On 31st March 2021, US President Joe Biden presented his plan to increase government spending by $2tn with a focus on infrastructure in order to give a substantial boost to the reshape of the US economy. His public investment program is particularly ambitious as it will play a fundamental role in US fight against climate change, and it will consider also investments in R&D linked to AI and biotechnology. In this sense, the purpose is to shrink the difference in competitiveness in those sectors with respect to China. According to Janet Yellen, US Treasury Secretary, the plan proposed by Joe Biden could deliver an increase equal to 1.6% to GDP by 2024. While on one side Biden’s proposal has been welcomed with enthusiasm by US corporates, the same cannot be said when details about stimulus funding were unveiled. In fact, the current US president has the intention to finance the government spending with an increase in corporate tax rate from 21 to 28 percent, going against the line of his predecessor Donald Trump, but still below the threshold of Obama’s administration fixed at 35%. In addition, the tax proposal has a very large spectrum. In fact, it would also lead to an increase in the tax rate to which overseas earnings are taxed, from 10.5 to 21 percent, and it will put an end to tax deductions to companies completing payments to “related parties” in low tax jurisdictions. Furthermore, there is the intention to impose restrictions related to anti inversion rules through which companies try to change their tax domicile thanks to particular M&A activities while tax incentives would be granted to companies investing in domestic R&D. Finally, besides the tax liability of a corporate, Biden proposed a minimum tax rate of 15 percent applied to book income, the one reported to investors and usually higher than the taxable one. At the same time, Biden has opened up the dialogue as he is willing to accept compromises based on concrete alternative proposals, especially after the criticism coming from US corporates and Republicans, afraid of the possible reduction of competitiveness of US companies. On the other side, the tax plan is not only aimed at covering the cost of the infrastructural plan, but it has the ambition to pave the way for a reform of the global tax system focusing on multilateral negotiations at the OECD and promoting convergence with other countries in certain areas as, for example, digital transactions.

Reactions from the several parties involved in the discussion have been divergent as US corporates will be particularly affected by Biden’s proposal. Consequently, it is relevant to understand which are the companies that will be probably suffering the most from the tax reform and if and how the US equity market reacted to this announcement.

First of all, technology companies and corporates involved in the business of communication services are likely to be the ones caring the most about the tax changes considering that their foreign transactions will be subject to less favorable conditions with respect to what happens today. This issue represents a further threat, on top of the recent rise in borrowing costs, which will negatively affects the high valuations of US Tech stocks. The latter have been characterized by record high values during the last year after the start of the COVID-19 pandemic, favored by the spread of lockdowns and smart-working across the globe. Right now, Tech stocks are suffering the most from pressures on the market.

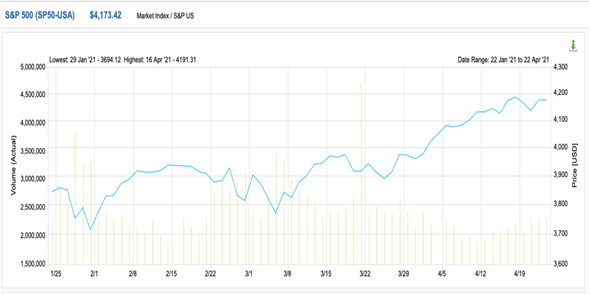

It is particularly interesting to see that, after Biden’s announcement and also in the days after the start of discussions around the proposal, the US stock market slightly fell, but it was actually able to continue rising up in the end. This doesn’t imply that investors are not worried about the dynamics around the tax reform. On the contrary, the proposed plan to finance the $2tn infrastructure plan can potentially lead to a reduction of 9% of earnings per share in companies in the S&P 500, negatively impacting the price of those shares. So, the reaction of the US index to the announcement of the tax reform is mainly due to the uncertainty around it (Figure 1). In fact, taxes will probably go up because the need for financing the infrastructure plan is evident, but it is not clear to what extent. The acrimonious discussion between Democrats and Republicans is likely to light up again while compromises will have to be achieved. In addition, American companies have suggested alternative sources of funding for the plan rather than corporate taxes. An example might be the increase of the federal gas tax, which, however, would represent a controversial point for the Democratic administration as it would affect also low-income households and Biden has made clear that households earning less than $400,000 per year will not face any tax increase.

Reactions from the several parties involved in the discussion have been divergent as US corporates will be particularly affected by Biden’s proposal. Consequently, it is relevant to understand which are the companies that will be probably suffering the most from the tax reform and if and how the US equity market reacted to this announcement.

First of all, technology companies and corporates involved in the business of communication services are likely to be the ones caring the most about the tax changes considering that their foreign transactions will be subject to less favorable conditions with respect to what happens today. This issue represents a further threat, on top of the recent rise in borrowing costs, which will negatively affects the high valuations of US Tech stocks. The latter have been characterized by record high values during the last year after the start of the COVID-19 pandemic, favored by the spread of lockdowns and smart-working across the globe. Right now, Tech stocks are suffering the most from pressures on the market.

It is particularly interesting to see that, after Biden’s announcement and also in the days after the start of discussions around the proposal, the US stock market slightly fell, but it was actually able to continue rising up in the end. This doesn’t imply that investors are not worried about the dynamics around the tax reform. On the contrary, the proposed plan to finance the $2tn infrastructure plan can potentially lead to a reduction of 9% of earnings per share in companies in the S&P 500, negatively impacting the price of those shares. So, the reaction of the US index to the announcement of the tax reform is mainly due to the uncertainty around it (Figure 1). In fact, taxes will probably go up because the need for financing the infrastructure plan is evident, but it is not clear to what extent. The acrimonious discussion between Democrats and Republicans is likely to light up again while compromises will have to be achieved. In addition, American companies have suggested alternative sources of funding for the plan rather than corporate taxes. An example might be the increase of the federal gas tax, which, however, would represent a controversial point for the Democratic administration as it would affect also low-income households and Biden has made clear that households earning less than $400,000 per year will not face any tax increase.

Figure 1: Increasing trend of the S&P 500 even after the announcement of the proposal of the tax reform. Source: FactSet

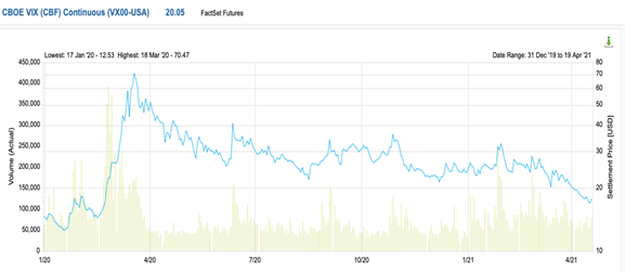

Finally, the tax reform proposed by Democrats could bring volatility in the equity market, but until now the “wait and see” approach has been the dominant one on Wall Street with current implied volatility at the lowest levels since March 2020 (Figure 2). On the other side, the tax reform will probably be one of the factors to be taken into consideration in the second half of the year and, also, in 2022. So, while it is true that extraordinary measures are in place to sustain the economy in such an unprecedented period of time, it is also true that protection from risks and challenges, even when the overall landscape seem to be calm, can be fundamental in the long run. Whether the tax storm on US Equity market will appear will depend on the final agreement on the financing of the plan, but, before that, having a clear view and trying to find repair in advance could really make the difference.

Figure 2: Implied Volatility at lowest levels since March 2020. Source: FactSet

Orazio Gianmarco Olivieri

BSCM would like to thank Factset for giving us access to their platform and providing charts and data

Want to keep up with our most recent articles? Subscribe to our weekly newsletter here