Introduction

There had long been speculation about whether Russia’s mobilization of troops on Ukraine’s eastern border would lead to an invasion, and when it finally did, its impact sent tremors through global markets as economic sanctions, supply chain shocks and destruction loomed. Energy prices hit all-time highs driving a further surge in inflation, the Russian ruble plumped and both European stock and bond markets were not spared. Given these broad implications, the article will look at the specific asset classes in the aftermath of the invasion, spanning from more traditional ones such as Commodities, Fixed Income and Equities to Alternatives like Real Estate.

Fixed Income

A main driver for the fixed income market will be inflation since it will determine the extent of interest rate hikes of central banks. Already before the conflict started inflation was rising, but it was a mixture of supply- and demand-driven inflation. The Russia-Ukraine conflict has an additional significant impact on the inflation rate, starting with the rise of oil and energy prices but also triggered by other commodities. In fact, not only oil prices were enormously affected, but also wheat prices, which receive less attention, are about two-thirds higher than a year ago, since Russia and Ukraine are huge exporters of those goods. Russia is the biggest exporter of wheat and ammonium nitrate, whereas Ukraine is the third biggest of corn, which will drive inflation on food. The longer the conflict goes on, the stronger those effects, which will determine a persistent inflation instead of a transitory one. Therefore, central banks would have to act more aggressively and this would bring bond yields up and prices down.

Corporate Bonds

Throughout the industries, financials might be the ones who profit the most from interest rate hikes due to higher margins. Therefore, bonds in this industry could have attractive upside potential. Besides financials, companies that benefit right now from high margins, like energy companies, can be interesting if the prices of these products stay high. It is important to mention that bonds from high-rated companies tend to be more sensitive to monetary policy changes since they tend to have longer maturities. Thus, they would be the ones most affected should central banks decide to revise their view.

Emerging Markets Sovereign Bonds

Unlike central banks in Western States, some central banks in emerging countries have already raised interest rates to combat inflation. If inflation proves to be transitory and flattens in 2022, bonds from these countries could benefit since investors are looking for yield and potential returns.

In the meantime, it is worth noticing that both Russian and Ukraine bonds get downgraded from all rating agencies: Fitch downgraded Russian sovereign rating to C and S&P to CC to reflect concerns over an imminent default triggered by the international sanctions imposed on the country. In addition to that, Ukraine Bonds’ rating was also lowered to B- by Fitch on the 4th of March.

Developed Markets Sovereign Bonds

Western industrial countries' bond yields are rising with German Bonds navigating in the positive territory after being negative for 30 months. The German 10-year bond yield has been rising from about -0.5% to over 0.5%. Since central banks decided to reduce or stop their bond purchasing programs, this will have a further negative effect on bond prices. For diversification or for risk-spreading purposes they still might be interesting for some investors.

European and Russian Equities

European Equities

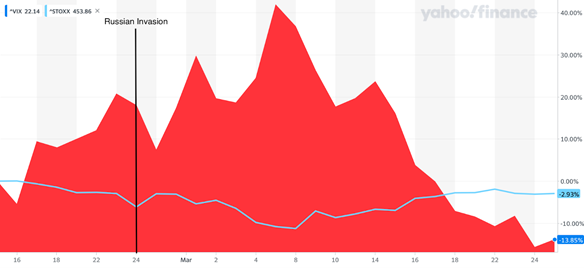

Stoxx European 600 has seen a strong rise since March 8th and wiped out all losses that occurred since the Ukraine invasion of Russia. After the invasion, the index lost nearly 9% in the following days. If we overlap the Euro Stoxx 600 Index with the CBOE VIX Index (which measures expectations of future market volatility) we see a negative correlation over the last thirty days. On the 8th of March, the VIX index reached its thirty-day high while the Euro Stoxx 600 reached its 30-day low. At the moment, the VIX is lower than before the invasion which would imply that investors are expecting calm and less volatile times lying ahead of us.

There could be two possible explanations behind this. First, investors might expect central banks to delay interest rate hikes due to the conflict and the impact on economic growth. However, this seems unrealistic especially in the US, given the soaring inflation and the latest statements from the FED. Second, and more likely, investors read from financial history, and this taught us that wars certainly can affect the real economy but have only a small impact on stock volatility and prices in the mid-and long-term.

