INDUSTRY OVERVIEW AND COMPARISON

Over the last decade, pharmaceutical companies and biotech firms have deployed outstanding amounts of capital and rendered this sector a multi-billion business. Their commitment to long term growth through innovation and intense research is attested by the fact that Big Pharma and Biotech regularly rank as the business sectors with the highest expenses in R&D. It is not unusual for firms operating in this industry to outsource, on a contractual basis, a share of their research services to other specialized companies, called Contract Research Organizations (CROs): it is a trend expected to increase in the foreseeable future as a way to reduce clinical development costs and focus resources on their core competencies. The activities covered comprise some critical functions of the clinical and preclinical stages of the drug development process.

The prevalent form of contractual relationship between CROs and its customers is still on a fixed-price basis. However, growing dissatisfaction in the industry led to a shift towards the unit-based pricing. The latter uses a proxy based on the completion of tasks and the number of hours needed to perform each task. However, criticisms towards this model arise from the sometimes needlessly length for an experimental drug to be approved and distributed on the market, 12 years on average. It implies the presence of variability in the quality of the visit to trial sites, dependent on the skills and the efficiency of the individual, whilst forcing vendors to incur in the same costs despite outcomes achieved.

A next step in the obligations’ evolution has been the adoption of a more flexible payment model that is outcome-driven and, thus, aims at establishing a proper set of incentives to complete trials in a timely and cost-effective manner. Being focused on productivity, it will also prompt innovation and result in higher-quality data, shorter timelines and better margins, as well as promoting long-term stability in the biopharma-outsourcing partner relationships.

The Commercial Physical Research industry is highly competitive, given its persisting high fragmentation in hundreds of limited-scope service providers and few globally covering companies, despite an increasing level of consolidation over the last decade. Index of long-term growth for the stock by endowments and hedge funds shows that the stocks of companies in this industry are held mostly by institutional investors (51.1%), while company insiders amount to no more than 17.4%.

Data from Q4 of 2019 and the first few months of 2020 highlights that CRO service market size is valued at more than $51 billion, and it is forecasted to reach approximately $91 billion by the end of 2026, exhibiting a CAGR of 11.4% in the projected period 2016-2026, given substantial funding in the Biotech sector growth, directly impacting on the growth in R&D spending.

The top biotech regions are Europe and North America, with the latter holding a dominating share which includes nearly 4,000 research services establishments on the US territory. Expansion of the service is demand-driven, at a significant rate, in the Asia Pacific region, and subsequently growing regulatory

harmonization is expected.

Over the last decade, pharmaceutical companies and biotech firms have deployed outstanding amounts of capital and rendered this sector a multi-billion business. Their commitment to long term growth through innovation and intense research is attested by the fact that Big Pharma and Biotech regularly rank as the business sectors with the highest expenses in R&D. It is not unusual for firms operating in this industry to outsource, on a contractual basis, a share of their research services to other specialized companies, called Contract Research Organizations (CROs): it is a trend expected to increase in the foreseeable future as a way to reduce clinical development costs and focus resources on their core competencies. The activities covered comprise some critical functions of the clinical and preclinical stages of the drug development process.

The prevalent form of contractual relationship between CROs and its customers is still on a fixed-price basis. However, growing dissatisfaction in the industry led to a shift towards the unit-based pricing. The latter uses a proxy based on the completion of tasks and the number of hours needed to perform each task. However, criticisms towards this model arise from the sometimes needlessly length for an experimental drug to be approved and distributed on the market, 12 years on average. It implies the presence of variability in the quality of the visit to trial sites, dependent on the skills and the efficiency of the individual, whilst forcing vendors to incur in the same costs despite outcomes achieved.

A next step in the obligations’ evolution has been the adoption of a more flexible payment model that is outcome-driven and, thus, aims at establishing a proper set of incentives to complete trials in a timely and cost-effective manner. Being focused on productivity, it will also prompt innovation and result in higher-quality data, shorter timelines and better margins, as well as promoting long-term stability in the biopharma-outsourcing partner relationships.

The Commercial Physical Research industry is highly competitive, given its persisting high fragmentation in hundreds of limited-scope service providers and few globally covering companies, despite an increasing level of consolidation over the last decade. Index of long-term growth for the stock by endowments and hedge funds shows that the stocks of companies in this industry are held mostly by institutional investors (51.1%), while company insiders amount to no more than 17.4%.

