Introduction

On October 8th, Tata Sons Chairman Emeritus Ratan Tata announced the historical return of lossmaking carrier Air India to the founders after its nationalization 68 years ago. Starting from an overview of the airline industry and a brief description of the two companies involved in the transaction, this article seeks to develop a thorough understanding of the risks, rationale, and synergies of the deal.

Industry Overview

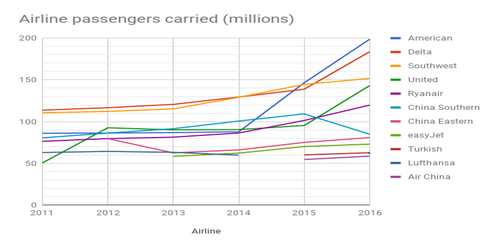

The airline industry contains a series of different services which focus on providing air transport to their customers. These services can be offered by airplanes or by helicopters. There are different types of airlines. From a geographical point of view, we can have international airlines, national airlines, or regional airlines. The seven biggest airline companies in the world are American Airlines, Delta, United, Emirates, Southwest, China Southern Airlines, and Ryanair. A crucial component of the travel industry, air travel’s performance profoundly impacts the sector as a whole.

On October 8th, Tata Sons Chairman Emeritus Ratan Tata announced the historical return of lossmaking carrier Air India to the founders after its nationalization 68 years ago. Starting from an overview of the airline industry and a brief description of the two companies involved in the transaction, this article seeks to develop a thorough understanding of the risks, rationale, and synergies of the deal.

Industry Overview

The airline industry contains a series of different services which focus on providing air transport to their customers. These services can be offered by airplanes or by helicopters. There are different types of airlines. From a geographical point of view, we can have international airlines, national airlines, or regional airlines. The seven biggest airline companies in the world are American Airlines, Delta, United, Emirates, Southwest, China Southern Airlines, and Ryanair. A crucial component of the travel industry, air travel’s performance profoundly impacts the sector as a whole.

Porter’s five forces analysis allows to better analyze the prospects and risks of the industry. Starting with the supplier power, we need to mention that Boeing and Airbus are the two leading aircraft suppliers globally: this relates to the buyer power and indicates that airlines have low upstream bargaining power as there are few suppliers and many buyers. The switching cost in this regard is also high as many airlines are tied to long-term contracts with airplane manufacturers.

Regarding the threat of substitution, we need to mention that another issue for the airline industry is that customers are highly price-conscious, and they nowadays have better access to information about ticket prices. The switching cost for price-sensitive customers is meager: therefore, it is easy for them to quickly react to price changes and shift between airlines. The resulting highly price-competitive environment is a real threat to profitability. Furthermore, there is a minor threat of potential new entrants in the market due to excessive capital requirements.

Airlines are both capital and labor-intensive, and there are high fixed costs relative to revenue. Another reason is the government policy: the airline industry is heavily regulated and monitored by both local and international authorities. In addition, access to low-cost inputs also plays a vital role. Established airlines have better creditworthiness than new airlines. Established airlines can also benefit from long-term relationships with aircraft suppliers. However, there is low brand loyalty in the airline industry, making it difficult for players in the industry to acquire a steady customer base. This relates to the severe price sensitivity of clients and their easy access to readily available information.

The airline industry faces competition from direct sources like trains, ferries, yachts, ships, and other vehicles. Another indirect substitute for business travelers is teleconferencing. The improvement in communication technology coupled with the new normal created by the global Covid-19 pandemic pose a particularly worrisome threat as this cost-efficient alternative to business traveling risks annihilating an entire revenue stream for airlines.

Regarding the Indian aviation industry, analysts believe it will overtake China and the USA and become the third-largest provider of airline services. Just in the financial year 2021, the Indian market generated 120 million dollars. Even though there was a decline of 30% in the internal passenger traffic in the CAGR from 2016 to 2021, several key developments in the Indian aviation sector seem very promising. Some of these include SpiceJet announcing a target of 100 million domestic passengers to be flown according to sustainable aviation measures, Boeing announcing its partnership with the University of Southern California and the Indian Aviation Academy to develop security management training for the whole aviation industry, and government officials presenting the proposal to create a water aerodrome at the Ujjani Dam.

