In the aftermath of the United Auto Workers' (UAW) protracted strike against major automakers, the automotive industry is grappling with seismic shifts. This article unravels the complexities of the wage disputes that fueled the six-week strike. From stagnant wages amid a cost-of-living crisis to demands for a substantial increase, the UAW strike has reshaped the industry's landscape, prompting a closer look at its present challenges and future trajectory. We explore the strike's impact on individual automakers, the evolving dynamics of labor relations, and the ripple effects on the industry's transition to electric vehicles (EVs). Amidst this turmoil, we assess the broader economic consequences domestically and internationally, outlining the obstacles and opportunities that lie ahead for the automotive sector and its interconnected global network

Wages in the automotive industry

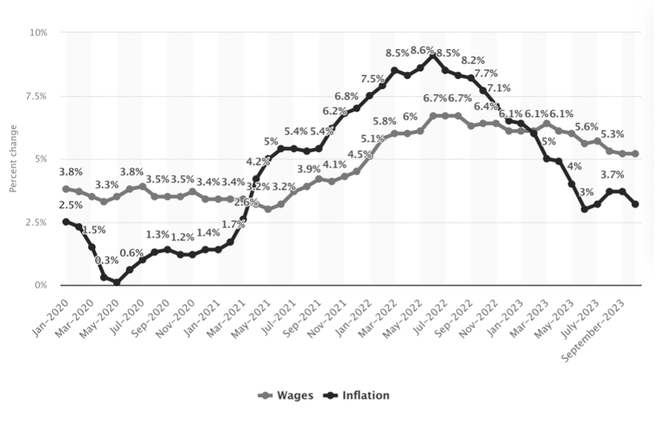

Automotive job wages have traditionally been indexed to inflation, but recently, there has been a shift. Stagnant income in the car industry has failed to keep up with the living cost crisis, while wages in similar sectors have continued to grow with inflation, such as machinery manufacturing, retail, and the hospitality sector. Tips, directly linked to inflation, have contributed to constant growth throughout the year, even though the tip percentage is narrowing annually. This situation has not gone unnoticed. Thousands of automotive workers joined forces to rebel against the industry, resulting in significant consequences, but the situation appears to have settled. The primary reason behind this unrest is that automakers' workers are not being treated on par with employees in other industries. While wage growth in most US sectors has outpaced inflation since March 2023 (with almost double the growth in June), the automotive industry lags behind. Multiple strikes have unfolded in 2023 within the US automotive sector, beginning on September 15th when the UAW (Union of Auto Workers) failed to reach a deal with the three largest automakers: Ford Motor, General Motors, and Stellantis. The decision to initiate strikes was made by the new president, Shawn Fain. The core complaint fueling the strike was that stagnant wages did not account for inflation. UAW's goals included improving retirement benefits and achieving a 32-hour workweek milestone, with retirement benefits having been permanently lost after the financial crisis. The strike has been the longest auto strike in 25 years.

Source: Statista

Analyzing the data reveals whether the workers' demands during the strikes had a strong financial motivation. From January 2023 to October 2023, average hourly wages remained mostly unchanged, with little fluctuation. Examining preliminary data for October in the automotive industry, the average hourly pay was $27.69, the same as at the beginning of the year. Salary growth is calculated at 0%, while inflation for the US dollar has risen much faster, resulting in a 3.2% reduction in purchasing power. However, the problems extend beyond this. Labor activism reflects a variety of factors, including rising living costs and workers feeling uncompensated for health risks during the COVID era. Compared to other manufacturing sectors, the automotive industry has consistently lagged in hourly wages, with a discrepancy of over $2 per hour. In the medium-short term, the transition to EV production poses another challenge. Ford has announced that electric vehicle construction would require 40% fewer workers due to fewer parts in the manufacturing process. This transition could potentially cost more than 35 thousand jobs out of the 400 thousand workers represented. Earlier this year, Ford and General Motors partnered with SK Innovation and LG Chem to build factories for battery supply, aiming to expand EV production. The UAW's demands were unusual, with requests for a 40% wage hike and a 20% immediate raise, significantly impacting company shares since the strike began on September 15th . The strikes also significantly impacted the industry itself. Ford alone lost $1.3 billion in operating earnings due to the six weeks of the strike. The company produced 80,000 fewer cars and trucks than it would have without the strike. Ford's loss in operating earnings accounted for over 10% of the total loss from the UAW strikes, totalling $10.4 billion

