The year 2023 has posed unparalleled challenges to the private equity landscape, marked by higher interest rates, reduced deal activity, and an escalating pool of uninvested capital. As the industry deals with slower dealmaking and prolonged due diligence, the standoff between buyers and sellers compounds the surge in dry powder, prompting concerns among stakeholders. The article dives into the current dynamics of private equity, exploring the reasons behind continued fundraising in the face of limited investment and exit opportunities. Additionally, it touches on the growing significance of ESG and the shifting focus towards private credit as an alternative investment in the evolving economic landscape.

Dry Powder Evolution

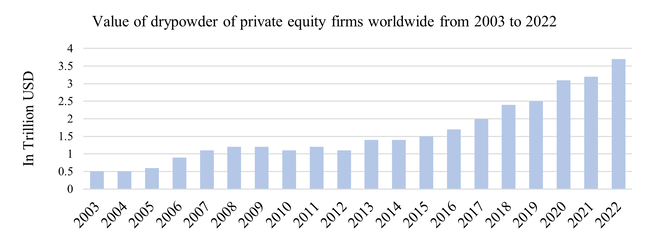

2023 was a very particular year for the private equity industry with many changes including higher interest rates, lower valuations, increased due diligence, and fewer exits. This ultimately led dealmaking to slow down with few very competitive hot deals that often end up in overpricing. As stated by Andrew Thompson, partner and head of PE at KPMG Asia-Pacific, “there is a buyer-seller stand-off in PE, as sellers hold out for higher boom-time prices and buyers seek more realistic prices”. As a result, dry powder (the amount of committed, but unallocated capital a firm has on hand), which was already at high levels, is increasing to even higher levels.

2023 was a very particular year for the private equity industry with many changes including higher interest rates, lower valuations, increased due diligence, and fewer exits. This ultimately led dealmaking to slow down with few very competitive hot deals that often end up in overpricing. As stated by Andrew Thompson, partner and head of PE at KPMG Asia-Pacific, “there is a buyer-seller stand-off in PE, as sellers hold out for higher boom-time prices and buyers seek more realistic prices”. As a result, dry powder (the amount of committed, but unallocated capital a firm has on hand), which was already at high levels, is increasing to even higher levels.

Source: Statista

But this increase in dry powder is not only given by the fact that firms are investing less but also by the fact that private equity firms are continuing to raise fund from investors despite the scarcity of investment opportunities and the uncertain economic outlook. Thompson also added: “This is an entirely normal part of the PE life cycle and these conditions often lead to the best investing climate when private market asset prices have adjusted to realistic levels.” But why are PE funds raising if they already have a lot of available cash on hands to exploit potential opportunities as they arise? Do they believe opportunities will shortly begin to emerge in great numbers? Or do they just want to increase their management fees in a weak economic period?

This very last question is concerning investors. But what is the issue? Even though dry powder sits with investors until it’s called by private equity managers and deployed into an investment, as committed capital, dry powder is included as part of a private equity manager’s assets under management. As most investment funds, private equity firms earn management fees on assets under management (1% on average), this means that they also earn money on the yet uninvested capital raised from investors. As PE firms are continuing to fundraise despite already having substantial uncalled capital, investors might begin pressuring investment managers, concerned that the firms are merely collecting management fess without making proactive investments.

However, Thompson and many others believe that the current environment can provide investors with significant opportunities to invest in good companies at a discounted price and that “the increase in dry powder is in anticipation of the large market correction that investors are expecting in the short term”. The largest PE funds buildup in dry powder could be attributed to this belief. According to the S&P data, KKR, a private equity investor, had the largest pool of uninvested capital (known as "dry powder") at $41.8 billion as of July 3. Over the past year, this global investment company made 51 investments.

Blackstone, an alternative investment management company, closely followed with $40.3 billion in dry powder and completed 23 investments in the last 12 months. S&P Global Market Intelligence observed that the top 25 private equity firms collectively hold 19.5% of the total uninvested capital in the middle of the year, with 19 of these firms based in the United States.

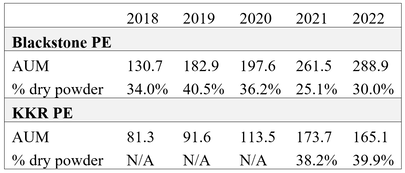

Among the largest private equity funds for assets under management, Blackstone and KKR reported the highest levels of dry powder in the past few years despite being among the most active funds.

