The country of Taiwan has seen a fairly small number of confirmed cases of COVID-19 compared with its regional neighbors: Hong Kong, Singapore and especially South Korea and Japan. These results are outstanding considering the high contagiousness of the virus and the continuous exchanges with this neighbourhood. Let’s briefly analyse the main drivers of the strategy applied to contain the sanitary emergency and let’s discover if it has been enough to restrain also the economic consequences of this global disaster.

“In the modern world, we live on information,” says Alex Tan, head of the political science department at the University of Canterbury in New Zealand. Indeed, first of all, the Taiwanese government held a series of press conferences with a linear flow of information, with which it managed to avoid the panic effect that has had so many disastrous consequences in other countries. The transparent approach and the abundant high-quality of medical facilities encouraged symptomatic people to self-report out of a sense of civic duty. Businesses contributed to the effort by implementing a variety of disease prevention measures.

There’s no doubt that many of these effective measures has been developed as a reaction to the lesson coming from the SARS outbreak in 2003, which had a disruptive impact on the Asian economy. Moreover, Taiwan is not a member of the World Health Organization and despite this may be seen as a weakness due to the circumstances, the foreclosure produced unexpected effects: the country benefited from a major independence about the sanitary emergency measures without needing the approval and the coordination of the WHO, realising preventive and faster solutions. Ironically, this exclusion damaged mostly other countries: as a non-member Taiwan wasn’t supposed to communicate updates on their new cases and related measures, their useful knowledge and experiences that could have helped other territories. Also, now that the emergency moved to another part of the world, as a non-member, Taiwan is not capable of contributing to the joint efforts of WHO- sending doctors, nurses and researchers to more affected countries.

So, is the excellence in the containment of the sanitary emergency enough to save Taiwan from an economic crisis? Mainly, the biggest damages are not due to the local economy itself but influenced by the constant, massive, inevitable contacts with other countries among the world. In this game, a dominant role is clearly played by China: many Taiwanese factories are located on the mainland, a relevant percentage of intermediate products by Taiwanese businesses are included in transactions and both businesses were hindered by the strict lockdown.

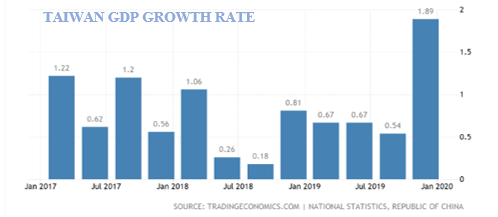

Based on the GDP growth of the last years we can see that the 2020 would have been a year full of the widest expectations, but the pandemic outbreak has clearly upended the plans, as in the rest of the world.

The new growth forecast, according to the government, is set to a 2.37% rate for 2020, down from the 2.71% reached last year. The declaration of Taiwan’s statistic minister stated the country will have no problem maintaining the 2 percent economic growth, partly helped by a planned $2 billion package, approved by the cabinet on 27 February. In politics, as did in the healthcare, they managed to avoid the hit of the panic button , an intelligent and safe move: the possibility of an interest rate cut by the central bank, a mirror move of US, has suddenly been denied. However, the risk of a weakening of the New Taiwan dollar is, comprehensively, still standing. In general, most sectors withstood heavy damage despite the pressures currently threatening the whole world.

It’s not all fun and games though, indeed even the best practice applied couldn’t avoid some issues in specific sectors which inevitably have an impact on other countries. The transportation sector mainly is facing several difficulties.

Aviation industry is the “biggest victim” of the epidemic: transportation ministry is planning a $140 million bailout, calculated to compensate for an estimated 25 % drop in air traffic. China Airlines, one of two major leaders together with EVA Air, defined the outbreak’s impact an “avalanche”. Flight passenger volume between Taiwan and the neighbourhood (China, HK and Macau) has dropped by up to 92%, according to The Diplomat. Moreover, Taiwan’s Travel Quality Assurance Association said over 90 percent of its almost 4000 agencies would be forced to stop business even in the second half of 2020, if the global emergency requires so.

Many grants have been approved also for workers: 137.5 million for dismissed workers and relaxed qualifications for entrepreneurship, by which anyone aged older than 20 wanting to start a new business would receive $66,725 in subsidies. Especially considering the latter point it is clear than the economics in general is keeping a positive attitude promoting new businesses, whereas, in other part of the world, the existing ones are struggling to save their financials.

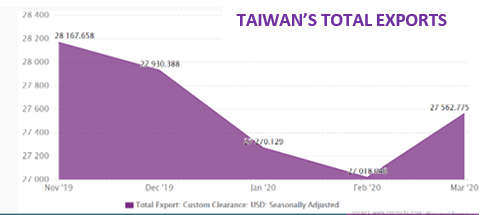

Moving on the “export” point of view, Taiwan’s National Development Council, at the beginning of February, predicted a heavy impact also in the branches of electronic components and the petrochemicals: 87% of Taiwan’s export to China are intermediate products, with electronics comprising the biggest category and 45% of the cited petrochemical industry’s total production is shipped to China. Nevertheless, in the month of March some positive signals came out: the country registered total exports for $27.6 bn, more than the value of February ($26 bn) and the monthly average of $25.3 bn Taiwan’s Trade Balance recorded a surplus of $3.6 bn.

Aviation industry is the “biggest victim” of the epidemic: transportation ministry is planning a $140 million bailout, calculated to compensate for an estimated 25 % drop in air traffic. China Airlines, one of two major leaders together with EVA Air, defined the outbreak’s impact an “avalanche”. Flight passenger volume between Taiwan and the neighbourhood (China, HK and Macau) has dropped by up to 92%, according to The Diplomat. Moreover, Taiwan’s Travel Quality Assurance Association said over 90 percent of its almost 4000 agencies would be forced to stop business even in the second half of 2020, if the global emergency requires so.

Many grants have been approved also for workers: 137.5 million for dismissed workers and relaxed qualifications for entrepreneurship, by which anyone aged older than 20 wanting to start a new business would receive $66,725 in subsidies. Especially considering the latter point it is clear than the economics in general is keeping a positive attitude promoting new businesses, whereas, in other part of the world, the existing ones are struggling to save their financials.

Moving on the “export” point of view, Taiwan’s National Development Council, at the beginning of February, predicted a heavy impact also in the branches of electronic components and the petrochemicals: 87% of Taiwan’s export to China are intermediate products, with electronics comprising the biggest category and 45% of the cited petrochemical industry’s total production is shipped to China. Nevertheless, in the month of March some positive signals came out: the country registered total exports for $27.6 bn, more than the value of February ($26 bn) and the monthly average of $25.3 bn Taiwan’s Trade Balance recorded a surplus of $3.6 bn.

Maria D'Amato

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.