Data from Q4 of 2019 and the first few months of 2020 highlights that CRO service market size is valued at more than $51 billion, and it is forecasted to reach approximately $91 billion by the end of 2026, exhibiting a CAGR of 11.4% in the projected period 2016-2026, given substantial funding in the Biotech sector growth, directly impacting on the growth in R&D spending.

The top biotech regions are Europe and North America, with the latter holding a dominating share which includes nearly 4,000 research services establishments on the US territory. Expansion of the service is demand-driven, at a significant rate, in the Asia Pacific region, and subsequently growing regulatory

harmonization is expected.

Source: Fortune Business Insights

Competition at the Laboratory service level is measured on the basis of testing capability, scientific and therapeutic experience, global footprint, price, quality and speed. Similarly, the clinical development service segment competes consistently to scientific and therapeutic experience, project team expertise, qualifications and experience, ability to recruit patients, price, quality and the ability to innovate to achieve time and cost savings for our customers.

BUSINESS ANALYSIS

Pharmaceutical Product Development LLC (PPD) is a Contract Research Organization (CRO), headquartered in Wilmington, North Carolina. The company provides integrated drug development, laboratory and lifecycle management services. PPD’s medical and scientific expertise encompasses a wide range of therapy areas including cardiovascular system, critical care, dermatology, gastroenterology, hematology, cancer, infectious diseases, ophthalmology, respiratory, endocrine systems, metabolism, rare diseases and urology. Its services are highly demanded by pharmaceutical, biotechnology, medical device, and academic and government organizations.

PPD was founded, as a one-person consulting firm, by Fred Eshelman in 1985 in Maryland and, four years later, was incorporated in North Carolina. In January 1996, PPD issued its first initial public stock offering on the Nasdaq. The company remained publicly traded until Dec 2011, when affiliates of the Carlyle Group and Hellman & Friedman, the Majority Sponsors, agreed to buy PPD for $3.9 billion in cash, one of the most prominent LBOs of that year. Furthermore, in April 2017, the Majority Sponsors agreed on a recapitalization of PPD that expanded its ownership structure to include two new investors, the Abu Dhabi investment authority and GIC Private Limited, Singapore’ sovereign fund. This transaction was based on a total enterprise value of $9.05 bn, clear sign of the exceptional growth experienced by PPD since going private in 2011.

Noteworthily, PPD went for 11 acquisitions. Amongst all, Evidera Holdings Inc. full takeover placed on September 2016 for $170.5 million stands out, given its contribution to health economics research and market data access to the provision of evidence-based solutions for pharmaceutical products. On the same year, $267.1 million accounted for the most expensive purchase in 100% of the clinical trial site network Synexus. More recently dated, in 2019, two full equity preliminary purchases have been made: on July 1st, the insight-provider technology company Medimix International was sold for $37.8 million, including $5 million in common stocks; while on September 3rd a cash on hand payment of $50.4 million for the research site Synarc Inc. was concluded.

Once a novel therapy is launched, customers benefit from lengthened market exclusivity periods, backed up with real-world evidence solutions proved by the innovative technologies and global regulatory knowledge embedded into their vast scientific expertise. PPD has gradually accomplished a leading role in the CROs industry, helping clients and their maximization of returns on R&D investments, strategically bending the cost and time curve of the clinical trials by accelerating therapeutics integration. That includes further strengthening their offering and expanding leading expertise in existing and novel geographies, critical to address pipelines and conduct integrated, simultaneous and multicentered researches specifically in the hematology/oncology areas, accounting for 75% of the total R&D spending. Further to this, through the Accelerated Enrollment solutions model, PPD is efficiently targeting one of the major challenges faced during clinical trials: patient recruitment. Its strategy mainly involves consolidating its existing network of clinical sites (over 180 in 17 countries) and providing support to leading independent ones. Using the aid of data-driven insights and advanced technology, the company aims at fostering more patient engagement and retention. This is accompanied by a commitment to contract with physicians, who serve as investigators to ensure that clinical trials regulatory requirements are respected and to safeguard the health of the patients. Moreover, capitalizing on the dedicated biotech laboratory services is essential for providing higher backlog visibility, significant operating leverage affordability and related conversion rates, being the underlying segment source of 18.3% company’s 2018 total direct revenues. At the interim, clinical development services segment represented 81.2% and 82.2% of the 9 months direct revenue for September 2019 and 2018, with the negligible remainder deriving from products sale.

