Introduction

As announced by the end of July 2022, One Medical has accepted Amazon’s offer of $18 per share to acquire the company in an all-cash transaction, which will evaluate the San Francisco-based company approximately $3.9 billion. The deal highlights Amazon’s willingness to strengthen its position in the healthcare market and become a key player in the industry in the years to come. In the article we will first collocate the deal in the broader picture of U.S. healthcare M&A, then analyze in detail its rationale and financials, and finally offer a perspective on its potential impact on healthcare services and society.

Overview of Recent M&A Activity in the Healthcare Industry

Amazon’s acquisition of One Medical can appear as a high-risk bet, given the current macroeconomic conditions. High interest rates, soaring inflation and an increasing risk of recession have in fact led to a substantial slowdown of global M&A activity which hit the healthcare industry as well, as shown in the graph below.

However, the US M&A market and more specifically a narrow range of industries, including healthcare, seem to have suffered a lower impact than other sectors and are showing signs of a reaction. The history of recent deals in the US healthcare industry pictures a positive response to the worldwide steep downward trend in M&A that followed the post pandemic boom.

There are different factors that can be analyzed to try to understand the reasons for an overall reassuring trend.

First of all, it is no surprise that some of the largest acquisitions in the last year were conducted by companies that have seen their profits soar during the Covid-19 pandemic. One of the latest news in the market was the announcement of the $17 billion acquisition of Abiomed, a medtech company producing heart pumps, by Johnson & Johnson, which could rely on $34 billion in cash and equivalents on its balance sheet following the record sales of 2021. J&J was also part of a bidding war with another key player in the Covid-19 vaccine market such as Pfizer, which prevailed in the $5.4 billion acquisition of Global Blood Therapeutics.

Furthermore, we are seeing a consolidation phenomenon in the industry, with a few players conducting several acquisitions to strengthen their position and gain a larger stake of the market. The US Department of Justice is keeping this process under close observation, as it is proven by the lawsuit that was put in act to stop the $13 billion acquisition of Change Healthcare by United Health Group, one of the largest health insurance companies of the country. The allegation of exploiting the data in possession of the target software company to outrun competitors was however denied by a federal judge at the end of September and the deal was closed shortly after. Such decision could boost the consolidation phenomenon in the sector: CVS, another leader in healthcare, has recently announced the acquisition of Signify Health for $8 billion with the main purposes of diversifying its business and keep up with the competitors’ expansion.

A third factor to be taken into consideration when explaining the high deal flow in the industry can be found in the investment opportunities driven by the increasing need for the implementation of new technologies in healthcare. Companies want a leading position in the race for digitalization and to be first to profit from the innovations that are constantly introduced in the business. To give an example, the software giant Oracle has entered the health data industry by purchasing Cerner, an electronic medical records group, for more than $28 billion, making it one of the largest deals of the past year. The fact that Oracle is not a healthcare company underlines the desire of new players to enter the industry and how the expectations for the growth of a market which already accounts for more than $4 trillion in expenditures only in the U.S. are very high. Oracle aims to modernize healthcare information systems and to provide a cheaper and more efficient services to patients by applying its easy-to-use systems to Cerner’s activity, making the target company a potentially “huge growth engine” in the future, as stated by Safra Catz, CEO of Oracle.

There are different factors that can be analyzed to try to understand the reasons for an overall reassuring trend.

First of all, it is no surprise that some of the largest acquisitions in the last year were conducted by companies that have seen their profits soar during the Covid-19 pandemic. One of the latest news in the market was the announcement of the $17 billion acquisition of Abiomed, a medtech company producing heart pumps, by Johnson & Johnson, which could rely on $34 billion in cash and equivalents on its balance sheet following the record sales of 2021. J&J was also part of a bidding war with another key player in the Covid-19 vaccine market such as Pfizer, which prevailed in the $5.4 billion acquisition of Global Blood Therapeutics.

Furthermore, we are seeing a consolidation phenomenon in the industry, with a few players conducting several acquisitions to strengthen their position and gain a larger stake of the market. The US Department of Justice is keeping this process under close observation, as it is proven by the lawsuit that was put in act to stop the $13 billion acquisition of Change Healthcare by United Health Group, one of the largest health insurance companies of the country. The allegation of exploiting the data in possession of the target software company to outrun competitors was however denied by a federal judge at the end of September and the deal was closed shortly after. Such decision could boost the consolidation phenomenon in the sector: CVS, another leader in healthcare, has recently announced the acquisition of Signify Health for $8 billion with the main purposes of diversifying its business and keep up with the competitors’ expansion.

