In contrast to its European counterparts, Italy's digital payments sector has trailed for years. The announcement of CVC's interest in acquiring Nexi, one of the country's largest players in the e-payment industry, completely stirred the market, with Nexi's stocks jumping as high as 19%. What would this acquisition mean for the emerging Italian e-payment industry?

CVC Capital Partners Interest in Nexi

Late in October, the business press has reported that CVC Capital Partners, a leading global private equity house, was gathering information about Nexi, the Italian leader in the payments industry. However, as reported by several articles, there is no evidence about an imminent offer by CVC to acquire Nexi. This potential deal is reported to be one of several options CVC is considering to enter into the attractive payment industry, but no formal contact or bid has been made to Nexi regarding this matter.

The interest from CVC Capital Partners in Nexi has been a topic of speculation, with some sources indicating that CVC is in the early stages of considering a potential bid for the European payments firm. This speculation has had a notable impact on Nexi's shares, which saw a significant increase, jumping as much as 19% at one point.

CVC Capital Partners Interest in Nexi

Late in October, the business press has reported that CVC Capital Partners, a leading global private equity house, was gathering information about Nexi, the Italian leader in the payments industry. However, as reported by several articles, there is no evidence about an imminent offer by CVC to acquire Nexi. This potential deal is reported to be one of several options CVC is considering to enter into the attractive payment industry, but no formal contact or bid has been made to Nexi regarding this matter.

The interest from CVC Capital Partners in Nexi has been a topic of speculation, with some sources indicating that CVC is in the early stages of considering a potential bid for the European payments firm. This speculation has had a notable impact on Nexi's shares, which saw a significant increase, jumping as much as 19% at one point.

The payment industry

The payment industry, a vital component of the model financial system, is a machine that allows for the seamless exchange of funds between buyers and sellers worldwide. It brings together a diverse spectrum of activities, from facilitating credit and debit card transactions to issuing and managing payment cards, operating payment networks, providing payment gateways and processing services, enabling online and mobile payments, and supporting the development and implementation of cutting-edge payment technologies. At its core, the payment industry ensures the secure and efficient transfer of money and other financial instruments, enabling businesses and individuals to conduct transactions with ease and confidence. It plays a pivotal role in driving economic growth and fostering commerce, especially online, being the modern day “backbone” of marketplaces. The payment industry connects banks, credit card companies, payment processors, merchants, and financial technology firms. Each plays a distinct role in facilitating payments, ensuring efficiency and accordance with regulatory frameworks.

As the digital landscape continues to evolve, the industry is forced to adapt rapidly to meet the changing needs of consumers and businesses. Online and mobile payment options are gaining widespread popularity, driven by convenience and accessibility. The industry is also embracing innovative technologies such as blockchain and artificial intelligence to enhance security, streamline processes, and expand payment options.

Main players in the market

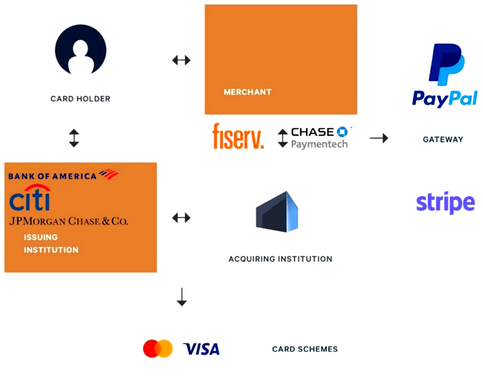

The Four Party Model can be used to understand the segmentation of the payment industry, with a gateway, acquirer, scheme, and issuer involved in every transaction. The industry itself is a complex ecosystem, comprising a diverse range of players; while the industry is fragmented, with numerous companies operating in each segment, a few key players dominate the market.

Leading payment gateways include PayPal, Stripe, Braintree, and Adyen. These are platforms that connect merchants to payment processors, enabling them to accept online and mobile payments. They provide a secure interface for processing card information and handling payment transactions.

