SoftBank Group Corp. is a Japanese multinational conglomerate holding company with the headquarter in Tokyo. The company owns stakes in Softbank Corp., Softbank Vision Fund, Arm Holdings, Fortress Investment Group, Boston Dynamics, Alibaba (29.5%), Yahoo Japan (48.17%), Uber (15%), many more companies. SoftBank was founded by Masayoshi Son, who also has the leadership position today. It was ranked in the Forbes Global 2000 list as the 36th largest public company in the world, and the second largest publicly traded company in Japan (after Toyota). Mizuho Financial Group is the main lender of SoftBank, having close ties. The company runs Vision Fund, the world's largest technology-focused venture capital fund, with over $100 billion in capital. This seems to be its main focus at the moment.

Recently, SoftBank led a new funding of $165 million in California-based Karius and invested $100 million in New York-based company Behavox, as the technology giant is making efforts to build a portfolio under its second Vision Fund. The two deals of $265 million investments in start-ups come at a time of intense investor scrutiny into SoftBank’s investments, including activist Elliott Management Corp.

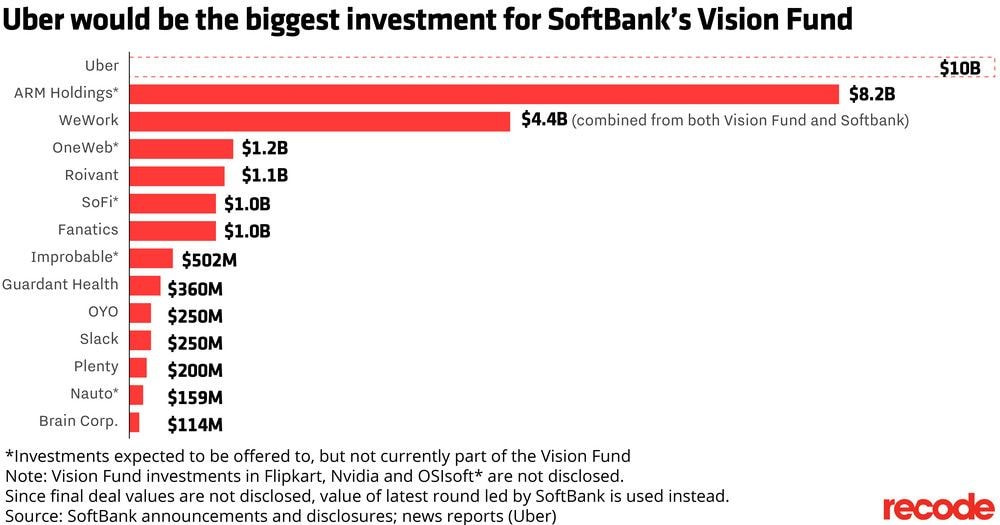

The Japanese-based company reported earlier this month the second quarter of losses regarding its first Vision Fund. This information is pushing Chief Executive Officer Masayoshi Son to scale back his second fund. It is known that SoftBank invested heavily in the darlings of Silicon Valley. However, In November 2019, the company reported a $6.5 billion loss, mostly because of investments in WeWork and Uber. This was the company's first quarterly loss in more than 14 years. Analysts predicted that the company deserved to lose much more than this, not because of its bad investments, but because of its bad thesis: aiming to create monopolies. Their strategy was to pour huge amounts of money into a single company, that there is no more competition and consumers are left with no choice, rising prices at its own will. This strategy is bad for investors, consumers and also for capitalism.

Going back to the recent investment, Karius is known for marketing a test that can detect quite quickly infections that are hard-to-diagnose through a simple blood sample. The funding will help expand its clinical research and commercial outreach. After the funding, the value of the company rounds at over $700 million, according to a filing made by the company to the state of Delaware, a copy of which was seen by Reuters. On the other hand, SoftBank became a user of Behavox’s platform way before making the investment. It uses AI to analyze internal company data such as employee emails and behavior to flag compliance issues and potential wrongdoing among employees. Its main clients include financial intermediaries, such as banks and private-equity firms. The investment (in the form of preferred shares) values Behavox at around $500M. The group will also be present in the company’s board. However, CEO Erkin Adylov and other key employees would remain the biggest shareholders of Behavox.scr.