A third factor to be taken into consideration when explaining the high deal flow in the industry can be found in the investment opportunities driven by the increasing need for the implementation of new technologies in healthcare. Companies want a leading position in the race for digitalization and to be first to profit from the innovations that are constantly introduced in the business. To give an example, the software giant Oracle has entered the health data industry by purchasing Cerner, an electronic medical records group, for more than $28 billion, making it one of the largest deals of the past year. The fact that Oracle is not a healthcare company underlines the desire of new players to enter the industry and how the expectations for the growth of a market which already accounts for more than $4 trillion in expenditures only in the U.S. are very high. Oracle aims to modernize healthcare information systems and to provide a cheaper and more efficient services to patients by applying its easy-to-use systems to Cerner’s activity, making the target company a potentially “huge growth engine” in the future, as stated by Safra Catz, CEO of Oracle.

Target Profile and Deal Rationale

Founded in 2007 by Tom Lee and headquartered in San Francisco, California, One Medical is a membership-based primary care platform with digital health and in-office care. Lee, who served as the company’s president and CEO until Amir Dan Rubin, a former executive with UnitedHealth Group took over in 2017, aimed to transform healthcare for its stakeholders through a human-centered and technology-powered model consisting in providing better care at a convenient price.

One Medical is eager to achieve its mission by delivering a primary care product that is available with differentiating features, such as 24/7 access to virtual care services (One Medical Now, available as an application too), chronic care management (One Medical Healthy Heart & others), prompt access to in-office primary care and specialty care coordination, behavioral healthcare (One Medical Healthy Mind), and even at-home care (One Medical At-Home). Over the years, the concept has proven attractive enough to entice investment capital from big players like the Carlyle Group, which invested $350 million in the company in 2018, the hedge fund Tiger Group and Alphabet, Google’s parent company.

Since its foundation, the company has experienced significant growth going from a single San Francisco clinic to 188 offices in 29 markets. To stimulate One Medical’s expansion, the firm closed a successful IPO with a $1.7 billion valuation, at a starting price of $14 per share in January 2020. Moreover, Iora Health, a competitor focused on Medicare patients, was acquired in a $2.1 billion deal last year. The growth of the firm peaked during the COVID pandemic, but it proved hard to sustain. Consequently, shares in One Medical’s parent company, 1Life Healthcare, lost around 70% of their value in the past 18 months.

One Medical is eager to achieve its mission by delivering a primary care product that is available with differentiating features, such as 24/7 access to virtual care services (One Medical Now, available as an application too), chronic care management (One Medical Healthy Heart & others), prompt access to in-office primary care and specialty care coordination, behavioral healthcare (One Medical Healthy Mind), and even at-home care (One Medical At-Home). Over the years, the concept has proven attractive enough to entice investment capital from big players like the Carlyle Group, which invested $350 million in the company in 2018, the hedge fund Tiger Group and Alphabet, Google’s parent company.

Since its foundation, the company has experienced significant growth going from a single San Francisco clinic to 188 offices in 29 markets. To stimulate One Medical’s expansion, the firm closed a successful IPO with a $1.7 billion valuation, at a starting price of $14 per share in January 2020. Moreover, Iora Health, a competitor focused on Medicare patients, was acquired in a $2.1 billion deal last year. The growth of the firm peaked during the COVID pandemic, but it proved hard to sustain. Consequently, shares in One Medical’s parent company, 1Life Healthcare, lost around 70% of their value in the past 18 months.

Nowadays, as reported in the One Medical’s 2022 third quarter report on November 2nd, the service counts on 815,000 members, experiencing a growth of 14% year-over-year, and executives at the firm expect to meet the yearly objective of opening around 30 to 40 additional offices in 2022. However, as the business expands, it shall be pointed out that One Medical is not yet profitable.

Revenue for One Medical was $623 million in 2021, up 64% from $380 million in 2020, and the company’s net sales in the third quarter of 2022 was $261.4 million, a 73% increase YoY. Still, One Medical reported a loss of $255 million for 2021 compared to $89 million in loss for 2020.

Nonetheless, Amazon has spotted in One Medical the prospect of expanding its drive into the medical market, and the acquisition of the San Francisco-based firm was announced in July 2022. According to a press announcement, the massive online retailer intends to acquire One Medical for $18 per share in an all-cash deal valued at around $3.9 billion, including the company's net debt. Based on the closing price of 1Life Healthcare, which does business under the name of One Medical, shares on July 21, 2022, the purchase price represents a 77% premium. Plus, as part of the arrangement between Amazon and One Medical, the private-equity firm Carlyle Group, will leave its position in the company. Finally, once the transaction is finalized, Amir Dan Rubin will remain in the firm as Chief Executive Officer.

Acquiring One Medical is a key step for Amazon’s goal to reinvent healthcare:

“We think health care is high on the list of experiences that need reinvention. Booking an appointment, waiting weeks or even months to be seen, taking time off work, driving to a clinic, (..), then making another trip to a pharmacy – we see lots of opportunity to both improve the quality of the experience and give people back valuable time in their days,” affirmed Neil Lindsay, Senior Vice President of Amazon Health Services.

