Introduction

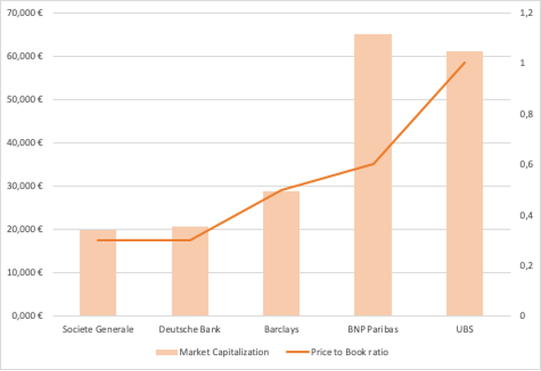

It is no secret in the financial industry that Société Générale (SocGen) has never been able to fully recover from the great financial crisis of 2008 and that it has constantly been lagging behind its European counterparties for over a decade. Since mid-2008, the stock has plunged 71%, and the French bank in 2022 has one of the lowest valuations among its peers. To put it in perspective, SocGen has a market valuation of €19bn with a Price-to-Book ratio hovering around 0.3. In contrast, its main rival, BNP Paribas, has a market valuation of €60bn with a Price-to-Book ratio above 0.5.

Market Valuation and Price to Book ratio of European Banks (Source: FactSet)

What lies behind this significant discrepancy in valuation is a series of ill-placed choices that ultimately resulted in the departure of SocGen CEO Frédéric Oudéa, who had been in charge of the business for nearly 15 years.

Analysts have traced back this weak strategic positioning of the bank to a series of factors. The first one is a highly unfavourable macroeconomic environment conditioned by the Covid pandemic and the war in Ukraine. The second one is the unprofitable investments that the bank has carried out from both a geographic and a product perspective.

For what concerns the geographic perspective, at the start of 2020, Oudéa fought back against shareholder pressure to dispose of SocGen’s Russian subsidiary Rosbank. He claimed that it would be foolish to abandon the Russian market now that Rosbank was starting to make a profit out of it and was gaining market share vis-à-vis its rivals. Maintaining its investment in Russia might have been a valid strategy had the conflict between Ukraine and Russia not occurred. However, things did not go as planned. Eventually, the situation culminated with the sale of Rosbank and the exit from the Russian market. Since the sale of Rosbank, SocGen top management has renovated its willingness to expand on its domestic market, focusing on its online-only retail bank, Boursorama, which is a leader in this segment.

For what concerns instead the product side of the business, SocGen has made investments in trading and equities businesses that proved less profitable than initially auspicated. Historically SocGen has had an incredible track record in the equity derivatives and structured product segment. To consolidate its position in the market, SocGen decided back in 2018 to purchase the Equity Markets and Commodities (EMC) business from Commerzbank. However, post-merger integration proved to be more complicated than initially anticipated, and in 2019 following the poor performance of its trading business, SocGen was forced to cut 8% of its investment banking division, closing down its commodities business and proprietary trading unit. Problems for SocGen continued accruing as the pandemic's harshly impacted its equity derivatives division. As companies cancelled announced dividends, the equities business of the French bank suffered losses in the region of hundreds of millions of euros.

The firm's poor stock performance, as shown in the graph below, eventually convinced the shareholders that there was a need for a change in leadership. In October 2022, the board decided to appoint Slawomir Krupa, former chief of the investment banking division of SocGen, as the new CEO to take charge in May of 2023.

Analysts have traced back this weak strategic positioning of the bank to a series of factors. The first one is a highly unfavourable macroeconomic environment conditioned by the Covid pandemic and the war in Ukraine. The second one is the unprofitable investments that the bank has carried out from both a geographic and a product perspective.

