In this decade, we have witnessed an incredible increase in consolidation among global financial markets infrastructure. Low market volatility and fierce competition in equities trading combined with ever decreasing fees earned by stock markets have pushed the players in the market towards consolidating with one another aiming to cut costs by increasing their scale. The squeeze of exchanges’ profitability, has pushed them to look for new areas in which to develop and prosper. A glaring example is the acquisition of Refitiv, an important data company, by the London Stock Exchange which will most likely position the exchange as one of the world’s biggest supplier of market data and infrastructure. The financial markets infrastructure industry has become scale and diversification dependent. It is increasingly difficult for exchanges to maintain profitability while existing on their own. Bolsas y Mercados Esponels (BME), which is the owner and operator of the Spanish stock exchange, doesn’t seem to have what it takes anymore to remain a purely independent player as shown by its declining annual revenues which have shrunk by about €50m over the course of the past five years. The Spanish company has tried to stick to the more traditional business of equities trading without great success.

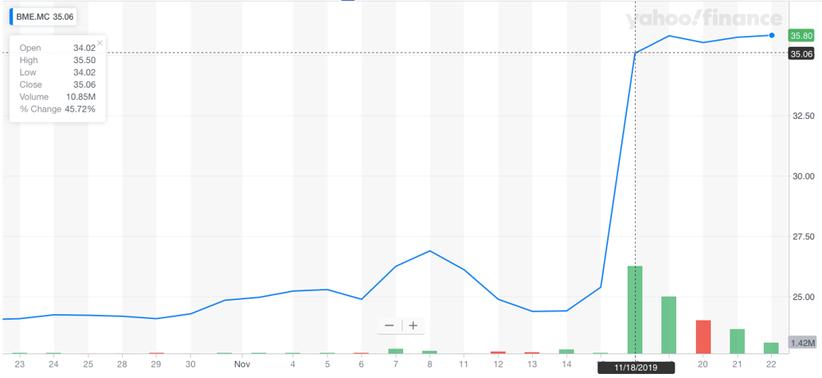

It doesn’t come as a surprise then that two different exchanges, the SIX and the Euronext, have both shown a strong interest for BME. This strong interest that might anticipate a bidding war has resulted in a surge in the stock price of the Spanish exchange operator. As shown by the graph below on Monday the 18th of November, the share price of BME increased to a record value of €35, from its previous closing value on Friday of €25 per share.

It doesn’t come as a surprise then that two different exchanges, the SIX and the Euronext, have both shown a strong interest for BME. This strong interest that might anticipate a bidding war has resulted in a surge in the stock price of the Spanish exchange operator. As shown by the graph below on Monday the 18th of November, the share price of BME increased to a record value of €35, from its previous closing value on Friday of €25 per share.

Source: Yahoo Finance

The increase in the share price of BME can be traced back to the official offer that has been presented by SIX on Monday. The Swiss exchange has offered a price of €34 per share, valuing the company at €2.8 bn. Since SIX is a private company the acquisition would have to be paid entirely with cash. That would not be a problem for the Swiss exchange as it has accumulated cash for approximately €3,46 bn and it can count on the backing of important Swiss banks such as Credit Suisse. The €2.8 bn valuation would imply an Enterprise-EBITDA forward multiple of nearly 15 times for BME, this is a record valuation if we think that Euronext – that in the last five years has definitively over performed BME – has been valued at 14 times the same multiple. The Swiss stock exchange is willing to pay such a high price for the acquisition of BME because it would allow it to have a main hub within the Europe Union and the possibility to build a derivative business. To further convince the shareholders of BME and the Spanish Government – that is bound to play a crucial role in this acquisition – SIX has offered to maintain some of BME’s independence. The possibility to retain national identity might be a decisive detail in convincing the Spanish Government of the goodness of the deal.

Even though the valuation and consequent offer proposed by SIX seems extremely favourable and a good deal for the Spanish Exchange, the stock price of BME on Friday the 26th of November was even higher than the most recent offer of the Zurich bourse operator. This can be interpreted as a sign that investors might be expecting an even higher offer to come their way. The Paris based exchange Euronext has in fact confirmed that it is in talks with the board of directors of the Spanish operator. Euronext has recently successfully concluded the acquisition of Oslo Bors - the operator of the Norwegian stock exchange – adding it to its already rich collection of European exchanges. As a matter of fact, Euronext owns and operates many former monopoly exchanges in Europe such as Amsterdam, Paris, Brussels, Dublin, Lisbon and of course Oslo. With the acquisition of BME it would add also Madrid to its set.