“We love inventing to make what should be easy easier and we want to be one of the companies that helps dramatically improve the healthcare experience over the next several years. Together with One Medical’s human-centered and technology-powered approach to health care, we believe we can and will help more people get better care, when and how they need it.”

The acquisition of One Medical adds momentum to the efforts by tech giants to penetrate the US’ $4 trillion healthcare economy. For instance, Amazon already took steps towards this direction in 2019 by launching Amazon Care, a telemedicine service which had a modest success, and an online pharmacy delivering prescription medications introduced after acquiring online pharmacy PillPack Inc. two years earlier. Moreover, the corporation is also utilizing its Amazon Web Services cloud and AI (Artificial Intelligence) services so that data can be utilized to discover trends and make predictions about diseases and treatment.

Yet, Amazon will face challenges in its attempt to disrupt the healthcare industry, such as respecting strict state and federal regulations and fierce competition by tech giants such as Alphabet, which bought fitness tracker Fitbit last year and London-based AI firm DeepMind in 2014, whose health team is now part of Google Health. As mentioned previously, Oracle acquired Cerner in order to enter the sector too.

Revenue for One Medical was $623 million in 2021, up 64% from $380 million in 2020, and the company’s net sales in the third quarter of 2022 was $261.4 million, a 73% increase YoY. Still, One Medical reported a loss of $255 million for 2021 compared to $89 million in loss for 2020.

Nonetheless, Amazon has spotted in One Medical the prospect of expanding its drive into the medical market, and the acquisition of the San Francisco-based firm was announced in July 2022. According to a press announcement, the massive online retailer intends to acquire One Medical for $18 per share in an all-cash deal valued at around $3.9 billion, including the company's net debt. Based on the closing price of 1Life Healthcare, which does business under the name of One Medical, shares on July 21, 2022, the purchase price represents a 77% premium. Plus, as part of the arrangement between Amazon and One Medical, the private-equity firm Carlyle Group, will leave its position in the company. Finally, once the transaction is finalized, Amir Dan Rubin will remain in the firm as Chief Executive Officer.

Acquiring One Medical is a key step for Amazon’s goal to reinvent healthcare:

“We think health care is high on the list of experiences that need reinvention. Booking an appointment, waiting weeks or even months to be seen, taking time off work, driving to a clinic, (..), then making another trip to a pharmacy – we see lots of opportunity to both improve the quality of the experience and give people back valuable time in their days,” affirmed Neil Lindsay, Senior Vice President of Amazon Health Services.

“We love inventing to make what should be easy easier and we want to be one of the companies that helps dramatically improve the healthcare experience over the next several years. Together with One Medical’s human-centered and technology-powered approach to health care, we believe we can and will help more people get better care, when and how they need it.”

The acquisition of One Medical adds momentum to the efforts by tech giants to penetrate the US’ $4 trillion healthcare economy. For instance, Amazon already took steps towards this direction in 2019 by launching Amazon Care, a telemedicine service which had a modest success, and an online pharmacy delivering prescription medications introduced after acquiring online pharmacy PillPack Inc. two years earlier. Moreover, the corporation is also utilizing its Amazon Web Services cloud and AI (Artificial Intelligence) services so that data can be utilized to discover trends and make predictions about diseases and treatment.

Yet, Amazon will face challenges in its attempt to disrupt the healthcare industry, such as respecting strict state and federal regulations and fierce competition by tech giants such as Alphabet, which bought fitness tracker Fitbit last year and London-based AI firm DeepMind in 2014, whose health team is now part of Google Health. As mentioned previously, Oracle acquired Cerner in order to enter the sector too.

Financial Analysis

Given the fact that 1Life Healthcare (the parent company of One Medical) has not managed to achieve any profits in its 15 years history, we cannot use the P/E ratio to investigate the performance of the company; this suggests us that the company is not mature yet, and it still has to find a way to become self-sustaining.

As reported on the last 10-Q (Q2 2022 1Life Healthcare10-Q, p. 43, liquidity and capital resources), despite the decline in the current ratio (declining to 2.6 at the end of Q2 2022 from 3.0 at the end of Q4 2021) the company still maintains a very strong liquidity position. Moreover, once we take into account the decrease in OpEx over the last three quarters, we can state that the company has more than enough resources to keep operating in the foreseeable future.