There had long been speculation about whether Russia’s mobilization of troops on Ukraine’s eastern border would lead to an invasion, and when it finally did, its impact sent tremors through global markets as economic sanctions, supply chain shocks and destruction loomed. Energy prices hit all-time highs driving a further surge in inflation, the Russian ruble plumped and both European stock and bond markets were not spared. Given these broad implications, the article will look at the specific asset classes in the aftermath of the invasion, spanning from more traditional ones such as Commodities, Fixed Income and Equities to Alternatives like Real Estate.

Fixed Income

A main driver for the fixed income market will be inflation since it will determine the extent of interest rate hikes of central banks. Already before the conflict started inflation was rising, but it was a mixture of supply- and demand-driven inflation. The Russia-Ukraine conflict has an additional significant impact on the inflation rate, starting with the rise of oil and energy prices but also triggered by other commodities. In fact, not only oil prices were enormously affected, but also wheat prices, which receive less attention, are about two-thirds higher than a year ago, since Russia and Ukraine are huge exporters of those goods. Russia is the biggest exporter of wheat and ammonium nitrate, whereas Ukraine is the third biggest of corn, which will drive inflation on food. The longer the conflict goes on, the stronger those effects, which will determine a persistent inflation instead of a transitory one. Therefore, central banks would have to act more aggressively and this would bring bond yields up and prices down.

Corporate Bonds

Throughout the industries, financials might be the ones who profit the most from interest rate hikes due to higher margins. Therefore, bonds in this industry could have attractive upside potential. Besides financials, companies that benefit right now from high margins, like energy companies, can be interesting if the prices of these products stay high. It is important to mention that bonds from high-rated companies tend to be more sensitive to monetary policy changes since they tend to have longer maturities. Thus, they would be the ones most affected should central banks decide to revise their view.

Emerging Markets Sovereign Bonds

Unlike central banks in Western States, some central banks in emerging countries have already raised interest rates to combat inflation. If inflation proves to be transitory and flattens in 2022, bonds from these countries could benefit since investors are looking for yield and potential returns.

In the meantime, it is worth noticing that both Russian and Ukraine bonds get downgraded from all rating agencies: Fitch downgraded Russian sovereign rating to C and S&P to CC to reflect concerns over an imminent default triggered by the international sanctions imposed on the country. In addition to that, Ukraine Bonds’ rating was also lowered to B- by Fitch on the 4th of March.

Developed Markets Sovereign Bonds

Western industrial countries' bond yields are rising with German Bonds navigating in the positive territory after being negative for 30 months. The German 10-year bond yield has been rising from about -0.5% to over 0.5%. Since central banks decided to reduce or stop their bond purchasing programs, this will have a further negative effect on bond prices. For diversification or for risk-spreading purposes they still might be interesting for some investors.

European and Russian Equities

European Equities

Stoxx European 600 has seen a strong rise since March 8th and wiped out all losses that occurred since the Ukraine invasion of Russia. After the invasion, the index lost nearly 9% in the following days. If we overlap the Euro Stoxx 600 Index with the CBOE VIX Index (which measures expectations of future market volatility) we see a negative correlation over the last thirty days. On the 8th of March, the VIX index reached its thirty-day high while the Euro Stoxx 600 reached its 30-day low. At the moment, the VIX is lower than before the invasion which would imply that investors are expecting calm and less volatile times lying ahead of us.

There could be two possible explanations behind this. First, investors might expect central banks to delay interest rate hikes due to the conflict and the impact on economic growth. However, this seems unrealistic especially in the US, given the soaring inflation and the latest statements from the FED. Second, and more likely, investors read from financial history, and this taught us that wars certainly can affect the real economy but have only a small impact on stock volatility and prices in the mid-and long-term.

Source: Yahoo! Finance

Russian Equities

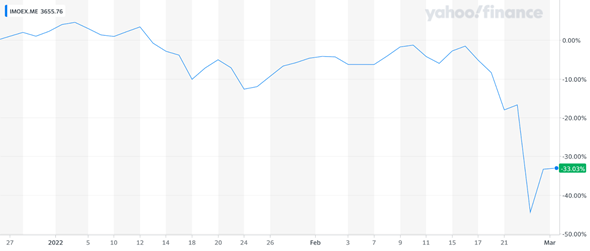

Compared to European stocks, Russian stocks lost dramatically in value. The Russian index MOEX lost short-term up to 50% and is now trading still 20% below its value before the invasion. The stock exchange in Moscow closed for three weeks after the invasion, therefore the chart below is incomplete in the timeline. Russia still has many stringent restrictions for foreign investors at the exchange. As an example, foreign investors are not able to get out of their holdings until April, they are not able to invest it afterward outside the country, and short-selling is forbidden. In the meanwhile, European restrictions make it hard for European investors to invest in the Russian stock market.

