 2002, the Kansas City Southern Industries spun-off several subsidiaries whose business was not directly related to the railroads industry and changed its formal name to Kansas City Southern. In 2005, the company purchased Transportacion Maritima Mexicana’s (TMM) shares in Grupo Transportación Ferroviaria Mexicana (TFM) and Texas Mexican Railway (TM), giving them full ownership of the companies. With this move, the company secured full control of the Mexican government concession to operate a rail system in the country previously won in a KCS-TMM joint bid during the ‘90s. In September 2020, the company rejected a $23bn takeover offer from Global Infrastructure Partners, a Blackstone-led consortium that valued it at a 17% premium compared to its share high of February 2020.

Kansas City Southern’s rail network extends for approximately 7,100 route miles from the Midwest and Southeast portions of the United States south into Mexico. With 181 interchange points with other railroads (including all U.S. and Mexico Class I railroads), it services 12 Gulf ports and 1 Pacific Ocean port. Among Class I railroads, KCS competitive advantage derives from having the shortest route between Kansas City, which is the second-largest rail hub in the US, and the Gulf of Mexico.

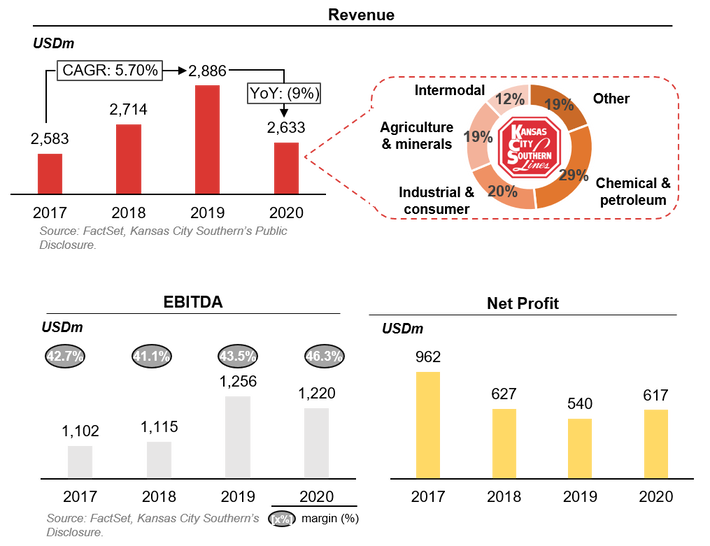

As a core strategy, Kansas City Southern aims at consistently being the fastest-growing, best-performing, most customer-focused transportation provider in North America. In this light, it leverages on the strategic location of its cross-border rail network and growth of the North American markets while maintaining operational excellence through investment in technologies, a strong cost discipline and a reliable operating environment. Prior to the Covid-19 pandemic, the company has delivered steadily improving key financial metrics, with a relevant growth in revenues, an operating ratio stable at around 64% and high EPS growth in the last 4 years. However, due to the recent disruption in the economy caused by the pandemic, KCS suffered a remarkable drop in revenues for the year 2020 (c.a. YoY -9%) showing a fairly low degree of resiliency to bad economic environments.

The shareholding structure of the company is dominated by Institutional Investors who represent 88.70% of the float, with the top 10 institutional holders owning 37.25% of the company. The Vanguard Group, Inc. is the largest shareholder (10.38%), followed by Massachusetts Financial Services Co. (7.40%), BlackRock Fund Advisors (5.61%) and SSgA Funds Management, Inc. (4.55%).

Deal Rationale

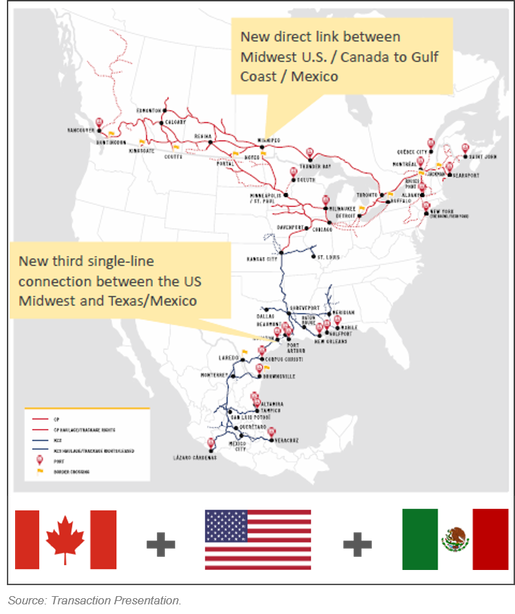

The transaction, which is by far the largest of the year, is to create the first U.S.-Mexico-Canada cross-continental rail network, employing roughly 20,000 employees throughout more than 20,000 miles of railroad.