Due to the presence of operating losses, it is complex to precisely determine the situation judging by the income statement alone. In this specific case, we are more interested in the debt and debt to equity ratio. In this case, we can observe how both the debt ratio and the debt-to-equity ratio have been slightly increasing (respectively from 0.232 in Q4 2021 to 0.251 in Q2 2022, and from 0.353 in Q4 2021 to 0.393 in Q2 2022), suggesting that the company is gradually taking on more debt without drastically changing the capital structure prior to the acquisition by Amazon. The rationale behind this increase in the amount of liabilities and debt can be found in One Medical’s intention to expand its physical presence, as in the span of 4 years it went from 30 to 180 locations in the continental US. Despite those increases in debt, we can safely state that debt solvency does not represent a problem.

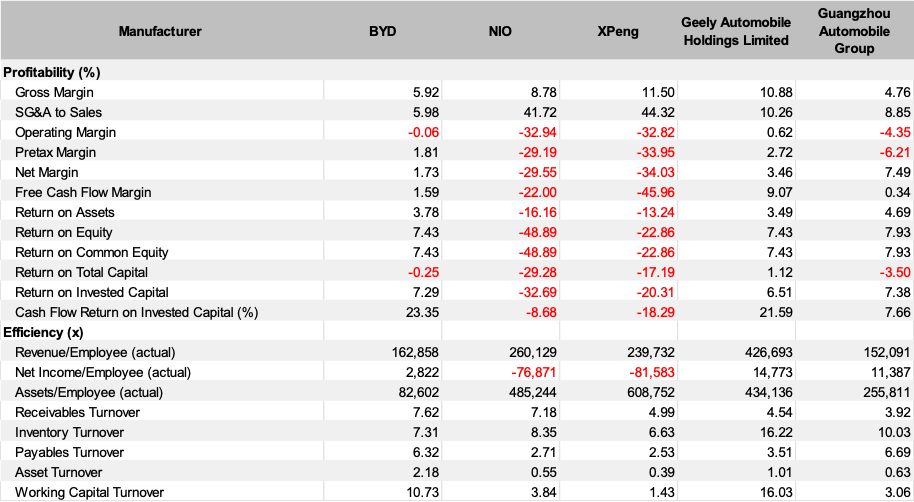

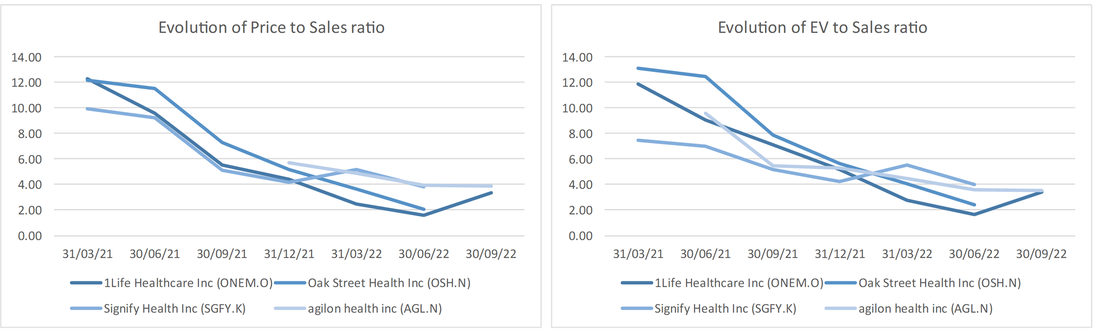

Given the peculiar nature of One Medical business plan, i.e. telemedicine, it becomes quite challenging to accurately compare the fundamentals and their multiples from various companies. Still, by choosing a restricted pool of companies it is possible to draw a few important considerations concerning the company’s relative valuation. We start by looking at the common measures of a company market value, namely the enterprise value and the market capitalisation, also known as equity value, in order to get a better idea of the size of the company in comparison to a few key competitors (including Signify Health Inc., which was recently acquired by CVS for $8 billion).

Due to the presence of operating losses, it is complex to precisely determine the situation judging by the income statement alone. In this specific case, we are more interested in the debt and debt to equity ratio. In this case, we can observe how both the debt ratio and the debt-to-equity ratio have been slightly increasing (respectively from 0.232 in Q4 2021 to 0.251 in Q2 2022, and from 0.353 in Q4 2021 to 0.393 in Q2 2022), suggesting that the company is gradually taking on more debt without drastically changing the capital structure prior to the acquisition by Amazon. The rationale behind this increase in the amount of liabilities and debt can be found in One Medical’s intention to expand its physical presence, as in the span of 4 years it went from 30 to 180 locations in the continental US. Despite those increases in debt, we can safely state that debt solvency does not represent a problem.

Given the peculiar nature of One Medical business plan, i.e. telemedicine, it becomes quite challenging to accurately compare the fundamentals and their multiples from various companies. Still, by choosing a restricted pool of companies it is possible to draw a few important considerations concerning the company’s relative valuation. We start by looking at the common measures of a company market value, namely the enterprise value and the market capitalisation, also known as equity value, in order to get a better idea of the size of the company in comparison to a few key competitors (including Signify Health Inc., which was recently acquired by CVS for $8 billion).