Compared to European stocks, Russian stocks lost dramatically in value. The Russian index MOEX lost short-term up to 50% and is now trading still 20% below its value before the invasion. The stock exchange in Moscow closed for three weeks after the invasion, therefore the chart below is incomplete in the timeline. Russia still has many stringent restrictions for foreign investors at the exchange. As an example, foreign investors are not able to get out of their holdings until April, they are not able to invest it afterward outside the country, and short-selling is forbidden. In the meanwhile, European restrictions make it hard for European investors to invest in the Russian stock market.

Source: Yahoo! Finance

Real Assets

Real assets are tangible assets that have an intrinsic value due to their substance and attributes. Since the Covid-19 pandemic spread, the global real assets market has been experiencing a fast-paced and rationalized development, that is supported by the ongoing fiscal and monetary policies and the low interest rates environment. For these reasons, the role of alternatives, and especially real assets, has moved from optional to essential. However, the recent invasion of Ukraine by Russia has outlined a series of geopolitical risks that may have consequences on this asset class. Here, the focus will be on the impact of the conflict on the real estate and the infrastructure industries.

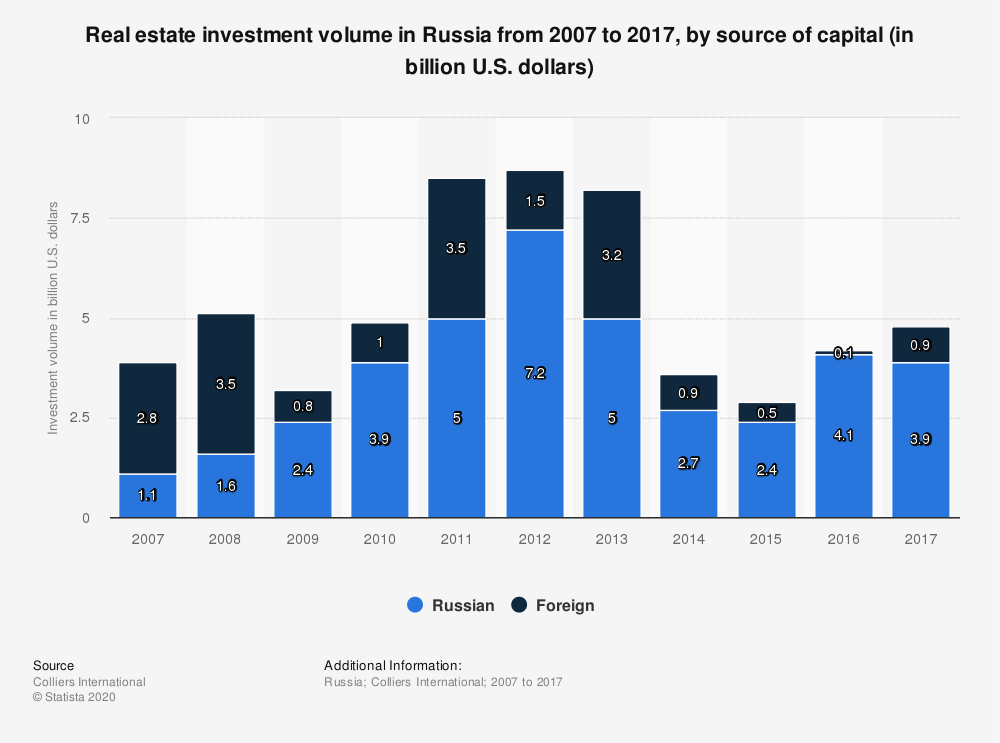

From a first analysis, the Ukraine-Russia conflict appears to have only a limited direct impact on real estate investors and managers, due to the limited exposure of real estate portfolios to assets in Russia or Ukraine. Specifically, the value of foreign investments to the real estate sectors in Russia has been fluctuating and declining from 2014 onwards, reaching a value of 0,9 billion US dollars in 2017, which is roughly 23 per cent of the total investment volume in the industry, as the graph below shows.

Real assets are tangible assets that have an intrinsic value due to their substance and attributes. Since the Covid-19 pandemic spread, the global real assets market has been experiencing a fast-paced and rationalized development, that is supported by the ongoing fiscal and monetary policies and the low interest rates environment. For these reasons, the role of alternatives, and especially real assets, has moved from optional to essential. However, the recent invasion of Ukraine by Russia has outlined a series of geopolitical risks that may have consequences on this asset class. Here, the focus will be on the impact of the conflict on the real estate and the infrastructure industries.