An acquirer, or payment processor, handles the authorization, clearing, and settlement of payment transactions. They act as facilitators between merchants and acquiring banks, ensuring that card payments are processed, and funds are transferred accordingly. Major payment processors include Fiserv, Chase Paymentech, Global Payments, TSYS, and Worldpay.

Schemes, or payment networks, such as Visa, Mastercard, and UnionPay, establish and manage the underlying infrastructure that enables card-based transactions. They act as intermediaries between cardholders, merchants, and issuing and acquiring banks, ensuring secure and efficient payment processing.

Lastly, the card issuer is the entity that provides payment cards to consumers and businesses, enabling them to make purchases and conduct financial transactions. Card issuers can be banks, credit unions, or retail companies. Notable card issuers include Bank of America, JPMorgan Chase, Wells Fargo, Citigroup, and Capital One.

These key players, along with numerous other companies operating in the payment industry, form an intricate network that facilitates the global exchange of funds, driving economic growth and fostering commerce.

Source: Clearhaus, Payments in E-commerce

Trends in the payments industry

The current high-inflation, high-rates environment is having a significant impact on the payment industry. Profit-wise, these conditions have broken the long-standing trend of fees being the main source of revenue growth. In 2022, EMEA’s transaction-based revenue rose at a steady 5%, while net interest income (NII) grew from 33% to 45% of total revenues. In terms of transaction volume, economic uncertainty, high inflation, and high interest rates have led to tighter consumer spending; however, the ECB expects real disposable income to rise thanks to rising wages and to a fading inflation as effect of the restrictive monetary policies implemented. This could raise the volume of transactions in the payments industry.

The industry has also been shaped by the growth in digital banking and e-commerce. This can be largely attributed to the COVID-19 pandemic, which saw a substantial shift away from in-person transactions. This trend has continued, five years on, with cash usage declining by 4% in 2022. In fact, over the past five years, electronic transactions have grown at three times faster rate than the overall payments revenue.

Nexi: an in-depth analysis of the Italian Payments Champion and its Business Model

Nexi is a leading Italian payment technology company that operates across the entire payment value chain, providing a comprehensive suite of products and services to banks, merchants, businesses, and institutions. It is the largest payment processing company in Italy, with a market share of over 70%. Nexi also has a strong presence in other European countries, including Austria, Belgium, France, Germany, Greece, Luxembourg, Poland, Portugal, Spain, and Switzerland.

Focusing on Italy, the cards and payments industry was valued at $347.1 billion in 2022, with an expected CAGR of over 8% from 2022 to 2026. Despite remaining cash-dependent as a country, there has been a noticeable initiative to encourage the switch from cash to digital payments. This has been facilitated by the government announcing the Progetto Italia Cashless plan in 2019, as well as Nexi itself launching the Micropayments refund initiative in 2020, with the aim of increasing card acceptance among small merchants. This is reflective of Nexi’s involvement in the entire payment process.

Nexi is connected to all four segments of the industry, partnering with all major payment networks, providing a range of payment gateway solutions to customers, and being both a leading payment processor and card issuer. Partnering with a range of payment networks allows Nexi to process a variety of transactions for its customers, adding to the company’s strong track record of innovation and customer service. In addition to its core payment processing business, Nexi is a leader in digital payments and cross-border payments, offering a range of solutions for online and mobile payments, as well as cross-country and cross-currency transactions. Nexi also offers value-added services, such as fraud prevention, data analytics, and marketing solutions.

These activities generate Nexi’s revenue, the breakdown of which is as follows:

- Payment processing fees: Nexi charges fees for processing transactions for its customers. These fees are typically based on the volume and value of transactions. For instance, processing a high-value international transaction would incur a higher fee than processing a low-value domestic transaction.

- Issuing fees: Nexi charges fees for issuing payment cards to its customers. These fees are typically based on the type of card and the number of cards issued. For example, issuing a premium credit card with a high spending limit would typically incur a higher fee than issuing a basic debit card.

- Acquiring fees: Nexi charges fees for acquiring merchants, which allows them to accept payments from customers using payment cards. These fees are typically based on the volume and value of transactions. Acquiring fees help Nexi maintain its network of merchants and expand its reach to potential customers.