In conclusion, the Indian aviation industry seems to have a lot of opportunity in terms of growth as air transport is still not affordable to the vast portion of the Indian population (more than 40% belongs to the middle class). There is a need for collaboration between the aviation industry and the government to implement specific policies to boost the sector. If there is a successful collaboration, India can undoubtedly fulfill its vision to gain an essential role in the global aviation industry.

Tata Group

Tata Group was founded in 1868 with Rs. 21,000 capital by the entrepreneur and philanthropist Jamsetji Nusserwanji as a private trading enterprise. After Jamsetji Tata’s death in 1904, his son Sir Dorab Tata became the Tata Group’s chairman. With Dorab’s command, the company quickly expanded into a wide range of new sectors, such as steel, electricity, education, consumer products, and aviation. In 1938 J. R.D Tata

Today, over 100 operating firms make up the Tata group, which is divided into seven commercial sectors: communications and information technology, engineering, materials, services, energy, consumer goods and chemicals. The company operates in over 100 countries across six continents and exports products and services to over 150 nations. In 2013-14, the combined revenue of Tata firms was $103.27 billion with 67.2 percent of that coming from businesses outside India. Over 581,470 individuals work for Tata firms around the world.

In their Worldwide 500 2014 report, Brand Finance, a UK-based consultancy firm, evaluated the Tata brand at $21.1 billion and ranked it 34th among the top 500 most valuable global brands. For more than 140 years, the Tata brand has been associated with strong values and corporate ethics in India. The organization has always believed in giving back to the communities they serve. Philanthropic trusts that have established national institutions for science and technology, medical research, social studies, and the performing arts own two-thirds of Tata Sons, the Tata promoter holding company.

Tata firms are establishing multinational organizations that will accomplish development via excellence and innovation, while meeting the interests of shareholders, employees, and civil society. Tata companies are based in India and dedicated to traditional values and integrity.

Regarding the threat of substitution, we need to mention that another issue for the airline industry is that customers are highly price-conscious, and they nowadays have better access to information about ticket prices. The switching cost for price-sensitive customers is meager: therefore, it is easy for them to quickly react to price changes and shift between airlines. The resulting highly price-competitive environment is a real threat to profitability. Furthermore, there is a minor threat of potential new entrants in the market due to excessive capital requirements.

Airlines are both capital and labor-intensive, and there are high fixed costs relative to revenue. Another reason is the government policy: the airline industry is heavily regulated and monitored by both local and international authorities. In addition, access to low-cost inputs also plays a vital role. Established airlines have better creditworthiness than new airlines. Established airlines can also benefit from long-term relationships with aircraft suppliers. However, there is low brand loyalty in the airline industry, making it difficult for players in the industry to acquire a steady customer base. This relates to the severe price sensitivity of clients and their easy access to readily available information.

The airline industry faces competition from direct sources like trains, ferries, yachts, ships, and other vehicles. Another indirect substitute for business travelers is teleconferencing. The improvement in communication technology coupled with the new normal created by the global Covid-19 pandemic pose a particularly worrisome threat as this cost-efficient alternative to business traveling risks annihilating an entire revenue stream for airlines.

Regarding the Indian aviation industry, analysts believe it will overtake China and the USA and become the third-largest provider of airline services. Just in the financial year 2021, the Indian market generated 120 million dollars. Even though there was a decline of 30% in the internal passenger traffic in the CAGR from 2016 to 2021, several key developments in the Indian aviation sector seem very promising. Some of these include SpiceJet announcing a target of 100 million domestic passengers to be flown according to sustainable aviation measures, Boeing announcing its partnership with the University of Southern California and the Indian Aviation Academy to develop security management training for the whole aviation industry, and government officials presenting the proposal to create a water aerodrome at the Ujjani Dam.

In conclusion, the Indian aviation industry seems to have a lot of opportunity in terms of growth as air transport is still not affordable to the vast portion of the Indian population (more than 40% belongs to the middle class). There is a need for collaboration between the aviation industry and the government to implement specific policies to boost the sector. If there is a successful collaboration, India can undoubtedly fulfill its vision to gain an essential role in the global aviation industry.

