Nowadays, investors have plenty of choices about how to invest their savings. Traditional mutual funds have been placed side by side with ETF, index funds, new technological algorithm-funds and many other sophisticated products. Among them, a category is rising faster and faster thanks to investors’ new attitude towards sustainability: socially responsible investments (SRI) or so-called ESG, thus environmentally, socially and governance responsible investments. Today we will analyze sustainable investments trying to understand if this ethical choice provides also economic benefits for investors’ savings.

First of all, we should define what SRI or ESG means. SRI was the first acronym used to catalog this branch of investments. It defined an investment discipline that added concerns about social or environmental issues to the traditional determinants of risk and return on equity portfolio construction. Then, the other abbreviation ESG came into vogue targeting a wider range of investments techniques that took into account also other perspectives of being socially responsible (thus environment, social and governance). Therefore, with some differences, both these two acronyms refer to sustainable investments and we will use them interchangeably.

SRI and ESG generally involve three distinctive techniques: exclusion, activism, and engagement. Exclusion means avoiding investment in companies whose operations are considered “socially unacceptable”, such as gambling, pornography or production of tobacco, alcohol, military weapons and civilian firearms, while activism consists of using the ownership to assert social objectives. Engagement often refers to the reinvestment of part of profits in projects to develop sustainable activities. Finally, sustainable investing may be carried out by individuals, normally through mutual funds, or by institutions such as charitable foundations and pension funds.

Having in mind what sustainable investing means, let’s take a closer insight of what these strategies imply.

Ethical decision: contributing to the sustainable development of the world

Sustaining the transition to a low-carbon economy and developing a global economy that cares about people are two important goals that sustainable investing could contribute in. In a world in which companies’ misbehaving conduct is still frequent (e.g.: environment depletion, labor injustices, lack of women or broader diversity on boards and corporate governance frauds), including some screening factors in investors’ investment-making decisions could be an important step. Screening investments for factors such as labor standards, greenhouse gas emissions, workplace diversity, efficient use of resources and corporate governance practices would lead investors to reward companies that are doing well under these perspectives while punishing others that have not already changed toward sustainability.

On this matter, in April 2006 at the New York Stock Exchange, the United Nations launched the Principles for Responsible Investment (PRI) initiative creating an international network of investors working together to put several principles to align investors with broader objectives of society into practice. As of August 2017, more than 1,750 signatories from over 50 countries, representing approximately US$70 trillion, have signed up to the Principles demonstrating the increasing interest and commitment in this topic by worldwide investors.

Higher returns: ESG factors are drivers of return

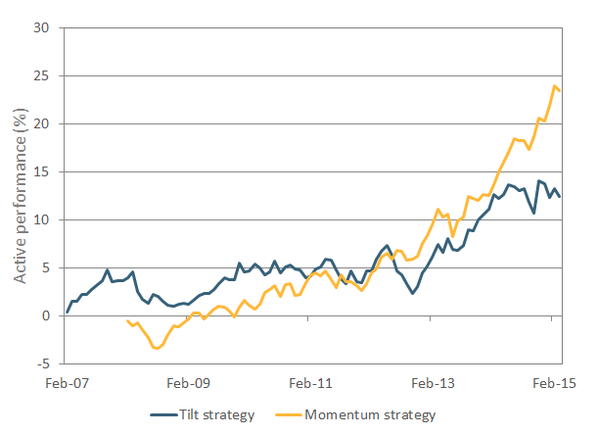

Moreover, most of the studies on the topic, at a corporate level, have already proven that there is a non-negative relationship between ESG principles and the corporate financial performance. In addition, in the large majority of studies reports, this relationship seems to be a positive one. Appling these considerations into an investors’ perspective, MSCI have analyzed the performance of two different portfolios:

Source: MSCI

A significant part of this outperformance was not explained by style factors alone; therefore, MSCI research showed that ESG factors were also drivers of return.

Some critics: an arbitrary and costly decision

On the other hand, some investors are still doubtful about benefits provided by sustainable investments. They especially argue that the choice about which companies to invest in is arbitrary and difficult to control over time. Why would you want to exclude some companies and not others? Moreover, the cost of screening companies and the loss of diversification of a sustainable portfolio could lead to a loss of value making the portfolio underperforming the market.

However, they should consider that thanks to new regulations about transparency and new shareholders’ interests in companies’ sustainable activities; it will be easier and easier for investors to have better information about how the companies operate leading to less arbitrary choices of investments. Furthermore, new technologies will decrease costs of obtaining information and screening companies while, as proved by MSCI, the loss of diversification is practically null if the strategy is well adopted.

