Last month, Xi Jinping, China’s president, announced that China would offer $60 billion in new funding to Africa. These funds will be used to finance public infrastructures in the target countries, in order to foster economic development; however, they come with some warnings, first of which is China’s interest in using such loans to control resources and political systems, in view of its global ambitions. In particular, in Zambia, a country heavily indebted, there are accusations toward Zambian government of giving up its sovereignity and of letting foreign nations to control its own governamental entities in exchange for $9.4 billion of debt, one third of which comes from China.

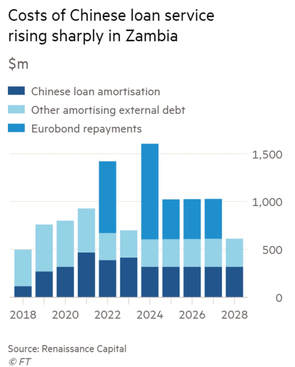

Now, however, it is discussed whether Zambia will be able to meet its obligations in the future and avoid default on its Eurobonds, as the installments on chinese borrowings are expected to rise in the following years. There are indeed several factors that can affect such risk, which are in turn subject to both market and political concerns.

First of all, the Zambian kwacha, the national currency, has depreciated against the US dollar in the last months, therefore making the $9.4 billion of debt more costly in terms of local currency. If this trend in the exchange rate continues in the following periods, the need of an IMF intervention might arise, which would cause further troubles for the country. An IMF assistence could cause some defaults in the short-run, analysts say, even if the ultimate aim is to stabilize the financial situation in the long-run: this in turn can have two major consequences, that is, Chinese and foreign investors in general would be hurt by these measures, and Zambian reputation could end up undermined, therefore leading to higher interest rates in the future and an even higher risk of default.

In particular, potentially higher future rates would add to what we can call the “second warning” from chinese funds: the fact that China is lending funds at commercial rather than concessional rates. This is a serious problem, considering that many loans are finishing their grace period, therefore leading to an expected increase in chinese loan amortization share of total debt to over 50% by 2021.

Another factor that is crucial in determining whether Zambia will be able to meet its obligations is the price of copper. Zambia in fact is highly dependent on copper, which covers about 60% of its overall exports, most of which is demanded by China itself (as a result of neo-colonialist ambitions to import raw materials in exchange for manufactured goods). This year, a cut in chinese spending and investments in infrastructures has caused a decrease in the price of copper, which increases Zambia’s risk of default on foreign debt, but such risk could still be reversed by the chinese trade war with the US which could, hopefully for Zambia, restore copper demand.

In the end, China’s decisions themselves can affect the risk of default by a re-negotiation of the terms on loans to Zambia, in particular by offering longer maturities or grace periods. China might be willing to do so both to avoid any crisis which could hurt its own investors and to preserve its longstanding relationship with Zambia.

With all of these factors playing a major role on risk, what is certain is that there will be an increase in the volatility of prices on Zambian Eurobonds, which could therefore represent an investment opportunity in the debt market.

Gianluca Sobrero

Now, however, it is discussed whether Zambia will be able to meet its obligations in the future and avoid default on its Eurobonds, as the installments on chinese borrowings are expected to rise in the following years. There are indeed several factors that can affect such risk, which are in turn subject to both market and political concerns.

First of all, the Zambian kwacha, the national currency, has depreciated against the US dollar in the last months, therefore making the $9.4 billion of debt more costly in terms of local currency. If this trend in the exchange rate continues in the following periods, the need of an IMF intervention might arise, which would cause further troubles for the country. An IMF assistence could cause some defaults in the short-run, analysts say, even if the ultimate aim is to stabilize the financial situation in the long-run: this in turn can have two major consequences, that is, Chinese and foreign investors in general would be hurt by these measures, and Zambian reputation could end up undermined, therefore leading to higher interest rates in the future and an even higher risk of default.

In particular, potentially higher future rates would add to what we can call the “second warning” from chinese funds: the fact that China is lending funds at commercial rather than concessional rates. This is a serious problem, considering that many loans are finishing their grace period, therefore leading to an expected increase in chinese loan amortization share of total debt to over 50% by 2021.

Another factor that is crucial in determining whether Zambia will be able to meet its obligations is the price of copper. Zambia in fact is highly dependent on copper, which covers about 60% of its overall exports, most of which is demanded by China itself (as a result of neo-colonialist ambitions to import raw materials in exchange for manufactured goods). This year, a cut in chinese spending and investments in infrastructures has caused a decrease in the price of copper, which increases Zambia’s risk of default on foreign debt, but such risk could still be reversed by the chinese trade war with the US which could, hopefully for Zambia, restore copper demand.

In the end, China’s decisions themselves can affect the risk of default by a re-negotiation of the terms on loans to Zambia, in particular by offering longer maturities or grace periods. China might be willing to do so both to avoid any crisis which could hurt its own investors and to preserve its longstanding relationship with Zambia.

With all of these factors playing a major role on risk, what is certain is that there will be an increase in the volatility of prices on Zambian Eurobonds, which could therefore represent an investment opportunity in the debt market.

Gianluca Sobrero