Despite the valuations consistently decreasing over time, the difference between the enterprise value and the market value has never been significant. This very fact entails that the various components of the EV bridge cancel each other out, but once we investigate the balance sheet, we can see how both cash and debt have changed quite significantly.

On a closer look:

On a closer look:

- Cash decreased from $341,971 thousands as of 31st of December 2021 to $139,506 thousands as of the 31st of October 2022.

- Debt increased from $ 610,777 thousands as of 31st of December 2021 to $638,843 thousands as of the 31st of October 202.

In terms of multiples, the same downward trend that we saw for the fundamentals can be found again for the multiples; this indicates that as EV and stock price went down, sales and EBITDA decreased, albeit in a much slower fashion. Given the fact that this very trend repeats itself over the years and across the whole industry, it is safe to state that this phenomenon does not concern One Medical only, but the whole telemedicine industry.

As some of those companies were founded or became publicly traded in the very recent past, it becomes much harder to assess whether this is an actual historical trend or if it is more of a recent phenomenon; but thanks to the recent interest by Amazon (for the acquisition of 1Life Healthcare) and CVS (for the acquisition of Signify Health Inc.), chances there will be significant changes in the valuations of companies operating in the telemedicine sector.

The Impact on the Market and Society

In the official press release from Amazon, both Neil Lindsay, SVP of Amazon Health Services, and Amir Dan Rubin, CEO of One Medical, spoke of the deal as being one that will “transform” healthcare. What will this massive deal mean for the healthcare industry?

If the One Medical deal goes through, by entering the primary care market, Amazon would be able to expand its foothold in the health industry, which is known to be particularly profitable. As for 2021, in the United States, the healthcare industry is worth $808 billion, and an impressive 65% of revenue comes from patient care. It is formed by a mixture of private and public insurance, with private ownership predominating. Among these private institutions, it is possible to distinguish between not-for-profit and for-profit.

Although primary care has been considered one of the least-profitable areas of medicine, it has been attracting major investments from retailers, health insurers, and drugstore chains in recent years. For example, Walgreens Boots Alliance last year paid $5.2 billion for a controlling stake in clinic chain VillageMD. And now, also Amazon is following these steps by announcing its plans for expansion. In fact, Michael Abrams, managing partner at Numerof and Associates, said that Amazon was having some difficulty in breaking into the employer market with Amazon Care. One Medical would be a huge shortcut to accelerated growth in this regard as One Medical already works with 8,000 companies. As Amazon has built its business with a laser focus on the consumer, the company's bigger push into the market incentivizes other players to take a consumer-centric approach.

Some experts believe this innovative approach to healthcare is going to force traditional providers to up their game, since “Amazon knows how to get customers, keep them and get them whatever it is they want.” Notably, approximately 44% of Americans have an active Amazon Prime membership, while the largest U.S. health system, HCA Healthcare, serves just 1% of Americans. Colin Banas, M.D., chief medical officer at DrFirst, noted that traditional healthcare delivery companies will need to adapt or become obsolete, as non-traditional models that seamlessly combine in-person with remote care increasingly compete with brick-and-mortar-based practices. He also thinks that the healthcare industry made the mistake of just standing and watching large chain drug stores gain a substantial share of primary care practice, giving to Amazon the possibility to leapfrog over the current issues with the vision of seamless and appropriate mobile care.

In addition to that, Millennials and Generation Z patients have less loyalty to traditional providers and are looking for convenience and price transparency. According to some experts, this deal is an innovative and progressive opportunity that is going to change the way we do healthcare. However, the excitement of some is met with the skepticism of many. In the United States, health care is expensive and difficult to obtain, while the quality does not always match the cost. We have seen that some believe it is possible that technology companies like Amazon have the answer to the problems of an industry that is fundamental to our well-being. Others believe that their moves into that sector will give them even more power over us and yet another industry to dominate. There are many lawmakers criticizing the deal. “Amazon’s purchase of a primary care provider network should be deeply concerning to American families and antitrust regulators,” Sen. Elizabeth Warren (D-MA) said. “Amazon already has too much economic power, a terrible track record with workers, and alarmingly little clinical experience, which raises major questions about how this deal could impact consumer prices and health care choices.” Even though it was believed that the merger would be challenged by regulators, some antitrust experts were not so sure that regulators would have a case to stop the deal, arguing that Amazon was not enough of a major player in the healthcare industry.

The purpose of reinventing the healthcare system is considered particularly scary by some. As Caitlin Seeley George, managing director of Fight for Future, said: “Amazon is a data company. What data does Amazon want to collect and how can they be thinking about monetizing it? That is not exactly what you want your healthcare provider to be thinking about.” In fact, Sen. Amy Klobuchar asked the Federal Trade Commission (FTC) to also consider the role of data, since the deal could result in the accumulation of highly sensitive personal health data in the hands of an already data-intensive company.