BUSINESS ANALYSIS

Pharmaceutical Product Development LLC (PPD) is a Contract Research Organization (CRO), headquartered in Wilmington, North Carolina. The company provides integrated drug development, laboratory and lifecycle management services. PPD’s medical and scientific expertise encompasses a wide range of therapy areas including cardiovascular system, critical care, dermatology, gastroenterology, hematology, cancer, infectious diseases, ophthalmology, respiratory, endocrine systems, metabolism, rare diseases and urology. Its services are highly demanded by pharmaceutical, biotechnology, medical device, and academic and government organizations.

PPD was founded, as a one-person consulting firm, by Fred Eshelman in 1985 in Maryland and, four years later, was incorporated in North Carolina. In January 1996, PPD issued its first initial public stock offering on the Nasdaq. The company remained publicly traded until Dec 2011, when affiliates of the Carlyle Group and Hellman & Friedman, the Majority Sponsors, agreed to buy PPD for $3.9 billion in cash, one of the most prominent LBOs of that year. Furthermore, in April 2017, the Majority Sponsors agreed on a recapitalization of PPD that expanded its ownership structure to include two new investors, the Abu Dhabi investment authority and GIC Private Limited, Singapore’ sovereign fund. This transaction was based on a total enterprise value of $9.05 bn, clear sign of the exceptional growth experienced by PPD since going private in 2011.

Noteworthily, PPD went for 11 acquisitions. Amongst all, Evidera Holdings Inc. full takeover placed on September 2016 for $170.5 million stands out, given its contribution to health economics research and market data access to the provision of evidence-based solutions for pharmaceutical products. On the same year, $267.1 million accounted for the most expensive purchase in 100% of the clinical trial site network Synexus. More recently dated, in 2019, two full equity preliminary purchases have been made: on July 1st, the insight-provider technology company Medimix International was sold for $37.8 million, including $5 million in common stocks; while on September 3rd a cash on hand payment of $50.4 million for the research site Synarc Inc. was concluded.

Once a novel therapy is launched, customers benefit from lengthened market exclusivity periods, backed up with real-world evidence solutions proved by the innovative technologies and global regulatory knowledge embedded into their vast scientific expertise. PPD has gradually accomplished a leading role in the CROs industry, helping clients and their maximization of returns on R&D investments, strategically bending the cost and time curve of the clinical trials by accelerating therapeutics integration. That includes further strengthening their offering and expanding leading expertise in existing and novel geographies, critical to address pipelines and conduct integrated, simultaneous and multicentered researches specifically in the hematology/oncology areas, accounting for 75% of the total R&D spending. Further to this, through the Accelerated Enrollment solutions model, PPD is efficiently targeting one of the major challenges faced during clinical trials: patient recruitment. Its strategy mainly involves consolidating its existing network of clinical sites (over 180 in 17 countries) and providing support to leading independent ones. Using the aid of data-driven insights and advanced technology, the company aims at fostering more patient engagement and retention. This is accompanied by a commitment to contract with physicians, who serve as investigators to ensure that clinical trials regulatory requirements are respected and to safeguard the health of the patients. Moreover, capitalizing on the dedicated biotech laboratory services is essential for providing higher backlog visibility, significant operating leverage affordability and related conversion rates, being the underlying segment source of 18.3% company’s 2018 total direct revenues. At the interim, clinical development services segment represented 81.2% and 82.2% of the 9 months direct revenue for September 2019 and 2018, with the negligible remainder deriving from products sale.

Source: Jefferies

A growing customers base, disciplined operation and financial approach in evaluating investments in capital efficient innovation opportunities are also key competitive strengths of the firm. In this regard, recent investments carry peri- and post-approval studies, site access and purpose-built PPD Biotech offering, leading to the achievement of strong financial results. No one customer accounts to more than 10% of the December 2019 revenues on a yearly basis, with the top 10 bringing in 47.5%, 50.5% and 49.5% of the company’s revenues for the years ended December 31, 2018, 2017 and 2016, respectively. Accordingly, their diversity prevents from incurring into concentration risk.