Tata Group

Tata Group was founded in 1868 with Rs. 21,000 capital by the entrepreneur and philanthropist Jamsetji Nusserwanji as a private trading enterprise. After Jamsetji Tata’s death in 1904, his son Sir Dorab Tata became the Tata Group’s chairman. With Dorab’s command, the company quickly expanded into a wide range of new sectors, such as steel, electricity, education, consumer products, and aviation. In 1938 J. R.D Tata

Today, over 100 operating firms make up the Tata group, which is divided into seven commercial sectors: communications and information technology, engineering, materials, services, energy, consumer goods and chemicals. The company operates in over 100 countries across six continents and exports products and services to over 150 nations. In 2013-14, the combined revenue of Tata firms was $103.27 billion with 67.2 percent of that coming from businesses outside India. Over 581,470 individuals work for Tata firms around the world.

In their Worldwide 500 2014 report, Brand Finance, a UK-based consultancy firm, evaluated the Tata brand at $21.1 billion and ranked it 34th among the top 500 most valuable global brands. For more than 140 years, the Tata brand has been associated with strong values and corporate ethics in India. The organization has always believed in giving back to the communities they serve. Philanthropic trusts that have established national institutions for science and technology, medical research, social studies, and the performing arts own two-thirds of Tata Sons, the Tata promoter holding company.

Tata firms are establishing multinational organizations that will accomplish development via excellence and innovation, while meeting the interests of shareholders, employees, and civil society. Tata companies are based in India and dedicated to traditional values and integrity.

Air India

Air India Limited flies passengers and freight from Bombay to destinations across the globe, including the United States, Europe, the Middle East, Africa, the United Kingdom, Russia, China, and Japan. It has the distinction of being the first all-jet airline in the world. Air-India flies three million passengers annually.

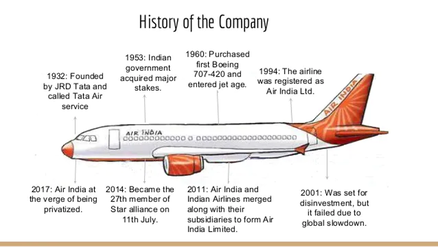

Tata Airlines, named after its founder J. R. D. Tata, commenced operations in 1932. After World War II ended in 1946, the airline was renamed Air India Limited and became a public enterprise. With the government owning 49 percent of the corporation, the airline was able to expand its reach outside of India in just two years, with frequent flights to Cairo, Geneva, and London. The name of the airline was altered once more to highlight its expanded sphere of operations, and it became Air-India International Limited.

For a variety of factors, India has fared better in the airline business than most other emerging countries. Whereas other airlines had to rely on foreign pilots to fly their planes, Air India relied mostly on Indian pilots. Similarly, skilled Indians were readily available to maintain India’s fleet as well as educate and monitor its crew; many other countries had to look elsewhere for such knowledge. Along with its sibling carriers, Air-India profited from these privileges. In the early 1950s, Air-India faced stiff competition for its routes for the first time. The availability of affordable, war-surplus DC-3s sparked the formation of a slew of new airlines.

The Indian government acquired control of all airlines operating inside its boundaries in 1953. The government also established two corporations as a result of the nationalization. The country’s internal travel needs were served by Indian Airlines Corporation, which amalgamated Air India Limited with six lesser lines. Air India International Corporation operated international routes. Singapore, Sydney, Moscow, and New York were all served by the international airline by 1960. Air India Limited’s fleet consists of Boeing 777-200ER, Boeing 747-400, Boeing 747-400 Combi, and Airbus 310 aircraft as of 1962, when the name was simplified to Air India Limited.

Attempts to privatize Air India were launched in 2000–01, and after its merger with Indian Airlines in 2006, it began to lose money. In 2017, another attempt at privatization was initiated, with ownership of the airline and related properties reverting to the Tatas in 2021.

For years, the airline’s losses and debts have been growing. Since merging with Indian Airlines in 2007, the airline has never generated a profit. It recorded a net loss of 10,000 crore rupees for the fiscal year that ended on March 31st, 2021. Air India’s client base has declined, owing in part to fierce private-sector rivalry, but also to cost-cutting that has harmed customer service. The standalone revenue of Air India Limited for 2020-21 was $12,104.05 crore, down from $28,524.44 crore the previous year.

Air India Limited flies passengers and freight from Bombay to destinations across the globe, including the United States, Europe, the Middle East, Africa, the United Kingdom, Russia, China, and Japan. It has the distinction of being the first all-jet airline in the world. Air-India flies three million passengers annually.