Softening Worker’s Power

While unemployment is at a historic low of 3.9%, hourly wages are gradually increasing to offset inflation. Manufacturing employment narrowed due to strikes being counted on the payroll. The slight softening in October shouldn't signal negative trends; rising worker power is causing wages to catch up with inflation. The job leaver rate was exceptionally high in September 2022 at 15.8%, but this year, in September 2023, it stood at 12.7%. The share of people on permanent layoff increased from 31.3% in October 2022 to 34.4% in October 2023. This decrease in the job leaver rate signifies a softening in real wage hikes, with workers leaving jobs at a higher rate during economic expansion and quitting less during periods of recession

UAW Strike and its rationale

After failing to reach a new tariff agreement, the UAW initiated its first simultaneous strike against all three major car manufacturers in Detroit on September 15th. The strike, involving workers from Ford, Stellantis, and GM, became the longest American auto strike in the past 25 years, concluding after six weeks on the 30th of October when the UAW signed a tentative agreement with the last of the three car manufacturers. These tentative agreements were ratified by UAW members in mid-November. But what were the demands behind the strike, which had substantial implications for the car industry?

Firstly, as discussed, compensation for workers has not kept pace with the cost of living. It was criticized that a hard-working person could no longer afford a life in middle-class America. Therefore, the UAW demanded a 36% increase over a four-year contract as well as the reinstatement of a cost-of-living adjustment. Additionally, the UAW asked to end the two-tier system that separates employees hired before and after 2007. Pay should be equalized between the groups, and everyone should receive defined benefit pensions. Further demands included a four-day work week, more time off, retiree healthcare, and a limited use of temporary workers.

One reason for these extreme claims and the intensive strike was the newly elected president of the UAW, Shawn Fain, who was elected earlier this year in March. His promises to be confrontational and to pursue a hard line in negotiations met with growing frustration within the union members due to the rising cost of living. But even the president himself called the demands 'audacious.' The strike started with around 13,000 workers but expanded to over 45,000 members of the UAW, imposing enormous financial losses on the car producers.

The UAW launched several stand-up strikes when the car manufacturers failed to meet a set deadline or progress in negotiations lacked speed. While starting the strike small with only focusing on three factories (one from each of the car producers), the UAW broadened its strike to several assembly plants and distribution centers all over the US. The strike had a substantial influence on production and therefore earnings. Hours after the strike against Ford ended with a tentative agreement on the 26th of October, Ford released an estimate that the strike cost the firm $1.3 billion of its earnings due to decreased production, directly negatively impacting the 3rd quarter adjusted earnings by $100 million. In addition, it withdrew its earnings guidance for the remaining year.

GM reported a few days before the strike ended an approximate decrease in operating profit of around $800 million and also withdrew its earning guidance for 2023. In addition, Stellantis reported that the strike led to a loss of around $3.2 billion in revenues through October. However, Stellantis kept its guidance for 2023, signaling financial strength. These substantial costs also forced the car manufacturers to sign the tentative agreements, which themselves will have significant financial implications for the companies' futures. When looking at stock prices, it is evident that General Motors and Ford trade well below the level before September 15th, showing significant losses for investors. However, Stellantis remained more stable and even trades above old levels. Much is uncertain about the future implications of the strike, but it is clear that the newly elected president, Shawn Fain, emerged as a clear winner from the negotiations and delivered upon his promises.

Implications for the automotive industry

In the wake of the UAW negotiations, the domestic automotive industry is set to undergo significant changes. The ratified agreements with Ford, General Motors, and Stellantis mark a pivotal shift in labor relations and compensation structures in the sector. Notably, Ford led the way with over 69% of its UAW workers supporting the deal, followed by Stellantis and GM, with 70% and 55% of workers' approval, respectively. On average, 64% of the Detroit-3 UAW membership voted in favor of the new contracts.

