Nowadays, semiconductors constitute a core component of the advanced technologies supporting modern electronics, especially computing, communications, healthcare and automotive. We live in an incredibly rapidly evolving society and we rely every day, more and more, on the fundamental roles that semiconductors cover in those industries. It is for this reason that, due to the current shortages of supplies, policymakers in Washington are considering federal incentives and investments to meet the current sky-high demand and reinforce the U.S. leadership in chip manufacturing, to avoid future crises.

In December, the SIA (Semiconductor Industry Association) anticipated a rise in chip sales of 8.4% in 2021, from 2020’s total of $433B, which represents a 5.1% increase between 2019 and 2020.

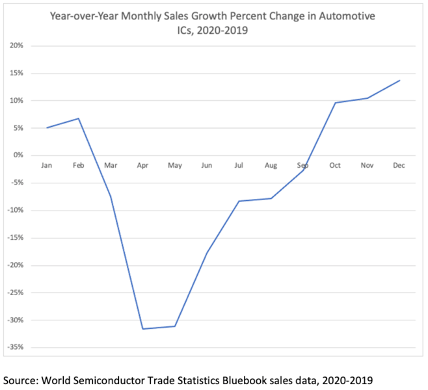

With the outbreak of the pandemic in the second quarter of 2020, manufacturers all over the world were preparing for a drastic cut in production and they weren't able to support the unexpected recovery of demand for automotive semiconductors in the third and fourth quarter of the past year. The reason behind this issue is the complexity of the manufacturing process, which accounts for an industry average of 26 weeks.

In December, the SIA (Semiconductor Industry Association) anticipated a rise in chip sales of 8.4% in 2021, from 2020’s total of $433B, which represents a 5.1% increase between 2019 and 2020.

With the outbreak of the pandemic in the second quarter of 2020, manufacturers all over the world were preparing for a drastic cut in production and they weren't able to support the unexpected recovery of demand for automotive semiconductors in the third and fourth quarter of the past year. The reason behind this issue is the complexity of the manufacturing process, which accounts for an industry average of 26 weeks.

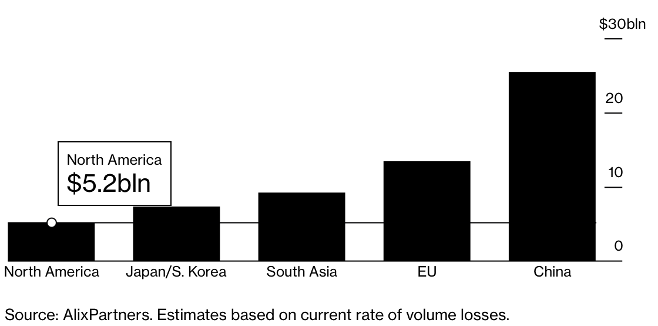

While semiconductors have improved the overall quality of our vehicles, the momentaneous shortage may cost $61B to the automotive industry, since the absence of some specific microcontrollers would impede their correct functioning.

Cars manufacturers, among which we have Fiat, Ford, Honda and Chrysler, have already notified investors of the current constraints and are extending production cuts over various regions.In particular, Volkswagen will receive the hardest hit, while BMW and Hyundai Kia have managed to stock large amounts of chips and won’t be affected in the near term. Both General Motors and Ford are expecting a reduction of at least $1 billion of their operating profit, with GM that has already halted production of one plant in Canada, Mexico and the United States and Ford that has canceled shifts at two significant pickup plants.

Looking at the experts’ estimates, UBS expects microchips’ prices to rise almost by 10% in the near term. It's not possible to predict how long the shortage will last but Fitch Solutions estimate the phenomenon to continue until the beginning of 2023.

Among its main causes, together with the huge boom of electronics of the last year, we have the outsourcing of chip factories and the effects of Trump’s trade war with China. The issue has started when the drastic changes brought into our lives by Covid-19, led consumers to stock up large volumes of electronic devices, especially PCs.

Work-at-home and virtual schooling were the main causes of the surge in demand, together with the exponential growth of telemedicine, which relies heavily on microchips.

The shortage is also highlighting the structural changes that the industry is undergoing. The majority of the companies are only designing the chips and the technology they require while relying on external manufacturers for the actual production. Those external manufacturers are defined as foundries; controlled by companies such as Samsung in South Korea and TSCM in Taiwan, which are unable to cope with the vigorous demand. As stated by Qualcomm’s incoming CEO, Cristiano Amon, the difficulties are “across the board”, underlining the chips’ designers’ reliance on just a few Asian producers, which are being limited also because of Trump’s trade war against China. As a consequence, the restriction that the U.S. has placed on Semiconductor Manufacturing International (SMIC) - the biggest foundry in China - is obliging companies, which have ties with the United States, to rely exclusively on their competitors.

Overall, the situation is strongly impacting Biden’s administration’s hopes to revive the manufacturing sector, during the pandemic depression. The options of the White House are very limited, especially in the near term considering that chip makers’ production expansion will take several months. While U.S. economists are expecting a reduction in automotive sales by 450,000 units in 2021, which approximately accounts for $15B in economic output, the shortage is questioning the ability and capacity of domestic supply chains.

Tommaso Tenti