Tata Airlines, named after its founder J. R. D. Tata, commenced operations in 1932. After World War II ended in 1946, the airline was renamed Air India Limited and became a public enterprise. With the government owning 49 percent of the corporation, the airline was able to expand its reach outside of India in just two years, with frequent flights to Cairo, Geneva, and London. The name of the airline was altered once more to highlight its expanded sphere of operations, and it became Air-India International Limited.

For a variety of factors, India has fared better in the airline business than most other emerging countries. Whereas other airlines had to rely on foreign pilots to fly their planes, Air India relied mostly on Indian pilots. Similarly, skilled Indians were readily available to maintain India’s fleet as well as educate and monitor its crew; many other countries had to look elsewhere for such knowledge. Along with its sibling carriers, Air-India profited from these privileges. In the early 1950s, Air-India faced stiff competition for its routes for the first time. The availability of affordable, war-surplus DC-3s sparked the formation of a slew of new airlines.

The Indian government acquired control of all airlines operating inside its boundaries in 1953. The government also established two corporations as a result of the nationalization. The country’s internal travel needs were served by Indian Airlines Corporation, which amalgamated Air India Limited with six lesser lines. Air India International Corporation operated international routes. Singapore, Sydney, Moscow, and New York were all served by the international airline by 1960. Air India Limited’s fleet consists of Boeing 777-200ER, Boeing 747-400, Boeing 747-400 Combi, and Airbus 310 aircraft as of 1962, when the name was simplified to Air India Limited.

Attempts to privatize Air India were launched in 2000–01, and after its merger with Indian Airlines in 2006, it began to lose money. In 2017, another attempt at privatization was initiated, with ownership of the airline and related properties reverting to the Tatas in 2021.

For years, the airline’s losses and debts have been growing. Since merging with Indian Airlines in 2007, the airline has never generated a profit. It recorded a net loss of 10,000 crore rupees for the fiscal year that ended on March 31st, 2021. Air India’s client base has declined, owing in part to fierce private-sector rivalry, but also to cost-cutting that has harmed customer service. The standalone revenue of Air India Limited for 2020-21 was $12,104.05 crore, down from $28,524.44 crore the previous year.

Deal Analysis

On October 8th the long-lasting deal finally concluded. Tata Group lastly managed to acquire a 100% stake in Air India. The government had tried to sell its stake in the company for years. In 2001 it tried to sell 40% of the stake. Several foreign airlines such as Lufthansa, British Airways and Singapore Airlines showed interest, but they withdrew because of the government clause that made a partnership with an Indian company mandatory to present a bid. Again in 2018, the government tried to sell the 76% stake and a part of its financial debt, but nobody found the terms attractive. In January 2020 the Civil Aviation Minister Hardeep Singh Puri stated “There is no choice, we either privatize or we close the airline” once more opening the doors to new possible offerings. By the end of last year, Air India received two bids: the Tata Group one and the other from the American investment firm Interups. In September, Ajay Singh, the owner of SpiceJet, an Indian low-cost airline, forwarded another bid.

Among these offers, Tata Group emerged as the successful bidder for acquiring the entire company including wholly owned subsidiary Air India Express (or AIXL, a low-cost airline with a particular focus on short-haul international operations, mainly in the Middle East market) and 50% stake in the joint venture Air India SATS (cargo handling and airport services on ground). The Tata Group’s holding company Tata Sons submitted an offer of Rs 18,000 Crore as the Enterprise Value of Air India through its wholly owned subsidiary Talace Pvt. Ltd. More specifically, the historical conglomerate offered $368m in cash for a 100% stake and agreed to take on $2bn of Air India’s total $8.2bn in debts. Some of Air India’s non-core assets and the remaining $6.2bn in debt will be transferred instead to a separate government-run holding company. The Tatas will take control of iconic brands like Air India, Indian Airlines and the Maharajah, but also of 13,500 permanent and contractual employees, Air India’s fleet of 117 wide-body and narrow body aircraft and, finally, of the AIXL’s fleet of 24 narrow body aircraft.