According to some analysts Euronext could pitch to investors of the Spanish company an offer of €40 per share that would mean valuing the company at €3.3 bn. However, this would be possible only through the issuance of new equity for a total of €1.9bn or alternatively some form of stock swap. Euronext would justify such a record valuation through the drive down in costs that would result from the added scale. The inclusion of cost savings in the deal proposal of Euronext – which was instead lacking in SIX’s proposal - might be an important element in convincing Spanish regulators.

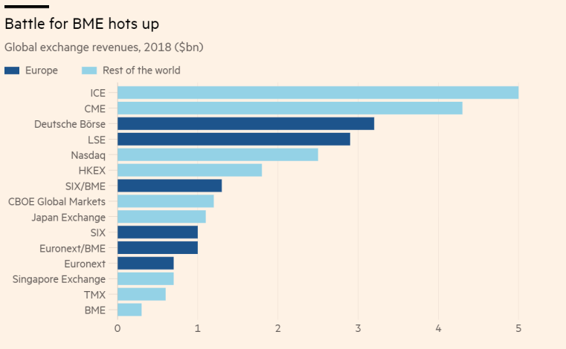

It is important to understand what is at stake for the two exchanges. As can be seen in the graph below BME’s fate will have a decisive impact on the European market infrastructure groups. The acquisition of BME would allow SIX consolidate even more its position as the third largest exchange operator by revenue in Europe. While if it were the Euronext to secure the deal, it could tie the SIX, becoming the second largest market infrastructure group within the European Union only behind the Deustche Börse.

The increase in the share price of BME can be traced back to the official offer that has been presented by SIX on Monday. The Swiss exchange has offered a price of €34 per share, valuing the company at €2.8 bn. Since SIX is a private company the acquisition would have to be paid entirely with cash. That would not be a problem for the Swiss exchange as it has accumulated cash for approximately €3,46 bn and it can count on the backing of important Swiss banks such as Credit Suisse. The €2.8 bn valuation would imply an Enterprise-EBITDA forward multiple of nearly 15 times for BME, this is a record valuation if we think that Euronext – that in the last five years has definitively over performed BME – has been valued at 14 times the same multiple. The Swiss stock exchange is willing to pay such a high price for the acquisition of BME because it would allow it to have a main hub within the Europe Union and the possibility to build a derivative business. To further convince the shareholders of BME and the Spanish Government – that is bound to play a crucial role in this acquisition – SIX has offered to maintain some of BME’s independence. The possibility to retain national identity might be a decisive detail in convincing the Spanish Government of the goodness of the deal.

Even though the valuation and consequent offer proposed by SIX seems extremely favourable and a good deal for the Spanish Exchange, the stock price of BME on Friday the 26th of November was even higher than the most recent offer of the Zurich bourse operator. This can be interpreted as a sign that investors might be expecting an even higher offer to come their way. The Paris based exchange Euronext has in fact confirmed that it is in talks with the board of directors of the Spanish operator. Euronext has recently successfully concluded the acquisition of Oslo Bors - the operator of the Norwegian stock exchange – adding it to its already rich collection of European exchanges. As a matter of fact, Euronext owns and operates many former monopoly exchanges in Europe such as Amsterdam, Paris, Brussels, Dublin, Lisbon and of course Oslo. With the acquisition of BME it would add also Madrid to its set.

According to some analysts Euronext could pitch to investors of the Spanish company an offer of €40 per share that would mean valuing the company at €3.3 bn. However, this would be possible only through the issuance of new equity for a total of €1.9bn or alternatively some form of stock swap. Euronext would justify such a record valuation through the drive down in costs that would result from the added scale. The inclusion of cost savings in the deal proposal of Euronext – which was instead lacking in SIX’s proposal - might be an important element in convincing Spanish regulators.

It is important to understand what is at stake for the two exchanges. As can be seen in the graph below BME’s fate will have a decisive impact on the European market infrastructure groups. The acquisition of BME would allow SIX consolidate even more its position as the third largest exchange operator by revenue in Europe. While if it were the Euronext to secure the deal, it could tie the SIX, becoming the second largest market infrastructure group within the European Union only behind the Deustche Börse.

Source: The Financial Times

This could mean that the company which fails to secure a deal with BME might find itself in a few years to be the next takeover target. A scenario that both the top management at SIX and at Euronext would do anything to avoid.

Federico Adorini

This could mean that the company which fails to secure a deal with BME might find itself in a few years to be the next takeover target. A scenario that both the top management at SIX and at Euronext would do anything to avoid.

Federico Adorini