In the wake of Reddit's recent IPO, shares initially surged 48%, reflecting investors' enthusiasm. However, beneath the surface of this market optimism a crucial question: can Reddit achieve profitability? Despite the initial soaring share price, uncertainties loom over the company's ability to translate revenue growth into sustained profitability. This article takes an in-depth look at Reddit's IPO journey, analyzing its financial performance, challenges and prospects for future profitability in a volatile market environment.

IPO market conditions analysis

Growing confidence in the U.S. economy resilience, combined with signals from the Federal Reserve hinting at potential interest rate cuts later this year, has reignited interest in IPOs. However, despite this renewed optimism, lingering geopolitical uncertainties and the backdrop of ongoing elections throughout the year suggest that the favorable conditions for IPOs may be short-lived.

In 2023, interest rates in major economies rose in an effort to curb inflation, reaching highs not seen in many years. Recent signs from the bond markets indicate that investors believe interest rates may have already reached their peak, with anticipated rate cuts factored in for 2024, despite assurances of prolonged rate stability from the central banks of the US, Europe, and the UK.

Furthermore, an active follow-on market underscores continued investor appetite for equity in quality businesses, offering promising prospects for the IPO market's recovery. In 2023, the U.S. was the global leader in follow-on issuance, while London retained its position as Europe's most active exchange.

In Europe, Douglas AG, a leading German perfume retailer, recently set the price of its 890 million EUR IPO at 26 EUR per share. Additionally, the company's owners have pledged to infuse approximately 300 million euros to fortify the group's financial position. Positioning itself as an attractive investment opportunity for European fund managers seeking exposure to the upscale beauty segment, Douglas's IPO arrives amidst a resurgence in IPO activity following two lackluster years driven by interest rate fluctuations. Despite this, Douglas's share price on the Frankfurt stock exchange has dropped over 15% since trading commenced, largely due to investor concerns triggered by a warning from Gucci’s owner, Kering, about weak sales, denting confidence in the luxury and retail sector.

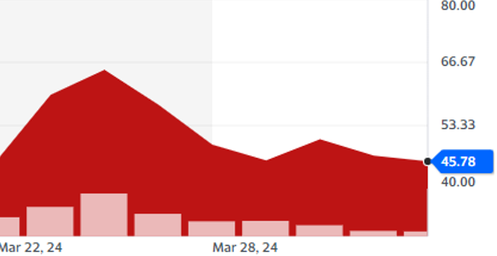

Meanwhile, in the U.S., the social media platform Reddit witnessed a stellar debut on the NYSE, with its shares surging 48% at the end of the first-day of trading, indicating a potential resurgence in investor appetite for IPOs, particularly those from promising yet financially struggling companies. Initially priced at $34, Reddit's shares opened at $47 on their first day of trading, only to experience a subsequent decline of nearly 25% between March 26th and March 28th. Now, Reddit’s shares are sitting below their initial closing price at $46.

Source: Yahoo Finance

About Reddit

Reddit was founded by University of Virginia students Steve Huffman, Alexis Ohnian and Aaron Schwarz in 2005 following their admission to Y Combinator’s first accelerator program. The idea behind Reddit was to create a community moderated news forum with an anonymous voting system to sort posts by relevance. After Reddit’s initial success, the site was acquired by publishing company Condé Nast in 2006, and later raised further funding from multiple renowned individual investors such as Sam Altman and Peter Thiel. In 2019 Tencent bought a minority stake in the company and is still the second largest shareholder after Advance Publications (the parent of Condé Nast). The company’s leadership has changed frequently throughout the years. The founders left the company a few years after its initial acquisition, but after outside executives were forced to step down due to managerial issues, Huffman and Ohnian were rehired as CEO and Executive chairman respectively, and the former is still in charge of the company.

Reddit’s business model, like many social media websites’, is mainly built on advertising and selling premium subscriptions. Reddit’s advertising business is divided into two categories, Reddit Ads managed service for large companies and political campaigns with minimum spending of $200,000 per year and a second where advertisers bid on advertising space. Reddit also offers premium memberships to its users for 6 dollars per month. Premium members get exclusive digital avatars, have exclusive access for “premium only” communities and enjoy ad-free browsing. Before its current system, Reddit users could purchase coins, the Reddit currency, to purchase awards, highlights users can gift for post and comment posters, and digital avatars.

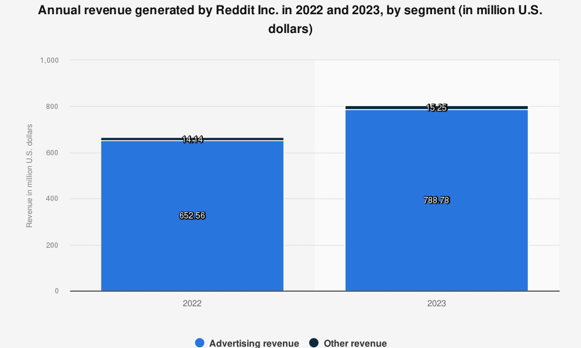

Source: Statista

Although Reddit’s business model bears similarity to other social media platforms, its community-based approach gives it a distinct cost advantage. Reddit’s thematical communities, called subreddits, are moderated by community appointed moderators, who are restricting and filtering content according to the often-strict content rules of subreddits. Other large social media platforms such as Facebook spend billions of dollars annually to make sure their users adhere to the company’s content policy. Due to Reddit’s community defined content policies and “self-policing” of subreddits, Reddit potentially saves hundreds of millions of dollars per year in such expenses.