This very last question is concerning investors. But what is the issue? Even though dry powder sits with investors until it’s called by private equity managers and deployed into an investment, as committed capital, dry powder is included as part of a private equity manager’s assets under management. As most investment funds, private equity firms earn management fees on assets under management (1% on average), this means that they also earn money on the yet uninvested capital raised from investors. As PE firms are continuing to fundraise despite already having substantial uncalled capital, investors might begin pressuring investment managers, concerned that the firms are merely collecting management fess without making proactive investments.

However, Thompson and many others believe that the current environment can provide investors with significant opportunities to invest in good companies at a discounted price and that “the increase in dry powder is in anticipation of the large market correction that investors are expecting in the short term”. The largest PE funds buildup in dry powder could be attributed to this belief. According to the S&P data, KKR, a private equity investor, had the largest pool of uninvested capital (known as "dry powder") at $41.8 billion as of July 3. Over the past year, this global investment company made 51 investments.

Blackstone, an alternative investment management company, closely followed with $40.3 billion in dry powder and completed 23 investments in the last 12 months. S&P Global Market Intelligence observed that the top 25 private equity firms collectively hold 19.5% of the total uninvested capital in the middle of the year, with 19 of these firms based in the United States.

Among the largest private equity funds for assets under management, Blackstone and KKR reported the highest levels of dry powder in the past few years despite being among the most active funds.

Source: FactSet

Private Equity exits: the IPO Landscape

In 2023, the IPO landscape for sponsored-backed companies listed on the NASDAQ and NYSE witnessed a marked deceleration in activity. When benchmarked against preceding years, both the volume of transactions and the capital raised experienced a significant diminution. Specifically, the market saw a modest tally of 6 transactions, the lowest since 2015, with the proceeds amassing a mere 218 million, in stark contrast to the robust 11.12 billion realized in 2017. One salient determinant of this downward trajectory is the Federal Reserve's upward adjustment of the Fed funds rate, elevating it to a level unparalleled in 22 years. This policy maneuver has inevitably made borrowing more costly, thereby potentially tempering the enthusiasm of investors towards the relatively riskier realm of IPOs. Additionally, the external environment, characterized by geopolitical uncertainties, evolving regulatory frameworks, and potential market saturation from prior years' IPO inundation, further underscores the prudent stance adopted in the 2023 NASDAQ and NYSE sponsored-backed IPO domain.

In 2023, the IPO landscape for sponsored-backed companies listed on the NASDAQ and NYSE witnessed a marked deceleration in activity. When benchmarked against preceding years, both the volume of transactions and the capital raised experienced a significant diminution. Specifically, the market saw a modest tally of 6 transactions, the lowest since 2015, with the proceeds amassing a mere 218 million, in stark contrast to the robust 11.12 billion realized in 2017. One salient determinant of this downward trajectory is the Federal Reserve's upward adjustment of the Fed funds rate, elevating it to a level unparalleled in 22 years. This policy maneuver has inevitably made borrowing more costly, thereby potentially tempering the enthusiasm of investors towards the relatively riskier realm of IPOs. Additionally, the external environment, characterized by geopolitical uncertainties, evolving regulatory frameworks, and potential market saturation from prior years' IPO inundation, further underscores the prudent stance adopted in the 2023 NASDAQ and NYSE sponsored-backed IPO domain.

Source: FactSet

On the other side of the pond, CVC Capital Partners, Europe's leading private equity group, has again delayed its IPO plans amid market volatility, symbolizing the broader hesitance in the sector. Despite its significant valuation of €15bn last year, the firm is now considering an IPO in 2024. Market disruptions such as inflation, interest rate hikes, and geopolitical issues like the Ukraine and Isreal conflict have put a damper on IPO activities. The broader implication here is that even private equity firms, who traditionally capitalize on investment opportunities, are showing caution, both in going public themselves and in offloading their holdings in this uncertain market environment.

Goldman Sachs Group Inc.’s top technology banker indicates that many private firms might delay their IPOs into next year due to unfavorable market conditions. Matt Gibson, who co-leads the bank's global technology, media, and telecom group, stated in a Bloomberg Television interview that a lot of these potential IPO candidates secured private capital during 2020 and 2021. These companies have exhibited financial prudence by conserving funds and reducing expenses, thus having the flexibility to postpone their public debuts. Gibson highlighted that the majority of these firms are in a position to defer their IPOs both this year and possibly into the next if necessary. Despite market fluctuations and decreasing valuations, the bank's primary recommendation to its clients this year has been to hold off. Gibson notes that these clients are coming to terms with the current valuation landscape. They are eagerly awaiting a couple of successful IPOs that not only price within expected parameters but also perform well post-IPO.