Source: Factset

PPD’s revenues are mostly concentrated in the US and Europe: revenues breakdown is almost the same in the last two years. Their activity is mainly pursued in developed countries: this is quite reasonable given the type of research and products they offer, based on new technologies, that in the vast majority of cases requires transparency and certain environmental standards. In addition, as mentioned in the first section of this article, US and Europe represent the dominating region for CRO and the one with the highest number of structures. Africa and Middle East represents the region in which they operate the least.

In the next years, revenues are expected to grow by 3.4% in 2020 and by 10.95% in 2021. These are pre-Covid 19 estimates and since its region of activity concerns all developed countries in which the lockdown has significantly impacted the economy, revenues growth estimates will be revised toward a lower value. Many firms in the CRO and pharma sector are fighting with the effects caused by the pandemic, which is changing the way they approach the business. The first segment that has been affected concerns on-going trials: pharma companies are trying to identify possible shutdowns at suppliers or logistic interruptions, while at the same time they are dealing with local lab testing capacity, patient retention and serious adverse event risks.

It is interesting to look at the financial results of PPD compared with its main competitors: Syneos Health, IQVIA, PRA Health, Eurofins Scientific, ICON.

In the next years, revenues are expected to grow by 3.4% in 2020 and by 10.95% in 2021. These are pre-Covid 19 estimates and since its region of activity concerns all developed countries in which the lockdown has significantly impacted the economy, revenues growth estimates will be revised toward a lower value. Many firms in the CRO and pharma sector are fighting with the effects caused by the pandemic, which is changing the way they approach the business. The first segment that has been affected concerns on-going trials: pharma companies are trying to identify possible shutdowns at suppliers or logistic interruptions, while at the same time they are dealing with local lab testing capacity, patient retention and serious adverse event risks.

It is interesting to look at the financial results of PPD compared with its main competitors: Syneos Health, IQVIA, PRA Health, Eurofins Scientific, ICON.

Source: Factset

The growth of PPD in the last year is in line with its peers: the company seems to be very profitable and the Gross Margin is above the average of 31.4%. From this data, it is possible to understand that the financial structure of PPD affects its profitability: in fact, EBIT Margin and EBITDA Margin are both above all the other comparables, but at the end PPD’s Net Margin is lower. This fact is probably due to high leverage and relevant interest expenses that characterizes PPD. In the next section the article will go in depth on the risks associated with debt.

RISK PROFILE

Evaluating the risk factors involved in the investment in PPD common stock is fundamental to ascertains the presence of contingencies whose occurrence could potentially harm the financial and non-financial performance of the company, the results of the operations and its prospective growth.

Firstly, the CRO industry is fragmented and highly competitive. Covance Inc. , ICON plc , IQVIA Holdings Inc. , PAREXEL International Corporation, PRA Health Sciences, Inc. and Syneos Health, Inc are only some of PPD’s main competitors. Eventually, biopharmaceutical companies began to show an undisputable tendency to establish long-term partnership and alliances with a selected number of CROs. The harsh reaction by firms operating in this industry soon turned into intense competition on price and other commercial terms and led many CROs to enter into less favorable contractual relationship with their clients. A non-improbable escalation of this conditions may adversely affect PPD’s business.

The company’s financial condition and cash flows are inevitably linked to the health of the biopharmaceutical sector. As a matter of tact, trends in R&D spending and the rate of outsourcing by bio pharmaceutical companies are key determinants of PPD’s operations, with particular regards to clinical development, whose revenues amounted to $2,545 mln in December 2019. Furthermore, excessively high levels of concentration in the Big Pharma and Biotech sector could result in a fall in the number of potential consumers and drugs being developed and, on the other hand, cut-throat competition could seriously limit the scope of PPD’s operations insofar as consumers may negotiate restrictions on the company’s ability to provide services to their own competitors. These latter comprise additional concerns for investors willing to own an equity stake in PPD.

Developing new drugs with market approval on safety and efficacy entails high out-of-pocket and time costs. Estimated expenses go beyond $2.5 billion over a 15-year timespan required to deliver a new product. Therefore, failure or inadequate performance of the services, besides compromising the results and the usefulness of the trials, may imply huge losses. Undeniably, the testing of new drugs on volunteers participating in clinical trials (Phase I-III of the clinical services) and the eventual sale to the public at large exposes PPD to the risk of liability for death or injury. According to this, the PPD’s performance of services is subject to very strict contractual requirements, regulatory standards and ethical consideration and non-compliance to this terms may cause the intervention of regulatory agencies through sanctions, delay/suspension of marketing and testing approval, civil or criminal prosecutions and operational restrictions.