- Value-added services: Nexi offers a variety of value-added services to its customers, such as fraud prevention, data analytics, and marketing solutions. These services are typically charged separately from payment processing fees. Value-added services provide additional benefits to Nexi's customers, such as reducing their risk of fraud and improving their marketing campaigns.

By diversifying its revenue streams across payment processing fees, issuing fees, acquiring fees, and value-added services, Nexi has created a robust business model that is well-positioned for long-term growth.

Nexi’s Metrics and Historical Stock performance

Nexi's financial metrics paint a picture of a company with a solid financial foundation. In 2022, Nexi reported gross revenues of €2.9 billion, representing a 13.4% increase from the previous year. This growth was driven by strong performance across all business segments, including merchant solutions, card issuing, and digital payments. Nexi's profitability is also noteworthy. In 2022, the company's net income reached €270.3 million, representing a 14.7% increase from 2021. This profitability is attributed to Nexi's efficient cost management and focus on high-margin products and services.

Nexi's financial health is further solidified by its strong balance sheet. The company's total equity stood at €4.8 billion in 2022, while its net debt-to-equity ratio remained at 1.2x. This strong balance sheet provides Nexi with the necessary financial flexibility to pursue growth opportunities and weather economic downturns.

Nexi's stock performance has been impressive for its industry over the past few years. Since its initial public offering (IPO) in 2019, Nexi's stock price has appreciated by over 120%, significantly outperforming the broader market. This remarkable growth is attributed to the company's strong financial performance, consistent growth strategy, and favorable industry trends. Its stock price has demonstrated resilience during periods of market volatility. Despite the COVID-19 pandemic and global economic uncertainties, Nexi's stock price has maintained an upward trajectory. This resilience reflects the company's strong foundation and investor confidence in its long-term growth prospects.

Italian e-payment landscape case study: FSI’s acquisition of BCC Pay

A deal of the kind of CVC’s would not be new to the Italian market. On January 31st, 2022, the Italian private equity group FSI announced its acquisition of 60% of BCC Pay, the electronic payments arm of the Italian cooperative bank Iccrea Banca. The deal was valued at € 500 million, with Iccrea holding on to 40% of BCC Pay.

FSI is the leading Italian private equity fund and one of the largest in Europe, with € 1.4 billion in capital commitments. With a long history in the fintech sector, its approach to investing involves the transformational growth of companies solely in the Italian mid-market segment.

As the largest Italian cooperative bank, Iccrea Banca is the fourth largest banking group in Italy by assets, with around € 175 billion in total consolidated assets. Its payment arm, BCC Pay, is a credit card payment solution and merchant services company that has an assets-light business model. Its product offerings include POS terminals and systems, as well as card issuing and acceptance.

This deal was part of a series of acquisitions in the Italian e-payments market, with investors keen on furthering the electronic revolution in a country that greatly favors cash in comparison to the rest of Europe. With about 4 million payment cards, 200.000 POS (point of sale) terminals, and € 50 billion in payment transactions at the time of the acquisition, FSI saw great potential in BCC Pay.

FSI’s strategic objectives included extending its product offering and continuing to improve service levels, investing in innovation and the digitalization of payments, and enlarging the customer base of the company. FSI’s track record in growing large fintech companies in Italy, coupled with Iccrea Banca’s expertise and network provided everything BCC needed to expand operations in the fast-growing Italian e-payment market.

Banco BPM, Iccrea and FSI partnership

On July 14, 2023, Banco BPM announced it had entered into an agreement with Iccrea and FSI to further develop BCC Pay. The agreement’s mission is to establish a third major credit hub in Italy, sector currently led by Intesa Sanpaolo and UniCredit. The deal involves BPM migrating to a new payment platform, as well as disincentivizing potential hostile takeovers. Furthermore, the alliance aims to break Nexi’s dominance in the payment industry, making BCC Pay the second-largest national operator.