From a first analysis, the Ukraine-Russia conflict appears to have only a limited direct impact on real estate investors and managers, due to the limited exposure of real estate portfolios to assets in Russia or Ukraine. Specifically, the value of foreign investments to the real estate sectors in Russia has been fluctuating and declining from 2014 onwards, reaching a value of 0,9 billion US dollars in 2017, which is roughly 23 per cent of the total investment volume in the industry, as the graph below shows.

Source: Statista

However, in the same period, the domestic real estate market of the CEE’s countries has largely benefitted of the large inflows of Russian capital. Likewise, in the last 5 years Ukraine reported an average annual real estate transaction volume of 418 million US dollars, according to Real Capital Analytics. Therefore, the major implications of the conflict for the real estate industry will be rather indirect and based on broader macroeconomic developments.

From an inflation standpoint, the Ukraine-Russia conflict curbed any hopes consumers might have had for a reverse in the current sky-rocketing trend, as oil prices in the last week have been climbing at their highest. Similarly, prices of other goods are also expected to grow.

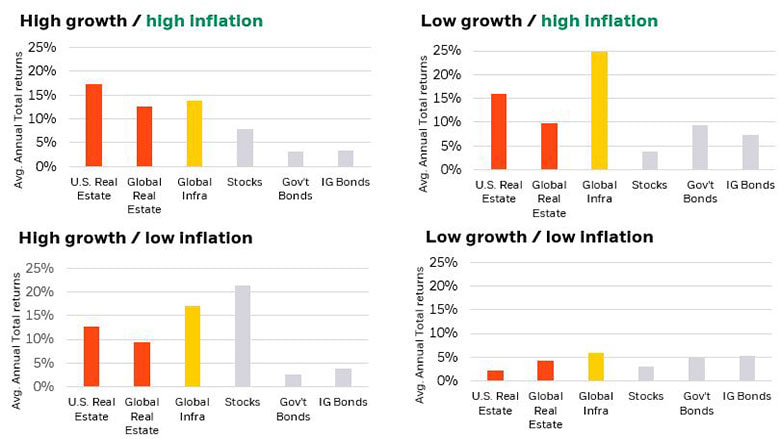

Historically, real assets like real estate have always outperformed traditional asset classes in inflationary environments even when inflation was not accompanied by high economic growth. In fact, as inflation spikes, rents grow and so does the occupancy rate and the demand for real estate infrastructure. Furthermore, any kind of risk of an increase in the expenses associated with real estate and infrastructure contracts is seldom mitigated by contractual adjustments or expense pass-through agreements. With regard to this latter, for instance, some real estate leases are triple net, meaning that the tenant pays all utilities and taxes, protecting real estate investors from fluctuations in the price of those items. By looking at the chart below, which shows average returns in different inflation-growth regimes, it is possible to verify that real assets perform well in three out of four scenarios.

From an inflation standpoint, the Ukraine-Russia conflict curbed any hopes consumers might have had for a reverse in the current sky-rocketing trend, as oil prices in the last week have been climbing at their highest. Similarly, prices of other goods are also expected to grow.

Historically, real assets like real estate have always outperformed traditional asset classes in inflationary environments even when inflation was not accompanied by high economic growth. In fact, as inflation spikes, rents grow and so does the occupancy rate and the demand for real estate infrastructure. Furthermore, any kind of risk of an increase in the expenses associated with real estate and infrastructure contracts is seldom mitigated by contractual adjustments or expense pass-through agreements. With regard to this latter, for instance, some real estate leases are triple net, meaning that the tenant pays all utilities and taxes, protecting real estate investors from fluctuations in the price of those items. By looking at the chart below, which shows average returns in different inflation-growth regimes, it is possible to verify that real assets perform well in three out of four scenarios.

Source: BlackRock

However, there is another inflation-linked double-sides effect on the construction costs of real estate and infrastructure projects. In fact, if on the one hand the high commodity prices contribute to an appreciation of the value of infrastructure and real estate investments, on the other hand they also tight margins for companies responsible for those projects, eventually causing delays in the final delivery. Lastly, an inflationary environment like the one we are currently experiencing, benefits borrowers since repaying debt with inflated money is more convenient. This is a crucial element to justify the positive performance of real assets, given that these are investments characterized by a high degree of leverage.