Goldman Sachs Group Inc.’s top technology banker indicates that many private firms might delay their IPOs into next year due to unfavorable market conditions. Matt Gibson, who co-leads the bank's global technology, media, and telecom group, stated in a Bloomberg Television interview that a lot of these potential IPO candidates secured private capital during 2020 and 2021. These companies have exhibited financial prudence by conserving funds and reducing expenses, thus having the flexibility to postpone their public debuts. Gibson highlighted that the majority of these firms are in a position to defer their IPOs both this year and possibly into the next if necessary. Despite market fluctuations and decreasing valuations, the bank's primary recommendation to its clients this year has been to hold off. Gibson notes that these clients are coming to terms with the current valuation landscape. They are eagerly awaiting a couple of successful IPOs that not only price within expected parameters but also perform well post-IPO.

Individual fund analysis: Exits and due active investments

Source: FactSet

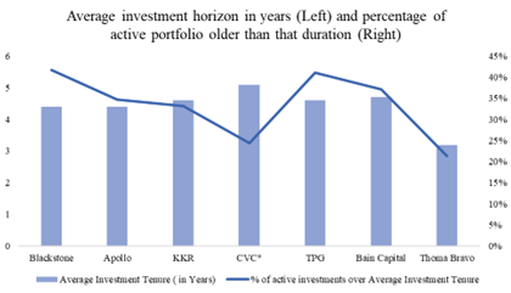

*CVC Included for comprehensive comparison purposes

*CVC Included for comprehensive comparison purposes

The chart provides a comparative visualization of seven prominent investment funds, namely Blackstone, Apollo, KKR, CVC, TPG, Bain Capital, and Thoma Bravo, focusing on their average investment durations and the percentage of their active investments exceeding these durations. Blackstone and Apollo exhibit nearly identical average investment horizons, hovering around 5 years. KKR's and TPG's durations are slightly shorter but comparable, with CVC showing a noticeable spike. Interestingly, while Bain Capital and Thoma Bravo have similar average holding durations, Bain Capital has a significantly higher percentage of active investments surpassing this tenure. In the broader context of the market data discussed earlier, private equity firms, including these seven, are exhibiting caution in the current volatile market environment. Many are holding onto their investments for extended periods, as evidenced by the substantial percentages of investments exceeding their average tenures. This aligns with the previous insights indicating that firms, even as influential as CVC, are postponing IPOs due to market turbulence. Such a trend underscores the prevailing market sentiment of patience and prudence amidst uncertainties.

