The article examines two macro risks that could impact investors: weaknesses in the commercial real estate market and concerns over the stability of regional banks. The commercial real estate market has been experiencing weaknesses and vulnerabilities that have investors concerned, particularly with the potential risks associated with commercial real estate investments for regional banks. On the other hand, regional banks have been facing concerns over their stability, with investors worried about potential risks associated with exposure to commercial real estate. The article, after describing both the commercial real estate market and regional banks, examines the interconnectedness between commercial real estate and regional banks, particularly focusing on lending practices, and how the two risks impact each other.

Commercial Real Estate: Weakness and Vulnerability

Lately the concerns regarding the commercial real estate (CRE) industry have been growing. Driven for a long period by low interest rates and easily accessible credit, the CRE industry started facing difficulties after the beginning of the pandemic, when the occupancy of the office buildings, as well as other commercial real estate units, fell sharply. The rising interest rates, as the result of the attempts of the central banks to ease inflation, has also hit the industry that is considered quite credit depended. Moreover, the recent stress among regional banking sector is expected to only add to the difficulties the industry has been facing. Before exploring the interconnectedness of the two sectors (CRE and regional banking) and the consequential risks, it is worth first having a look at the CRE industry and its major recent trends.

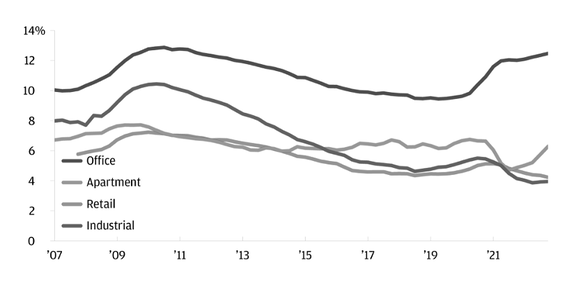

According to the National Association of Real Estate Investment Trusts, the US CRE industry value is estimated to fall within a range of $18-$22 trillion dollars. It is comprised by several subsectors (or asset classes) such as multifamily properties, industrial, retail, and office buildings. The multifamily properties are the highest performing of all the asset classes. The owners of this type of assets are not immune to cost rises, but they can adjust rents depending on the market environment annually, if not monthly. Industrial property sector (warehouses and industrial space) is mostly driven by an increase in e-commerce, however, a major challenge related to rising rates pertains to long-term leases. Retail sector experiences some difficulties to bounce back because of the rise in e-commerce, as well as a result of remote work (less people work in downtown offices and, thus, frequent city center malls). Offices remain a unique category in current circumstances, as its future seems unclear. The office CRE sector is characterized by the highest vacancy rates (i.e., the percentage of all available units in a rental property, that are vacant or unoccupied at a particular time). Which is worth noting, vacancy rates in other sectors such as retail or industrial remain well below the pre-pandemic level, while in case of the offices it has been growing ever since. According to Moody’s analytics, none of the regions in the U.S. have seen vacancy rates dip below their pre pandemic, end of 2019 levels, which can signal that it might take time for the office subsector to recover.

Lately the concerns regarding the commercial real estate (CRE) industry have been growing. Driven for a long period by low interest rates and easily accessible credit, the CRE industry started facing difficulties after the beginning of the pandemic, when the occupancy of the office buildings, as well as other commercial real estate units, fell sharply. The rising interest rates, as the result of the attempts of the central banks to ease inflation, has also hit the industry that is considered quite credit depended. Moreover, the recent stress among regional banking sector is expected to only add to the difficulties the industry has been facing. Before exploring the interconnectedness of the two sectors (CRE and regional banking) and the consequential risks, it is worth first having a look at the CRE industry and its major recent trends.

According to the National Association of Real Estate Investment Trusts, the US CRE industry value is estimated to fall within a range of $18-$22 trillion dollars. It is comprised by several subsectors (or asset classes) such as multifamily properties, industrial, retail, and office buildings. The multifamily properties are the highest performing of all the asset classes. The owners of this type of assets are not immune to cost rises, but they can adjust rents depending on the market environment annually, if not monthly. Industrial property sector (warehouses and industrial space) is mostly driven by an increase in e-commerce, however, a major challenge related to rising rates pertains to long-term leases. Retail sector experiences some difficulties to bounce back because of the rise in e-commerce, as well as a result of remote work (less people work in downtown offices and, thus, frequent city center malls). Offices remain a unique category in current circumstances, as its future seems unclear. The office CRE sector is characterized by the highest vacancy rates (i.e., the percentage of all available units in a rental property, that are vacant or unoccupied at a particular time). Which is worth noting, vacancy rates in other sectors such as retail or industrial remain well below the pre-pandemic level, while in case of the offices it has been growing ever since. According to Moody’s analytics, none of the regions in the U.S. have seen vacancy rates dip below their pre pandemic, end of 2019 levels, which can signal that it might take time for the office subsector to recover.