In response, Nexi is expected to implement pricing policies and is executing a plan to divest non-digital payment divisions. There are rumors that Nexi might sell its National Interbank Network, which would provide the resources to pursue new acquisitions without relying heavily on debt. Furthermore, Nexi’s recent partnership with Microsoft will allow them to leverage Microsoft Azure Cloud solutions to improve the flow of their digital operations.

The evolution of these partnerships and strategies are shaping the future of the Italian payment industry, restructuring the existing landscape and introducing new players.

Valuation

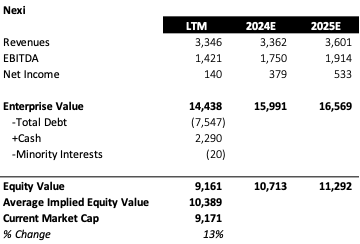

In order to understand the potential deal size of the acquisition of Nexi by CVC, we have decided to carry out a relative valuation exercise based on trading comparables and past transactions.

The multiple we have decided to adopt is the EV/EBITDA multiple, as Nexi is a mature company with relatively stable cash flows. This decision takes into account the unique characteristics of the pay-tech industry, which, while often marked by rapid growth and occasionally negative cash flows, still presents Nexi as a relatively stable performer. Such industry traits might typically suggest the use of the EV/Revenues multiple; however, Nexi's established market position and financial stability make the EV/EBITDA multiple a more fitting choice for our valuation purposes.

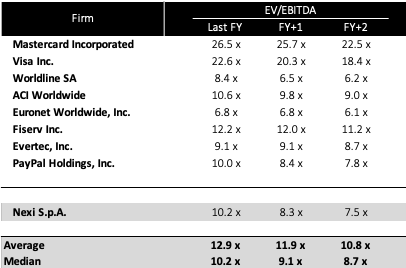

Trading Multiples

In order to proceed with the trading multiples valuation, we have firstly selected an international set of comparable companies in the payment industry, clustered in three groups:

- Credit Card Companies (VISA and Mastercard)

- Payment Processing Companies (Worldline, ACI Worldwide, Euronet Worldwide, Fiserv, Evertec)

- Digital Payment Companies (PayPal, Block, Adyen)

Based on the LTM financial data, the analysts’ consensus about future prospects, the current Market Capitalization, and the implied Enterprise Value, we have built a valuation panel. Overall, it seems like Nexi is undervalued by the market, as it is trading at an EV/EBITDA LTM multiple of 10.2x, which is 30% lower than the average of its peers (12.9x). Furthermore, this undervaluation is also nuanced if we take into account the forward multiples for 2024E and 2025E. This further reinforces the idea that Nexi could be a good target for a public takeover.

In order to reinforce our findings, we have also decided to look at the analysts’ consensus rating. Overall, 60.9% of Equity Research Analysts classify Nexi’s stock as a Buy, 34.8% as a Hold, and 4.3% as a Sell. Furthermore, on average, analysts have set a 12M target price for Nexi at €8.93, which is 28% higher than Nexi’s Last Price, €6.98.

Based on the above trading Multiples, we carried out a valuation exercise to find the Implied Equity Value of Nexi. Based on the median EV/EBITDA LTM, EV/EBITDA ‘24E, and EV/EBITDA ‘25E we have understood that the Enterprise Value of the Italian payments company is between €14.4bn and €16.6bn. By subtracting the Net Financial Position (Financial Debts minus Cash) and Minority Interests, we obtain the Equity Value implied by each valuation multiple, both last and forward. The Implied Equity Value ranges between €9.2bn and €11.3bn, with the average of the three multiples standing at €10.4bn, a 13% increment compared to the current market price.

Past Transaction Multiples

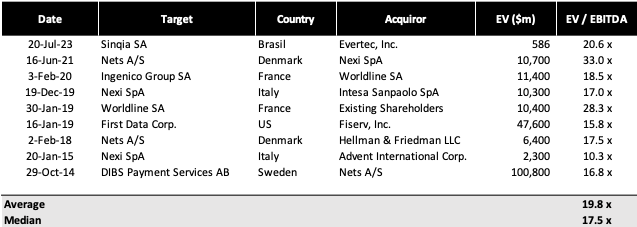

To account for the control premium that comes with strategic acquisitions, we decided to also look at past transaction multiples. Our findings analyze nine different acquisitions in the electronic payments industry in the past decade.