Deal Rationale

The transaction, which is by far the largest of the year, is to create the first U.S.-Mexico-Canada cross-continental rail network, employing roughly 20,000 employees throughout more than 20,000 miles of railroad.

The business combination will expand the competitive options for customers and contribute significantly to the diversification of the business mix of the two railway companies. Keith Creel, Canadian Pacific Chief Executive Officer, declared: “This will create the first US-Mexico-Canada railroad . . . [and combine the] two best-performing Class 1 railroads for the past three years on a revenue growth basis.”

Canadian Pacific has been searching for a target in the past years without success, as part of an expansionary strategy in the North American continent. In particular, CP approached two of its largest rivals: CSX in 2014 and Norfolk Southern in 2016 but both attempts were unsuccessful. And finally, CP managed to find a suitable target that would allow it to implement a “north-south” strategy.

The booming post-pandemic US economy is only the part of the bigger rationale, while another important part of the deal reasoning is the new free trade agreement between the three countries of North America. The US-Mexico-Canada Trade Agreement (USMCA) that was supported by former President Donald Trump, and came into force in July 2020, significantly improved the trade projections among the three countries for the next decade.

The deal is to have a serious impact on the overall structure of the North American railroad industry comparable to that of the 1999 case when CSX and Norfolk Southern – the two big operators in the eastern US – took over Conrail and split it.

Canadian Pacific has been searching for a target in the past years without success, as part of an expansionary strategy in the North American continent. In particular, CP approached two of its largest rivals: CSX in 2014 and Norfolk Southern in 2016 but both attempts were unsuccessful. And finally, CP managed to find a suitable target that would allow it to implement a “north-south” strategy.

The booming post-pandemic US economy is only the part of the bigger rationale, while another important part of the deal reasoning is the new free trade agreement between the three countries of North America. The US-Mexico-Canada Trade Agreement (USMCA) that was supported by former President Donald Trump, and came into force in July 2020, significantly improved the trade projections among the three countries for the next decade.

The deal is to have a serious impact on the overall structure of the North American railroad industry comparable to that of the 1999 case when CSX and Norfolk Southern – the two big operators in the eastern US – took over Conrail and split it.

In particular, the combination connects six of the seven largest metro regions in North America and will create a new direct link between Midwest U.S. and Canada to the Gulf Coast and Mexico as well as a new third single-line connection between the US Midwest and Texas/Mexico. This will considerably enhance Canadian Pacific and Kansas City Southern strategic positioning in the North America Railroad and Transportation industry, unlocking new markets, investment opportunities and service offerings.

As far as the revenues are concerned, the combined annual revenues for 2020 amount to $8.7bn. Canadian Pacific Railway and Kansas City Southern are among the railroads with the highest 3-year Constant Annualized Growth Rate (CAGR) and this deal will considerably enhance the revenue projections for the newly formed group.

As far as the revenues are concerned, the combined annual revenues for 2020 amount to $8.7bn. Canadian Pacific Railway and Kansas City Southern are among the railroads with the highest 3-year Constant Annualized Growth Rate (CAGR) and this deal will considerably enhance the revenue projections for the newly formed group.