Real assets will also be severely affected by a further macro impact, that is the disruption of the global supply. Specifically, the supply shortage is not only a consequence of the aforementioned increase in commodities’ prices, but it also arises from the need of re-adapting the global supply chains to the current geopolitical risks.

Forex

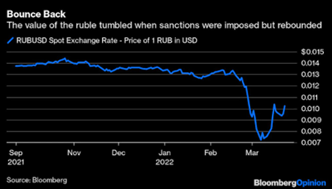

The Ukraine-Russia conflict has also had a strong impact on foreign exchange prices and especially on the Russian ruble. Specifically, the ruble has strongly declined in value starting from the Russian invasion and above all after the sanctions imposed by Western countries at the beginning of March.

In particular, the decision to freeze Russia's central bank’s holdings of dollars, euros and other top currencies had the specific aim of destroying the ruble. The result was coherent with the predictions, given that the Russian currency dropped 40% against the dollar in the week after the decision. However, there was a fast and unexpected recovery in the following days. As of today, the ruble is, in fact, down 25% against the dollar and 18% against the euro.

Real assets will also be severely affected by a further macro impact, that is the disruption of the global supply. Specifically, the supply shortage is not only a consequence of the aforementioned increase in commodities’ prices, but it also arises from the need of re-adapting the global supply chains to the current geopolitical risks.

Forex

The Ukraine-Russia conflict has also had a strong impact on foreign exchange prices and especially on the Russian ruble. Specifically, the ruble has strongly declined in value starting from the Russian invasion and above all after the sanctions imposed by Western countries at the beginning of March.

In particular, the decision to freeze Russia's central bank’s holdings of dollars, euros and other top currencies had the specific aim of destroying the ruble. The result was coherent with the predictions, given that the Russian currency dropped 40% against the dollar in the week after the decision. However, there was a fast and unexpected recovery in the following days. As of today, the ruble is, in fact, down 25% against the dollar and 18% against the euro.

Source: Bloomberg

One of the reasons that could explain such mitigated effects of the sanctions on the ruble is the fact that Russia is still allowed to sell all its fossil fuels, and therefore to use the related proceeds, i.e foreign currencies, to support the ruble. Furthermore, on March 23rd, Russia’s President Vladimir Putin started asking “hostile countries” to pay for Russian oil and gas exports in ruble, in order to contrast the effect of the economic sanctions on Russia’s currency. Specifically, the list includes the US, all European Union members, Switzerland, and Norway. In the event that this request was to be accepted, Russia could have found a way to avoid the financial sanctions entirely, therefore preventing the ruble from experiencing further drop in value.

Commodities

One would be amiss not to mention commodities when analyzing the market impacts of Russia’s invasion of Ukraine a month ago. Russia, as a country, has long characterized itself as an exporter of commodities such as wheat, oil, natural gas or steel.

In fact, prior to the invasion, in terms of annual exports, Russia ranked 4th in the world for steel, 3rd for coal, 2nd for crude oil, and 1st for wheat in the years 2019-2020.

Commodities

One would be amiss not to mention commodities when analyzing the market impacts of Russia’s invasion of Ukraine a month ago. Russia, as a country, has long characterized itself as an exporter of commodities such as wheat, oil, natural gas or steel.

In fact, prior to the invasion, in terms of annual exports, Russia ranked 4th in the world for steel, 3rd for coal, 2nd for crude oil, and 1st for wheat in the years 2019-2020.

Volatility in Brent Crude Oil

In the days following the invasion, western governments imposed packages of unprecedented sanction on Russia, eager to exert political and economic pressure on Vladimir Putin. These included the USA banning all oil and gas imports, as well as a commitment from the United Kingdom to phase out all Russian oil by the end of 2022, while the European Union (which imports 25% of its oil from Russia). President Biden justified this move as “not subsidising” Russia’s belligerent military campaigns. These sanctions, coupled with firms such as Shell, BP and Equinor refusing to take delivery of “bloodstained” oil, have undoubtedly had an impact on market prices, as seen by the 40% hike in Brent Crude prices in the days which followed the invasion.

In the days following the invasion, western governments imposed packages of unprecedented sanction on Russia, eager to exert political and economic pressure on Vladimir Putin. These included the USA banning all oil and gas imports, as well as a commitment from the United Kingdom to phase out all Russian oil by the end of 2022, while the European Union (which imports 25% of its oil from Russia). President Biden justified this move as “not subsidising” Russia’s belligerent military campaigns. These sanctions, coupled with firms such as Shell, BP and Equinor refusing to take delivery of “bloodstained” oil, have undoubtedly had an impact on market prices, as seen by the 40% hike in Brent Crude prices in the days which followed the invasion.