To have a complete overview of the risks that an investor might face by investing in PPD, it is fundamental to assess if the business is safe and sound from a financial standpoint. The company is clearly highly leveraged: the LT Debt/Total Assets ratio is higher than 1 meaning that PPD’s future obligations will be substantial and it may affect its future profitability. Indeed, the firm’s Interest Coverage Ratio (EBIT/Interest Expense), equal to 1.3, is below the peers’ average of 3.74. An analysis of liquidity ratios is necessary to gain a clearer insight. Last year, the company Current Ratio was equal to 0.9, lower with respect to the 1.1 of the year before. This variation may indicate that PPD have some problems in meeting its short-term obligations, even though it does not seem warning considered the industry average. This concern comes from the extraordinary high level of the Debt/EBITDA ratio, which is 7.7 and has shown an increasing pattern during the last three years. Furthermore, the Net Change in Cash from last year is -$207 million. By going in depth into the liability side, PPD’s Gross Debt amounts to $4,193.9 million, of which almost 70% is represented by Term Loans, while the remaining part has been covered by issuing bonds: part of the proceeds of the IPO will be used to pay back Senior Notes due 2022. S&P’s last report rated PPD’s credit position B+ on 11th February 2020.

By looking only to most liquid assets and the firm’s ability to meet obligations that came due immediately, the landscape become clearer: the Quick Ratio is almost equal to the Current Ratio and above one. The reason can be found in the characteristics of the business: Inventory and Prepaid expenses are relatively low considering the focus of the company on R&D.

DEAL RATIONALE AND VALUATION

PPD’s growth strategy needs fundings to be implemented, so the firm decided to start trading their shares on capital markets. On 5th February 2020, PPD successfully listed on Nasdaq. PPD issued on the market 60,000,000 shares at a price of $27. The underwriters have been granted an option to purchase up to 9,000,000 additional shares of common stock at any time within 30 days from the date of this prospectus to cover over-allotments (Greenshoe).

The net proceeds from the offering, after deducting underwriting discounts, commissions and estimated offering expenses, will be approximately $1,533.6 million. This amount will be mainly devoted to redeem $550 million in aggregate principal amount of the 7.625%/8.375% Senior PIK Toggle Notes due 2022, plus accrued and unpaid interest thereon and $5.5 million of redemption premium. After that, $900.0 million in aggregate principal amount of the 7.75%/8.50% Senior PIK Toggle Notes due 2022, plus accrued and unpaid interest thereon and $9.0 million of redemption premium. Any excess net proceeds from this offering will be used for general corporate purposes, which may include, among other things, further repayment of indebtedness.

Many advisors participated in the valuation process and the offering was led by Barclays, J.P. Morgan Chase, Morgan Stanley and Goldman Sachs. Sixteen banks underwrote the deal. The IPO has been valued at approximately $1.62 billion. The initial price range during marketing activity was between $24 and $27. The advisors to complete the valuation have taken into account many variables that it is necessary to analyze in order to perform a proper valuation of the company. By running an Asset Side valuation, the Enterprise Value can be derived by considering a long-term growth rate of 14.4% (prior of the spread of Covid-19) and WACC = 11.36%. The valuation that follows is the result of a stable growth model elaborated by our analysts and it is compared to IPO’s features.

RISK PROFILE

Evaluating the risk factors involved in the investment in PPD common stock is fundamental to ascertains the presence of contingencies whose occurrence could potentially harm the financial and non-financial performance of the company, the results of the operations and its prospective growth.

Firstly, the CRO industry is fragmented and highly competitive. Covance Inc. , ICON plc , IQVIA Holdings Inc. , PAREXEL International Corporation, PRA Health Sciences, Inc. and Syneos Health, Inc are only some of PPD’s main competitors. Eventually, biopharmaceutical companies began to show an undisputable tendency to establish long-term partnership and alliances with a selected number of CROs. The harsh reaction by firms operating in this industry soon turned into intense competition on price and other commercial terms and led many CROs to enter into less favorable contractual relationship with their clients. A non-improbable escalation of this conditions may adversely affect PPD’s business.