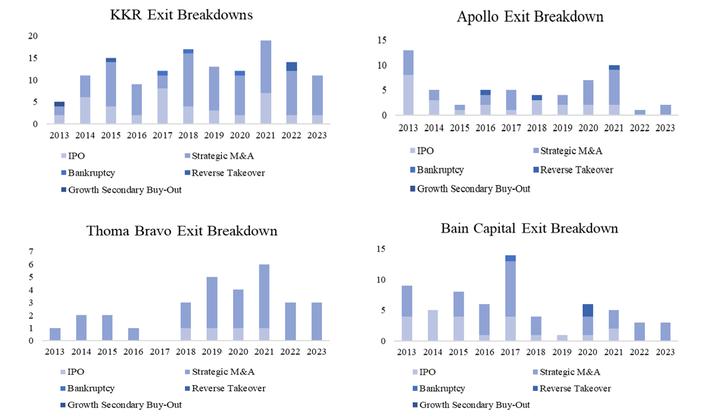

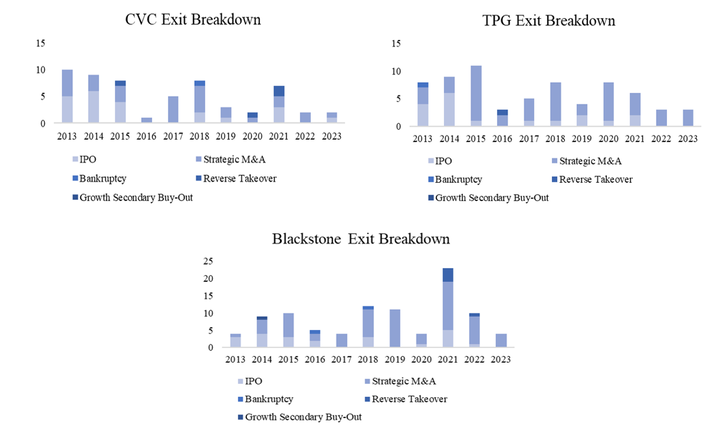

The individual graphs show the exit breakdowns for the funds covered, for the past 10 years and split into 5 major exit strategies. For all of the funds, a noticeable downturn in exit numbers can be observed for 2022 and 2023 (until present day). Most funds exhibit a spike of exits in 2021, when a red-hot IPO market boosted PE returns, but since, for all the reasons stated above, the PE market exits have cooled considerably.

Global effects of the FCA Investigation in the UK

Given the recent deceleration in the IPO market, the FCA's impending review takes on new significance within the PE landscape. The downturn in IPO activity implies that the ability of PE firms to exit their investments through public listings has become significantly more challenging. In such a climate, the FCA's scrutiny of valuation practices may add pressure on PE firms, already grappling with longer holding periods for their investments and reduced exit opportunities.

Therefore, the FCA's review could potentially complicate the valuation strategies of PE firms, which may need to adjust to more conservative approaches. These changes come at a time when PE firms are already exhibiting patience, awaiting favorable market conditions to execute profitable exits. Regulatory pressures for more transparent and rigorous valuation processes may thus intersect with an already complex market dynamic, compelling PE firms to navigate cautiously through both operational challenges and a frozen IPO market.

The individual graphs show the exit breakdowns for the funds covered, for the past 10 years and split into 5 major exit strategies. For all of the funds, a noticeable downturn in exit numbers can be observed for 2022 and 2023 (until present day). Most funds exhibit a spike of exits in 2021, when a red-hot IPO market boosted PE returns, but since, for all the reasons stated above, the PE market exits have cooled considerably.

Global effects of the FCA Investigation in the UK

Given the recent deceleration in the IPO market, the FCA's impending review takes on new significance within the PE landscape. The downturn in IPO activity implies that the ability of PE firms to exit their investments through public listings has become significantly more challenging. In such a climate, the FCA's scrutiny of valuation practices may add pressure on PE firms, already grappling with longer holding periods for their investments and reduced exit opportunities.

Therefore, the FCA's review could potentially complicate the valuation strategies of PE firms, which may need to adjust to more conservative approaches. These changes come at a time when PE firms are already exhibiting patience, awaiting favorable market conditions to execute profitable exits. Regulatory pressures for more transparent and rigorous valuation processes may thus intersect with an already complex market dynamic, compelling PE firms to navigate cautiously through both operational challenges and a frozen IPO market.

Source: FactSets

ESG and Private Equity

In comparison to the discussed short-term and rapid changes in the Private Equity sector, the market is simultaneously undergoing a long-term transition in regard to an increasing consideration of ESG in their daily activities. In the last years ESG has become a major consideration across firms and investors in all sectors as environmental and social awareness raises. The Private Equity market is not an exception. Pressure on Private Equity firms to improve their ESG objectives as well as their reporting is coming especially from LPs. As public pension funds already amount to approximately 31% of all PE investors, as reported by Bloomberg, they have substantial influence on the PE market. Many institutional investors have put structures in place to rate funds according to ESG guidelines and only invest in PE firms aligned to their goals. According to BNP Pariba´s 2023 ESG Global Survey, institutional investors are shifting their investment towards investments with measurable positive impact. However, PE firms are not only incentivized by easier fund raising and pressure by investors to increase their ESG goals, but also by potential gains in profit. Due to the current importance of ESG, which is expected to further raise in the future, companies with an integrated ESG strategy can expect higher valuation all other factors equal. Therefore, in the long run PE firms will only be able to generate high returns when incorporating an effective ESG strategy. In addition, with customers being more observant of the social impact a company has, ESG guidelines can create equally much value for portfolio companies. In the Global Private Equity Responsible Investment Survey 2023 by PwC one third of PE respondents said that ESG was a major value driver in more than 50% of their firm's recent deals.

