First months of 2020 are going to inaugurate a new positive season for IPOs in South Korean markets because of the recent announcement that SK Biopharmaceuticals, a subsidiary of the group SK Holdings Co. and the third drug producer of the country, filed the preliminary requests for the process of listing in the Korea Exchange. The period scheduled is January 2020 while the company’s intention is to raise more than 850m $, therefore becoming the biggest IPO since May 2017, in particular after the listing of the mobile gaming company NetMarble’s raising 2.3$ bn. The advisors the company selected are Citigroup and NI Investments & Securities.

In order to catch the underlying rationale of this decision, it is essential to give a brief glimpse of the company’s background as well as a current image of the broader market environment. The manifested intention to go public derives from the potential upward coming from the recent development of a new medication, Cenobamate, which will be sold under the name XCOPRI in 2020 in the US. In particular, this new drug has proved optimistic and positive clinical responses for the treatment of partial-onset seizure and all the other symptoms of epilepsy.

As a result, SK Biopharmaceuticals was the first Korean company to gain the approval of the FDA (US Food and Drug Administration) amid the optimistic expectations of the effects that this medication can produce in the treatment of epilepsy seizures. Indeed, during the clinical tests one-fifth of patients did not present any seizure after the treatment.

Local analysts regard this future listing under a positive perspective, estimating the value of the new drug of approximately 4.6bn $ resulting in an enterprise value of 6.7bn $ especially because the projected revenues of XCOPRI are likely to overcome the ones of other medications produced by SK Biopharmaceuticals peers, such as UCB’s Vimpat medication whose revenues amounted to 1.3bn $ in 2018.

On the other hand, this IPO has the power to revert the current status quo of the pharmaceutical Korean market, which is experiencing a significant slowdown, where the value of IPOs dropped from 7bn $ in 2016 to 3bn $ in 2018. Indeed, in 2016 there have been significant listings, such as the one of Samsung Biologics for 1.9bn $ and Celltion for 900bn $. However, in 2019 a non-supporting sentiment of investors along with unsuccessful clinical results, made the market cautious about investing in these companies. This negative sentiment was exacerbated, inter alia, by a quite long series of scandals involving healthcare companies, such as Kolon, who falsely reported the active principles of a medication for the osteoarthritis to get the approval, or Samsung Biologics who increased its valuation to go public, or SillaJen who experienced a case of insider trading.

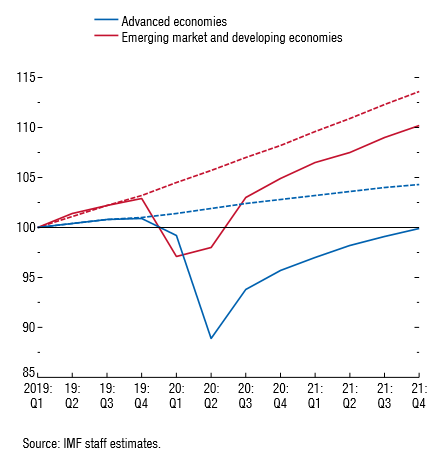

Moreover, this negative market trend is also reflected in a significant plunge of 30% in the Korean stock market since the peak reached in 2018, as shown by the graph below presenting the trend of the Kosdaq composite index.

In order to catch the underlying rationale of this decision, it is essential to give a brief glimpse of the company’s background as well as a current image of the broader market environment. The manifested intention to go public derives from the potential upward coming from the recent development of a new medication, Cenobamate, which will be sold under the name XCOPRI in 2020 in the US. In particular, this new drug has proved optimistic and positive clinical responses for the treatment of partial-onset seizure and all the other symptoms of epilepsy.

As a result, SK Biopharmaceuticals was the first Korean company to gain the approval of the FDA (US Food and Drug Administration) amid the optimistic expectations of the effects that this medication can produce in the treatment of epilepsy seizures. Indeed, during the clinical tests one-fifth of patients did not present any seizure after the treatment.

Local analysts regard this future listing under a positive perspective, estimating the value of the new drug of approximately 4.6bn $ resulting in an enterprise value of 6.7bn $ especially because the projected revenues of XCOPRI are likely to overcome the ones of other medications produced by SK Biopharmaceuticals peers, such as UCB’s Vimpat medication whose revenues amounted to 1.3bn $ in 2018.

On the other hand, this IPO has the power to revert the current status quo of the pharmaceutical Korean market, which is experiencing a significant slowdown, where the value of IPOs dropped from 7bn $ in 2016 to 3bn $ in 2018. Indeed, in 2016 there have been significant listings, such as the one of Samsung Biologics for 1.9bn $ and Celltion for 900bn $. However, in 2019 a non-supporting sentiment of investors along with unsuccessful clinical results, made the market cautious about investing in these companies. This negative sentiment was exacerbated, inter alia, by a quite long series of scandals involving healthcare companies, such as Kolon, who falsely reported the active principles of a medication for the osteoarthritis to get the approval, or Samsung Biologics who increased its valuation to go public, or SillaJen who experienced a case of insider trading.

Moreover, this negative market trend is also reflected in a significant plunge of 30% in the Korean stock market since the peak reached in 2018, as shown by the graph below presenting the trend of the Kosdaq composite index.

Notwithstanding, SK Biopharmaceuticals has all the powers to become an industry champion, as reported by analysts’ consensus. Indeed, global pharmaceutical market is mainly dominated by American and Japanese companies, while Korean pharmaceutical market has been populated by companies producing generical drugs rather than develop new ones. This bold strategy of SK Biopharmaceutical to keep investing in R&D in order to develop new products is expected to pay off in 2020 in terms of projected market capitalization as well as revenues. In conclusion, besides the risk associated to estimates and forecasts, SK Biopharmaceuticals should be an example for all the other companies in the market.

Vincenzo Ricci

(Cover image by kalhh-Pixabay)

Vincenzo Ricci

(Cover image by kalhh-Pixabay)