A self-reinforcing trend

In conclusion, investors are more and more interested in sustainable strategies to invest their savings. These solutions seem to bring to higher returns and to be self-reinforcing: investors ask for more sustainable investments while corporate involved in ESG projects obtain better results pushing competitors to take similar initiatives. Moreover, investing in a sustainable way is an ethical decision that could bring to a better world in our future. Therefore, this spiral is both ethically and economically virtuous and it is progressively changing how investors are investing their savings.

Matteo Zocca

First of all, we should define what SRI or ESG means. SRI was the first acronym used to catalog this branch of investments. It defined an investment discipline that added concerns about social or environmental issues to the traditional determinants of risk and return on equity portfolio construction. Then, the other abbreviation ESG came into vogue targeting a wider range of investments techniques that took into account also other perspectives of being socially responsible (thus environment, social and governance). Therefore, with some differences, both these two acronyms refer to sustainable investments and we will use them interchangeably.

SRI and ESG generally involve three distinctive techniques: exclusion, activism, and engagement. Exclusion means avoiding investment in companies whose operations are considered “socially unacceptable”, such as gambling, pornography or production of tobacco, alcohol, military weapons and civilian firearms, while activism consists of using the ownership to assert social objectives. Engagement often refers to the reinvestment of part of profits in projects to develop sustainable activities. Finally, sustainable investing may be carried out by individuals, normally through mutual funds, or by institutions such as charitable foundations and pension funds.

Having in mind what sustainable investing means, let’s take a closer insight of what these strategies imply.

Ethical decision: contributing to the sustainable development of the world

Sustaining the transition to a low-carbon economy and developing a global economy that cares about people are two important goals that sustainable investing could contribute in. In a world in which companies’ misbehaving conduct is still frequent (e.g.: environment depletion, labor injustices, lack of women or broader diversity on boards and corporate governance frauds), including some screening factors in investors’ investment-making decisions could be an important step. Screening investments for factors such as labor standards, greenhouse gas emissions, workplace diversity, efficient use of resources and corporate governance practices would lead investors to reward companies that are doing well under these perspectives while punishing others that have not already changed toward sustainability.

On this matter, in April 2006 at the New York Stock Exchange, the United Nations launched the Principles for Responsible Investment (PRI) initiative creating an international network of investors working together to put several principles to align investors with broader objectives of society into practice. As of August 2017, more than 1,750 signatories from over 50 countries, representing approximately US$70 trillion, have signed up to the Principles demonstrating the increasing interest and commitment in this topic by worldwide investors.

Higher returns: ESG factors are drivers of return

Moreover, most of the studies on the topic, at a corporate level, have already proven that there is a non-negative relationship between ESG principles and the corporate financial performance. In addition, in the large majority of studies reports, this relationship seems to be a positive one. Appling these considerations into an investors’ perspective, MSCI have analyzed the performance of two different portfolios:

- ”ESG Tilt”: a strategy that overweighted stocks with higher ESG ratings,

- ”ESG Momentum”: a strategy that overweighted stocks that have improved their ESG rating during recent periods.

Source: MSCI

A significant part of this outperformance was not explained by style factors alone; therefore, MSCI research showed that ESG factors were also drivers of return.

Some critics: an arbitrary and costly decision

On the other hand, some investors are still doubtful about benefits provided by sustainable investments. They especially argue that the choice about which companies to invest in is arbitrary and difficult to control over time. Why would you want to exclude some companies and not others? Moreover, the cost of screening companies and the loss of diversification of a sustainable portfolio could lead to a loss of value making the portfolio underperforming the market.

However, they should consider that thanks to new regulations about transparency and new shareholders’ interests in companies’ sustainable activities; it will be easier and easier for investors to have better information about how the companies operate leading to less arbitrary choices of investments. Furthermore, new technologies will decrease costs of obtaining information and screening companies while, as proved by MSCI, the loss of diversification is practically null if the strategy is well adopted.

A self-reinforcing trend

In conclusion, investors are more and more interested in sustainable strategies to invest their savings. These solutions seem to bring to higher returns and to be self-reinforcing: investors ask for more sustainable investments while corporate involved in ESG projects obtain better results pushing competitors to take similar initiatives. Moreover, investing in a sustainable way is an ethical decision that could bring to a better world in our future. Therefore, this spiral is both ethically and economically virtuous and it is progressively changing how investors are investing their savings.

Matteo Zocca