The growing acceptance by GPs that ESG performance can play a vital part in financial performance provides a great chance for society. Due to the special role PE firms hold within the economy they can assert pressure on firms across different industries more effectively than ordinary shareholders of public equities. As a PE firm takes ownership of a company and can influence the company from a governance perspective it has access to internal information and the opportunity to implement ESG measures. In addition, a PE firm´s typical holding period of a company is between three to five years giving it the long-term incentive and opportunity to integrate ESG measures. Furthermore, the size of the big PE firms makes it possible for them to set KPIs and a consistent ESG framework within as well as across sectors, making the measurement and reporting of ESG related information easier. Even though great progress has been made and the big PE firms release ESG reports, many still critique missing transparency within the Private Equity reporting process. It is especially hard for the LPs to understand the actual ESG impact the firms have in which they are invested in. Therefore, generally more transparency is needed in Private Equity and especially when it comes to the ESG impact of the portfolio companies. Due to the growing size of the Private Equity market and its unique role in the economy, it can and will have to play a big part in directing companies to more social and environmental practices and it must do so in a transparent way.

Private Credit: The Future of Private Capital

As inferred previously as well, high interest rates and suffocatingly tightened monetary policies have chilled PE activity to languish at 10-year lows recently. Major factor that backs the repercussions of these secured economic policies should certainly be the spiraling costs of financing. Given the concerns of excessive leverage negatively affecting the quantitative tightening policy of Central Banks to curb inflation, we can justify the increased scrutiny from regulators and investors, ultimately leading to a drought of deal flow for Private Equities. Therefore, tighter credit in the market has indeed led many buyers to increasingly tap the Private Credit industry.

Private Credit, in simplest terms, is a non-bank lending process where the debt is not issued or traded in the public markets. It is also sometimes known as Private Lending, Private Debt, or Direct Lending. It comes with benefits such as flexible financing terms/structures, access to capital for companies not qualified for bank loans, and support from experienced lenders. In the face of the recent surge of energy crisis and looming recessionary threats within Europe, Private Credit’s been used for an extensive range of purposes by PEs, especially for funding investments such as the age-old growth capital, working capital, and also a select few instances of capital restructuring. In fact, recently, some PEs have even resorted to Direct Lending themselves in order to put their dry powder to proper use. This is primarily due to the fact that these investments, at around 11% interest rate, provided the highest returns when compared to any other alternative asset classes throughout 2023.

Additionally, what bolsters the opportunities within the Direct Lending industry is its back-to-back record breaking feats. The $1.9 trillion Private Credit market just set a fresh record for the largest loan in its history. Private lenders including Oak Hill Advisors LP, Blue Owl Capital Inc, and HPS Investment Partners provided a $5.3 billion loan package to Finastra–a fintech firm based in London. Comprising a $4.8 billion unitranche, a blend of senior and subordinated debt, and a $500 million revolver facility, this financing was the biggest Private Credit loan ever. Furthermore, Apollo (a PE firm itself) being poised to sign more than $4 billion in NAV loans to other PE firms who are looking to raise cash in challenging high-cost environments is a perfect testament to the fact that Private Credit can be used for both the employment of dry powder or the acquisition of financial leverage. Even PE behemoths such as KKR are seen to be struggling to refinance their debt through the syndicated leveraged loan market, resorting to Private Credit funds for loans worth well over $3 billion.

Besides the ones already mentioned, there are multiple apparent evidence that signal a further growth of Private Credits in the near future. With PEs like Oaktree and Blackstone looking to raise $18 billion and $7.1 billion to finance their pre-planned projects respectively, Private Debt is prone to observe a hike in its rates of returns while simultaneously attempting to address the needs of multi-billion-dollar Private Equity firms. These, complemented with exceedingly high US Federal Rates (2008 Crisis levels) and CLOs taking the strongest hits, solidify our assumptions that concern the spread of the industry even more extensively.

Finally, what makes Private Credit an open door with endless invitations for opportunities is a two-perspective reasoning. First, with skyrocketing demand against limited supply, lending can be made to firms with high creditworthiness, taking away the risk factor from a supposedly risky asset class. Second, within an economy facing a significantly distressed situation, PEs could exploit distressed investments through Private Credit and generate massive returns (refer to “Private Equity in the Distressed Space”). To say the very least, Private Credit funds are amidst a fundraising spree, lending fundamentally to companies and firms that require help financing their takeovers and everyday operations, aiding the LBO and overall M&A charts to recover from their -33% and -20% respective plummeting decrease during the transition between 2022 and 2023.

