In the evolving world of cryptocurrencies, the recent approval granted by Singaporean authorities to the crypto platform Paxos for the issue a US dollar-pegged stablecoin (a digital token whose value is pegged to another asset class such as fiat currency) highlights a potential shift in the country's crypto market and transformative developments in the sector’s global landscape. This news emerges against a backdrop of collapsed digital projects and ventures in Singapore, including FTX and Three Arrows Capital, but it could be just what is needed to turn the tide and reignite the city-state’s crypto sector. In this article, we explore the role of Paxos and stablecoins in the digital ecosystem, the history of Singapore’s crypto market and highlight the risks and benefits of this latest operation.

Introducing Singapore’s crypto framework and the stablecoin market

On November 16th, Paxos received an “In Principle Approval” from the Monetary Authority of Singapore (MAS) for a new entity that would be issuing USD-Backed Stablecoin in the island-state. The agreement follows the proposal of a new regulatory framework for stablecoins, released by the MAS in August, applicable to single-currency stablecoins pegged to the Singaporean dollar or any G10 currency, including the U.S. dollar. Paxos’ new entity will be compliant with the new regulatory guidelines, and, once approval is finalized, the crypto platform will be able to partner with enterprise clients in order to issue this USD-backed stablecoin in Singapore.

Meanwhile, the UK has already laid its stablecoin cards on the table, setting out guidelines to regulate the digital tokens in a bid to try to facilitate their use as a payment option for everyday goods and services. Developments in Singapore, pushing for key-digital assets one-week later, possibly hint at a brewing international competition in stablecoin adoption.

However, despite these developments, concrete evidence of robust demand for dollar-pegged stablecoins in Singapore or across Asia remains elusive.

Challenges in identifying stablecoin markets arise from crypto traders employing virtual private networks (VPNs) to obscure their locations, complicating accurate market identification. For instance, top trading pairs for major stablecoins like Tether, USDC, DAI, and BUSD primarily involve currencies other than the Singaporean dollar, suggesting limited market presence in the country. Amid Paxos' ambitions to democratize financial access through its Singapore venture, the overall stablecoin market has experienced a 33% decline in market capitalization. The total market capitalization of stablecoins dropped to $127.9 billion as of November. That’s the lowest since August 2021. The sector was $137.9 billion in December. This reflects a stagnant market scenario and challenging efforts at market expansion.

On November 16th, Paxos received an “In Principle Approval” from the Monetary Authority of Singapore (MAS) for a new entity that would be issuing USD-Backed Stablecoin in the island-state. The agreement follows the proposal of a new regulatory framework for stablecoins, released by the MAS in August, applicable to single-currency stablecoins pegged to the Singaporean dollar or any G10 currency, including the U.S. dollar. Paxos’ new entity will be compliant with the new regulatory guidelines, and, once approval is finalized, the crypto platform will be able to partner with enterprise clients in order to issue this USD-backed stablecoin in Singapore.

Meanwhile, the UK has already laid its stablecoin cards on the table, setting out guidelines to regulate the digital tokens in a bid to try to facilitate their use as a payment option for everyday goods and services. Developments in Singapore, pushing for key-digital assets one-week later, possibly hint at a brewing international competition in stablecoin adoption.

However, despite these developments, concrete evidence of robust demand for dollar-pegged stablecoins in Singapore or across Asia remains elusive.

Challenges in identifying stablecoin markets arise from crypto traders employing virtual private networks (VPNs) to obscure their locations, complicating accurate market identification. For instance, top trading pairs for major stablecoins like Tether, USDC, DAI, and BUSD primarily involve currencies other than the Singaporean dollar, suggesting limited market presence in the country. Amid Paxos' ambitions to democratize financial access through its Singapore venture, the overall stablecoin market has experienced a 33% decline in market capitalization. The total market capitalization of stablecoins dropped to $127.9 billion as of November. That’s the lowest since August 2021. The sector was $137.9 billion in December. This reflects a stagnant market scenario and challenging efforts at market expansion.