For what concerns the geographic perspective, at the start of 2020, Oudéa fought back against shareholder pressure to dispose of SocGen’s Russian subsidiary Rosbank. He claimed that it would be foolish to abandon the Russian market now that Rosbank was starting to make a profit out of it and was gaining market share vis-à-vis its rivals. Maintaining its investment in Russia might have been a valid strategy had the conflict between Ukraine and Russia not occurred. However, things did not go as planned. Eventually, the situation culminated with the sale of Rosbank and the exit from the Russian market. Since the sale of Rosbank, SocGen top management has renovated its willingness to expand on its domestic market, focusing on its online-only retail bank, Boursorama, which is a leader in this segment.

For what concerns instead the product side of the business, SocGen has made investments in trading and equities businesses that proved less profitable than initially auspicated. Historically SocGen has had an incredible track record in the equity derivatives and structured product segment. To consolidate its position in the market, SocGen decided back in 2018 to purchase the Equity Markets and Commodities (EMC) business from Commerzbank. However, post-merger integration proved to be more complicated than initially anticipated, and in 2019 following the poor performance of its trading business, SocGen was forced to cut 8% of its investment banking division, closing down its commodities business and proprietary trading unit. Problems for SocGen continued accruing as the pandemic's harshly impacted its equity derivatives division. As companies cancelled announced dividends, the equities business of the French bank suffered losses in the region of hundreds of millions of euros.

The firm's poor stock performance, as shown in the graph below, eventually convinced the shareholders that there was a need for a change in leadership. In October 2022, the board decided to appoint Slawomir Krupa, former chief of the investment banking division of SocGen, as the new CEO to take charge in May of 2023.

Stock price trend for Société Générale, GLE FR (Source: FactSet)

In this article, we will look at one of the first big moves that Krupa has made since being appointed by the board. In fact, on November 22, Societe Generale and AllianceBernstein announced their plans to form a Joint Venture combining their cash equity and equity research businesses. We will analyze this joint venture deal, which sees SocGen and AllianceBernstein (AB) joining forces to serve equity clients with a complete offering. To carry out this analysis, we will first go over the concept of a joint venture. Secondly, we will be looking at the profile of the companies involved and what the ownership structure of the joint venture is going to be. Finally, we will close with some remarks regarding the strategic positioning for the future of the business.

Joint Ventures

Most often, people might confuse the concept of Joint Venture for the age-old process of Merger and Acquisition (M&A). However, the differences between these are pretty significant. While, an acquisition is concerned with the idea of one business entity taking over another, usually with the intent of adding the acquired entity as a subsidiary to its business portfolio, a Joint Venture, instead, involves two separate entities undertaking a company or business together, sharing its profit, loss, and control. The venture is maintained as its own entity, separate from the other party’s company business interests. Although JVs eventually tend to end up as takeovers anyways, the root concept helps us identify the differences promptly. To name a few recent JVs across multiple industries, the first one would be the partnership between software solution company Microsoft Azure and the analytics company SAS–the objective being for enabling customers to easily run their SAS workloads in the MS Clouds, leading to an expansion of the companies’ business solutions and unlocking critical value from their digital transformation initiatives. Another recent joint venture within medical research is the one between Kantaro Biosciences and RenalytixAI, aimed at introducing a new class of diagnostic tests for antibody testing. Fiserv and USDA too formed partners for facilitating the acceptance of online Electronic Benefits Transfer (EBT) payments to allow users to buy groceries online. However, more than any of this, the most talked about JV announcement currently is within the finance industry–between the financial services company SocGen and the Asset Management Company AllianceBernstein. Aimed at diversifying SocGen’s IB away from its reliance on the leading derivatives franchise, this JV aims for growth in terms of cash equities. Principally, like most other JVs, this one too focuses on a niche partnership, primarily within global cash equities and equity research.