These four-and-a-half-year agreements promise substantial wage increases. Workers can expect a 27% wage hike by April 2028, including an 11% rise upon ratification. Additionally, cost-of-living adjustments (COLAs), suspended since 2009, are now reinstated. With these adjustments, 'top wages' are projected to grow by 33%, reaching over $42 per hour by 2027. Moreover, workers will receive a $5,000 ratification bonus in December. Beyond wages, the agreements entail significant commitments to production facilities, with Stellantis allocating $19 billion, Ford $8 billion, and GM $2 billion in new investments.

Looking ahead, the domestic automotive industry faces several challenges and opportunities. The reintroduction of COLAs, previously considered a 'no-fly zone,' introduces long-term uncertainty in labor cost inflation. Besides this, Ford estimates the UAW contract could add $850 to $900 per car unit, impacting margins by approximately 2% before mitigation efforts.

There are also implications for EV adoption. The increased labor costs were likely not fully anticipated in EV strategies formulated over the past few years. Consequently, automakers might reassess their EV strategies, potentially leading to slower spending rates, heightened focus on partnerships, and possible asset write-downs. These adjustments, while potentially volatile in the short term, could signal a shift towards more prudent capital expenditure plans. Auto companies are expected to emphasize the adaptability of their EV capital budgets in upcoming financial reports. Furthermore, the UAW's successful negotiations could inspire similar efforts at other manufacturers, including Tesla. With Tesla employing between 45,000 and 50,000 factory workers in higher cost-of-living areas, the financial implications are considerable, potentially impacting Tesla's U.S. labor costs by $4 to $5 billion.

All in all, the recent UAW negotiations have set a new precedent in the automotive industry, influencing wage structures, investment commitments, and potentially the pace of EV adoption. This shift in labor dynamics presents both challenges and opportunities for the industry, particularly in the context of an evolving economic landscape and the ongoing transition to electric vehicles.