Insight into Paxos: previous operations in Singapore and its role in the crypto sphere

Paxos, a cryptocurrency trading and custody platform, announced in 2022 that Paxos Global Pte Ltd had acquired a license from the Monetary Authority of Singapore (MAS). Under the new license, Paxos will be able to offer digital payment token services, and it will become the first blockchain infrastructure platform from the USA with a Major Payments Institution (MPI) license.

The newly received license should help Paxos establish a better presence of its services in the Asian region. Given the strong demand for the U.S. dollar, through its strategic developments in Singapore’s crypto sphere, Paxos aims to open the financial system to everyone, introducing significant opportunities to global markets and billions of users, allowing users outside the U.S. to get dollars safely, reliably and under regulatory protections.

The company offers various crypto-related services and has made substantial contributions to the development of regulated stablecoins and blockchain-based financial infrastructure. Here's an overview:

Stablecoins: Paxos introduced the Paxos Standard (PAX) stablecoin in 2018, one of the industry's first regulated stablecoins pegged to the US dollar. Additionally, the company launched PAX Gold (PAXG), a regulated digital token backed by physical gold.

Blockchain-Based Settlement: Paxos received SEC approval to test a blockchain-based settlement service for US-listed equities, subsequently launching the service in 2020.

Crypto Brokerage and Partnerships: Paxos initiated a crypto brokerage service, forging partnerships with significant entities like PayPal, Revolut, and OANDA, enhancing accessibility to cryptocurrencies for a broader audience.

However, Paxos also faced regulatory challenges, notably in February 2023, when US regulators ordered Paxos to cease issuing Binance's BUSD stablecoin. The Binance-branded stablecoin has faded to near-irrelevancy ever since falling foul of New York regulators earlier this year. This setback clipped Paxos' wings in the stablecoin market, impacting its stablecoin business substantially.

Still as of today, Paxos continues to maintain a pivotal presence in the crypto landscape by providing diverse services. Paxos remains active in offering regulated stablecoins like Paxos Standard (PAX) and exploring stablecoin-related ventures within Singapore. The company is focused on blockchain-based settlement services and post-trade automation, contributing to the evolution of financial infrastructure.

While the blockchain firm has seen success in introducing regulated stablecoins, exploring blockchain-based settlement services, and establishing strategic partnerships in the crypto sphere, challenges persist in navigating regulatory complexities, as seen with the BUSD issuance cessation. Overall, the company continues to evolve and innovate within the crypto space, balancing successes with regulatory hurdles and market dynamics.

Insight into Paxos: previous operations in Singapore and its role in the crypto sphere

Paxos, a cryptocurrency trading and custody platform, announced in 2022 that Paxos Global Pte Ltd had acquired a license from the Monetary Authority of Singapore (MAS). Under the new license, Paxos will be able to offer digital payment token services, and it will become the first blockchain infrastructure platform from the USA with a Major Payments Institution (MPI) license.

The newly received license should help Paxos establish a better presence of its services in the Asian region. Given the strong demand for the U.S. dollar, through its strategic developments in Singapore’s crypto sphere, Paxos aims to open the financial system to everyone, introducing significant opportunities to global markets and billions of users, allowing users outside the U.S. to get dollars safely, reliably and under regulatory protections.

The company offers various crypto-related services and has made substantial contributions to the development of regulated stablecoins and blockchain-based financial infrastructure. Here's an overview:

Stablecoins: Paxos introduced the Paxos Standard (PAX) stablecoin in 2018, one of the industry's first regulated stablecoins pegged to the US dollar. Additionally, the company launched PAX Gold (PAXG), a regulated digital token backed by physical gold.

Blockchain-Based Settlement: Paxos received SEC approval to test a blockchain-based settlement service for US-listed equities, subsequently launching the service in 2020.

Crypto Brokerage and Partnerships: Paxos initiated a crypto brokerage service, forging partnerships with significant entities like PayPal, Revolut, and OANDA, enhancing accessibility to cryptocurrencies for a broader audience.

However, Paxos also faced regulatory challenges, notably in February 2023, when US regulators ordered Paxos to cease issuing Binance's BUSD stablecoin. The Binance-branded stablecoin has faded to near-irrelevancy ever since falling foul of New York regulators earlier this year. This setback clipped Paxos' wings in the stablecoin market, impacting its stablecoin business substantially.