Conclusions

In 2023, the private equity sector grappled with a challenging landscape marked by higher interest rates, reduced deal activity, and an excess of uninvested capital. This led to a standoff between buyers seeking lower prices and sellers holding out for elevated valuations, resulting in a slowdown of dealmaking, extended due diligence, and a notable decline in IPO exits, particularly for sponsored-backed companies. Notably, even industry leaders like CVC Capital Partners postponed public offerings, signaling widespread market hesitance. Concurrently, the UK's FCA is poised to review valuation practices, potentially introducing added regulatory scrutiny to exit strategies and valuations, reflecting an industry adopting a more cautious approach, with firms and investors anticipating a shift towards more favorable conditions.

Against this backdrop, the private equity landscape is undergoing a significant transformation where ESG considerations have become as vital as financial metrics. Pressure from Limited Partners and a societal emphasis on sustainability necessitate the integration of ESG goals for long-term profitability, along with a commitment to transparency and accountability in reporting.

Meanwhile, in the Private Credit market, private equity firms are finding a crucial lifeline amidst a tightening monetary environment. As traditional financing grows costlier, Private Credit provides flexible alternatives, enabling efficient capital deployment. The sector's robust growth, evidenced by record-breaking deals and fundraising, empowers Private Equity firms to navigate economic challenges and explore opportunities for leveraged buyouts and mergers, even in the face of a global financial market downturn.

In comparison to the discussed short-term and rapid changes in the Private Equity sector, the market is simultaneously undergoing a long-term transition in regard to an increasing consideration of ESG in their daily activities. In the last years ESG has become a major consideration across firms and investors in all sectors as environmental and social awareness raises. The Private Equity market is not an exception. Pressure on Private Equity firms to improve their ESG objectives as well as their reporting is coming especially from LPs. As public pension funds already amount to approximately 31% of all PE investors, as reported by Bloomberg, they have substantial influence on the PE market. Many institutional investors have put structures in place to rate funds according to ESG guidelines and only invest in PE firms aligned to their goals. According to BNP Pariba´s 2023 ESG Global Survey, institutional investors are shifting their investment towards investments with measurable positive impact. However, PE firms are not only incentivized by easier fund raising and pressure by investors to increase their ESG goals, but also by potential gains in profit. Due to the current importance of ESG, which is expected to further raise in the future, companies with an integrated ESG strategy can expect higher valuation all other factors equal. Therefore, in the long run PE firms will only be able to generate high returns when incorporating an effective ESG strategy. In addition, with customers being more observant of the social impact a company has, ESG guidelines can create equally much value for portfolio companies. In the Global Private Equity Responsible Investment Survey 2023 by PwC one third of PE respondents said that ESG was a major value driver in more than 50% of their firm's recent deals.

The growing acceptance by GPs that ESG performance can play a vital part in financial performance provides a great chance for society. Due to the special role PE firms hold within the economy they can assert pressure on firms across different industries more effectively than ordinary shareholders of public equities. As a PE firm takes ownership of a company and can influence the company from a governance perspective it has access to internal information and the opportunity to implement ESG measures. In addition, a PE firm´s typical holding period of a company is between three to five years giving it the long-term incentive and opportunity to integrate ESG measures. Furthermore, the size of the big PE firms makes it possible for them to set KPIs and a consistent ESG framework within as well as across sectors, making the measurement and reporting of ESG related information easier. Even though great progress has been made and the big PE firms release ESG reports, many still critique missing transparency within the Private Equity reporting process. It is especially hard for the LPs to understand the actual ESG impact the firms have in which they are invested in. Therefore, generally more transparency is needed in Private Equity and especially when it comes to the ESG impact of the portfolio companies. Due to the growing size of the Private Equity market and its unique role in the economy, it can and will have to play a big part in directing companies to more social and environmental practices and it must do so in a transparent way.

Private Credit: The Future of Private Capital

As inferred previously as well, high interest rates and suffocatingly tightened monetary policies have chilled PE activity to languish at 10-year lows recently. Major factor that backs the repercussions of these secured economic policies should certainly be the spiraling costs of financing. Given the concerns of excessive leverage negatively affecting the quantitative tightening policy of Central Banks to curb inflation, we can justify the increased scrutiny from regulators and investors, ultimately leading to a drought of deal flow for Private Equities. Therefore, tighter credit in the market has indeed led many buyers to increasingly tap the Private Credit industry.

