One of the main concerns to our economic future and social and environmental landscape is represented by the effects of global warming and pollution. Today this threat has become one crucial bullet point of every political program as well as the polar star of the European Community Recovery Plan together with the economic digitalization. In particular, the EU has set an important milestone: EU 55% CO2 emission-free by 2030 in order to reach a complete zero-emission EU economy by 2050. An ambitious goal that reflects the overall sentiment of change and necessity of action.

If we consider the financial world, this new perspective can be summarized in two features:

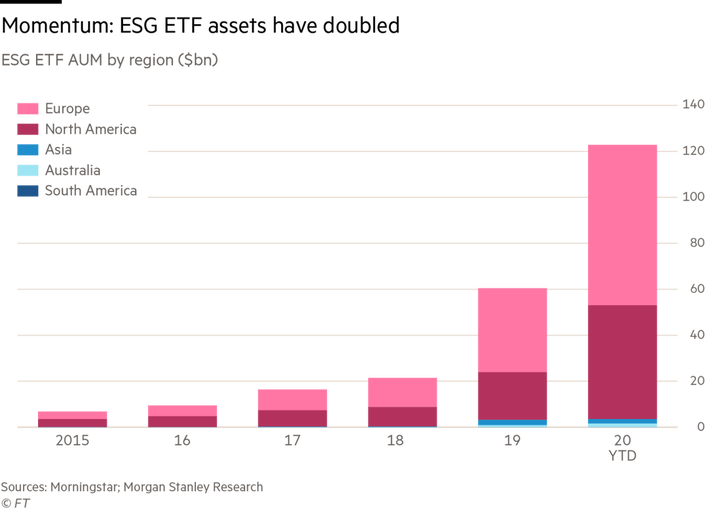

The ESG investment perspective can be clearly seen in the ETF sector. Passive investing has constantly increased since the 2008 crisis and according to analysts, it will reach a capitalization of more than $40tn by 2025. A global survey by the Index Industry Association highlighted the ESG as one of the leading growth drivers in the industry, recording a 40% increase in the number of indices over the past year, up from 13.9% growth in the previous year.

If we consider the financial world, this new perspective can be summarized in two features:

- ESG (Environmental and Social Governance): it refers to a new vision in terms of asset financial analysis by which an asset, that can be a corporate stock or a more diversified portfolio is analyzed both considering its economic fundamentals and the environmental and social impact of the company or pool of companies underlying the asset.

- SRI (Socially Responsible Investments): it represents the result of the ESG analysis: the creation of different portfolios with a Best-in-Class approach and an impact investing activity, which means an investment policy focused more on companies, funds, and organizations with a low social-environmental impact associated to a financial return.

The ESG investment perspective can be clearly seen in the ETF sector. Passive investing has constantly increased since the 2008 crisis and according to analysts, it will reach a capitalization of more than $40tn by 2025. A global survey by the Index Industry Association highlighted the ESG as one of the leading growth drivers in the industry, recording a 40% increase in the number of indices over the past year, up from 13.9% growth in the previous year.

In addition, even the most influential people and companies in the industry are now publicly taking positions in the sustainability matter. Larry Fink, CEO of BlackRock, for example, in his letter to CEOs of 2020 appoints sustainability as the new investment standard of the company, announces the introduction and focus of the ESG analysis in the Aladdin Platform and ESG portfolios as an important part of their active asset management solutions that they propose.With that said, the number one rule of finance is “No lunch is free”, so what kind of advantages does the ESG analysis concretely bring to a portfolio? The answer is solidity.

The ESG analysis, together with the economic analysis, give the tools to operate a better capital allocation strategy towards companies that have stronger long-term viability. It indeed takes into account numerous factors that deeply affect the reputational risk of a company (such as social policies and programs towards main stakeholders, in particular workers; CSR initiatives; implementation of sustainable productive processes; renewable energies, etc.), which nowadays has huge consequences on credit and financial risk.

