Rakuten Group Inc is a global Japanese company, global leader in internet services that empower individuals, communities, businesses and society. With approximately 1.6 billion members across the world, the group provides more than 70 services across a wide variety of sectors, including internet services such as e-commerce, travel and digital content. One of its businesses, Rakuten Bank, which offers fintech services such as credit cards, banking, securities, e-money and smartphone app payments, was made public in 2022 starting a prosperous period for IPOs in the APAC region.

Introduction

The Asia-Pacific IPO market navigated the recent economic turmoil better than all competitors, as per a White&Case analysis. Throughout 2022, APAC saw the highest aggregate IPO volume and value globally, as well as the smallest yearly decline, thus proving its remarkable resilience. While year-on-year deal volume declined 70% across North America and 60% in EMEA, Asian markets only experienced a drop of approximately 23%.

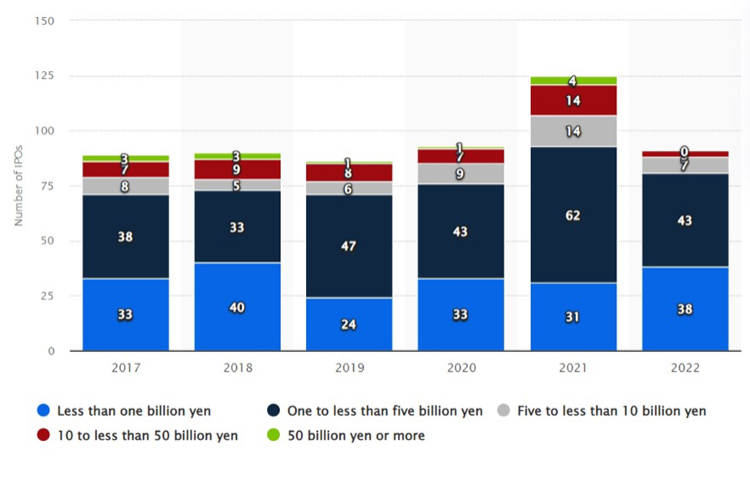

The graph above shows the number of IPOs in the APAC region since 2017, split by its size.

The first quarter of 2023 was once again dominated by APAC, as the region accounted for 59% of global IPOs, according to research by EY.

Listing activity is led by China and India. In China, government support schemes for important industries lower the regulatory requirements for IPOs. India is expected to be the fastest growing economy of the world in 2023. Other advanced economies that are traditional hotspots for issuances are Singapore, Hong Kong, Japan, and South Korea

In Japan, IPO activity has been slow in the first quarter of 2023, with Rakuten being the only share sale to raise more than 50 billion yen, the equivalent of approximately USD 366.8 million. The graph below provides an overview of deals by size in Japan throughout the last six years based on data from Statista and a survey by Deloitte.

Listing activity is led by China and India. In China, government support schemes for important industries lower the regulatory requirements for IPOs. India is expected to be the fastest growing economy of the world in 2023. Other advanced economies that are traditional hotspots for issuances are Singapore, Hong Kong, Japan, and South Korea

In Japan, IPO activity has been slow in the first quarter of 2023, with Rakuten being the only share sale to raise more than 50 billion yen, the equivalent of approximately USD 366.8 million. The graph below provides an overview of deals by size in Japan throughout the last six years based on data from Statista and a survey by Deloitte.

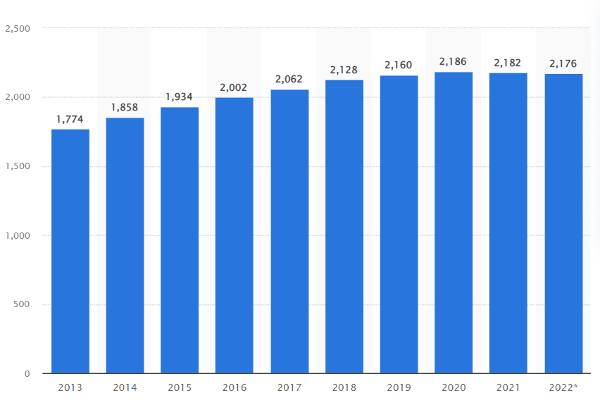

The total number of large cap companies listed on the Tokyo Stock Exchange by year.

The trend has slowed down in recent years, with 2021 and 2022 seeing a decline.

The trend has slowed down in recent years, with 2021 and 2022 seeing a decline.

On Friday the 21st of April the Tokyo Stock Exchange has seen the largest IPO in the last 5 years when Rakuten Bank opened its gates to let investors in. Even with the lower than originally expected price per share (¥1,400 instead of ¥1,960 - $10.3 instead of 14.3), the $625 million listing is the largest in Japan since the $20 billion-plus IPO of SoftBank in December 2018, and its share price has continued to rise since, reaching an intraday peak of ¥1,930, up 38% from the initial price, despite starting fears of weak demand.