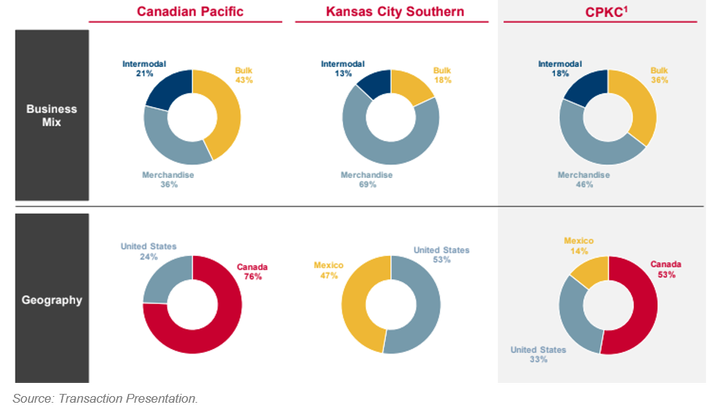

The deal will contribute not only to increase the scale of revenues but also to diversify the market exposure of the two companies which currently focus on different freight markets. With regards to the business mix, the pre-synergy annual revenues for 2020 of the new group depend by 46% on Merchandise freight, 36% on Bulk freight and the remaining 18% on Intermodal freight. From a geographical point of view, 53% of revenues is related to operations in Canada, 33% in the U.S. and the remaining 14% in Mexico.

Forecasts for the business combination include the generation of $780m of annualized synergies within three years, comprising $600m in EBITDA Growth derived from market opportunities such as the expanded market reach in North America and the planned investments in network sidings and extensions. The remaining $180m are Cost and Efficiency improvements ranging from fuel, equipment rents to facilities, IT and G&A costs. The post-synergies free cash flow generation per year amounts to $2bn.

On the financial side, the merger would allow a continued commitment in maintaining a solid balance sheet and retaining the investment-grade rating, considered by the management of the two firms essential to perform ordinary financing operations as well as to implement the forecasted capital investments. At the same time, the combined entity would be able to deleverage efficiently, expecting to decrease leverage from 3.8x 2021 to ~2.5x in 2023.

In terms of ESG, the strategy of the new group will focus on the reduction of emissions and improvement of the fuel efficiency of locomotives, parallel to the ongoing innovation in the sector through the development of the 1st line-haul hydrogen locomotive in North America. A significant portion of the investment is allocated to safety, comprising the development of a Centralized Train Control and the implementation of predictive analytics to reduce failures.

Deal Structure

On the 21st of March 2021, Canadian Pacific Railway Limited agreed to acquire Kansas City Southern in a stock and cash transaction, representing an enterprise value of $29bn, which includes the assumption of $3.8bn of outstanding KCS debt. The offer came in at $275 per share, representing a 26% premium on unaffected 30d VWAP and 23% on KCS’ closing price (on the 19th of March). Following the closing into a common trust, common shareholders of KCS will receive 0.489 of a CP share and $90 in cash for each KCS common share held, whereas preferred shareholders will receive $37.50 in cash for each (KCS) share.

Transaction value of $29bn will result in the implied valuation of 20.4x EV/ EBITDA (LTM) and 40.6x P/E (LTM).

To fund the stock portion of the merger, CP will issue 44.5m new shares, whereas the cash portion will be funded through a combination of cash-on-hand and by raising approximately $8.6bn in debt, for which financing has been committed. The combined entity will be named Canadian Pacific Kansas City (CPKC), and KCS shareholders are expected to own 25% of the combined company.

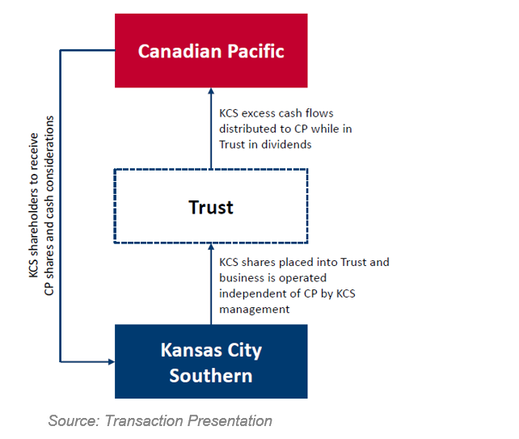

Due to the regulation requirements transaction will be executed as a 2-step process which is a standard procedure for the railroad industry. First, CP will establish an independent voting trust to acquire the shares of KCS. Upon shareholder approval of the transaction and satisfaction of customary closing conditions, the Canadian company will acquire KCS’ shares and place them into the voting trust (expected to be completed in the second half of 2021), at which point KCS shareholders will receive their consideration. CP’s placement of KCS shares into the voting trust will insulate KCS from control by CP until the Surface Transportation Board (STB) authorizes control, and KCS’ management and Board of Directors will continue to steward the company while it is in trust. The STB is an independent federal agency established in 1996 to assume some regulatory functions that had been previously administered by the Interstate Commerce Commission (ICC), abolished in the same year. The Board’s approval is a vital part of all M&A transactions regarding the railroad sector, as it seeks to ensure a balanced and sustainable competition, as well as an enhanced economic efficiency within the industry.