Financial Industry Brief & Consolidation

Investment Banks are generally involved in underwriting new stock issues, handling M&As for clients, and acting as financial advisors. Similarly, Asset Management Companies invest the pooled funds from clients to work through multiple investments–be it binds, stocks, or real estates. A partnership between these companies (SocGen and AllianceBernstein in this case) in forms of JVs would mean that the parties could exercise each other’s resources with ease and focus on ultimate attainment of their objectives with benefits such as shared risks and increased awareness of the customer base. Within the euro area banking sector, M&As are regarded as options to reduce overcapacity and weak profitability. However, the sector continues with weak profitability and excess capacity, with many undersized banks and costly physical banking infrastructure. Therefore, the overall efficiency and stability of the banking system would benefit from further consolidation which – as noted by experts in the field – should be more driven by market forces, with each proposed transaction accessed individually. For these kinds of consolidation, JVs (both domestic and international) could be considered as another significantly strong alternative. For instance, a research paper by the Philadelphia Federal Reserve conveyed how the most profitable JVs of French banks are likely to engage with banks in neighboring countries. Horizontal ventures help banks go forth and meet their competitive challenge through the expansion of products they offer to their customers, strengthening the customer ties against the pull of competition, and searching for new sources of revenues, thus easing competitive pressures on their profitability.

About Société Générale

Société Générale was founded in 1864 and as one of the leading European financial services group is based on a diversified and integrated banking model and has been playing an active role in the real economy for 150 years. With more than 117,000 employees in 66 countries, SocGen serves 25 million clients worldwide every day, achieving a strong position in Europe and a close connection with the rest of the world. The group offers advice and services to private, corporate and institutional clients on three main business areas: French Retail Banking, in the branches of Société Générale, Crédit du Nord and Boursorama, offering a full range of multichannel financial services among the most advanced in the field of digital innovation, International Retail Banking, Insurance and Financial Services, with networks in Africa, Central and Eastern Europe, Banking and Investor Solutions, with market-recognized expertise, top-level international ranking, and integrated solutions. Société Générale is taking part in the joint venture through its leading ESG Equity Research and its Renowned Global Electronic Execution.

About AllianceBernstein

AllianceBernstein is one of the largest investment management firms globally, headquartered in New York with offices in major investment centers, listed on the New York Stock Exchange and with $627B in assets under management as of October 31, 2022. The company is The Premier Equity Research house with 1,000 companies covered worldwide, with unparalleled liquidity access and a Wider Distribution Network in volume and geographies with privileged access to US investors. The global equities venture also involves Alliance Bernstein as it is Best-in-class Equity Research and Execution Services and as it Owns premier financials research brand: Autonomous.

Deal Rationale

For Société Générale and Bernstein Research Services clients, this new joint venture will offer world-class cash equities and research services combined with Société Générale’s integrated platforms for equity capital markets, equity derivatives, and prime services, providing clients with an enhanced experience. The plan will provide world-class investment insight across AMER, EMEA & APAC equity markets, as well as unparalleled access to liquidity and world-leading trading technology. The merged entities will bring complementary strengths and a shared vision of a leading full-service equity brokerage business to support the needs of global investor clients and issuers. As Robert van Brugge, CEO of Bernstein Research Services, said: “This partnership gives us the opportunity to participate in the high added value segments of the global equities business” because it builds on the innovative quantitative approaches of both organizations, aiming to expand on these strengths and bring new and unique perspectives, skills, and insights to better serve clients. Indeed, Stephane Loiseau, head of SocGen's cash equities business, added “And, importantly, it would also allow us to preserve and expand our firms’ unique strengths, expertise, and cultures”.

Ownership, Competitors and Financial Analysis

Société Générale plans to acquire a 51% stake in the joint venture, but the price has not been disclosed, with an option to achieve 100% ownership after five years, with closing expected by the end of 2023. The joint venture will be run as a long-term partnership under the Bernstein name and will be headquartered in London. Robert van Brugge, CEO of Bernstein Research Services, will become CEO of the new entity for an initial period of five years, while Stephane Loiseau, head of Société Générale’s cash equities business, will become Deputy CEO.

The deal with Alliance Bernstein comes as SocGen aims to keep pace with larger and more profitable competitors such as Bnp Paribas in France and major Wall Street banks Goldman Sachs and JP Morgan. Last year, SocGen's city rival BNP Paribas bought the remaining 50% stake in cash equity execution and research firm Exane and is now working to expand Exane's footprint in the US. Likewise, the connection with Alliance Bernstein should help SocGen's presence in the US and this is especially useful at a time when the outlook for European banks looks dire.