The company’s financial condition and cash flows are inevitably linked to the health of the biopharmaceutical sector. As a matter of tact, trends in R&D spending and the rate of outsourcing by bio pharmaceutical companies are key determinants of PPD’s operations, with particular regards to clinical development, whose revenues amounted to $2,545 mln in December 2019. Furthermore, excessively high levels of concentration in the Big Pharma and Biotech sector could result in a fall in the number of potential consumers and drugs being developed and, on the other hand, cut-throat competition could seriously limit the scope of PPD’s operations insofar as consumers may negotiate restrictions on the company’s ability to provide services to their own competitors. These latter comprise additional concerns for investors willing to own an equity stake in PPD.

Developing new drugs with market approval on safety and efficacy entails high out-of-pocket and time costs. Estimated expenses go beyond $2.5 billion over a 15-year timespan required to deliver a new product. Therefore, failure or inadequate performance of the services, besides compromising the results and the usefulness of the trials, may imply huge losses. Undeniably, the testing of new drugs on volunteers participating in clinical trials (Phase I-III of the clinical services) and the eventual sale to the public at large exposes PPD to the risk of liability for death or injury. According to this, the PPD’s performance of services is subject to very strict contractual requirements, regulatory standards and ethical consideration and non-compliance to this terms may cause the intervention of regulatory agencies through sanctions, delay/suspension of marketing and testing approval, civil or criminal prosecutions and operational restrictions.

To have a complete overview of the risks that an investor might face by investing in PPD, it is fundamental to assess if the business is safe and sound from a financial standpoint. The company is clearly highly leveraged: the LT Debt/Total Assets ratio is higher than 1 meaning that PPD’s future obligations will be substantial and it may affect its future profitability. Indeed, the firm’s Interest Coverage Ratio (EBIT/Interest Expense), equal to 1.3, is below the peers’ average of 3.74. An analysis of liquidity ratios is necessary to gain a clearer insight. Last year, the company Current Ratio was equal to 0.9, lower with respect to the 1.1 of the year before. This variation may indicate that PPD have some problems in meeting its short-term obligations, even though it does not seem warning considered the industry average. This concern comes from the extraordinary high level of the Debt/EBITDA ratio, which is 7.7 and has shown an increasing pattern during the last three years. Furthermore, the Net Change in Cash from last year is -$207 million. By going in depth into the liability side, PPD’s Gross Debt amounts to $4,193.9 million, of which almost 70% is represented by Term Loans, while the remaining part has been covered by issuing bonds: part of the proceeds of the IPO will be used to pay back Senior Notes due 2022. S&P’s last report rated PPD’s credit position B+ on 11th February 2020.

By looking only to most liquid assets and the firm’s ability to meet obligations that came due immediately, the landscape become clearer: the Quick Ratio is almost equal to the Current Ratio and above one. The reason can be found in the characteristics of the business: Inventory and Prepaid expenses are relatively low considering the focus of the company on R&D.

DEAL RATIONALE AND VALUATION

PPD’s growth strategy needs fundings to be implemented, so the firm decided to start trading their shares on capital markets. On 5th February 2020, PPD successfully listed on Nasdaq. PPD issued on the market 60,000,000 shares at a price of $27. The underwriters have been granted an option to purchase up to 9,000,000 additional shares of common stock at any time within 30 days from the date of this prospectus to cover over-allotments (Greenshoe).

The net proceeds from the offering, after deducting underwriting discounts, commissions and estimated offering expenses, will be approximately $1,533.6 million. This amount will be mainly devoted to redeem $550 million in aggregate principal amount of the 7.625%/8.375% Senior PIK Toggle Notes due 2022, plus accrued and unpaid interest thereon and $5.5 million of redemption premium. After that, $900.0 million in aggregate principal amount of the 7.75%/8.50% Senior PIK Toggle Notes due 2022, plus accrued and unpaid interest thereon and $9.0 million of redemption premium. Any excess net proceeds from this offering will be used for general corporate purposes, which may include, among other things, further repayment of indebtedness.

Many advisors participated in the valuation process and the offering was led by Barclays, J.P. Morgan Chase, Morgan Stanley and Goldman Sachs. Sixteen banks underwrote the deal. The IPO has been valued at approximately $1.62 billion. The initial price range during marketing activity was between $24 and $27. The advisors to complete the valuation have taken into account many variables that it is necessary to analyze in order to perform a proper valuation of the company. By running an Asset Side valuation, the Enterprise Value can be derived by considering a long-term growth rate of 14.4% (prior of the spread of Covid-19) and WACC = 11.36%. The valuation that follows is the result of a stable growth model elaborated by our analysts and it is compared to IPO’s features.