Source: TradingView

OPEC Involvement

A subsequent correction on March 9th saw the benchmark fall 13%, the largest single-day drop since April 2020. The Organisation of Petroleum Exporting Countries, OPEC, exists as a cartel that aims to limit individual countries’ oil outputs, in an effort to maintain prices at higher, profit-making levels. The March 9th price correction has been associated with an announcement by the UAE, an OPEC member, that the country is willing to increase oil production, and will encourage other members of the cartel to follow suit. OPEC members have roughly 4 million barrels of daily spare capacity, while Russia exports roughly 5 million per day, although the vast majority of that is to the EU, which at time of writing, has yet to formally ban imports of Russian oil. But questions remain about whether OPEC+ (an extension organisation of OPEC, chaired by Russia) members will increase oil production by an amount sufficient to compensate for the sanction-induced decline, with some members of the organisation, such as Saudi Arabia, enjoying close political ties to Russia.

Nickel Short Squeeze

Once a relatively unknown phenomenon, short squeezes enjoy infamy following the events of January 2021. To those unfamiliar with the concept, a short squeeze occurs when a high level of short interest in a security (i.e. bets on the price decreasing) is coupled with a sudden price increase, causing investors holding short positions to close them (by buying the security), thus further increasing upwards price pressure.

Prior to the invasion, Tsingshan, a major Chinese nickel manufacturer, entered a large short position of nickel- a bet that failed miserably when Russia’s invasion of Ukraine threatened to decrease global nickel supplies (owing to the fact that in 2020, Russia was the world’s largest exporter of nickel). Within a matter of minutes, Nickel’s price had more than doubled causing the London Metal Exchange to halt trading of the rare metal for over a week. The price has since stabilized, with nickel trading at around 33,000 dollars per tonne on March 30th, down from a high of over 100,000 on March 18th.

A subsequent correction on March 9th saw the benchmark fall 13%, the largest single-day drop since April 2020. The Organisation of Petroleum Exporting Countries, OPEC, exists as a cartel that aims to limit individual countries’ oil outputs, in an effort to maintain prices at higher, profit-making levels. The March 9th price correction has been associated with an announcement by the UAE, an OPEC member, that the country is willing to increase oil production, and will encourage other members of the cartel to follow suit. OPEC members have roughly 4 million barrels of daily spare capacity, while Russia exports roughly 5 million per day, although the vast majority of that is to the EU, which at time of writing, has yet to formally ban imports of Russian oil. But questions remain about whether OPEC+ (an extension organisation of OPEC, chaired by Russia) members will increase oil production by an amount sufficient to compensate for the sanction-induced decline, with some members of the organisation, such as Saudi Arabia, enjoying close political ties to Russia.

Nickel Short Squeeze

Once a relatively unknown phenomenon, short squeezes enjoy infamy following the events of January 2021. To those unfamiliar with the concept, a short squeeze occurs when a high level of short interest in a security (i.e. bets on the price decreasing) is coupled with a sudden price increase, causing investors holding short positions to close them (by buying the security), thus further increasing upwards price pressure.

Prior to the invasion, Tsingshan, a major Chinese nickel manufacturer, entered a large short position of nickel- a bet that failed miserably when Russia’s invasion of Ukraine threatened to decrease global nickel supplies (owing to the fact that in 2020, Russia was the world’s largest exporter of nickel). Within a matter of minutes, Nickel’s price had more than doubled causing the London Metal Exchange to halt trading of the rare metal for over a week. The price has since stabilized, with nickel trading at around 33,000 dollars per tonne on March 30th, down from a high of over 100,000 on March 18th.

Source: TradingView

Conclusion

As peace talks continue and Russia’s invasion continues to lose pace, questions will begin to be asked about the long-run market impacts of the war, and about Russia’s position in the global economy.

Sources:

By Matthew Gleeson, Leopold Plattner, Annalisa Sgaramella

As peace talks continue and Russia’s invasion continues to lose pace, questions will begin to be asked about the long-run market impacts of the war, and about Russia’s position in the global economy.

Sources:

- Atlantic Council

- Barrons

- BBC

- BlackRock

- CBS News

- EU Commission

- fDi Intelligence

- Financial Times

- Investment Monitor

- Julius Baer

- JP Morgan

- Morgan Stanley

- New York Times

- Real Estate Capital USA

- Statista

- TradingView

By Matthew Gleeson, Leopold Plattner, Annalisa Sgaramella