In the 2023 commercial real estate outlook, Al Brooks, head of commercial real estate at JP Morgan, listed the following major macroeconomic factors that can potentially lead to a mild recession in the sector: geopolitical risk, high inflation, and rising interest rates. Moreover, taking into the consideration the recent distress in the regional banking sector, we can say that the CRE industry is dealing with a “challenging” environment. The Goldman Sachs note in March highlighted the potential spillover effect due to the interconnectedness of CRE and regional banks: “The recent stress in the banking sector has fueled growing concern about spillover effects on the commercial real estate industry. With over half of the $5.6tn of outstanding commercial loans sitting on bank balance sheets, bank lending remains the primary source of funding for the sector. This is particularly the case for small banks which capture the lion’s share of lending.”

Source: JP Morgan

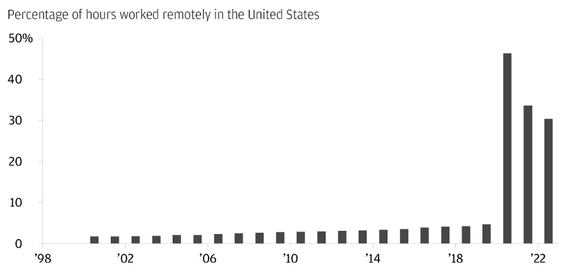

Regional banks are the most exposed agents to commercial real estate lending

Some of the top commercial real estate (CRE) lenders in the United States have significant exposure to office loans, which are projected to suffer continuous pressure due to the enduring power of remote work. In fact, although more people returned to workplaces in 2022, the overall degree of remote work remains seven times higher than it was prior to the epidemic. Moreover, additional pressure comes from the Federal Reserve's historically quick rate of interest rate rises during the past year, combined with accelerating layoffs in professional and business services (e.g., in the technology sector) and the obsolescence of older office buildings.

Some of the top commercial real estate (CRE) lenders in the United States have significant exposure to office loans, which are projected to suffer continuous pressure due to the enduring power of remote work. In fact, although more people returned to workplaces in 2022, the overall degree of remote work remains seven times higher than it was prior to the epidemic. Moreover, additional pressure comes from the Federal Reserve's historically quick rate of interest rate rises during the past year, combined with accelerating layoffs in professional and business services (e.g., in the technology sector) and the obsolescence of older office buildings.

Source: JP Morgan

While loss rates may increase dramatically and have an impact on revenues, it appears that the largest bank CRE lenders can manage their exposure. However, what is extremely important to bear in mind in reality is that roughly 80% of CRE lending is done by the community and regional banks. With regional banks we mean mid-sized financial institutions with a large number of locations—often referred to as branches—distributed within a certain geographic area. According to the Federal Reserve Board, regional banks have assets ranging from $10 billion to $100 billion. In the United States, examples of such agents are Silicon Valley Bank and First Republic Bank, both of which have recently made headlines. Investors have started expressing concerns about the regional banks' balance sheet vulnerabilities ever since two regional U.S. banks, Silicon Valley Bank and Signature Bank, abruptly and unexpectedly failed in March, sending shockwaves through the U.S. financial system.

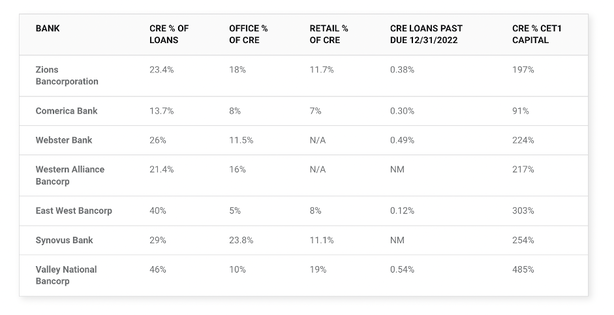

As already mentioned, exposure to CRE and office space seems to be manageable among larger banks because these larger banks have significantly de-risked their portfolios since the Great Recession and accumulated capital. Furthermore, Dodd-Frank regulation, implemented in 2010, has encouraged less lending and more bond investment, which has contributed to the recent bank problems. However, for smaller banks, CRE lending is their bread and butter, thus they have far larger exposure, especially when compared to their capital. Below, we present the positions of numerous regional banks at the end of last year in terms of CRE exposure and retail and office loans in this portfolio, two categories that investors are interested in.