Still as of today, Paxos continues to maintain a pivotal presence in the crypto landscape by providing diverse services. Paxos remains active in offering regulated stablecoins like Paxos Standard (PAX) and exploring stablecoin-related ventures within Singapore. The company is focused on blockchain-based settlement services and post-trade automation, contributing to the evolution of financial infrastructure.

While the blockchain firm has seen success in introducing regulated stablecoins, exploring blockchain-based settlement services, and establishing strategic partnerships in the crypto sphere, challenges persist in navigating regulatory complexities, as seen with the BUSD issuance cessation. Overall, the company continues to evolve and innovate within the crypto space, balancing successes with regulatory hurdles and market dynamics.

What are stablecoins and why are they useful?

A stablecoin is a kind of blockchain-based token. It is pegged to a collateral, such as a fiat currency or a commodity, and it aims to maintain a steady value. Examples of the most traded stable coins include Tether (USDT), which is pegged to the U.S. Dollar, and Pax Gold (PAXG), which is pegged to the value of gold.

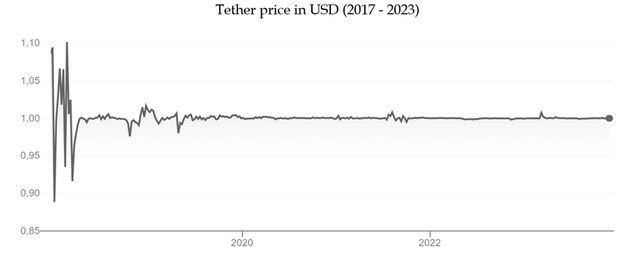

Traditional cryptocurrencies such as Bitcoin have become known for their volatility. While they guarantee effective decentralization and complete independence from any monetary authority, they don’t allow investors to maintain the value of their digital assets without having to offload into fiat currency or to pay for goods and services in an effective manner.Stable cryptocurrencies present themselves as a way for users to benefit from the advantages offered by traditional cryptocurrencies, such as immutability and pseudonymity, without their main shortcoming, which is high volatility. It comes without surprise, then, that stablecoins have become incredibly popular and widely used in the crypto world. For example, with $84 billion in circulation, Tether is not only the most popular stablecoin, but also the most traded cryptocurrency in the world, after having surpassed Bitcoin in terms of trading volume in 2019. In the last three years, tether has successfully maintained its peg to the USD.

The peg of Tether to the USD, stable in the last three years

A big advantage of stablecoins, and in particular of the fact that stablecoins exist for many fiat currencies, is that users don’t need multiple international bank accounts to send money to other countries. They can do so with just one crypto wallet. For example, a US investor that needs to send money to China could do so by simply owning and transferring a token representing the renminbi. This decentralized peer-to-peer model enables cost savings by eliminating the need to pay processing fees and administrative costs associated with third-party intermediaries. It also shortens transfer time and has the further advantage of not requiring the disclosure of personal data.

Deep-Dive into the stablecoin market and types of stablecoins

While in recent months the stablecoin market has contracted a bit, taking a more long-term look, the market capitalization of stablecoins has strongly grown in recent years, from $2.6 billion in 2019 to roughly $127.9 billion as of November 2023. One of the reasons behind this growth is that the number of use cases for stablecoins has grown significantly since they were introduced. Stablecoins are now created in association with several different reserve assets, such as metals, real estate and even other digital currencies. In particular, based on the mechanism used to stabilize their value, we can identify four main categories.

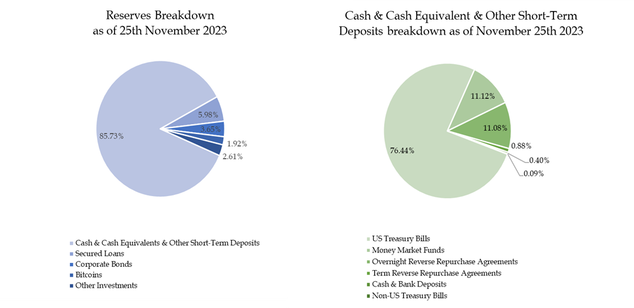

Fiat-collateralized stablecoins: As the name suggests, they rely on sovereign currencies like the pound or the US dollar. The already mentioned Tether (USDT) is clearly an example of this category. In simple terms, when issuing a certain number of tokens, the issuer must ensure to be in possess of reserves equivalent to the token amount as collateral. The reserves are usually overseen by independent custodians, who undergo regular compliance audits. To ensure the credibility of the token, the issuer’s transparency regarding reserves is paramount. For example, Tether updates a breakdown of its reserves holdings daily on its website.