Source: Factset

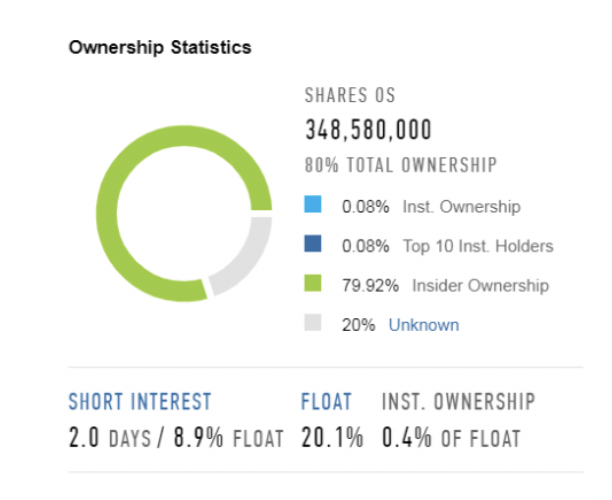

After the IPO, the Shareholder compositions is changed, also considering the Floating that represents 20.1% of Total Equity. The great majority of the ownership is in the end of private equity funds: Hellman & Friedman still represents the main Stakeholder with 45.45% of shares. All the other funds that participated in the privatization of PPD in 2011 still own the remaining Equity of the company: in the specific, Carlyle holds 19.06% and the Abu Dhabi Investment Authority another 7.34%

Source: Factset

The chart below shows the aftermarket performance of PPD’s share price, compared with the performance of two main competitors.

Source: Factset

PPD opened for trading at $31 after pricing its common shares at $27. Even though the company is highly levered, the enthusiasm of investors, driven by fat margins, continued for some days: on February 11th the stock price surged at $33.23. It represented the peak: after that, the price started going down, gradually approaching what is considered its fair value. After the outbreak of Covid-19, the Stock price plunged to $10.66. It has been clearly affected by the panic in the market. Recently PPD’s shares have been trading at a range of $21.61-$23.48. This value is quite close to the value estimated previously, but the present scenario is really uncertain. Revenues and estimates of growth will be revised and the initial public offering price may be too high. On the other hand, researchers from Deutsche Bank and Evercore in their last report confirmed the “Buy” or “Overweight” position, which actually represents 100% of the consensus: the average target price among analysts is $27.15.

It is clear that, in this moment of market turmoil, delivering a proper and complete estimate of the standalone value of a company is hardly attainable. Notwithstanding this enduring period of economic disruption, Biotech and Pharma stocks seem to perform better: this is probably related to the importance that this industry has in the fight against Covid-19. The race towards the cure has already started, but the solution seems still far. In fact, the process of developing a vaccine requires prolonged periods of testing before any cure can be implemented, given the absolute and common priority of protecting human health. Everyday, pieces of information on new steps towards a vaccine on Covid-19 are disclosed by a large number of biotech and pharmaceutical companies, fueling the expectations of investors that are speculating on which one will find the cure. That being said, the adoption of unconventional and faster methods of clinical trials rises the degree of risk embedded with the race to the vaccine and may seriously affect the financial performances of the players involved.

Leonardo Baldassarri

Andrea Longoni

Maria Vittoria Scino

BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

It is clear that, in this moment of market turmoil, delivering a proper and complete estimate of the standalone value of a company is hardly attainable. Notwithstanding this enduring period of economic disruption, Biotech and Pharma stocks seem to perform better: this is probably related to the importance that this industry has in the fight against Covid-19. The race towards the cure has already started, but the solution seems still far. In fact, the process of developing a vaccine requires prolonged periods of testing before any cure can be implemented, given the absolute and common priority of protecting human health. Everyday, pieces of information on new steps towards a vaccine on Covid-19 are disclosed by a large number of biotech and pharmaceutical companies, fueling the expectations of investors that are speculating on which one will find the cure. That being said, the adoption of unconventional and faster methods of clinical trials rises the degree of risk embedded with the race to the vaccine and may seriously affect the financial performances of the players involved.

Leonardo Baldassarri

Andrea Longoni

Maria Vittoria Scino

BSCM would like to thank FactSet for providing charts and data. The FactSet platform has been extremely useful in all the stages of the draft of this analysis.

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.