Why is the FTC investigating Amazon? Because of the One Medical deal, as well as the plans to buy iRobot (producer of the Roomba vacuum), Amazon is set on gathering more consumer data. The FTC will be looking into both business acquisitions to see if they violate anti-trust laws and whether data acquired from Amazon will give the company unfair advantages in their respective markets. Amazon assured that, as required by the regulations of the Health Insurance Portability and Accountability Act (HIPAA), it will never share One Medical customers’ personal health information outside of One Medical for advertising or marketing purposes of other Amazon products and services without clear permission from the customer. However, it is said that HIPAA protections will be inadequate to prevent Amazon from acquiring patients’ data. The company could get around it through privacy waivers from One Medical patients, perhaps by offering discounts on its Prime service.

Another issue regards the market segment for which the services are targeted. One Medical aims its services at an affluent market segment. The amount charged for the services instantly discourages families that may have difficulty scraping together their insurance plan premiums and copays, which members must pay for separately.

Then there is also the firm’s practice of geographical segregation. One Medical says it places its offices in affluent, richer areas while ignoring low-income neighborhoods, clearly focusing on a certain type of customers.

Despite Amazon’s ambition to help more people get better care, some experts see the One Medical acquisition as a straight business deal rather than a blow for healthcare reform, unless they substantially change the model. If they do not, this is believed just to be another selective deal serving a part of the population that is already favored by the current healthcare system.

If the One Medical deal goes through, by entering the primary care market, Amazon would be able to expand its foothold in the health industry, which is known to be particularly profitable. As for 2021, in the United States, the healthcare industry is worth $808 billion, and an impressive 65% of revenue comes from patient care. It is formed by a mixture of private and public insurance, with private ownership predominating. Among these private institutions, it is possible to distinguish between not-for-profit and for-profit.

Although primary care has been considered one of the least-profitable areas of medicine, it has been attracting major investments from retailers, health insurers, and drugstore chains in recent years. For example, Walgreens Boots Alliance last year paid $5.2 billion for a controlling stake in clinic chain VillageMD. And now, also Amazon is following these steps by announcing its plans for expansion. In fact, Michael Abrams, managing partner at Numerof and Associates, said that Amazon was having some difficulty in breaking into the employer market with Amazon Care. One Medical would be a huge shortcut to accelerated growth in this regard as One Medical already works with 8,000 companies. As Amazon has built its business with a laser focus on the consumer, the company's bigger push into the market incentivizes other players to take a consumer-centric approach.

Some experts believe this innovative approach to healthcare is going to force traditional providers to up their game, since “Amazon knows how to get customers, keep them and get them whatever it is they want.” Notably, approximately 44% of Americans have an active Amazon Prime membership, while the largest U.S. health system, HCA Healthcare, serves just 1% of Americans. Colin Banas, M.D., chief medical officer at DrFirst, noted that traditional healthcare delivery companies will need to adapt or become obsolete, as non-traditional models that seamlessly combine in-person with remote care increasingly compete with brick-and-mortar-based practices. He also thinks that the healthcare industry made the mistake of just standing and watching large chain drug stores gain a substantial share of primary care practice, giving to Amazon the possibility to leapfrog over the current issues with the vision of seamless and appropriate mobile care.

In addition to that, Millennials and Generation Z patients have less loyalty to traditional providers and are looking for convenience and price transparency. According to some experts, this deal is an innovative and progressive opportunity that is going to change the way we do healthcare. However, the excitement of some is met with the skepticism of many. In the United States, health care is expensive and difficult to obtain, while the quality does not always match the cost. We have seen that some believe it is possible that technology companies like Amazon have the answer to the problems of an industry that is fundamental to our well-being. Others believe that their moves into that sector will give them even more power over us and yet another industry to dominate. There are many lawmakers criticizing the deal. “Amazon’s purchase of a primary care provider network should be deeply concerning to American families and antitrust regulators,” Sen. Elizabeth Warren (D-MA) said. “Amazon already has too much economic power, a terrible track record with workers, and alarmingly little clinical experience, which raises major questions about how this deal could impact consumer prices and health care choices.” Even though it was believed that the merger would be challenged by regulators, some antitrust experts were not so sure that regulators would have a case to stop the deal, arguing that Amazon was not enough of a major player in the healthcare industry.

The purpose of reinventing the healthcare system is considered particularly scary by some. As Caitlin Seeley George, managing director of Fight for Future, said: “Amazon is a data company. What data does Amazon want to collect and how can they be thinking about monetizing it? That is not exactly what you want your healthcare provider to be thinking about.” In fact, Sen. Amy Klobuchar asked the Federal Trade Commission (FTC) to also consider the role of data, since the deal could result in the accumulation of highly sensitive personal health data in the hands of an already data-intensive company.