Tether’s reserve composition as of November 25, 2023

Commodity-backed stablecoins: Gold and other commodities can also be utilized as backing, and they function similarly to fiat-collateralized currencies. Commodity-backed stablecoins are pegged to the value of underlying commodity assets like gold, silver, or real estate. Holders of these stablecoins have a claim to their underlying assets. As the market price for these commodities increases, traders benefit from an increase in the value of their fractional ownership of the commodity.

Crypto-Collateralized Stablecoins: coins that are backed by other cryptocurrencies. To counteract volatility, these stablecoins use overcollateralization, where the reserve cryptocurrency exceeds the value of the issued stablecoins. Users obtain these stablecoins by locking their collateral tokens in a smart contract, creating a buffer against market fluctuations. Reclaiming the collateral involves repaying stablecoins into the smart contract, liquidating the position. The idea behind these coins is to provide the benefits of a digital currency without the risk of extreme volatility. These stablecoins make cryptocurrencies a viable payment option for businesses, as most do not want to deal with volatile currencies. An example is the EOSDT Token, which track the US dollar but leverages both EOS and BTC collateral to enhance market liquidity.

Algorithmic stablecoins: these stablecoins achieve price stability through algorithms and smart contracts, without relying on fiat, crypto, or commodities as collateral. Unlike traditional stablecoins, they use preset formulas to control the coin's supply dynamically. These stablecoins employ a dynamic mechanism to control circulation. If the price falls below the desired level, the algorithm reduces the number of tokens in circulation. Conversely, if the token price surpasses the desired level, more tokens are issued. Examples include the DefiDollar (DUSD) and Ampleforth (AMPL).

A brief history: how Singapore became a Global Crypto Hub

In 2017, China implemented stringent measures against cryptocurrency, effectively prohibiting the operation of exchanges and the utilization of digital currencies. Subsequently, numerous cryptocurrency firms sought refuge in Singapore, which emerged as a leading jurisdiction for licensing such entities.

During the significant surge in Bitcoin's value amid the pandemic, Singapore significantly bolstered its position as a focal point within the cryptocurrency landscape. Investments in the Singaporean crypto sector soared to $1.48 billion in 2021, representing a substantial tenfold increase from the preceding year and accounting for nearly half of the total investments in the Asia Pacific region during that period. However, 2022 brought challenging times. Some major players based in Singapore, like Terraform Labs and Three Arrows Capital, took big hits, and it caused a massive $2 trillion crash in the entire crypto market (as measured by total crypto market capitalization).

Nevertheless, the Monetary Authority of Singapore (MAS) remains committed to promoting a digital asset hub, encouraging projects focused on the institutional use of blockchain technology. There is talk of the benefits of digital ledgers for more efficient payments and tokenization of illiquid assets for easier buying and selling.

Singapore's accolades as a conducive environment for top-tier businesses stem from its strong infrastructure, global connectivity, and a pool of talented individuals. This interconnected ecosystem plays a crucial role. The country's competitive economy, strategically located in the heart of Southeast Asia, serves as a magnet for highly skilled labor. The combination of a well-educated workforce and considerable institutional experience in the fintech sector has been a catalyst for Singapore's success. Some of the first successful initial coin offerings (ICOs) have come from Singaporean startups such as TenX, a cryptocurrency payment platform that in 2017 raised a staggering $43 million in just seven minutes. In the same year, Singapore outperformed the United States, raising $1.5 billion compared to $1.2 billion in ICO funding.