Another interesting topic to look at is focused on Alibaba. The giant raised up to $13b in a share listing last year, which lifted the value of SoftBank’s 25% stake in the company and provides the collateral for much of its $140bn in net debt. Alibaba’s stock performance is critical not only to SoftBank, but also to the health of the Japanese group’s lenders — especially Mizuho.

In other ways, SoftBank’s debt position is improving. Not long ago, the merger between the telecom companies Sprint (SoftBank-owned) and T-Mobile US cleared the regulatory barriers in the US. This move will allow SoftBank to shift approximately $38bn from its balance sheet. However, leverage is still an issue not only for the company, but also for its lenders.

SoftBank claims that it is “in a solid financial position” with “enormous unrealized value” from its Alibaba position. On this measure, its net debt is $43.7bn.

Moreover, we are facing times when there is virtually no demand for corporate loans in Japan, which is why it comes as a surprise that SoftBank is one of the very few companies with any desire to borrow. Besides, the fees it has paid so far exceed $2bn only in the past five years (data from Refinitiv).

Recently, SoftBank led a new funding of $165 million in California-based Karius and invested $100 million in New York-based company Behavox, as the technology giant is making efforts to build a portfolio under its second Vision Fund. The two deals of $265 million investments in start-ups come at a time of intense investor scrutiny into SoftBank’s investments, including activist Elliott Management Corp.

The Japanese-based company reported earlier this month the second quarter of losses regarding its first Vision Fund. This information is pushing Chief Executive Officer Masayoshi Son to scale back his second fund. It is known that SoftBank invested heavily in the darlings of Silicon Valley. However, In November 2019, the company reported a $6.5 billion loss, mostly because of investments in WeWork and Uber. This was the company's first quarterly loss in more than 14 years. Analysts predicted that the company deserved to lose much more than this, not because of its bad investments, but because of its bad thesis: aiming to create monopolies. Their strategy was to pour huge amounts of money into a single company, that there is no more competition and consumers are left with no choice, rising prices at its own will. This strategy is bad for investors, consumers and also for capitalism.

Going back to the recent investment, Karius is known for marketing a test that can detect quite quickly infections that are hard-to-diagnose through a simple blood sample. The funding will help expand its clinical research and commercial outreach. After the funding, the value of the company rounds at over $700 million, according to a filing made by the company to the state of Delaware, a copy of which was seen by Reuters. On the other hand, SoftBank became a user of Behavox’s platform way before making the investment. It uses AI to analyze internal company data such as employee emails and behavior to flag compliance issues and potential wrongdoing among employees. Its main clients include financial intermediaries, such as banks and private-equity firms. The investment (in the form of preferred shares) values Behavox at around $500M. The group will also be present in the company’s board. However, CEO Erkin Adylov and other key employees would remain the biggest shareholders of Behavox.scr.

Another interesting topic to look at is focused on Alibaba. The giant raised up to $13b in a share listing last year, which lifted the value of SoftBank’s 25% stake in the company and provides the collateral for much of its $140bn in net debt. Alibaba’s stock performance is critical not only to SoftBank, but also to the health of the Japanese group’s lenders — especially Mizuho.

In other ways, SoftBank’s debt position is improving. Not long ago, the merger between the telecom companies Sprint (SoftBank-owned) and T-Mobile US cleared the regulatory barriers in the US. This move will allow SoftBank to shift approximately $38bn from its balance sheet. However, leverage is still an issue not only for the company, but also for its lenders.

SoftBank claims that it is “in a solid financial position” with “enormous unrealized value” from its Alibaba position. On this measure, its net debt is $43.7bn.

Moreover, we are facing times when there is virtually no demand for corporate loans in Japan, which is why it comes as a surprise that SoftBank is one of the very few companies with any desire to borrow. Besides, the fees it has paid so far exceed $2bn only in the past five years (data from Refinitiv).

Ana Letitia Cosniceru

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

(Cover image by Miki Yoshito-Flickr. https://www.flickr.com/photos/mujitra/5253845074)

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

(Cover image by Miki Yoshito-Flickr. https://www.flickr.com/photos/mujitra/5253845074)