As already mentioned, exposure to CRE and office space seems to be manageable among larger banks because these larger banks have significantly de-risked their portfolios since the Great Recession and accumulated capital. Furthermore, Dodd-Frank regulation, implemented in 2010, has encouraged less lending and more bond investment, which has contributed to the recent bank problems. However, for smaller banks, CRE lending is their bread and butter, thus they have far larger exposure, especially when compared to their capital. Below, we present the positions of numerous regional banks at the end of last year in terms of CRE exposure and retail and office loans in this portfolio, two categories that investors are interested in.

Source: Bank regulatory filings/earnings materials.

From the graph, the majority of these small banks are heavily involved in financing for commercial real estate, offices, and retail. A crucial limit is 300% when considering CRE exposure as a proportion of core capital. Banks can easily go above this threshold, but at that point, especially if they have had rapid growth recently, regulators will start to take notice. Some of the players mentioned above, such as Valley National and East West Bancorp, are at or much above this 300% cutoff. Nonetheless, so far, credit quality has been remarkably good, with virtually no loan losses and scarcely any loans where the borrowers are even past due on payments occurring in the CRE portfolios of all of these institutions. Furthermore, it appears that the majority of these CRE loan portfolios were underwritten cautiously. For instance, at Valley National, the CRE portfolio's weighted average loan-to-value ratio was 58% at the end of 2022, implying that the usual borrower equity in a loan is 42% of the appraised property value, providing borrowers with significant skin in the game. In Valley National's CRE portfolio, the weighted average debt-to-service coverage ratio (DSCR), which considers a borrower's operational revenue as a percentage of debt payments, was 175%.

Provided that this results to be the current situation for most of the regional banks, stability should not be in doubt for now. Still, in the next few paragraphs, we will present the possible outlooks for the future in a more detailed way.

Provided that this results to be the current situation for most of the regional banks, stability should not be in doubt for now. Still, in the next few paragraphs, we will present the possible outlooks for the future in a more detailed way.

Regional banks and Commercial Real Estate: two crises overlapping

The stability of regional banks and the weakness in the Commercial Real Estate (CRE) market are two different macroeconomic topics, but their crises overlap sharply.

Midsize and regional banks hold 4.4 times more exposure to US CRE loans than their larger counterparts. These loans represent 28.7% of smaller banks’ assets, and are typically packaged into complex financial products to be sold to investors, allowing banks to raise more money to make new loans; these securitized products are called Commercial Mortgage-Backed Securities (CMBS), resulting in a more-than-$72-billion market last year.

In the last few months though, banks became more conservative with respect to loans, inevitably slowing down construction activity and increasing the likelihood of a recession.

The possibility of further increases in interest rates by the Fed and the more aggressive regulators' calls are leading banks to conserve capital to strengthen their balance sheets.

Banks tightening lending standards strongly affect the real estate sector, which was already impacted by the macroeconomic situation since CRE asset values are very long duration in nature and consequently particularly sensitive to interest rates. In fact, steady future cash flows from commercial buildings become less attractive as rates rise, and real estate stocks were among the hardest hit by the Fed’s aggressive rate hikes in 2022.

Along with falling property values, tighter financial conditions and illiquid markets, a significant percentage of CRE loans will require refinancing in the coming years, exacerbating difficulties for borrowers in a rising rate environment. Actually, banks are still refinancing, but at a lower LTV (Loan-To-Value) than before and at a higher rate, inevitably leading to a possible CRE market downturn.

As mentioned before, the office sector is the most affected among CRE, as a growing number of people have been working remotely since the pandemic and estimated office values have fallen by about 20%; at the moment, other large portions of CRE (e.g. logistics, hotels, data centres) are still performing well and have strong fundamentals, but even so, analysts are wondering whether the office crisis will spread.

In fact, the underperformance of certain CRE niches has an impact on regional banks' earnings, depending on the exposure to losses across these vulnerable sectors and the severity and speed of those losses.

Signature Bank’s failure is proof of the reciprocal impact that the CRE market and regional banks have on each other. Before collapsing, Signature Bank was one of the medium-sized banks providing the bulk of commercial real estate loans to businesses. Before regulators stepped in March, numerous customers fled the bank, withdrawing more than $10 billion in deposits. Even with the sale of banking deposits to New York Community Bancorp, which picked up about $34 billion in customer deposits, there are concerns about whether other banks will fill the gap left by the collapse of Signature: its real estate portfolio is still up in the air.

The risk deriving from this correlation is difficult to quantify, but profitability challenges in the banking sector could reduce available financing and raise the cost for small and medium-sized businesses. Therefore, regional banks have been looking for a CRE hedging strategy for years, but it’s considered a “white whale”, as the sector seems to be unexpectedly difficult to short or hedge. At the same time though, CRE is broadly distributed amongst big banks, small banks, insurance companies, government agencies, securitizations and mortgages, reassuring on the catastrophic hypothesis of it being a systemic issue in the banking system.