But they're not ignoring the risks. They aim to curb risky speculative trading by retail investors in the crypto sphere. Furthermore, there have been some concerns about fraud and financial discrepancies that arose after the 2022 crypto crash, such as the case involving the Bahamas-based FTX exchange. So, MAS is tightening things up to protect consumers, making Singapore one of the toughest places for crypto rules while still trying to make tokenization and other crypto stuff work smoothly. They aim to establish stringent consumer protection measures, making Singapore one of the strictest regulatory environments for cryptocurrency while facilitating tokenization and related aspects. They began tightening consumer protection measures before the 2022 crypto downturn, curbing digital asset-related advertisements and halting token lending to the general public.

MAS is also vigilant in monitoring potential instances of money laundering and illicit activities associated with digital currency.

Their approach is to start with a light regulatory touch and strengthen protocols as risks become more evident.

In 2023, the ownership of cryptocurrencies increased to 43%, a significant jump of 3% from the previous year. This surge in ownership is often aligned with well-defined government regulations. Indeed, in 2020, Singapore introduced the Payment Services Act, laying the foundation for a comprehensive regulatory framework governing all cryptocurrencies, whether trading or using tokens for transactions. Currently, the Monetary Authority of Singapore (MAS) is in charge of issuing licenses for digital payment tokens to crypto companies that want to be legitimized. Virtual asset service providers operating outside Singapore's borders also need a proper license, but only a few have been approved among a swarm of over 100 applicants vying for new cryptocurrency payment licenses.

Chia Hock Lai, co-chair of the Blockchain Association Singapore, revealed that Singapore is currently home to over 200 cryptocurrency firms. However, since the introduction of the licensing framework, some have either ceased operations or relocated elsewhere.

Today: Singapore as a Crypto Powerhouse

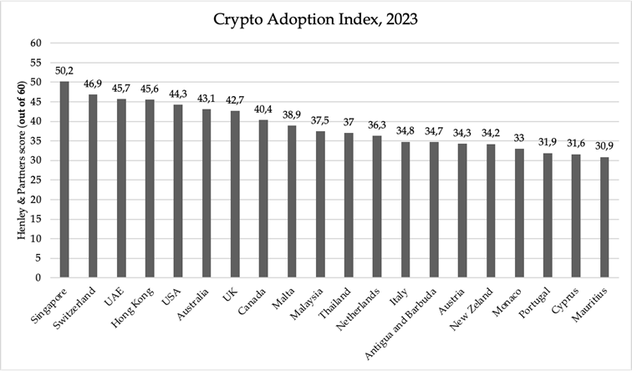

Singapore has solidified its position as the leading global hub for cryptocurrencies, securing a remarkable score of 50.2 out of 60, or 83.76%, according to the latest report from Henley & Partners (5 Sep. 2023), a London-based investment migration consultancy. The purpose of the index is to evaluate and rank host countries for investment migration based on their embrace and incorporation of crypto and blockchain technologies.

Switzerland follows closely in second place with a score of 78.17%, boasting a well-established crypto infrastructure, a robust legal framework, and a renowned reputation for privacy and security. The United Arab Emirates (UAE) claims the third spot at 76.17%, earning praise for its favorable tax policies and high economic stability.Hong Kong secures the fourth spot at 76%, while the United States, Australia, and the United Kingdom trail closely behind, ranking fifth, sixth, and seventh, respectively, in terms of crypto adoption. Canada, Malta, and Malaysia round up the top ten countries, showcasing the most appealing investment migration program options for crypto investors.

Notably, Hong Kong is evolving its approach to crypto, aiming to safeguard investors while nurturing a digital asset center. Across the globe, entities like the European Union and Dubai are developing new regulatory frameworks. However, the United States, under the Securities & Exchange Commission (SEC) chair Gary Gensler, faces challenges due to legislative uncertainties, impacting the broader regulatory landscape.

Henley and Partners Crypto Adoption Index, September 2023

Singapore's (second) recent rise in the cryptocurrency industry

In recent months, several prominent cryptocurrency players, including Coinbase, Crypto.com exchanges, the Singapore arm of Sygnum Bank, Circle Internet Financial and Ripple Labs, have secured licenses in Singapore for digital payment token services. Singapore's vibrant ecosystem for cryptocurrency companies and service providers has attracted digital asset companies seeking refuge from regulatory restrictions in other countries.