With the acquisition, Air India returns to its original founders after 68 years from the nationalization completed by the post-independence government. Few minutes after the deal closes, Tata Sons Chairman Emeritus Ratan Tata posted a photo of the founder JRD Tata with an Air India plane celebrating this historical moment:

However, at first sight, Tata Group’s move seems too risky for many reasons. To start with, it is necessary to recall the historical frame. After the nationalization, Air India benefitted from international competition’s restrictions and a domestic monopoly, which covered above-average operational costs. The wave of economic liberalization of 1991 detonated a fierce competition putting Air India in serious trouble. The market share of domestic passenger traffic rapidly eroded dropping to the current 12%. In the last years, the firm has lost $2.6m a day. Since 2009 New Delhi had to provide more than $14bn in financial support. Air India remained operational only thanks to taxpayer-funded bailouts. The ex-flag-carrier suffered from low aircraft utilization, high aviation fuel prices, high airport usage charges, unsatisfactory public perception, weakening of the rupee, competition from low-cost airlines, lack of revenue generation skills and many other problems. Air India was also blamed for being responsible for heavy price wars damaging competition and causing bankruptcies to some competitors such as Kingfisher Airlines and Jet Airways.

Moreover, the pandemic strongly affected the overall industry because of travel restrictions. Every company is facing hard times and Tata Group is already quite exposed as it controls two smaller airlines, accounting for almost 11% of the domestic market, through an 84% stake in AirAsia India and a 51% stake in Vistara, co-owned with Singapore Airlines. Of course, also these two companies suffered from the recent airline industry crisis. Therefore, the acquisition of Air India could raise diversification issues and deepen Tata’s losses in this industry.

Another problematic aspect is represented by the workforce. More than 13,000 employees seem to be an overwhelming number and restructuring the employee base could be a big challenge for the new owners as the workforce is unionized, resistant to change and with enormous lobbying power. Additionally, the deal between Tata Group and the government includes a clause that prohibits redundancies in the first year and, after that, pay-offs if Tata decides to cut staff numbers. Lastly, it would require significant investment and it would probably take three to five years to restore Air India. “It is a big bold decision for the Tatas, post-Covid, to take such a large debt. It speaks to their confidence that there is a viable business case” Kapil Kaul, South Asia director for the Center for Asia Pacific Aviation, told the Financial Times.

Challenges and risks are several, but the reasons why Air India remains attractive are numerous and the rationale behind the deal is solid. Aside from the iconic brands like Air India, Indian Airlines and the fleet of 141 planes, Tata will take control of the airline’s 4,400 domestic and 1,800 international landing and parking slots at national airports, as a well as 900 slots at foreign airports including prized slots at London’s Heathrow airport. Air India has an appealing international footprint. More than two-thirds of the airline’s consolidated revenues come from the international market. It is the leading Indian player in this market having a strong influence in North America, Europe and the Middle East with attractive bilateral rights and slots. Additionally, Air India owns prime real estate. The fixed assets (buildings, planes and lands), according to the government, were worth more than $6bn in March 2020. In addition, Air India has more than 40,000 pieces of art and collectibles, including a valuable ashtray designed and gifted by Salvador Dalì. Air India also possesses a precious frequent flyer program with more than 3 million members and thousands of high skilled pilots and crew.

The deal will more than double Tata’s domestic market share to 27% and provide a platform for growth through Air India’s network of landing slots abroad, especially in New York and London. Furthermore, the low-cost Air India Express does a booming business moving Indian workers to and from the Persian Gulf that could dovetail with Tata’s already-owned low-cost Air Asia India. Tata can also provide Air India with capital and a prestigious management which is essential for the company.

Another opportunity is represented by the post-pandemic context. The crisis of the aviation industry has increased the availability of new aircraft as demand plummeted. Boeing and Airbus are already pounding Tata’s door.

An important synergy is the potential partnership between Air India and Tata Consulting Services, the largest information-technology consultancy in India. The latter can tie together the various components and lead to savings in different areas such as loyalty programs and bookings. Another significant synergy is represented by the benefits due to marketing links that Indian Hotels, the hospitality division of the conglomerate, can get through partnerships with Air India.

As seen in the first part of the article, the Indian aviation market is still nascent, and different analysts estimate robust long-term growth and a vastly underserved market. Some analysts estimate an increase in passenger traffic of up to 20% per year. Tata Group has always believed in the potential of the sector, as demonstrated by the stakes owned by the conglomerate in Vistara and Air Asia India.

Lastly, Tata Group will have the opportunity to overturn the current extremely negative reputation of the airline, leveraging its credibility to gain the market’s trust.

Managing this operation will not be trivial, and no large carrier has handled it well. Air India’s turnaround will require patience, long-term capital, and world-class expertise. We have no reasons to believe Tata does not have them.

Arshdeep Singh

Federico Farante

Joris Pema