This comes as a silver lining in an otherwise precarious time period for the bank’s parent company, the conglomerate Rakuten, which has seen a fourth straight year of losses following the launch of their mobile network subsidiary, which has been rapidly depleting company resources, further damaging its already fragile reputation.

This comes as a silver lining in an otherwise precarious time period for the bank’s parent company, the conglomerate Rakuten, which has seen a fourth straight year of losses following the launch of their mobile network subsidiary, which has been rapidly depleting company resources, further damaging its already fragile reputation.

The graph shows the evolution of the share price.

*The 21st displays the share price at the closing of the market

*The 21st displays the share price at the closing of the market

From Dom Pérignon to Barcelona

It seems like in the past few years Rakuten has made headlines for all the wrong reasons: from a financial perspective, they recently recorded a $2.75 billion loss last year, the highest one in the company’s history. Marketing has brought even more bad news, since its €55mn-a-year shirt sponsorship deal with Barcelona FC that drew severe criticism from investors. And having a controversial and flamboyant tech entrepreneur as their CEO has certainly not helped gain the confidence of investors when Hiroshi Mikitani was spotted clubbing with dozens of young women and pouring expensive champagne in the mouths of partygoers. All of these have played their part in shaping a polarized reputation for Japan’s largest e-commerce platform.

Rakuten’s Banking Business

Rakuten Bank was established in 2000 and has rapidly announced itself as a pioneer of online banking through innovative measures such as full online service, cashback programs and points reward systems that allowed users to gain discounts in the Rakuten marketplace. This strategy of embracing new technologies and offering attractive incentives helped them become an important name in Japan’s banking industry. However, it remained one of the few profitable branches of Rakuten, registering a $150 million profit that stood in contrast to the $2.75 loss that its parent company lost. But was the decision to spin off their profitable banking business a desperate one from Rakuten, trying to separate winners and losers, or can this successful IPO help regain the trust of investors and, more importantly, can Tokyo use this momentum to help them regain the crown of Asia’s main financial centre?

Reasons and main aspects of the IPO deal

The April 21st Rakuten Bank IPO shows us that fintech or internet banking IPOs can still succeed in these perilous times, but at a significant trade off. Since declaring their plans to list in July 2022, Rakuten Bank and its lead banker, Daiwa Securities, have been attempting to find a method to do so. The agreement encountered difficulties that were both external and internal.

The IPO of a digital bank in Asia was being launched by Rakuten at maybe the worst possible time, as the tech industry was in freefall and Asian fintechs like Paytm and Alibaba were suffering the most. For instance, Korea's KakaoBank briefly became the nation's most valuable bank following a stunning offering a year prior to the IPO announcement; a year later, it traded at under a third of its opening price. The reason why Rakuten still went for an IPO is because of the strikingly ambitious plan by founder Hiroshi Mikitani to transform Rakuten from an e-commerce group to a telecom’s player, with a mobile network ready to compete against NTT DoCoMo, SoftBank and others. Combining all these things (consumer e-commerce, telecoms, banking, brokerage) would make a powerful force.

The market, though, wasn't at all confident that Rakuten could make it. Because the requirements to build a mobile network to compete against operators likeNTT DoCoMo are expensive, Rakuten was unable to wait for more opportune conditions to launch its digital bank IPO. Consequently, Daiwa and Rakuten found themselves forced to make an accommodation with the market. They started out pitching the deal at an indicative range with ¥1,960 ($14.64) at the top of it. After investors expressed their disagreement with the price, the deal eventually sold at ¥1,400 a share, and then promptly went right up to ¥1,960 on its first day of trading anyway. Even if the initial valuation may have been correct, it doesn’t mean that it is coherent with the actual situation the company is currently in.

This could imply that investors, which were heavily damaged by tech in the last 18 months, want some payback. Still, Rakuten raised $625 million equivalent that it urgently needs and is considered Japan’s biggest IPO since 2018. So, deals can still get done, though it helps if the business being listed has a track record rather than some elemental sense of promise. Rakuten’s digital banking business, the biggest internet lender in Japan, is profitable and has been for several years. In fact, if it wasn’t linked to its debt-heavy parent (Rakuten Group), it probably could have raised a lot more. As it is, based on first-day trading, it has a value of ¥330 billion (about $2.5 billion). The problem is that official data doesn’t actually support this value.

The allocation was clearly tilted towards overseas investors as shown by the increase in the proportion of the IPO that could be bought by foreigners. However, in the larger context of the Rakuten corporation, there are still questions regarding the source of the funding that will be used to support the fervent ambitions of the company's founder, Hiroshi Mikitani. Rakuten Group reported a yearly loss of 372.8 billion yen in February.

Even after a launch bounce of 40%, that is more than four times what this IPO raised and more than the bank's entire market value. By 2024, Rakuten must pay $400 billion in bonds. There is a whole lot more to accomplish for the gathering to arrive at a position of safety.

By Federica Guirguis, Teo Matei, Dinu Cionga

SOURCES

- Ft.com

- Reuters.com

- Japantimes.co.jp

- Bloomberg.com

- Statista

- EY

- Deloitte

- White&Case