Why is the FTC investigating Amazon? Because of the One Medical deal, as well as the plans to buy iRobot (producer of the Roomba vacuum), Amazon is set on gathering more consumer data. The FTC will be looking into both business acquisitions to see if they violate anti-trust laws and whether data acquired from Amazon will give the company unfair advantages in their respective markets. Amazon assured that, as required by the regulations of the Health Insurance Portability and Accountability Act (HIPAA), it will never share One Medical customers’ personal health information outside of One Medical for advertising or marketing purposes of other Amazon products and services without clear permission from the customer. However, it is said that HIPAA protections will be inadequate to prevent Amazon from acquiring patients’ data. The company could get around it through privacy waivers from One Medical patients, perhaps by offering discounts on its Prime service.

Another issue regards the market segment for which the services are targeted. One Medical aims its services at an affluent market segment. The amount charged for the services instantly discourages families that may have difficulty scraping together their insurance plan premiums and copays, which members must pay for separately.

Then there is also the firm’s practice of geographical segregation. One Medical says it places its offices in affluent, richer areas while ignoring low-income neighborhoods, clearly focusing on a certain type of customers.

Despite Amazon’s ambition to help more people get better care, some experts see the One Medical acquisition as a straight business deal rather than a blow for healthcare reform, unless they substantially change the model. If they do not, this is believed just to be another selective deal serving a part of the population that is already favored by the current healthcare system.

Conclusion

Amazon acquiring One Medical represents just one of the latest steps that tech giants are taking to transform and innovate the healthcare industry, and specifically primary care. One Medical, from its part, expects that joining Amazon and having access to its enormous resources will be a tremendous next step in expanding its market share and granting access to high quality and high value healthcare for all its customers.

What is certain is that this acquisition will be impactful and will contribute to change US society’s approach to telemedicine and, more in general, healthcare. For this reason, it is crucial that both the companies and the regulating institutions involved collaborate in order to provide the best possible experience and service to patients.

What is certain is that this acquisition will be impactful and will contribute to change US society’s approach to telemedicine and, more in general, healthcare. For this reason, it is crucial that both the companies and the regulating institutions involved collaborate in order to provide the best possible experience and service to patients.

By Stefano Graziosi, Edoardo Miccio, Matilde Oliana, and Matteo Panizza

Sources

- 1Life Healthcare Inc. (2020, March 27). UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K for the fiscal year ending 31st of December 2019, 1Life Healthcare Inc. investor.onemedical.com. https://investor.onemedical.com/node/6601/html

- 1Life Healthcare Inc. (2021, March 17). UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K for the fiscal year ending 31st of December 2020, 1Life Healthcare Inc. investor.onemedical.com. https://investor.onemedical.com/node/7551/html

- 1Life Healthcare Inc. (2022, August 3). UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q for the quarterly period ended June 30, 2022, 1Life Healthcare Inc. investor.onemedical.com. https://investor.onemedical.com/node/8931/html

- 1Life Healthcare Inc. (2022, February 22). UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K for the fiscal year ending 31st of December 2021, 1Life Healthcare Inc. investor.onemedical.com. https://investor.onemedical.com/node/8641/html

- 1Life Healthcare Inc. (2022, November 2). UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10- Q for the quarterly period ended September 30, 2022, 1Life Healthcare Inc. investor.onemedical.com. https://investor.onemedical.com/node/9106/html

- Aliaj, O., Criddle, C., & Fontanella-Khan, J. (2022, July 21). Amazon to acquire One Medical for $3.9bn. Financial Times. https://www.ft.com/content/e81b6b94-8c95-44ff-9012-cf20b2073e4b

- Aliaj, O., Vandevelde, M., & Fontanella-Khan, J. (2022, September 6). CVS buys home healthcare group Signify Health for $8bn. Financial Times. https://www.ft.com/content/6a41c9c9-9d47-4c69-8d4c-b221c2d25073

- Amazon/One Medical: no Rx for bloated healthcare spending. (2022, July 21). Financial Times. https://www.ft.com/content/2f49caf0-4987-4ebd-a54b-9ab0bf33b978

- Angus, L. (2022, August 23). Global Blood Therapeutics’ tough negotiating led Pfizer to boost its buyout offer 3 times, filing shows. Fierce Pharma. https://www.fiercepharma.com/pharma/how-pfizer-became-interested-global-blood-and-beat-deal-talk-firstcomer-54b-acquisition

- Banning-Lover, R. (2022b, August 4). London-listed hospital group Mediclinic accepts £3.7bn offer. Financial Times. https://www.ft.com/content/9459b9a8-4dd0-4453-aa62-46d9076ef0c6