Forecasts for the business combination include the generation of $780m of annualized synergies within three years, comprising $600m in EBITDA Growth derived from market opportunities such as the expanded market reach in North America and the planned investments in network sidings and extensions. The remaining $180m are Cost and Efficiency improvements ranging from fuel, equipment rents to facilities, IT and G&A costs. The post-synergies free cash flow generation per year amounts to $2bn.

On the financial side, the merger would allow a continued commitment in maintaining a solid balance sheet and retaining the investment-grade rating, considered by the management of the two firms essential to perform ordinary financing operations as well as to implement the forecasted capital investments. At the same time, the combined entity would be able to deleverage efficiently, expecting to decrease leverage from 3.8x 2021 to ~2.5x in 2023.

In terms of ESG, the strategy of the new group will focus on the reduction of emissions and improvement of the fuel efficiency of locomotives, parallel to the ongoing innovation in the sector through the development of the 1st line-haul hydrogen locomotive in North America. A significant portion of the investment is allocated to safety, comprising the development of a Centralized Train Control and the implementation of predictive analytics to reduce failures.

Deal Structure

On the 21st of March 2021, Canadian Pacific Railway Limited agreed to acquire Kansas City Southern in a stock and cash transaction, representing an enterprise value of $29bn, which includes the assumption of $3.8bn of outstanding KCS debt. The offer came in at $275 per share, representing a 26% premium on unaffected 30d VWAP and 23% on KCS’ closing price (on the 19th of March). Following the closing into a common trust, common shareholders of KCS will receive 0.489 of a CP share and $90 in cash for each KCS common share held, whereas preferred shareholders will receive $37.50 in cash for each (KCS) share.

Transaction value of $29bn will result in the implied valuation of 20.4x EV/ EBITDA (LTM) and 40.6x P/E (LTM).

To fund the stock portion of the merger, CP will issue 44.5m new shares, whereas the cash portion will be funded through a combination of cash-on-hand and by raising approximately $8.6bn in debt, for which financing has been committed. The combined entity will be named Canadian Pacific Kansas City (CPKC), and KCS shareholders are expected to own 25% of the combined company.

Due to the regulation requirements transaction will be executed as a 2-step process which is a standard procedure for the railroad industry. First, CP will establish an independent voting trust to acquire the shares of KCS. Upon shareholder approval of the transaction and satisfaction of customary closing conditions, the Canadian company will acquire KCS’ shares and place them into the voting trust (expected to be completed in the second half of 2021), at which point KCS shareholders will receive their consideration. CP’s placement of KCS shares into the voting trust will insulate KCS from control by CP until the Surface Transportation Board (STB) authorizes control, and KCS’ management and Board of Directors will continue to steward the company while it is in trust. The STB is an independent federal agency established in 1996 to assume some regulatory functions that had been previously administered by the Interstate Commerce Commission (ICC), abolished in the same year. The Board’s approval is a vital part of all M&A transactions regarding the railroad sector, as it seeks to ensure a balanced and sustainable competition, as well as an enhanced economic efficiency within the industry.

The STB review is expected to be completed by the middle of 2022 and, upon obtaining control approval, only at this moment the two companies will be integrated, unlocking the benefits of the merger.

Market Reaction

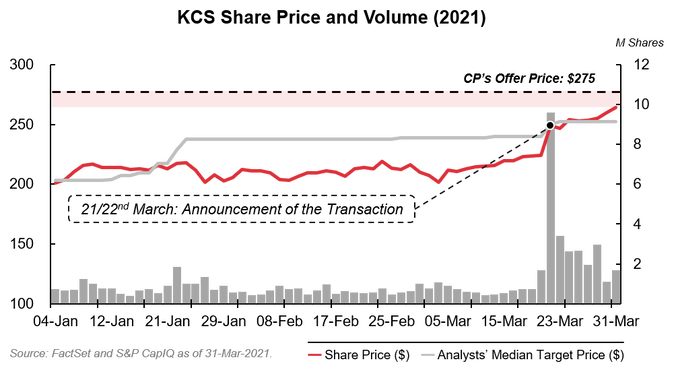

On Friday 19th March, the trading day before the announcement, Kansas City Southern stock (NYSE: KSU) stood at $224.16, implying an acquisition premium on the price per share of 22.9%. If the one week and one-month prior prices are considered, the acquisition premium rises respectively to 27.8% and 29.5%.