Private Credit, in simplest terms, is a non-bank lending process where the debt is not issued or traded in the public markets. It is also sometimes known as Private Lending, Private Debt, or Direct Lending. It comes with benefits such as flexible financing terms/structures, access to capital for companies not qualified for bank loans, and support from experienced lenders. In the face of the recent surge of energy crisis and looming recessionary threats within Europe, Private Credit’s been used for an extensive range of purposes by PEs, especially for funding investments such as the age-old growth capital, working capital, and also a select few instances of capital restructuring. In fact, recently, some PEs have even resorted to Direct Lending themselves in order to put their dry powder to proper use. This is primarily due to the fact that these investments, at around 11% interest rate, provided the highest returns when compared to any other alternative asset classes throughout 2023.

Additionally, what bolsters the opportunities within the Direct Lending industry is its back-to-back record breaking feats. The $1.9 trillion Private Credit market just set a fresh record for the largest loan in its history. Private lenders including Oak Hill Advisors LP, Blue Owl Capital Inc, and HPS Investment Partners provided a $5.3 billion loan package to Finastra–a fintech firm based in London. Comprising a $4.8 billion unitranche, a blend of senior and subordinated debt, and a $500 million revolver facility, this financing was the biggest Private Credit loan ever. Furthermore, Apollo (a PE firm itself) being poised to sign more than $4 billion in NAV loans to other PE firms who are looking to raise cash in challenging high-cost environments is a perfect testament to the fact that Private Credit can be used for both the employment of dry powder or the acquisition of financial leverage. Even PE behemoths such as KKR are seen to be struggling to refinance their debt through the syndicated leveraged loan market, resorting to Private Credit funds for loans worth well over $3 billion.

Besides the ones already mentioned, there are multiple apparent evidence that signal a further growth of Private Credits in the near future. With PEs like Oaktree and Blackstone looking to raise $18 billion and $7.1 billion to finance their pre-planned projects respectively, Private Debt is prone to observe a hike in its rates of returns while simultaneously attempting to address the needs of multi-billion-dollar Private Equity firms. These, complemented with exceedingly high US Federal Rates (2008 Crisis levels) and CLOs taking the strongest hits, solidify our assumptions that concern the spread of the industry even more extensively.

Finally, what makes Private Credit an open door with endless invitations for opportunities is a two-perspective reasoning. First, with skyrocketing demand against limited supply, lending can be made to firms with high creditworthiness, taking away the risk factor from a supposedly risky asset class. Second, within an economy facing a significantly distressed situation, PEs could exploit distressed investments through Private Credit and generate massive returns (refer to “Private Equity in the Distressed Space”). To say the very least, Private Credit funds are amidst a fundraising spree, lending fundamentally to companies and firms that require help financing their takeovers and everyday operations, aiding the LBO and overall M&A charts to recover from their -33% and -20% respective plummeting decrease during the transition between 2022 and 2023.

Conclusions

In 2023, the private equity sector grappled with a challenging landscape marked by higher interest rates, reduced deal activity, and an excess of uninvested capital. This led to a standoff between buyers seeking lower prices and sellers holding out for elevated valuations, resulting in a slowdown of dealmaking, extended due diligence, and a notable decline in IPO exits, particularly for sponsored-backed companies. Notably, even industry leaders like CVC Capital Partners postponed public offerings, signaling widespread market hesitance. Concurrently, the UK's FCA is poised to review valuation practices, potentially introducing added regulatory scrutiny to exit strategies and valuations, reflecting an industry adopting a more cautious approach, with firms and investors anticipating a shift towards more favorable conditions.

Against this backdrop, the private equity landscape is undergoing a significant transformation where ESG considerations have become as vital as financial metrics. Pressure from Limited Partners and a societal emphasis on sustainability necessitate the integration of ESG goals for long-term profitability, along with a commitment to transparency and accountability in reporting.

Meanwhile, in the Private Credit market, private equity firms are finding a crucial lifeline amidst a tightening monetary environment. As traditional financing grows costlier, Private Credit provides flexible alternatives, enabling efficient capital deployment. The sector's robust growth, evidenced by record-breaking deals and fundraising, empowers Private Equity firms to navigate economic challenges and explore opportunities for leveraged buyouts and mergers, even in the face of a global financial market downturn.

By: Leo Antlitz, Amos Appendino, Rares Ionescu, Prasiddha Rajaure

Sources

- Statista

- Factset

- Alluve

- S&P

- Bloomberg

- Financial Times

- PWC

- Institutionalinvestor

- Forbes

- Fund Selector Asia