Future outlook

Considering the current economic climate, it is no wonder that investors have feelings of uncertainty for the future. Persistent inflation and rising costs of real estate could reflect negatively on their investment portfolios. Hence, it would be important for investors to consider different modes of production, including but not limited to hedging from inflation with derivatives. Nonetheless, futures may not always lead to positive returns, so investors must be certain in their future outlook by consulting financial analysts and market research. While the purchase of options would lead to a smaller loss in the case of a failed hedging strategy, the amount should be smaller than in the case of futures. Still, successful hedging has the potential to minimize the already rising costs for real estate owners and provide some stabilization in uncertain times.

Another important issue to address is the lack of tenants for CRE, especially for office buildings. With a shift towards remote work models, investors might want to reconsider their rent models, instead by creating coworking spaces. Rent price would be split among multiple clients instead of a single one in a monthly subscription-based model, therefore reducing costs for one party while possibly increasing returns for the investor. By adjusting towards modern work standards, investors could increase their ROI despite the current macroeconomic slowdown. Still, there are some downsides to the strategy such as the possible need for further investment and time delays in the registration of a new business. For other types of properties, considering that costs of production across many industries are increasing, best case scenarios include lowering prices to match market standards and minimizing losses. Whether inflation is here to stay or not, it can take time for consumers to rebuild their spending confidence and for wages to increase. Once macroeconomic status quo is reached, it will become easier for investors to repay their loans back to the banks. Meanwhile, banks need to adjust their expectations and plan accordingly in order to survive the tough times. Unfortunately, some banks may not survive the crisis and others may excel, we have already seen that with the fall of large commercial banks. Still, preventative measures can be taken in the form of partnership creations or mergers.

Considering the current economic climate, it is no wonder that investors have feelings of uncertainty for the future. Persistent inflation and rising costs of real estate could reflect negatively on their investment portfolios. Hence, it would be important for investors to consider different modes of production, including but not limited to hedging from inflation with derivatives. Nonetheless, futures may not always lead to positive returns, so investors must be certain in their future outlook by consulting financial analysts and market research. While the purchase of options would lead to a smaller loss in the case of a failed hedging strategy, the amount should be smaller than in the case of futures. Still, successful hedging has the potential to minimize the already rising costs for real estate owners and provide some stabilization in uncertain times.

Another important issue to address is the lack of tenants for CRE, especially for office buildings. With a shift towards remote work models, investors might want to reconsider their rent models, instead by creating coworking spaces. Rent price would be split among multiple clients instead of a single one in a monthly subscription-based model, therefore reducing costs for one party while possibly increasing returns for the investor. By adjusting towards modern work standards, investors could increase their ROI despite the current macroeconomic slowdown. Still, there are some downsides to the strategy such as the possible need for further investment and time delays in the registration of a new business. For other types of properties, considering that costs of production across many industries are increasing, best case scenarios include lowering prices to match market standards and minimizing losses. Whether inflation is here to stay or not, it can take time for consumers to rebuild their spending confidence and for wages to increase. Once macroeconomic status quo is reached, it will become easier for investors to repay their loans back to the banks. Meanwhile, banks need to adjust their expectations and plan accordingly in order to survive the tough times. Unfortunately, some banks may not survive the crisis and others may excel, we have already seen that with the fall of large commercial banks. Still, preventative measures can be taken in the form of partnership creations or mergers.

By Anastasia Larionova, Matteo Panizza, Polina Mednikova, Sofia Rubino

SOURCES

- https://www.ft.com/content/705df695-c81c-4ddf-8d56-a0a6e9cd7500

- https://www.nytimes.com/2023/03/22/business/svb-signature-commercial-real-estate.html

- https://www.reuters.com/markets/us/banking-crisis-scars-struggling-us-real-estate-stocks-2023-04-19/

- https://privatebank.jpmorgan.com/gl/en/insights/investing/are-banks-vulnerable-to-a-crisis-in-commercial-real-estate

- https://www.fool.com/investing/2023/04/05/is-the-market-right-to-be-concerned-about-regional/

- https://www.thestreet.com/dictionary/r/regional-bank

- https://www.bloomberg.com/news/articles/2023-04-10/transcript-what-commercial-real-estate-stress-means-for-banks-and-bond-funds?leadSource=uverify%20wall

- https://www.reit.com/data-research/research/nareit-research/estimating-size-commercial-real-estate-market-us-2021

- https://www.jpmorgan.com/commercial-banking/insights/2023-commercial-real-estate-trends

- https://www.ft.com/content/65524cf7-954d-44a1-beb5-b24d29c30945