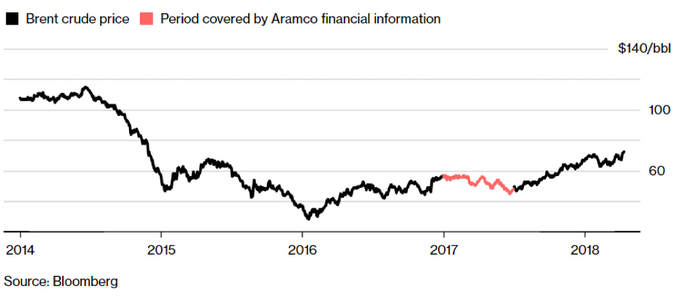

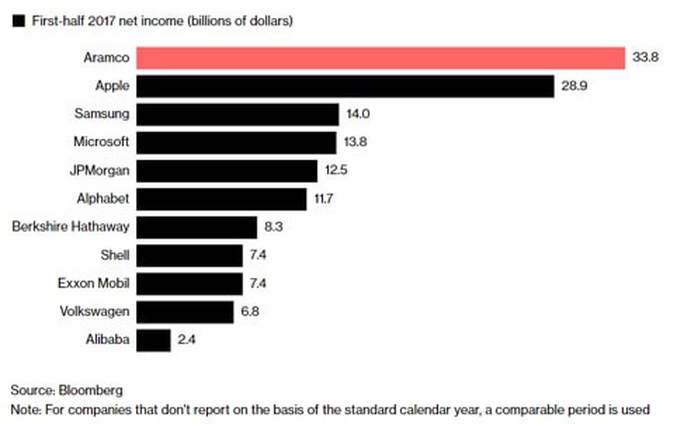

One of the most important secret of the Business world was unveiled on April 13th, with Saudi Aramco that has released detailed accounting information for the first semester of 2017 to the international news agency Bloomberg. The Saudi Arabian national oil company IPO is expected in 2019. The net income for the first semester of 2017 was of $33.8 billion (Exhibit 1), given the oil price ranging around $50-55 per barrel. The tech giant Apple in the same period has registered a net income of $28 Billion, while for other oil giants as Exxon and Shell the same financial metric amounted $7.4 billion each (Exhibit 2).

Paragraph. Clicca qui per modificare.

Paragraph. Clicca qui per modificare.

It is also interesting to look at the most important concerns that will arise during the imminent valuation of Saudi Aramco by the main advisor Moelis&Co.: the cash flows from operations is $52.1 billion, while the outflow to the Saudi Crown amounts $58.4 billion, considering Royalties ($18.5 B) and Taxes ($39.9 B).

Even though Aramco is the most profitable company in the world, the strong correlation of profits with the oil price fluctuations and the large amount paid back to the royal family are the two major concerns that investors will probably deeply monitor before investing. The royalty marginal rate is around 20% for oil prices up to $70 a barrel, and it goes up to 40% between $70 and $100, the most probable range for oil price in the next decade. It is unclear whether Saudi Arabia is planning any change to the tax regime prior to the IPO to boost the valuation up to the hypothetical $100 billion of the 5% stake sustained by the Saudi Prince Mohammed bin Salman, which would imply a total value of $2 trillion of the National oil company.

On the other hand, the peer comparison shows two main distinctive factors. Saudi Aramco not only invests more in Capex than the two oil giants Exxon and Shell, but it has an incredible competitive advantage in the production costs: around $4 a barrel against the $20 of Shell and Exxilon. Another important data is the net debt that virtually amounts to zero with total borrowings of $20.2 billion and cash & cash equivalents of $19 billion; this is an interesting fact considering that the two aforementioned competitors rely on an important amount of debt to finance their operations (Exhibit 3). An even stronger reason to invest in Aramco’s stake is the centrality of this firm for Saudi Kingdom in the diversification process already started in Middle East energetic companies, which are heavily investing in renewable source of energy, positioning themselves as global leaders also in the after-oil energetic era to come.

.

Even though Aramco is the most profitable company in the world, the strong correlation of profits with the oil price fluctuations and the large amount paid back to the royal family are the two major concerns that investors will probably deeply monitor before investing. The royalty marginal rate is around 20% for oil prices up to $70 a barrel, and it goes up to 40% between $70 and $100, the most probable range for oil price in the next decade. It is unclear whether Saudi Arabia is planning any change to the tax regime prior to the IPO to boost the valuation up to the hypothetical $100 billion of the 5% stake sustained by the Saudi Prince Mohammed bin Salman, which would imply a total value of $2 trillion of the National oil company.

On the other hand, the peer comparison shows two main distinctive factors. Saudi Aramco not only invests more in Capex than the two oil giants Exxon and Shell, but it has an incredible competitive advantage in the production costs: around $4 a barrel against the $20 of Shell and Exxilon. Another important data is the net debt that virtually amounts to zero with total borrowings of $20.2 billion and cash & cash equivalents of $19 billion; this is an interesting fact considering that the two aforementioned competitors rely on an important amount of debt to finance their operations (Exhibit 3). An even stronger reason to invest in Aramco’s stake is the centrality of this firm for Saudi Kingdom in the diversification process already started in Middle East energetic companies, which are heavily investing in renewable source of energy, positioning themselves as global leaders also in the after-oil energetic era to come.

.

It is clear that this information has been a way to maintain the interest of the potential investors stronger than ever given the move to shift the IPO to 2019 with a target oil price around $70 a barrel. There are still a lot of fundamental pieces of information missing from which a successful IPO will be affected, but it is certain that Aramco has a strong position in the oil industry with a daily output that doubles the major competitors. At the same time, the Saudi Kingdom should improve its credibility and transparency, helping to improve Saudi Aramco’s performance and efficiency in leading a transformation in a multi-sources energetic company.

Riccardo Nocita