Based on the above panel, we can see that similar transactions in the payments industry were valued in a range between 16.8x and 20.6x EBITDA (respectively, the 25th and 75th Percentiles), with a median multiple of 17.5x.

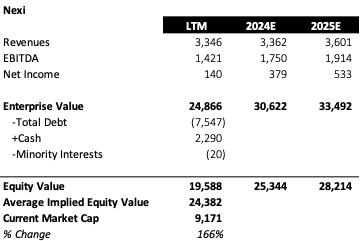

Given the median EV/EBITDA, we ran another valuation analysis to understand the potential value of Nexi in a transactional setting:

As it is possible to notice, the past transactions valuation yields a significantly higher value compared to the trading multiples valuation. Specifically, the average implied Equity Value of Nexi is €24.4bn, more than 165% higher than the company’s current market capitalization.

We believe that this result is attributable to three different factors, namely the overall undervaluation of Nexi’s shares, the incorporation of the control premium in the past transactions multiples, and, most importantly, the sector in which Nexi operates in.

Indeed, regarding the last point, technology companies often command high transaction multiples due to their substantial growth potential, innovative services, and valuable intellectual property. Additionally, the nature of the payment industry, characterized by recurring revenue models, scalable products, and low marginal costs, makes these companies particularly attractive. Indeed, acquirers are willing to pay a premium for the anticipated synergies, strategic fit, and competitive advantages such as entry into new markets or advanced technology offerings. The control premium and competitive bidding situations in this rapidly evolving sector further amplify the multiples paid in transactions.

Conclusion

The Italian e-payment landscape is undergoing a period of significant transformation, marked by strategic acquisitions and partnerships. The case of FSI's acquisition of BCC Pay, and the subsequent partnership with Banco BPM and Iccrea, highlights a clear trend toward consolidation and digitalization in the industry. These moves not only reflect the growing demand for digital payment solutions in a traditionally cash-favoring market but also indicate a strategic shift among major financial players in Italy.

The acquisition and partnership strategies are geared toward creating a more competitive market, challenging the existing dominance of key players like Nexi, Italy’s largest player and one of the most important operators in Europe.

In this landscape, Nexi seems to be currently undervalued by the market despite its strategic partnerships and business model position it as a strong player in the industry. The high transaction multiples observed in past deals in the sector underscore the premium placed on companies that offer innovative payment solutions and have the potential to disrupt traditional banking and payment systems.

Given the interesting business environment driven by a significant shift towards a more integrated, digital-first approach in financial transactions, as well as Nexi’s underperforming stock price and stable profitability and cash flows, the company seems to be an optimal target for a public buyout. The potential interest from major investment firms like CVC Capital Partners in acquiring Nexi further emphasizes the company's value and potential in the rapidly evolving payment sector.

A similar transaction would likely accelerate the pace of innovation and competition in the Italian e-payment market, signaling a new era of digital financial services. It could also trigger a wave of similar strategic moves across Europe, as companies and investors alike recognize the growing importance and profitability of digital payment platforms. As the industry continues to evolve, Nexi, bolstered by a possible acquisition by a financial sponsor, could play a pivotal role in shaping the future of digital payments and financial technology in Europe.

By Maya Doyle, Anastasia Larionova, Lucas Albin Lazcano, Francesco Pezzuto

SOURCES

- Gruppo BCC Iccrea

- Fondo Strategico Italiano

- Corriere della Sera

- Nexi Group

- Reuteurs

- Bloomberg

- Mergermarket

- The Wall Street Journal

- Financial Times

- The Nilson Report

- PaymentsSource

- PYMNTS.com

- The Journal of Private Equity

- Institutional Investor

- Private Equity Week

- PE Hub

- Preqin

- McKinsey

- ECB

- Clearhaus

- Mordor Intelligence

- Global Data