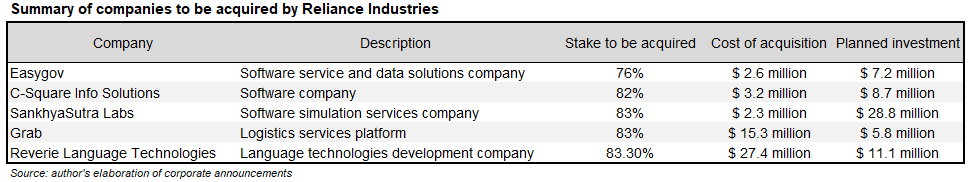

In the two weeks ended on March 3rd, Reliance Industries announced the acquisition of five tech companies. The acquisitions, expected to be completed by 2021, will support the plans of the Indian conglomerate to improve its “digital initiatives”.

Reliance will pay $50.8 million in cash for the acquisition of the shares, and will then invest an additional $61.6 million into the acquired entities.

Reliance will pay $50.8 million in cash for the acquisition of the shares, and will then invest an additional $61.6 million into the acquired entities.

Indeed, these transactions may appear inconsequential when their size is compared to the one of Reliance – which last year reported a net income of $5.2 billion. Nevertheless, they are highly significant as they represent the company’s firsts steps into the space of e-commerce.

|

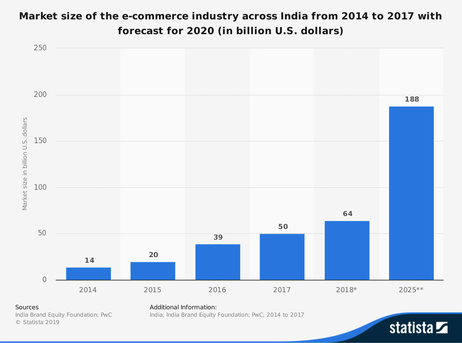

E-commerce is currently booming in India thanks to the rapid spread of smartphones and affordable data plans, which are providing internet access to an increasingly large number of people.

Despite the astonishing expansion which Indian e-commerce has seen in recent years, online retail in India still accounts for a very modest portion of total retail (2.5% as of 2016), signalling the presence of a substantial opportunity for growth. According to estimates from the India Brand Equity Foundation, the size of the e-commerce industry in India will reach $188 billion in 2025, jumping from $64 billion in 2018. |

As Reliance’s chairman Mukesh Ambani explained during the “Vibrant Gujarat Summit”, an investment conference held in mid-January, the conglomerate aims to penetrate Indian e-commerce by leveraging the combined strength of Reliance Retail and Reliance Jio – respectively its retail and telecom subsidiary – which are planned to jointly launch a “new commerce” platform within the end of this year.

One of the key benefits of this partnership would be generated by Jio’s reach: by providing internet services to over 250 million people, almost half of the Indian internet user-base, Jio can facilitate customer acquisition and greatly reduce the costs incurred by Reliance.

The details of the platform, which according to Ambani is going to benefit millions of small merchants, have not yet been revealed. It is heavily speculated, however, that it will allow small and medium-sized retailers to sell their goods online, as well as enable Reliance Retail to market its private labels.

This would pose a serious threat to Amazon and Wal-Mart, by raising competition at a particularly unfavourable time. The two American giants, which have invested billions in developing business in India and now account for over 70% of the country’s online sales, are in fact being heavily hit by recent changes in Indian regulation.

While India has been prohibiting foreign multi-brand retailers from selling goods directly to consumers for a long time, so far Amazon and Wal-Mart have been able to exploit legal workarounds – such as establishing joint ventures with local companies, which would hold inventories and then sell them to consumers – to effectively operate in the country undisturbed.

The Indian government did not seem to be troubled by these workarounds until a few months ago. With the approach of a general election in India, however, the government led by prime minister Narendra Modi has become increasingly responsive to the concerns of small merchants and business owners – a crucial electoral constituency, historically supportive of the Modi government. These groups have been greatly impacted by the competition brought by foreign multinationals, which are able to offer products at lower price-points. The new Indian regulation, which has taken effect February 1st, therefore bans the workarounds which foreign companies had found, and renders wholesaling goods to businesses their only option.

This deals a huge blow to Amazon and Wal-Mart to the benefit of Reliance, which at the moment is positioned exceptionally well in order to capture the opportunities presented by Indian e-commerce.

Alessandro Marengo

One of the key benefits of this partnership would be generated by Jio’s reach: by providing internet services to over 250 million people, almost half of the Indian internet user-base, Jio can facilitate customer acquisition and greatly reduce the costs incurred by Reliance.

The details of the platform, which according to Ambani is going to benefit millions of small merchants, have not yet been revealed. It is heavily speculated, however, that it will allow small and medium-sized retailers to sell their goods online, as well as enable Reliance Retail to market its private labels.

This would pose a serious threat to Amazon and Wal-Mart, by raising competition at a particularly unfavourable time. The two American giants, which have invested billions in developing business in India and now account for over 70% of the country’s online sales, are in fact being heavily hit by recent changes in Indian regulation.

While India has been prohibiting foreign multi-brand retailers from selling goods directly to consumers for a long time, so far Amazon and Wal-Mart have been able to exploit legal workarounds – such as establishing joint ventures with local companies, which would hold inventories and then sell them to consumers – to effectively operate in the country undisturbed.

The Indian government did not seem to be troubled by these workarounds until a few months ago. With the approach of a general election in India, however, the government led by prime minister Narendra Modi has become increasingly responsive to the concerns of small merchants and business owners – a crucial electoral constituency, historically supportive of the Modi government. These groups have been greatly impacted by the competition brought by foreign multinationals, which are able to offer products at lower price-points. The new Indian regulation, which has taken effect February 1st, therefore bans the workarounds which foreign companies had found, and renders wholesaling goods to businesses their only option.

This deals a huge blow to Amazon and Wal-Mart to the benefit of Reliance, which at the moment is positioned exceptionally well in order to capture the opportunities presented by Indian e-commerce.

Alessandro Marengo