Among these companies is Huobi, a cryptocurrency exchange initially focused on China, which has greatly expanded its presence in Singapore. U.S. companies such as Gemini, led by the Winklevoss twins, have also established regional headquarters in Singapore, despite being one of the companies sued by the SEC as part of the U.S. crackdown.

The growing interest from these industry giants underscores Singapore's potential to emerge as Asia's leading cryptocurrency hub, especially if the sector continues its gradual recovery. In addition, MAS's forward-looking approach indicates Singapore's commitment to integrating innovative blockchain technology beyond just cryptocurrency trading, signaling a broader transformation of the financial landscape.

Back to the Paxos news: forecasted advantages of a stablecoin in Singapore

Following the announcement of the Monetary Authority of Singapore (MAS) regarding their plans focused on regulated stablecoins, the city-state will face a promising transformation of its’ financial landscape. One of the first advantages that will be highlighted in the near future is the efficiency in transactions. Stablecoins can facilitate faster and more cost-effective cross-border transactions compared to traditional banking systems and thus can be particularly beneficial for remittances and international trade. A trustworthy stablecoin has the potential to completely change the payments system in Singapore, getting an edge over its neighbor Honk Kong which continues to be against this phenomena. We should not think about payments as the simple act of transferring money, but more as a social experience linking people. Therefore, Paxos has the potential to better integrate in our digital lives and offer faster and cheaper payments, giving Singapore the first mover’s advantage in the Asian landscape.

Furthermore, the presence of a stablecoin in Singapore would further push technological innovations, especially in the financial sector. Blockchain and distributed ledger technologies that underpin many stablecoins may lead to the development of new financial products and services, thanks to their open architecture, as opposed to the proprietary legacy systems of banks. Such an example can be Web 3, an extension of cryptocurrency using blockchain in innovative ways, which could contribute to a possible move away from centralized web platforms and data centers towards decentralized networks. Therefore, this type of technological innovation would be beneficial for Singapore as it will attract increased investment that will strengthen country’s economic prospects.

Potential downsides

Even if stablecoins are designed to have a stable value, one initial concern lies in the volatility of stablecoin prices. Despite being pegged to real world assets, market dynamics could still lead to fluctuations, potentially exposing investors to financial risks. On the other hand, considering the expected lower level of volatility, stablecoins may have a considerable impact on the dynamics of the cryptocurrency market. Traders and investors might use it as a ‘safe heaven’ during times of market volatility, potentially affecting the prices of other cryptocurrencies. This scenario represents an important aspect to bear in mind, considering the recent crypto events in Singapore, namely Terraform Labs’ UST algorithmic stablecoin failure on millions of citizens.

Moreover, it is also important to consider the impact that a stablecoin will have on the Monetary Authority of Singapore (MAS), the country’s central bank. A stablecoin may challenge the traditional role of the MAS in managing monetary policy and currency issuance. The MAS would likely face the need to adapt further regulatory frameworks to address potential concerns related to consumer protection, money laundering, and overall financial stability associated with stablecoin adoption. Furthermore, the stablecoin's potential competition with the Singapore Dollar could prompt the MAS to carefully consider the impact on domestic monetary conditions and economic stability. Therefore, the MAS should strike a balance between fostering innovation, which would further solidify country’s position as a leading global hub for cryptocurrencies and preserving monetary control in order to navigate the evolving landscape of digital currencies.

Therefore, Paxos has the opportunity to contribute to some significant technological advancements and a revolutionizing payments system, but an important first step is gaining the trust of users. If users believe in the stability and reliability of a stablecoin, it could gain widespread adoption. However, concerns about security, regulation, or the stability of the underlying peg could hinder adoption.

By Gauri Gupta, Vittoria Palmieri, Lorenzo Pastorelli, Laurian David Pop

SOURCES

- Bloomberg

- CoinDesk

- Cryptopedia

- Financial Times

- GoogleFinance

- Henley and Partners

- IMF

- Osborne Clarke

- Paxos press release

- Reuters

- Techopedia