This step change toward becoming a world-leading equity company, at the Société Générale Group level, will increase profitability starting in 2025 - as the Paris-based bank declared – and on target, it will generate an increase in profitability (ROTE) of between +15 and +20 basis points. The expected impact on the CET1 ratio, which has already been included in the Group's trajectory for 2025 presented during Société Générale’s financial results for the second quarter of 2012, would be limited to about 10 basis points at closing. Furthermore, there will be an Impact of the expected target incremental Net Income in 2028, based on Société Générale’s 51% stake in the joint venture and including all synergies, on the profitability (ROTE) estimated by analysts' consensus in 2026 (Visible Alpha as of 10/24/2022).

The proposed transaction has received the support of Société Générale’s and AllianceBernstein’s Boards of Directors and Subject to workers council consultation a swell as approval of regulators and customary closing conditions, the deal is anticipated to close by the end of next year.

The deal with Alliance Bernstein comes as SocGen aims to keep pace with larger and more profitable competitors such as Bnp Paribas in France and major Wall Street banks Goldman Sachs and JP Morgan. Last year, SocGen's city rival BNP Paribas bought the remaining 50% stake in cash equity execution and research firm Exane and is now working to expand Exane's footprint in the US. Likewise, the connection with Alliance Bernstein should help SocGen's presence in the US and this is especially useful at a time when the outlook for European banks looks dire.

This step change toward becoming a world-leading equity company, at the Société Générale Group level, will increase profitability starting in 2025 - as the Paris-based bank declared – and on target, it will generate an increase in profitability (ROTE) of between +15 and +20 basis points. The expected impact on the CET1 ratio, which has already been included in the Group's trajectory for 2025 presented during Société Générale’s financial results for the second quarter of 2012, would be limited to about 10 basis points at closing. Furthermore, there will be an Impact of the expected target incremental Net Income in 2028, based on Société Générale’s 51% stake in the joint venture and including all synergies, on the profitability (ROTE) estimated by analysts' consensus in 2026 (Visible Alpha as of 10/24/2022).

The proposed transaction has received the support of Société Générale’s and AllianceBernstein’s Boards of Directors and Subject to workers council consultation a swell as approval of regulators and customary closing conditions, the deal is anticipated to close by the end of next year.

Growth Perspectives

Regarding the benefits that companies within the finance industry reap from a JV, it is important to understand that the financing considerations within a JV are a lot more attractive than internal expansion. This is primarily because the parties within a JV share their risks rather than facing them alone. A single–small/moderate-sized organization–may not have adequate capital for expansion. With internal finance unavailable and outside capital financing too expensive, JV becomes one of the most accessible alternatives for growth. Floating new stocks or costs of obtaining a loan require transaction costs such as costs of finding, negotiating, or paying an underwriter which cannot be avoided, no matter the size of the loan or volume of stocks issued. Thus, the partners to a JV may be able to provide their own financing, or at least provide enough collateral to reduce the premium required by outside investors. Furthermore, Joint Ventures may be able to reach a larger market than its partners would attain individually. This results in a comparatively large scale of operations and financing needs. Therefore, outside financing under these circumstances involves a comparatively small transaction cost per unit of funds raised. The JV will thus achieve economies of scale in raising capital. For example, an US bank holding company familiar with the products of American exporters might team up with a Japanese bank familiar with the needs of Japanese firms to form an export trading company. Or a Texas bank holding company familiar with the regional real estate market might pool its skills with an investment banking firm experienced in the area of investment advice to form a real estate investment advisory firm. Even though M&As would allow a bank to achieve certain benefits, the Bank Holding Company Act would prohibit a bank holding company from acquiring a commercial firm, and interstate banking restrictions could prevent a merger between bank holding companies located in different parts of the country. Bolstered by the simplicity to dissolve a JV compared to M&A, banks with short-term objectives or those who want to engage in acts of uncertain profitability tend to prefer JV to M&A. Two banks might initiate a JV to a merger if they complement in ways specific to the venture, however, are deemed incompatible in other aspects. These aspects could be one of the banks being strongly decentralized, with bank divisions independent of the executives to make decisions, while the other bank could be more hierarchical, with executives exercising more power. This lack of synergy could lead to M&A being disadvantageous.