Implication on the economy and international outlook

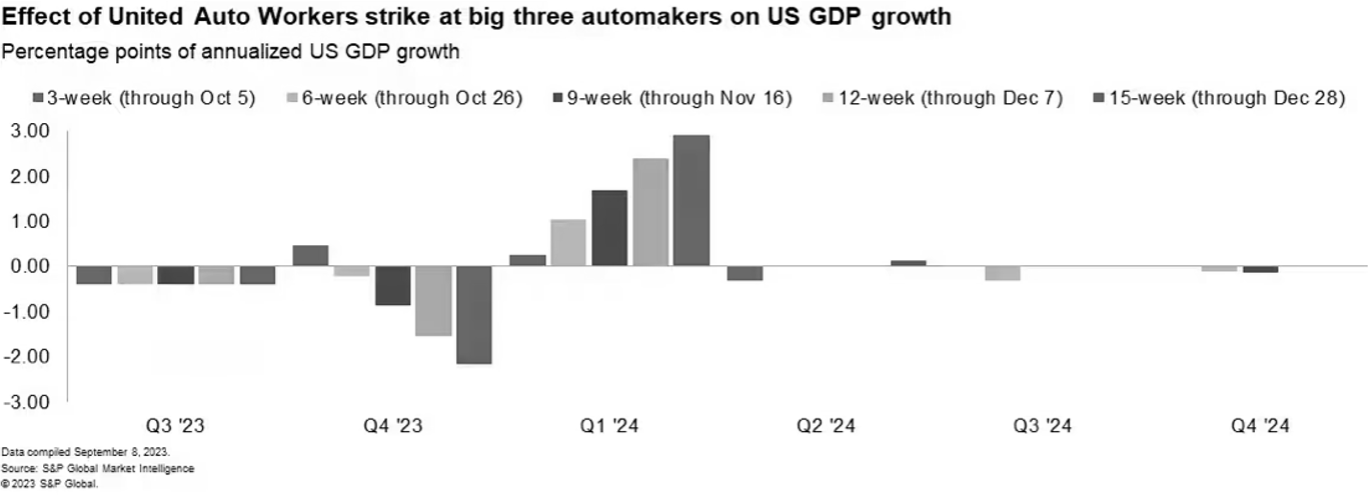

The US auto strike has already caused many problems for the industry, increasing production costs; however, the strike’s impacts reach beyond that. Losses climbed beyond 7 billion USD after production halted—a significant hit alongside persistent inflation. Furthermore, strike pay prevented consistent pay – workers carefully planned each purchase, reducing consumption further within their community. Ehrlich estimated that 440 million USD of income would be lost for a strike of two weeks, only rising to 9.1 billion USD if it extends to eight weeks, suggesting a significant hit to the economy, alongside an estimated 10.6 million USD tax revenue loss for only two weeks. Even if the automotive industry is not as important to the US economy as it was before, the loss of income will adversely affect nearby local businesses—resulting in loss of revenue, bankruptcies, and layoffs. As seen in the graph below, the impacts of the UAW protests greatly depend on the duration of the strikes, with diverse outcomes. Labor costs are only 5% of production; hence, wage rises still would have a limited impact towards production costs, but of course, not negligible.

The impact can extend to buyers. Car prices have been dropping for some time, and only in August was there a 0.3% rise in the cost of cars, after four months of no growth or decline. Therefore, strikes will limit the supply of cars, leading to a rise in costs even further, putting pressure on buyers when they already face problems related to inflation, higher interest rates, and a higher cost of living.

The impact of the strike stretches to other countries that have exposure. Forvia, a French car parts maker, may resort to temporary layoffs caused by decreasing sales. Autoliv, a Swedish company and the largest producer of car airbags and seatbelts, observed little effect from the strikes but does not deny further similar strikes can become detrimental to sales. Smaller firms depending on US car manufacturers will observe greater losses due to the unexpected demand drop, while larger diversified firms will ride the wave. Nevertheless, the vast shortages of car parts seen over the years may imply automotive companies will be slow to cancel their past orders.

Source: S&P Global

Work unions are not prevalent in the US, unlike their European counterparts. Nevertheless, the UAW has left its mark, perhaps encouraging further protests within Europe. For the first time, Tesla’s workers have gone on strike. The movement continues in Sweden, which is known for its unions and powerful collective bargaining. Sweden does not manufacture Tesla’s cars but houses many service shops, of which 130 mechanics requested a collective bargaining agreement, later rejected. As is the culture, other sectors showed their solidarity by also participating in the protests, through limiting services to Tesla car repairs. This may have a spillover to Germany, where Tesla runs factories and employs more people. US companies downplaying the importance of unions domestically and internationally will have a multitude of consequences for their production, as employers are less willing to work under these conditions.

At times of uncertainty and possible downturn, unionizing and protesting continue to destabilize the economic climate. The US does not often see unionized activity; however, the UAW may have paved the way for a change in perspective towards unions. The public has shown greater sympathy compared to previously. Unions may bring about safer employment opportunities, but given a greater picture, it is putting a greater strain not only on the US economy but also Europe, where there is a spillover of the impact, both monetarily and ideologically.

At times of uncertainty and possible downturn, unionizing and protesting continue to destabilize the economic climate. The US does not often see unionized activity; however, the UAW may have paved the way for a change in perspective towards unions. The public has shown greater sympathy compared to previously. Unions may bring about safer employment opportunities, but given a greater picture, it is putting a greater strain not only on the US economy but also Europe, where there is a spillover of the impact, both monetarily and ideologically.

Conclusion

The six-week UAW strike, the longest in US history, has called for changes to wage structure of the automotive industry. The increase in wages will help workers deal with the detrimental impact of inflation and overall increased living expenses; however, the decrease in production during these past months and increased costs may have an unfavorable impact on the production of EVs and negative effects on companies’ yearly performance. The strike is likely to reach beyond the automotive industry – negative impacts towards the communities, decreased economic growth, and far-reaching consequences for European suppliers of car parts. The US work unions are not as prominent within Europe, hence this may prove to be a shifting point towards the change in perspective, as the public becomes more sympathetic with workers in an ever-struggling economy.

By Leo Antlitz, Vasara Silininkaite, Giulio Losano, Orestas Freigofas

SOURCES

- U.S. Bureau of Labor statistics

- Financial Times

- Reuters

- CNN

- Forbes

- CNBC

- S&P Global

- The Guardian

- Statista

- NPR