- Brusie C. (2022, September 22). Amazon To Buy One Medical for $3.9 Billion; FTC Investigates. Nurse.org.

https://nurse.org/articles/amazon-plan-buy-one-medical/#:~:text=In%20July%202022%2C%20Amazon%20announced,Medical%2C%20a%20primary%20care%20organization

- Fierce Medical (2022, July 21). Amazon scoops up primary care company One Medical in deal valued at $3.9B. https://www.fiercehealthcare.com/health-tech/amazon-shells-out-39b-primary-care-startup-one-medical

- Financial Times (2022, July 21). Amazon to acquire One Medical for $3.9bn. https://www.ft.com/content/e81b6b94-8c95-44ff-9012-cf20b2073e4b

- Financial Times (2022, September 13). The next Big Tech battle: Amazon’s bet on healthcare begins to take shape. https://www.ft.com/content/fa7ff4c3-4694-4409-9ca6-bfadf3a53a62

- Healthcare M&A: Titans on spree as regulatory crackdown falls flat. (2022, September 26). Financial Times. https://www.ft.com/content/57a81d00-6305-4930-9cc2-b2d6ad196301

- Hiltzik, M. (2022, August 18). Column: Amazon’s acquisition of a medical firm may not disrupt healthcare, but could disrupt your life. Los Angeles Times.

https://www.latimes.com/business/story/2022-08-18/column-amazons-one-medical - J&J/Abiomed: healthcare giant pays high price to bulk up on medtech. (2022, November 1). Financial Times. https://www.ft.com/content/3be437f3-a4da-4ccd-a920-6e0be908a923

- Landi H. (2022, July 21). Amazon scoops up primary care company One Medical in deal valued at $3.9B. Fierce Healthcare.

https://www.fiercehealthcare.com/health-tech/amazon-shells-out-39b-primary-care-startup-one-medical - Landi H. (2022, July 25). What Amazon's $4B One Medical play reveals about its healthcare ambitions. Fierce Healthcare.

https://www.fiercehealthcare.com/health-tech/how-amazons-one-medical-deal-could-boost-its-healthcare-ambitions-and-heat-competition - Morrison S. (2022, July 22). Amazon wants to be your doctor now, too. Vox.

https://www.vox.com/recode/2022/7/21/23273207/amazon-one-medical-merger-telehealth-antitrust

- One Medical (2022, February 23). 2021 Annual Report. https://investor.onemedical.com/static-files/6f123919-67b1-4ed6-8044-f34b92249c6d

- One Medical (2022, November 2). 2022 Third Quarter Report. https://investor.onemedical.com/news-releases/news-release-details/one-medical-announces-results-third-quarter-2022,

- Oracle Purchase of Cerner Approved. (2022, June 1). Oracle. https://www.oracle.com/news/announcement/oracle-purchase-of-cerner-approved-2022-06-01/

- Oracle/Cerner: healthcare is a safer bet than TikTok. (2021, December 20). Financial Times. https://www.ft.com/content/a79b31f2-e869-44a4-abf7-374dbb5307c6

- Thomson Reuters Eikon. (2022). [1Life Healthcare Inc. (ONEM.O) Financial Overview, Valuation, Peer Comparison, Intrinsic Valuation, standardized in millions of US dollars, 2020-2022] [Data set]. https://eikon.thomsonreuters.com/index.html

- Thomson Reuters Eikon. (2022). [aglion Health Inc. (AGL.N) Financial Overview, Valuation, Peer Comparison, Intrinsic Valuation, standardized in millions of US dollars, 2020-2022] [Data set]. https://eikon.thomsonreuters.com/index.html

- Thomson Reuters Eikon. (2022). [Doximity Inc. (DOCS.N) Financial Overview, Valuation, Peer Comparison, Intrinsic Valuation, standardized in millions of US dollars, 2020-2022] [Data set]. https://eikon.thomsonreuters.com/index.html

- Thomson Reuters Eikon. (2022). [Oak Street Health (OSH.N) Financial Overview, Valuation, Peer Comparison, Intrinsic Valuation, standardized in millions of US dollars, 2020-2022] [Data set]. https://eikon.thomsonreuters.com/index.html

- Thomson Reuters Eikon. (2022). [Signify Health (SGFY.K) Financial Overview, Valuation, Peer Comparison, Intrinsic Valuation, standardized in millions of US dollars, 2020-2022] [Data set]. https://eikon.thomsonreuters.com/index.html

- Wall Street Journal (2022, July 21). Amazon to Buy One Medical Network of Health Clinics in Healthcare Expansion. https://www.wsj.com/articles/amazon-to-buy-one-medical-for-3-9-billion-11658408934