The market response to the deal announcement has been rather mild and on 22nd March, KSU price increased by 11.1% and climbed to $249.09. During the following week, KSU price remained relatively stable and eventually closed at $253.62 on March 26th and $263.92 on March 31st. However, the price stayed significantly below the offer price of $275 indicating market’s concern regarding the approval of the deal by the Surface Transportation Board (STB) and potential execution risk. The median target price of analysts demonstrated a positive trend but still stayed far below the offer price confirming market concerns regarding the deal execution.

Market Reaction

On Friday 19th March, the trading day before the announcement, Kansas City Southern stock (NYSE: KSU) stood at $224.16, implying an acquisition premium on the price per share of 22.9%. If the one week and one-month prior prices are considered, the acquisition premium rises respectively to 27.8% and 29.5%.

The market response to the deal announcement has been rather mild and on 22nd March, KSU price increased by 11.1% and climbed to $249.09. During the following week, KSU price remained relatively stable and eventually closed at $253.62 on March 26th and $263.92 on March 31st. However, the price stayed significantly below the offer price of $275 indicating market’s concern regarding the approval of the deal by the Surface Transportation Board (STB) and potential execution risk. The median target price of analysts demonstrated a positive trend but still stayed far below the offer price confirming market concerns regarding the deal execution.

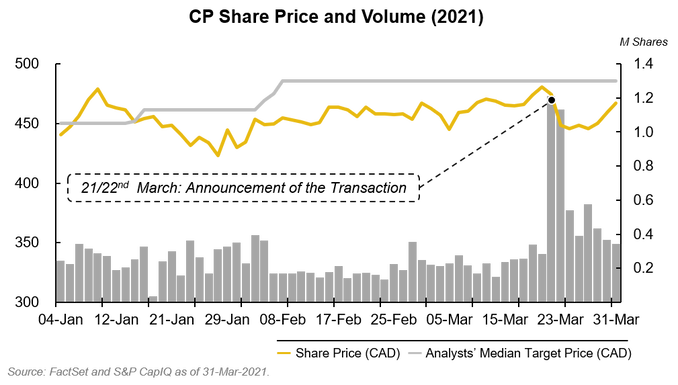

As far as the buyer is concerned, Canadian Pacific Railway stock (TSE: CP) was trading at CAD 474.27 ($379.42) on Friday 19th March. After the deal announcement, the market reaction was rather negative, as common for similar deals. CP price dropped by 5.4% to CAD 448.60 as investors proved to be concerned about the significant premium that Canadian Pacific Railway offered to pay for the acquisition. The price eventually almost returned to its pre-deal level and stabilized at CAD 467.27 on 31st March.

Advisors

During the deal negotiation, Evercore Group L.L.C. acted as financial advisor to the Board of Directors of Canadian Pacific Railway while BMO Nesbitt Burns Inc. and Goldman Sachs Canada Inc. acted as financial advisors to Canadian Pacific Railway Limited.

BSCM would like to thank FactSet for giving us access to their platform and providing charts and data.

Emanuele Delfino

Edoardo Pelli

Federico Panariello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Sources:

During the deal negotiation, Evercore Group L.L.C. acted as financial advisor to the Board of Directors of Canadian Pacific Railway while BMO Nesbitt Burns Inc. and Goldman Sachs Canada Inc. acted as financial advisors to Canadian Pacific Railway Limited.

BSCM would like to thank FactSet for giving us access to their platform and providing charts and data.

Emanuele Delfino

Edoardo Pelli

Federico Panariello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

Sources:

- FactSet

- S&P CapIQ

- Canadian Pacific public disclosure

- Kansas City Southern public disclosure

- Official Transaction presentation

- FT

- World Bank

- STB

- U.S. Federal Railroad Administration