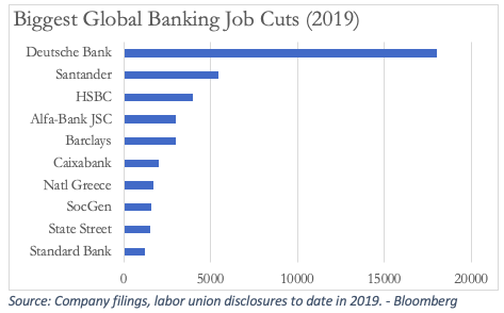

58,200 jobs. This is the estimation published by Bloomberg last month regarding the jobs that will be cut by the major banks by 2019. Every week we learn about new workforce reduction plans: the last to announce cuts were HSBC (10,000 jobs), Barclays (3,000 in the single second quarter of 2019) and Deutsche Bank (18,000 employees, of which 9,000 in Germany). Furthermore, it is worth noting that even Unicredit could insert another round of massive staff cuts, both in Italy and in the other European countries, to reduce operating costs by up to 10%, according to Bloomberg indiscretions.

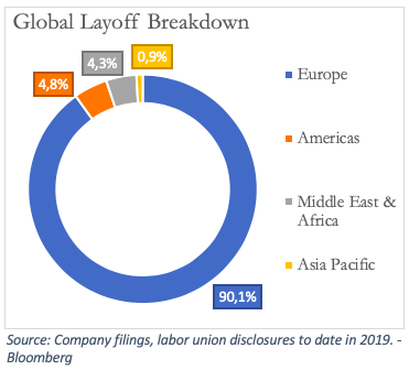

This earthquake did not spare even the investment banking division. Think of SocGen, which has reduced its workforce employed in investment banking services by 8% this year, or to Citi, who fired more than 20 directors of the same division in London just three weeks ago. These operations are covering different groups all over the world but are particularly evident in the EU and European institutions.

What are the factors that led to these massive restructuring? Why especially in our continent?

As often happens, simple questions do not find equally simple answers. The reasons that led to these personnel operations are different and can be classified into at least 3 types: macroeconomic, regulatory and geopolitical. The mix of these factors is impacting heavily on banks' balance sheets, forcing them to cut costs where possible.

Let's start with the macroeconomic environment. The current level of interest rates, further confirmed by the extremely accommodating choices recently made by FED and ECB, are detrimental to the revenues of financial institutions, as recently stated by Andrew Lowe (Berenberg): "It's hard to make money as an investment bank in a negative rates environment." And it is indeed true, especially in Europe: banks see for the first time the level of the so-called "banking privilege", coinciding with the deposit rate set by the central bank (CBD), falling below zero. This implies that now being a bank is no longer an advantage, but a disadvantage: the reserves at the ECB are being eroded instead of generating revenues. It is worth noting that European banks are also penalized by the still too weak growth of the Eurozone countries, against US institutions that can count on an American economy still in good health.

What are the factors that led to these massive restructuring? Why especially in our continent?

As often happens, simple questions do not find equally simple answers. The reasons that led to these personnel operations are different and can be classified into at least 3 types: macroeconomic, regulatory and geopolitical. The mix of these factors is impacting heavily on banks' balance sheets, forcing them to cut costs where possible.

Let's start with the macroeconomic environment. The current level of interest rates, further confirmed by the extremely accommodating choices recently made by FED and ECB, are detrimental to the revenues of financial institutions, as recently stated by Andrew Lowe (Berenberg): "It's hard to make money as an investment bank in a negative rates environment." And it is indeed true, especially in Europe: banks see for the first time the level of the so-called "banking privilege", coinciding with the deposit rate set by the central bank (CBD), falling below zero. This implies that now being a bank is no longer an advantage, but a disadvantage: the reserves at the ECB are being eroded instead of generating revenues. It is worth noting that European banks are also penalized by the still too weak growth of the Eurozone countries, against US institutions that can count on an American economy still in good health.

Moving to the regulatory reason, on 3 January 2018 the new MiFID II legislation came into force in the European Union. Its main objective is to increase transparency in financial markets in favour of investors, setting more stringent common rules for the institutions of the 28 EU countries. Even if regulators’ intention is certainly respectable, the approval of this new package of laws has contributed to raise the general level of bureaucracy in the operations and consequently the costs that the companies must bear. MiFID II increased the concentration of research houses in Europe, reducing the coverage of small business research and making the survival of smaller companies impossible. All this has further strengthened the competitive advantage of American banks towards their overseas peers.

Finally, we have the geopolitical motivations. Every day we read about developments on the Brexit and trade war fronts, without ever witnessing a real release of one of the two main fears of the markets. This situation is dangerous as it raises the level of uncertainty in the financial markets: until there is a resolution of these two concerns, we will continue to see high volatility in the markets and above all on banking stocks. Other secondary geopolitical reasons are not to be overlooked, such as the Italian political crisis of last year, which caused further uncertainty about the stability of the Eurozone.

Beyond these three reasons listed, several specific reasons lead each bank to implement staff cuts. For example, the willingness of the two major Swiss banks to focus on their core business, wealth management. Deutsche Bank is facing more serious specific problems than any other investment bank, and the 18,000 jobs cut is nothing but the first step towards a complete restructuring of the company. Another example is HSBC, which is progressively shifting its centre of gravity from Europe to Asia.

To conclude, what do we expect in the coming months? Should we suspect more cuts? Can Canary Wharf empty as some analysts’ fear? There is no answer. The plans of the banks are often unclear, and many companies have refused to issue statements regarding restructuring. What is certain is that the structure of European investment banks is not adequate to withstand the environment described above for a long time.

Davide Cibaldi

Finally, we have the geopolitical motivations. Every day we read about developments on the Brexit and trade war fronts, without ever witnessing a real release of one of the two main fears of the markets. This situation is dangerous as it raises the level of uncertainty in the financial markets: until there is a resolution of these two concerns, we will continue to see high volatility in the markets and above all on banking stocks. Other secondary geopolitical reasons are not to be overlooked, such as the Italian political crisis of last year, which caused further uncertainty about the stability of the Eurozone.

Beyond these three reasons listed, several specific reasons lead each bank to implement staff cuts. For example, the willingness of the two major Swiss banks to focus on their core business, wealth management. Deutsche Bank is facing more serious specific problems than any other investment bank, and the 18,000 jobs cut is nothing but the first step towards a complete restructuring of the company. Another example is HSBC, which is progressively shifting its centre of gravity from Europe to Asia.

To conclude, what do we expect in the coming months? Should we suspect more cuts? Can Canary Wharf empty as some analysts’ fear? There is no answer. The plans of the banks are often unclear, and many companies have refused to issue statements regarding restructuring. What is certain is that the structure of European investment banks is not adequate to withstand the environment described above for a long time.

Davide Cibaldi