The Million Dollar question: Will Reddit ever be profitable?

“We have a history of net losses and we may not be able to achieve or maintain profitability in the future”, read the SEC’s Registration Statement as Reddit filed for its Initial Public Offering. How can a company with 20-year historical losses that amount to more than $717 million decide to debut in the New York Stock Exchange? While it is not unusual for young companies making a loss to go public, Reddit has been one of the most used social media platforms and has been consistently reporting losses for years. Despite Reddit’s future of uncertainty, its recent confidence indicates that it might be on track towards profitability despite never having been profitable before.

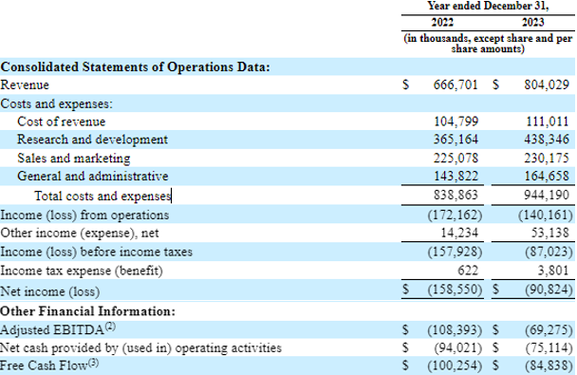

Reddit’s main financial results presented in the IPO’s prospectus are the following:

Source: IPO prospectus

Future outlook and projections

In terms of future outlook, Reddit claimed it expects to mimic last year’s growth rate, with at least a 20% sales growth in 2024. Although this signifies a great increase in revenue, the expectations are to break even this year, still not seeing those desired green numbers. Moreover, it is important to note the great deal of uncertainty about Reddit’s future. In fact, its performance is so uncertain that as of the writing of this article, the only analyst to have published projections is Dan Salmon from New Street Research.

In his recent projections, Salmon has forecasted a revenue of $1.16 billion for 2024, a 44% increase from last year. Furthermore, Salmon expects a revenue growth of 34% in 2025, reaching a value of 1.55 billion. More importantly, he projects Reddit to have a positive adjusted EBITDA for the first time in years, reaching $172 million in 2024, followed by $326 million and $525 million in 2026, respectively.

However, comparisons with similar “second-tier social media companies''- as Robert Armstrong from the FT suggests- have shown that growing revenues do not imply profitability. Ignoring Facebook’s post-IPO performance due to a clear first-mover advantage in the social media realm, Snap, Pinterest, and Twitter have shown that growing revenue into the billions does not necessarily imply profitability. These companies’ true free cash flow, (that is operating cash flow minus stock-based compensations and capital expenditure) have not been consistently positive.

For a social media Company, generating positive free cash flow depends on Daily Active Users (DAU) and Average Revenue Per User (ARPU). Reddit’s DAU is decent, with around 73 million daily active unique users. However, despite experiencing a growth in DAU of 27% in Q4 of 2023 as compared to the same period in 2022, it still lags Meta’s 2.11 billion DAU, Twitter/X’s 220 million DAU, and Snap’s 375 million DAU. Furthermore, Reddit’s DAU per quarter is significantly volatile as it is greatly affected by geopolitical and cultural events, shown by the increase in DAU after the Russian invasion of Ukraine.

With regards to ARPU, the numbers show Reddit is not doing a good job monetizing their user base. Reddit’s 2023 Q4 ARPU was $3.42, 2% less than 2022 Q4’s. In the United States, Reddit’s ARPU was

$2.09 below the average for social media companies. In fact, it was 17x less than Meta’s in 2023 for the U.S. and Canada. However, these numbers combined with the fact that Reddit has the most unique users in any social media company (most Reddit users are inactive in other platforms) show great opportunity to improve monetization. Reddit has a lot of bargaining power and access to a community that no other social media Company has, and it must take advantage of it.

What can we expect from Reddit, then? Well, Reddit finds itself in a crossroad with multiple paths towards its profitability. Exploring new revenue sources to stop relying solely on advertising revenue and decreasing R&D costs relative to their revenue are the keys to success. The only thing we can say for sure is that if it is not able to efficiently turn the growing DAU into cash it will not be able to follow Meta’s path and will most likely have the fate of the other “second tier” social media companies.

Conclusion

As Reddit's IPO progresses, it becomes increasingly evident that, although the company has caught the attention of investors with its initial soaring share price, the path to profitability remains uncertain. Despite robust revenue growth and strategic initiatives such as artificial intelligence development and licensing agreements, Reddit's high operating expenses continue to weigh on its financial performance. The coming years will be crucial for Reddit, which will have to address these challenges and try to translate its growing user base into sustainable profitability. In a dynamic market landscape characterised by volatility and innovation, the fate of Reddit's profitability depends on its ability to effectively monetise its platform while managing expenses wisely.

By Lucas Albín Lazcano, Mate Mangoff, Alexander Lockhart

Sources

- CNBC

- Morningstar

- Fitch ratings

- Reddit prospectus

- Financial Times

- Fortune

- Investor place

- Yahoo Finance

- Statista