Impact of current macro situation

Another quintessential area that should be studied and analyzed with complete diligence before instigating a JV could be the market forces impacting the situation of the economy. For instance, currently, amidst elevated uncertainty, high energy price pressures, erosion of households’ purchasing power, and tighter financing conditions are expected to tip the EU into a recession soon. This might affect the expansion process of banks through a joint venture. Similarly, as inflation keeps cutting into households’ disposable incomes, the reduction in economic activities is set to continue in the first quarter of 2023 too. However, there are opportunities present even within crises such as this one. With consistently rising interest rates, two firms with synergetic relationships and shared operations forming a JV could lead to a reduction in costs and help increase returns through balanced expansion while other banks struggle to keep up. More importantly, the labor market is seen to have performed strongly, with employment and participation at their highest and unemployment at its lowest in decades. Therefore, if a JV could exploit these possibilities, they could perhaps increase efficiency at the lowest costs. Some successful JVs between banks and financial institutions that give us confidence regarding their success could be the one between Chase Manhattan Bank and Dreyfus Corporation in 1985, Tradeshift and HSBC in 2017, or the Deutsche Bank and Traxpay in 2021. Be it through supply chain financing or the integration of tech and banking expertise, synergetic Joint Ventures throughout history have been proven to yield strongly positive results. Let us look more into the future strategic positioning of the recently announced Joint Venture between the financial services company SocGen and the asset management company AllianceBernstein in the rest of this article.

Future strategic positioning

Regarding the strategic rationale of this joint venture, there are two pivotal points worth highlighting. The first is that Krupa is most likely trying to provide SocGen and AB customers with a complete equity offering. SocGen will significantly benefit from AB's robust research network in the US and Asia, geographic areas in which SocGen today is underwhelming. This complete equity offering will also be less reliant on the equity derivatives and structured products business of SocGen, which is exposed to heavy losses, as we saw during the pandemic. This is in stark contrast to the cash equity and research business emerging from the joint venture which is instead much less capital-absorbing. A second point worth highlighting is the similarity between this joint venture and the one made by BNP Paribas and Exane. BNP has been striving to become in future years one of the critical equity players in Europe, and this move could be an attempt by SocGen to compete with its historical rival for a top spot as an equity house.

Nevertheless, a few questions still need to be answered on whether it was the right call to go forward with this joint venture. The equity business seems to be rapidly consolidating, and many analysts believe it will become dominated by top US players. JP Morgan, in 2022 alone, generated double the revenue of SocGen from buying and selling stocks and this gap is projected to be increasing. Some may question whether SocGen is trying to run a race that it has already lost. Notwithstanding these considerations diversifying away from the more volatile equity derivatives business seems to be a good idea for the French Bank, yet further steps are still needed if the long-awaited turnaround of SocGen is to be fulfilled.

Nevertheless, a few questions still need to be answered on whether it was the right call to go forward with this joint venture. The equity business seems to be rapidly consolidating, and many analysts believe it will become dominated by top US players. JP Morgan, in 2022 alone, generated double the revenue of SocGen from buying and selling stocks and this gap is projected to be increasing. Some may question whether SocGen is trying to run a race that it has already lost. Notwithstanding these considerations diversifying away from the more volatile equity derivatives business seems to be a good idea for the French Bank, yet further steps are still needed if the long-awaited turnaround of SocGen is to be fulfilled.

By Federico Adorini, Anna Rosaria Manni, and Prasiddha Rajaure

Sources:

- Federal Reserve Bank Philadelphia Official Website

- European Central Bank Official Website

- Reuters

- Financial Times

- FactSet

- Milano Finanza

- Société Générale Official Website