Moreover, the field of socially responsible investments refers mainly to projects and companies with a very long-term perspective, over 30 years, which implicitly gives them a lower exposure to crises, black swans, and economic bubbles due to value realignment over the long run.

If we consider products such as mutual funds and ETF, a study conducted by four Italian researchers of the ESG International Research Group analyzing a database of more than 6000 funds and 20 thousand assets has found out that ESG/SRI funds are able to better protect investors from systemic risk and are less exposed and interconnected with the performance of the other typologies of funds.

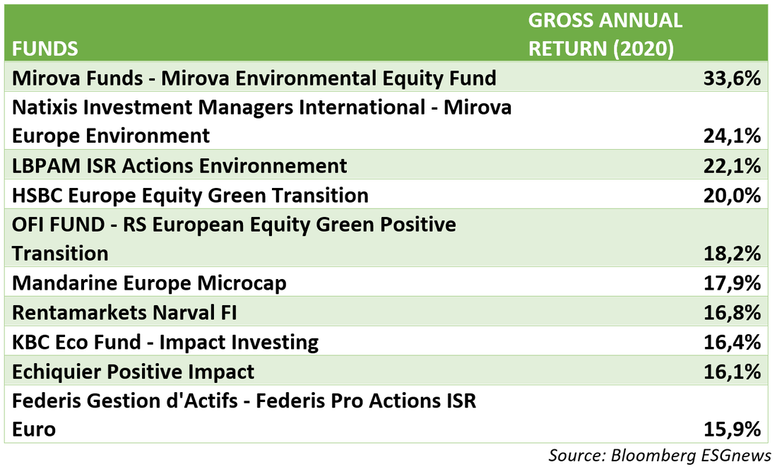

Regarding the European market, the best ESG fund is the Luxemburgian “Mirova Europe Environmental Equity Fund” with a gross annual return of 33,6%, much higher compared to the MSCI Europe Total Return. It is subsidiary asset management of the Natixis investment banking firm. The fund manages a portfolio of 58 assets that go from the renewable energies sector to transport and construction and companies are selected in order that the ONU environmental set of goals are respected.

The ESG analysis, together with the economic analysis, give the tools to operate a better capital allocation strategy towards companies that have stronger long-term viability. It indeed takes into account numerous factors that deeply affect the reputational risk of a company (such as social policies and programs towards main stakeholders, in particular workers; CSR initiatives; implementation of sustainable productive processes; renewable energies, etc.), which nowadays has huge consequences on credit and financial risk.

Moreover, the field of socially responsible investments refers mainly to projects and companies with a very long-term perspective, over 30 years, which implicitly gives them a lower exposure to crises, black swans, and economic bubbles due to value realignment over the long run.

If we consider products such as mutual funds and ETF, a study conducted by four Italian researchers of the ESG International Research Group analyzing a database of more than 6000 funds and 20 thousand assets has found out that ESG/SRI funds are able to better protect investors from systemic risk and are less exposed and interconnected with the performance of the other typologies of funds.

Regarding the European market, the best ESG fund is the Luxemburgian “Mirova Europe Environmental Equity Fund” with a gross annual return of 33,6%, much higher compared to the MSCI Europe Total Return. It is subsidiary asset management of the Natixis investment banking firm. The fund manages a portfolio of 58 assets that go from the renewable energies sector to transport and construction and companies are selected in order that the ONU environmental set of goals are respected.

If we analyze for example the portfolio of LPB AM Actions Environnement, a branch of the French group “La Banque Postale Asset Management”, focused on renewable energies, the main capital outflows were directed to:

Matteo Girello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.

- Orsted: energy company that in 2020 doubled its share prices and in 2021 was awarded for the third time in a row as the most sustainable energy company in the world in the Global 100 ranking

- Alfen: Dutch company specialized in energy warehousing and power grids, that in 2020 have quadrupled its share price

- Falck Renewables: Italian company specialized in the production of renewable energies systems

- Scatec: Norwegian that operates in the field of solar energy

Matteo Girello

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here.